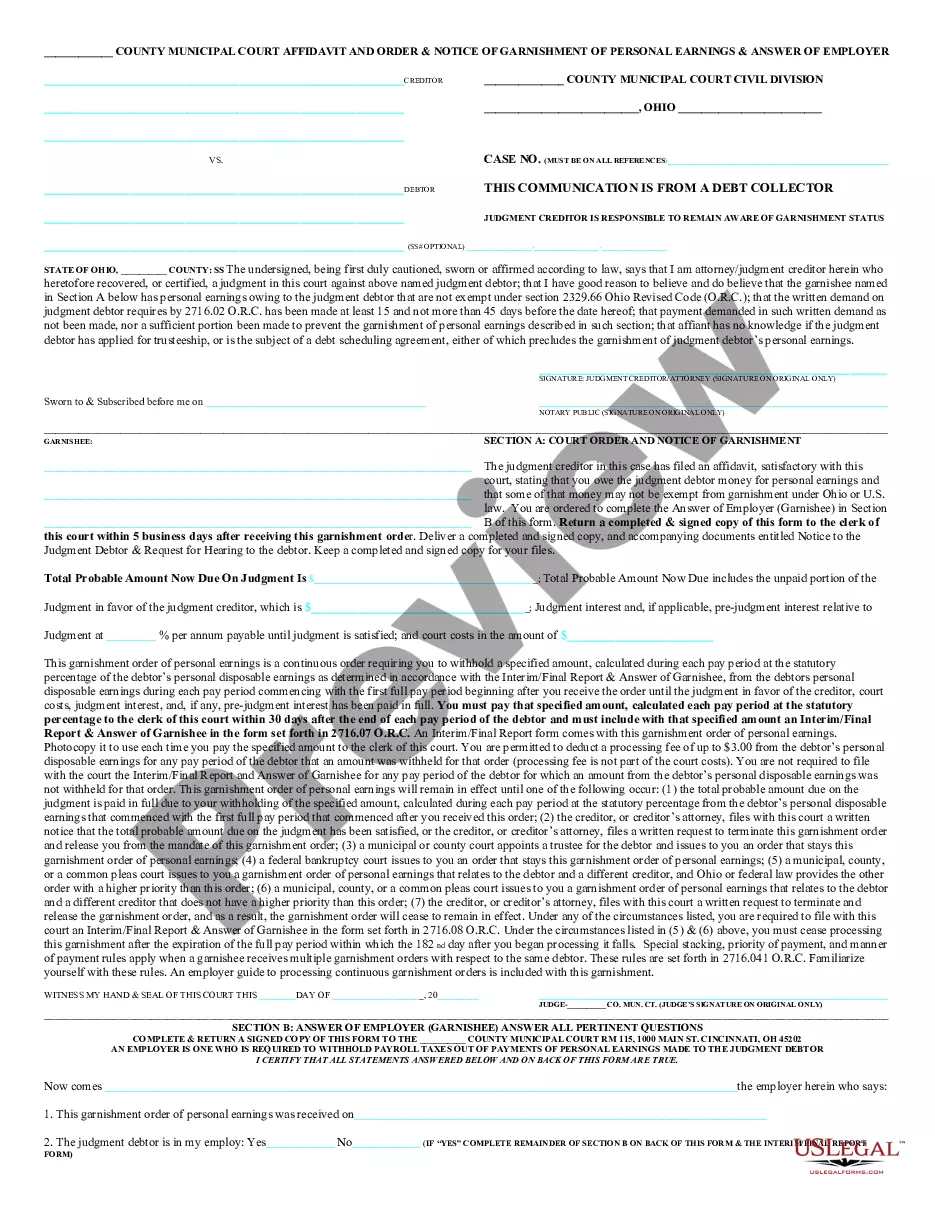

This Ohio form, an Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, is for use in Ohio garnishment cases. It is available in Word or Rich Text format.

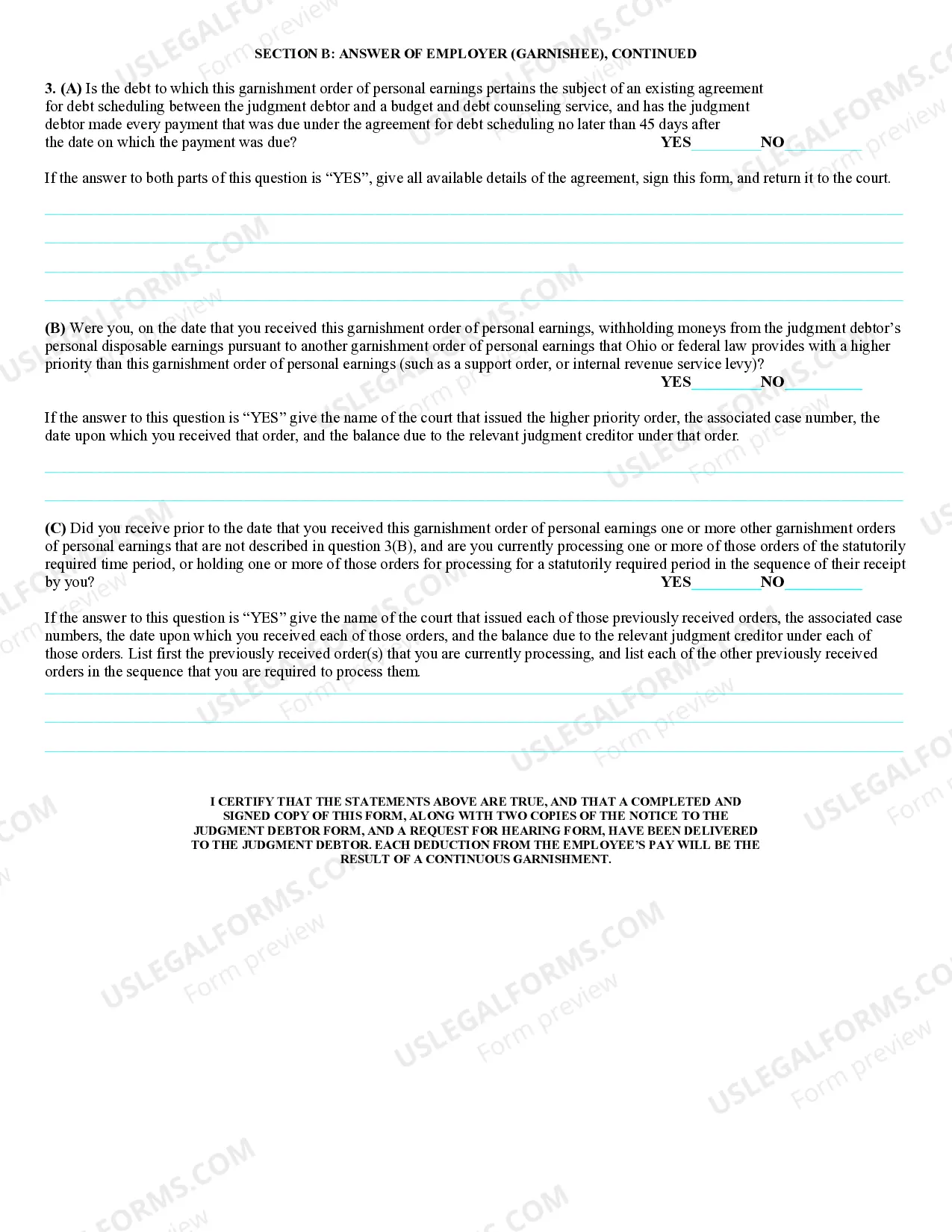

Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document used in the state of Ohio to initiate the process of garnishing an individual's wages or personal earnings. The purpose of this document is to notify the employer of the debtor's legal obligations regarding the garnishment order and request their cooperation in deducting a specified amount from the employee's paycheck. The Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer contains several crucial elements. The document typically starts with the identification of the court and the case number, providing necessary information for tracking purposes. It also includes the name and address of both the debtor and the creditor, ensuring accurate communication between all parties involved. Furthermore, this affidavit outlines the amount owed by the debtor, including any outstanding balances, interests, and fees. It specifies the percentage or fixed sum to be withheld from the employee's earnings and provides instructions on how frequently the payments should be made, such as weekly, biweekly, or monthly. Additionally, it may detail the duration of the garnishment, delineating the period during which the employer should deduct funds from the employee's paycheck. In instances where there are different types of Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings, they may include: 1. Regular Garnishment: This is the standard type of garnishment where the court order is issued to deduct a specific amount or percentage from the employee's earnings until the debt is fully repaid. 2. Child Support Garnishment: In cases involving child support, this type of garnishment is used to deduct a portion of the employee's wages to fulfill their child support obligations. 3. Tax Garnishment: If a debtor owes outstanding taxes, this form of garnishment enables the government or related tax authorities to collect the owed amount from the individual's earnings. 4. Student Loan Garnishment: When an individual fails to make payments towards their student loan, the creditor can initiate garnishment proceedings to collect the outstanding balance through deductions from the borrower's wages. To summarize, the Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document designed to inform employers about their responsibility to withhold a portion of an employee's wages to satisfy a debt. Through this document, the court aims to facilitate debt repayment while still considering the financial well-being of the debtor. Employers are legally obligated to comply with this notice and ensure accurate and timely deductions from their employee's wages.Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document used in the state of Ohio to initiate the process of garnishing an individual's wages or personal earnings. The purpose of this document is to notify the employer of the debtor's legal obligations regarding the garnishment order and request their cooperation in deducting a specified amount from the employee's paycheck. The Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer contains several crucial elements. The document typically starts with the identification of the court and the case number, providing necessary information for tracking purposes. It also includes the name and address of both the debtor and the creditor, ensuring accurate communication between all parties involved. Furthermore, this affidavit outlines the amount owed by the debtor, including any outstanding balances, interests, and fees. It specifies the percentage or fixed sum to be withheld from the employee's earnings and provides instructions on how frequently the payments should be made, such as weekly, biweekly, or monthly. Additionally, it may detail the duration of the garnishment, delineating the period during which the employer should deduct funds from the employee's paycheck. In instances where there are different types of Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings, they may include: 1. Regular Garnishment: This is the standard type of garnishment where the court order is issued to deduct a specific amount or percentage from the employee's earnings until the debt is fully repaid. 2. Child Support Garnishment: In cases involving child support, this type of garnishment is used to deduct a portion of the employee's wages to fulfill their child support obligations. 3. Tax Garnishment: If a debtor owes outstanding taxes, this form of garnishment enables the government or related tax authorities to collect the owed amount from the individual's earnings. 4. Student Loan Garnishment: When an individual fails to make payments towards their student loan, the creditor can initiate garnishment proceedings to collect the outstanding balance through deductions from the borrower's wages. To summarize, the Cincinnati Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document designed to inform employers about their responsibility to withhold a portion of an employee's wages to satisfy a debt. Through this document, the court aims to facilitate debt repayment while still considering the financial well-being of the debtor. Employers are legally obligated to comply with this notice and ensure accurate and timely deductions from their employee's wages.