The Cuyahoga Ohio Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the rights, responsibilities, and procedures for operating an LLC in Cuyahoga County, Ohio. It serves as a crucial tool to establish the business's internal governance and provides guidelines for decision-making, profit distribution, and member duties. This operating agreement is specifically tailored to meet the requirements and regulations set forth by the Ohio Secretary of State and the Ohio Revised Code. This agreement is designed to protect the interests of the LLC members and ensures clarity in their relationships and obligations. The Cuyahoga Ohio LLC Operating Agreement typically covers the following key aspects: 1. Formation and Purpose: It defines the formation details of the LLC, including the registered business name and purpose of its establishment. 2. Membership: This section outlines the criteria for becoming a member of the LLC, the process for acquiring or transferring membership interest, and the rights and responsibilities associated with membership. It may also outline the procedures for admitting new members and withdrawing or expelling existing members. 3. Capital Contributions: The operating agreement addresses the initial capital contributions made by each member, which may include cash, property, or services. It also establishes the guidelines for future capital contributions and how they would be allocated among the members. 4. Profit and Loss Distribution: This section specifies how the LLC's profits and losses will be distributed among the members. It outlines the allocation percentages or formulas agreed upon, which may be based on the members' capital contributions, ownership percentages, or any other mutually agreed basis. 5. Management and Decision-making: The operating agreement determines whether the LLC will be member-managed or manager-managed. In member-managed LCS, all members have the authority to participate in the management and decision-making process. Conversely, in manager-managed LCS, designated managers handle the day-to-day operations and decision-making. 6. Meetings and Voting: If the LLC is member-managed, this section details the process for conducting meetings and voting on important matters. It outlines the notice requirements, quorum thresholds, and voting powers of each member. Manager-managed LCS may also include provisions for manager meetings and voting procedures. 7. Dissolution and Termination: This portion of the agreement addresses the circumstances under which the LLC would be dissolved, such as by member vote, bankruptcy, or expiration of the agreed-upon term. It also outlines the procedures for winding up the LLC's affairs, distributing remaining assets, and handling any outstanding liabilities. While the Cuyahoga Ohio LLC Operating Agreement generally covers these key aspects, it can be customized to meet the specific needs of the LLC and its members. By tailoring the agreement, additional provisions can be included to address areas such as dispute resolution, non-competition agreements, ownership transfer restrictions, and any other pertinent matters. It's worth mentioning that while there may be various templates or formats available for LLC operating agreements, it is crucial to ensure compliance with the applicable laws and regulations in Cuyahoga County, Ohio. Additionally, seeking the guidance of a legal professional is highly recommended in order to draft, review, or modify the operating agreement to accurately reflect the intentions and goals of the LLC and its members.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo Operativo de Sociedad de Responsabilidad Limitada LLC - Ohio Limited Liability Company LLC Operating Agreement

Description

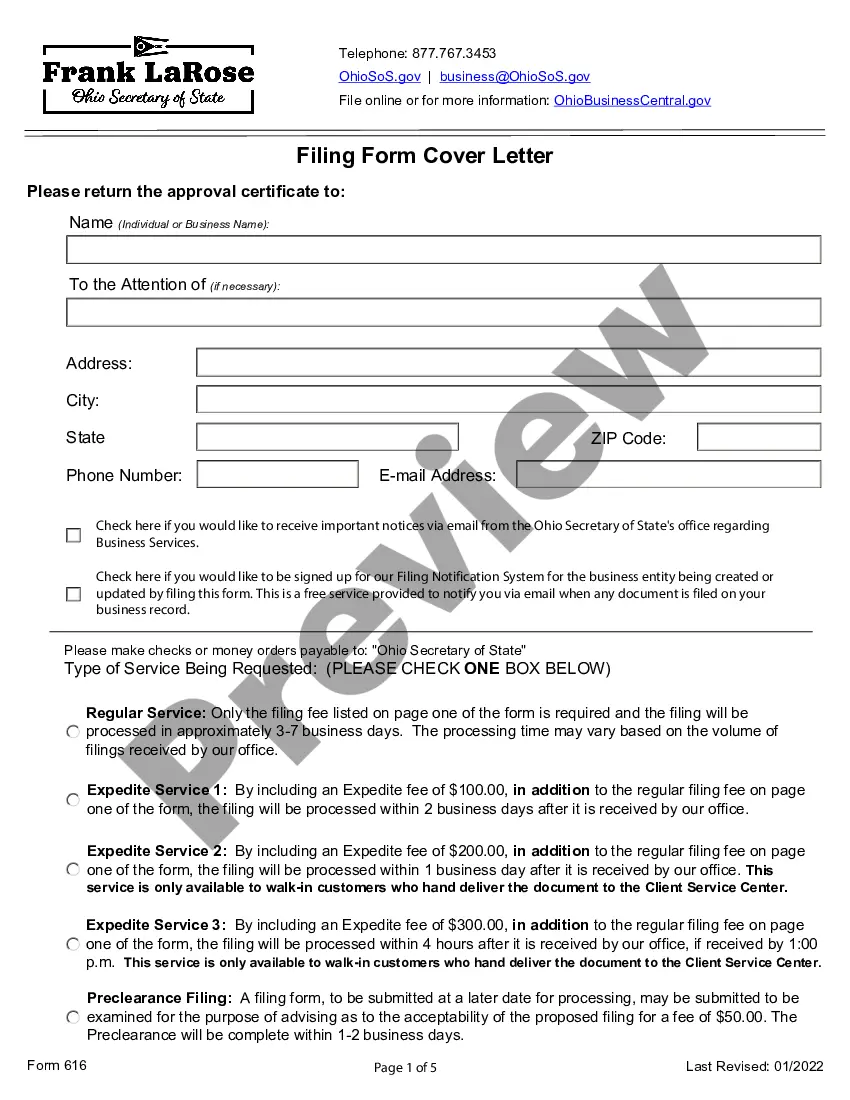

How to fill out Cuyahoga Ohio Acuerdo Operativo De Sociedad De Responsabilidad Limitada LLC?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person without any legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Cuyahoga Ohio Limited Liability Company LLC Operating Agreement or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cuyahoga Ohio Limited Liability Company LLC Operating Agreement quickly using our reliable service. If you are presently a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to downloading the Cuyahoga Ohio Limited Liability Company LLC Operating Agreement:

- Be sure the form you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the document and read a short outline (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment method and proceed to download the Cuyahoga Ohio Limited Liability Company LLC Operating Agreement as soon as the payment is done.

You’re good to go! Now you can go on and print out the document or complete it online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.