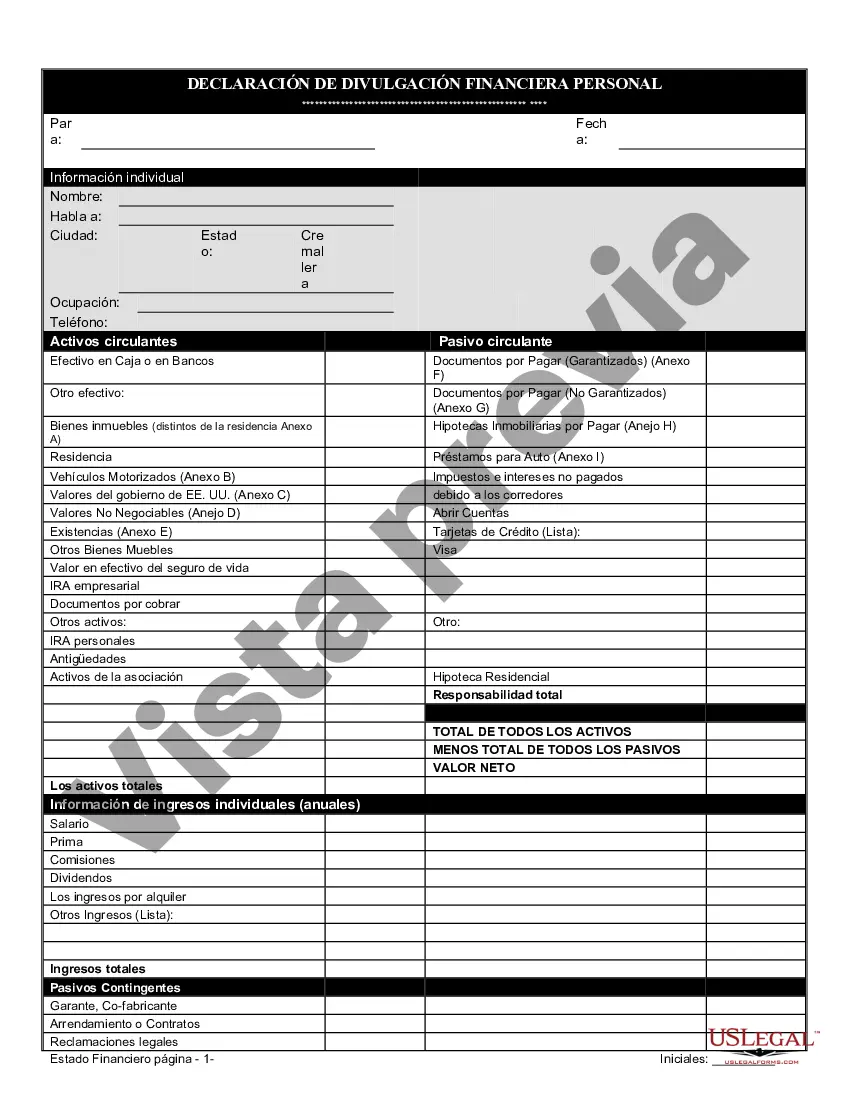

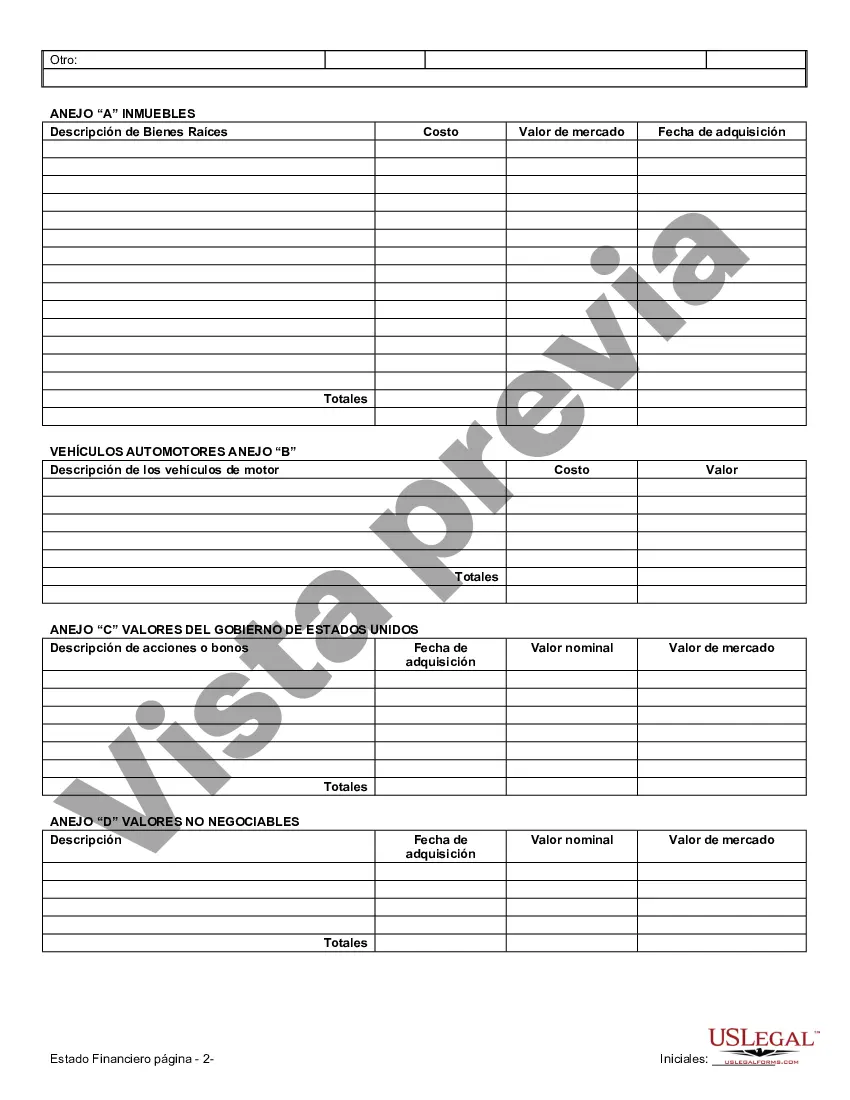

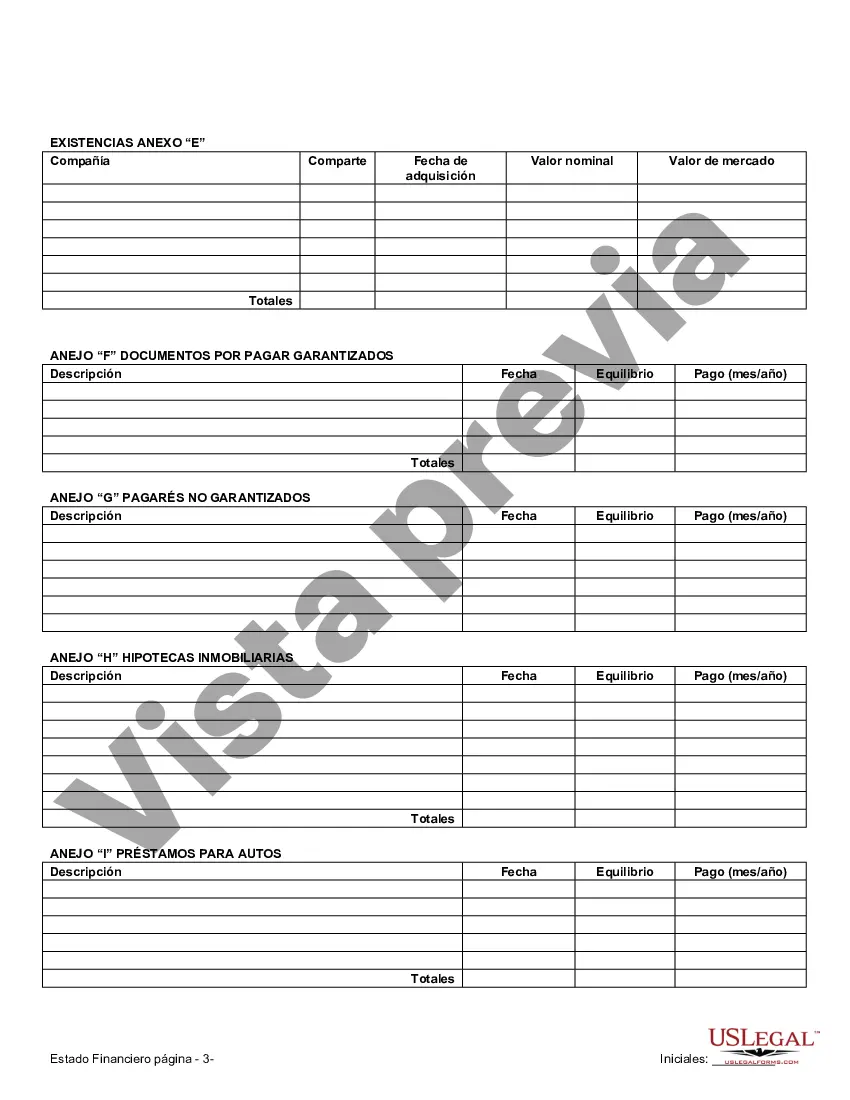

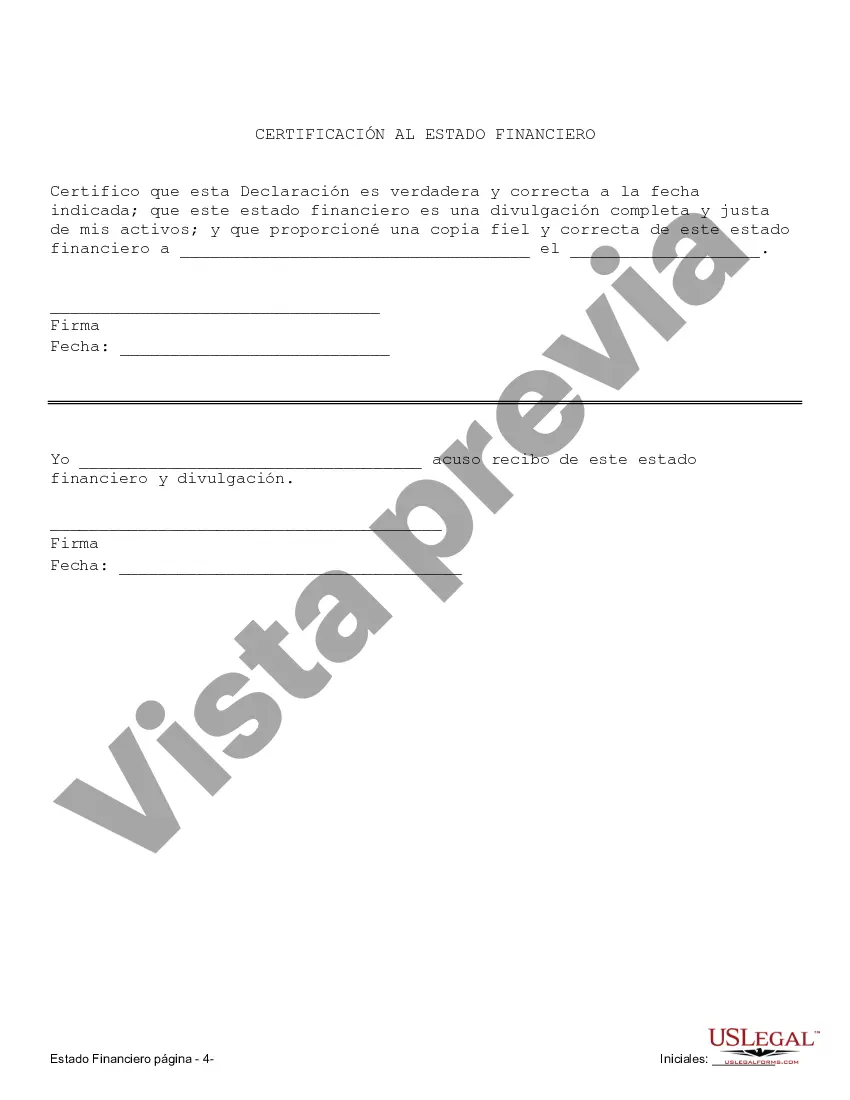

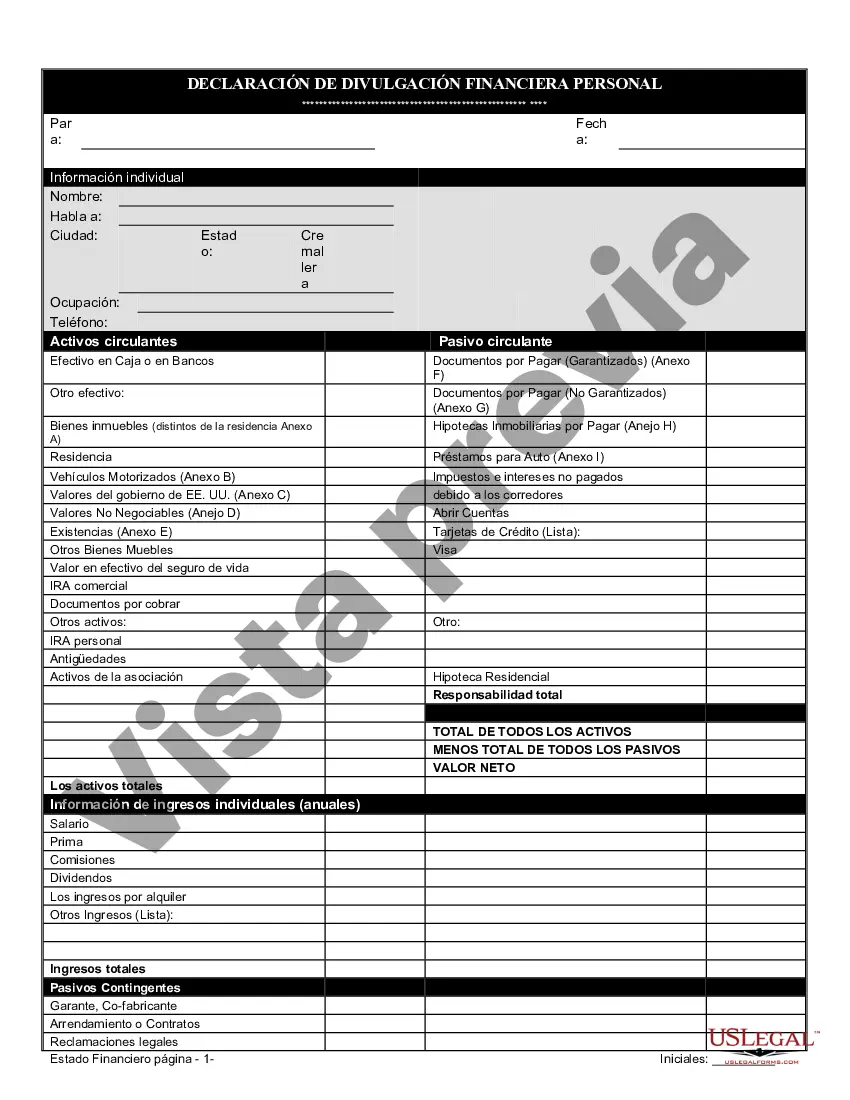

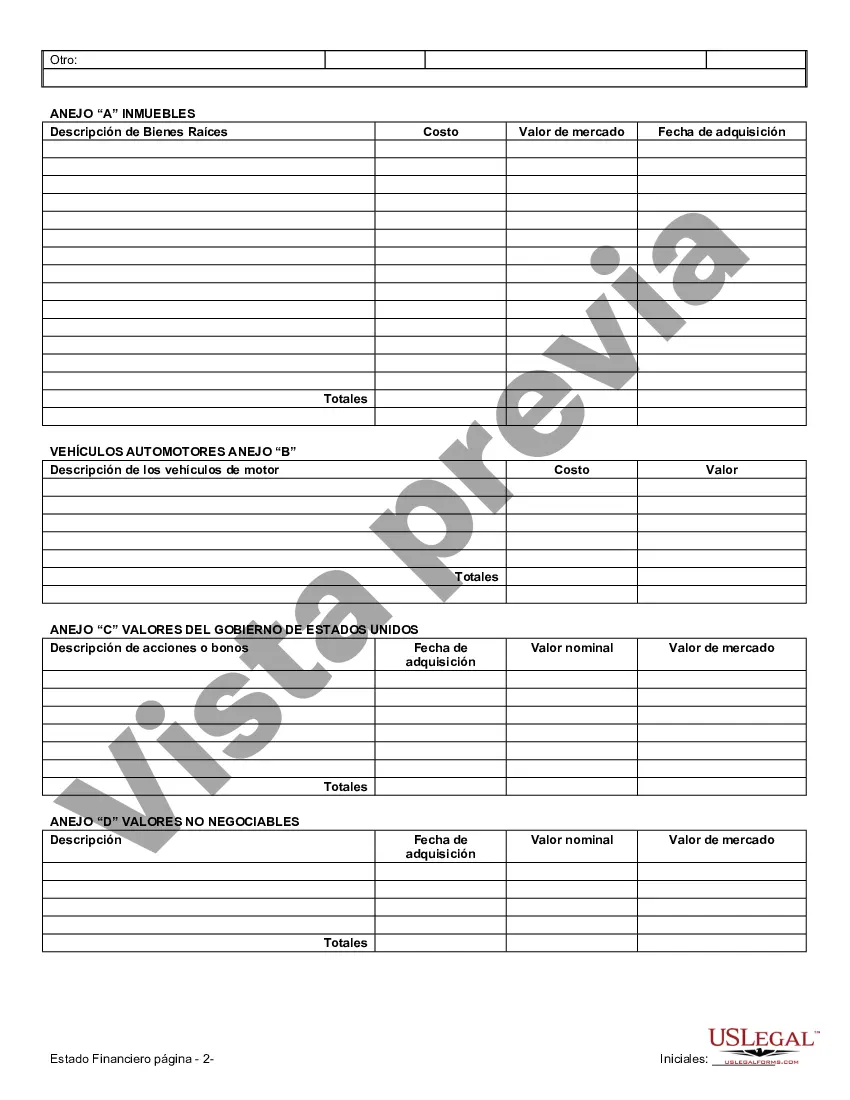

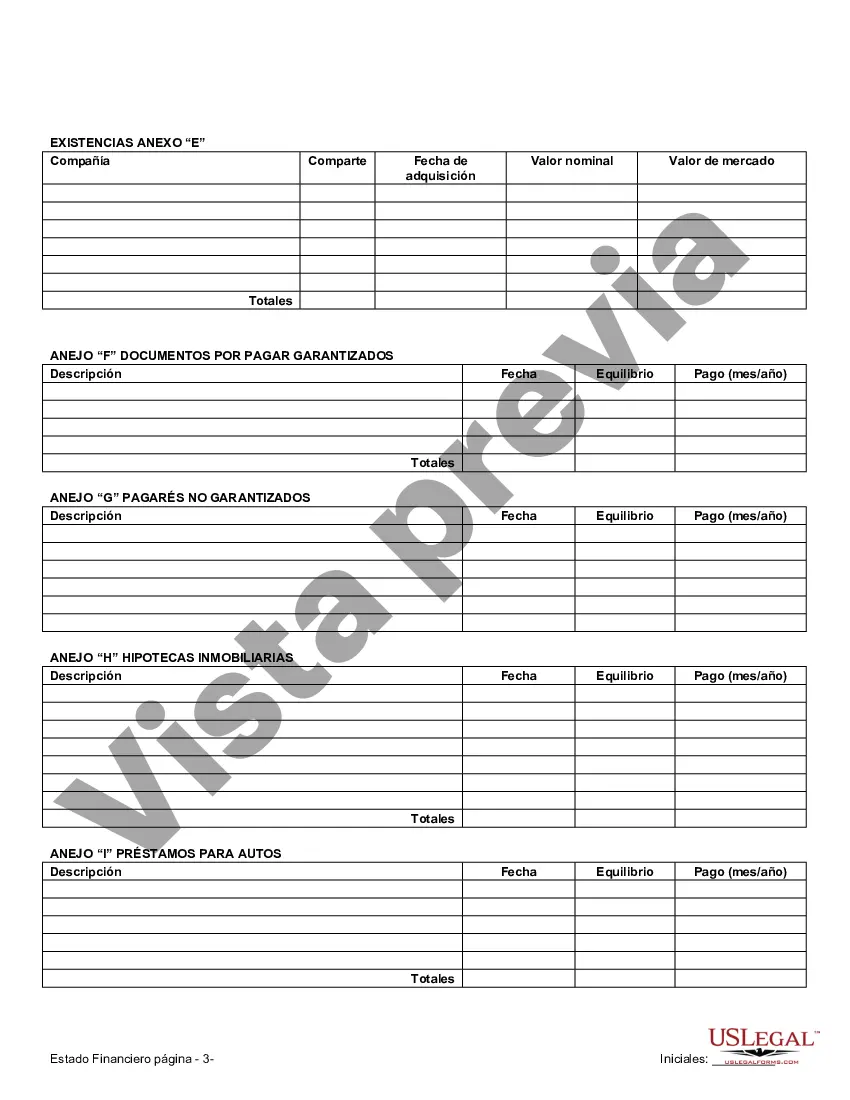

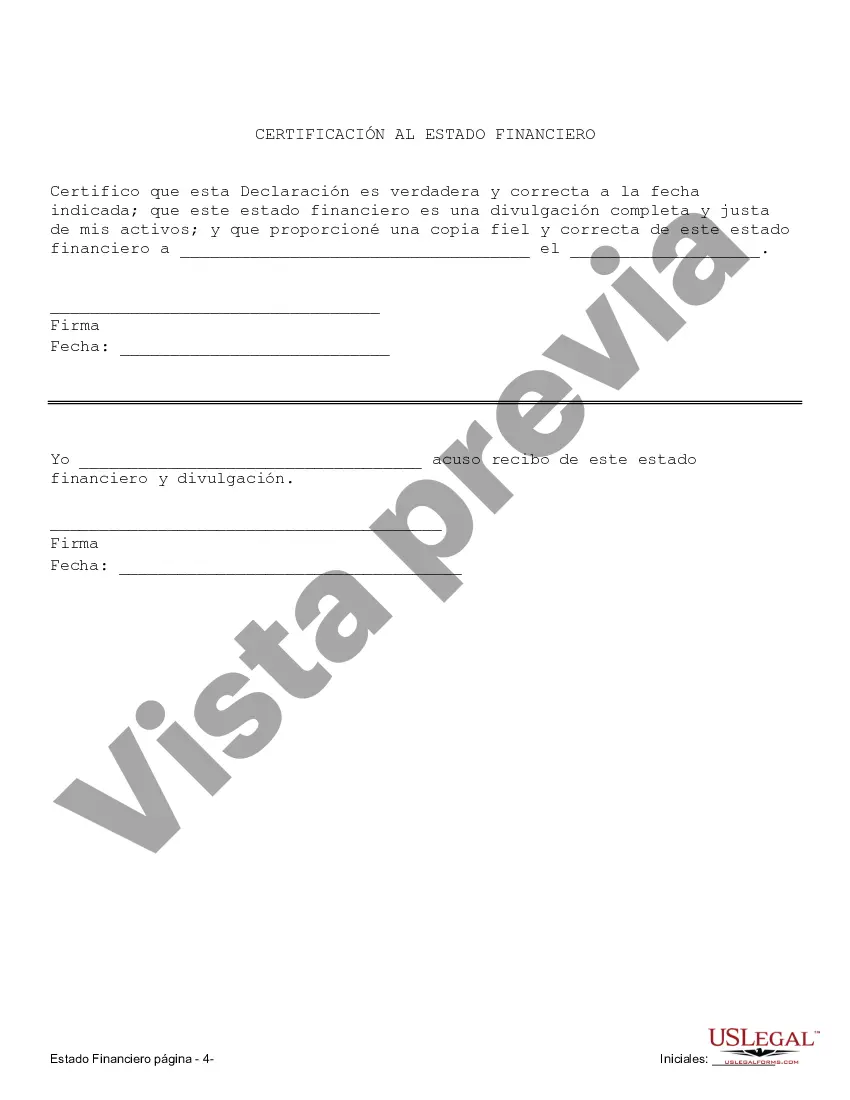

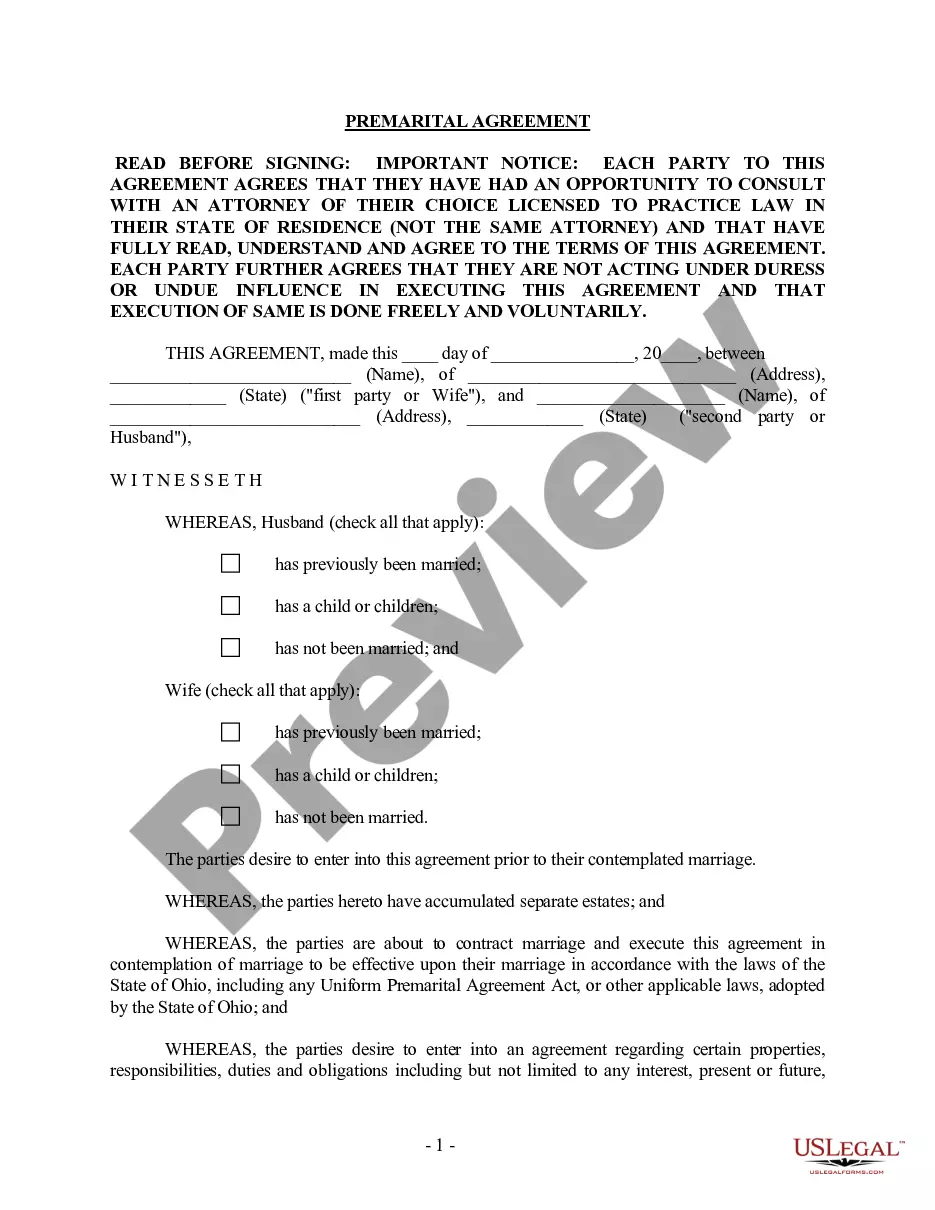

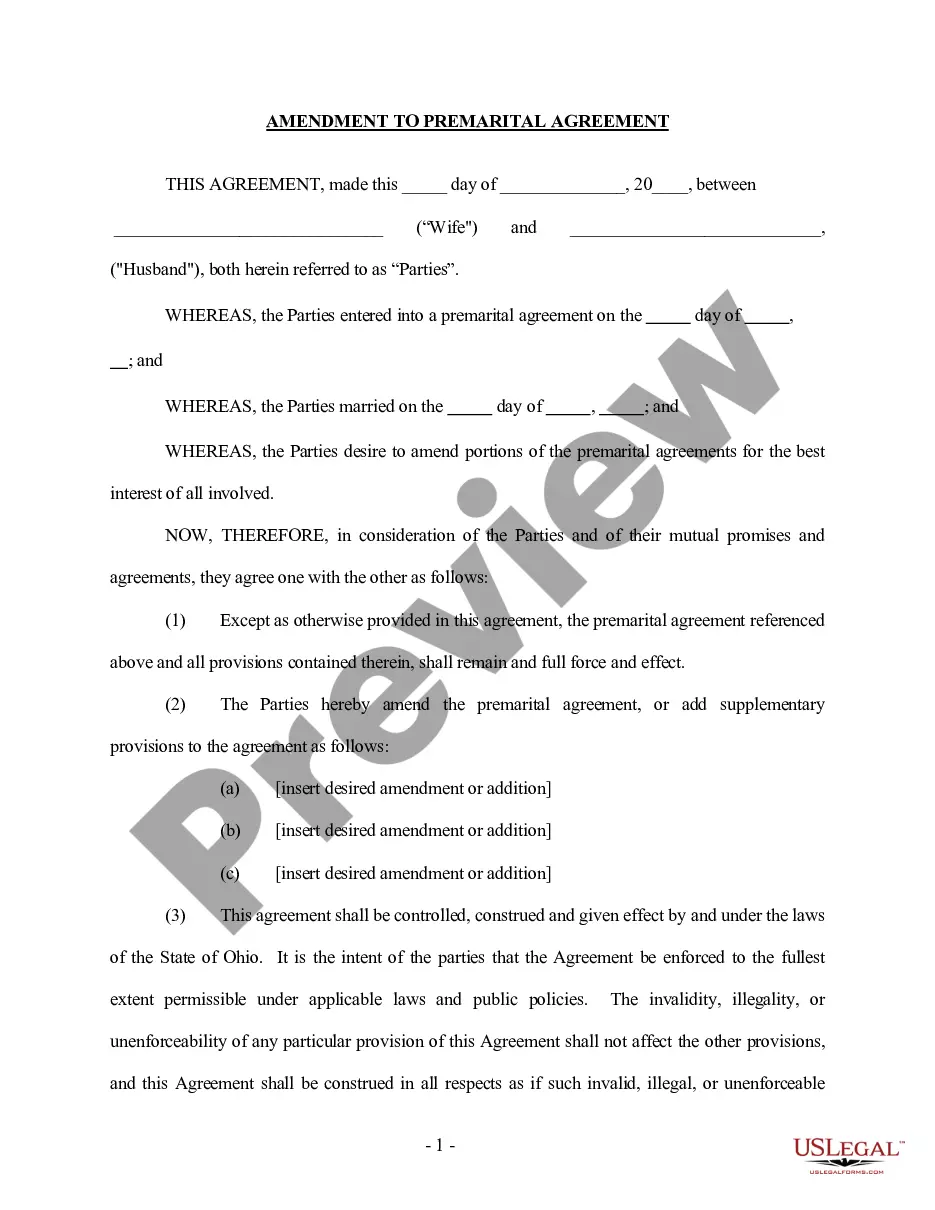

Dayton Ohio Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Dayton, Ohio, financial statements play a crucial role in drafting prenuptial (or premarital) agreements. These agreements are legal documents that are entered into by couples prior to getting married or entering into a civil partnership. Prenuptial agreements outline the division and management of assets, debts, properties, and finances during the marriage and in the event of a divorce or separation. To ensure the accuracy and enforceability of such agreements, it is necessary to include detailed financial statements specific to Dayton, Ohio. Types of Dayton Ohio Financial Statements: 1. Personal Financial Statement: One type of financial statement used in connection with a prenuptial agreement is the Personal Financial Statement. This statement provides an overview of an individual's assets, liabilities, income, and expenses. It includes details such as bank accounts, investments, real estate properties, business interests, retirement accounts, loans, credit card debts, and other financial obligations. 2. Business Financial Statement: In cases where one or both partners own a business or have significant business interests, a Business Financial Statement becomes necessary. It provides a comprehensive picture of the business's financial health and performance. This statement generally includes details such as income statements, balance sheets, cash flow statements, and other relevant financial information specific to the business. 3. Real Estate Financial Statement: If the couple owns or intends to own real estate properties, a Real Estate Financial Statement must be included in the prenuptial agreement. This statement provides an accurate assessment of the value, mortgages, loans, and other financial aspects related to the properties. It may also include rental income, property taxes, maintenance costs, and any other relevant details. 4. Retirement Account Statements: Retirement account statements are critical in prenuptial agreements, especially if there are significant retirement savings or pension plans involved. These statements provide an overview of retirement accounts, including 401(k), IRA, or pension plans. It showcases the current value, contributions, vested benefits, and beneficiary designations. 5. Investment Account Statements: For individuals with diversified investment portfolios, including stocks, bonds, mutual funds, or other financial instruments, Investment Account Statements are essential. These statements show the investments' current value, historical performance, dividends or interest earned, and any outstanding loans linked to the investments. It is important to note that each financial statement should be accurate, up-to-date, and verified by supporting documentation. The inclusion of these various Dayton Ohio Financial Statements in prenuptial agreements helps establish transparency, fairness, and safeguards the interests of both parties involved. It is recommended to consult with legal professionals or financial advisors familiar with Ohio laws to ensure compliance and accuracy in preparing these statements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dayton Ohio Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement

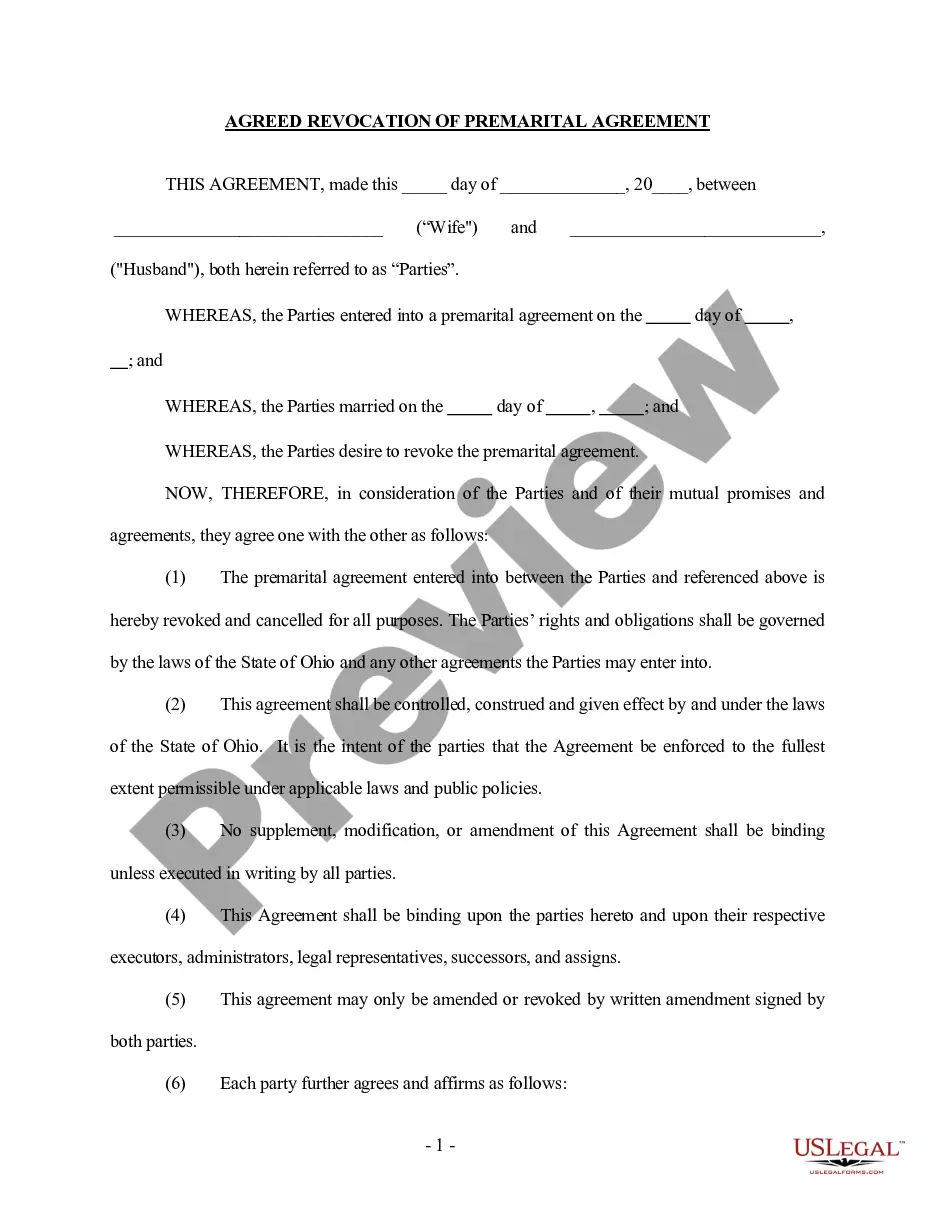

Description

How to fill out Dayton Ohio Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are looking for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms website – one of the most considerable online libraries. Here you can get a large number of document samples for business and individual purposes by types and states, or key phrases. Using our high-quality search option, getting the most up-to-date Dayton Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement is as elementary as 1-2-3. Moreover, the relevance of each record is proved by a group of expert attorneys that on a regular basis check the templates on our website and update them according to the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Dayton Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the sample you need. Read its information and utilize the Preview option to explore its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to find the needed file.

- Confirm your choice. Select the Buy now button. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Dayton Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement.

Every single template you save in your profile has no expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you need to have an extra duplicate for modifying or creating a hard copy, you may return and export it again at any time.

Make use of the US Legal Forms professional collection to get access to the Dayton Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement you were seeking and a large number of other professional and state-specific samples on a single website!