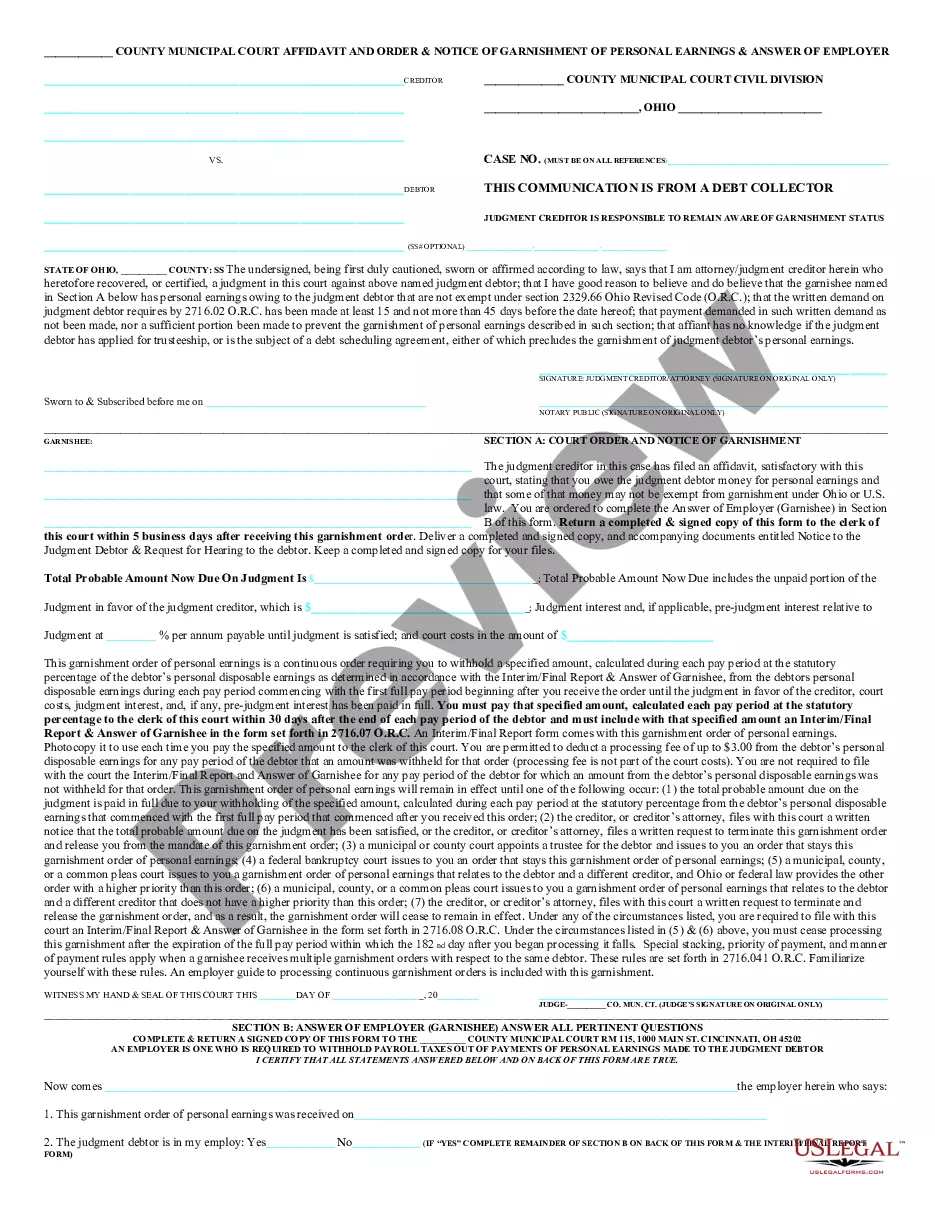

This Ohio form, an Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, is for use in Ohio garnishment cases. It is available in Word or Rich Text format.

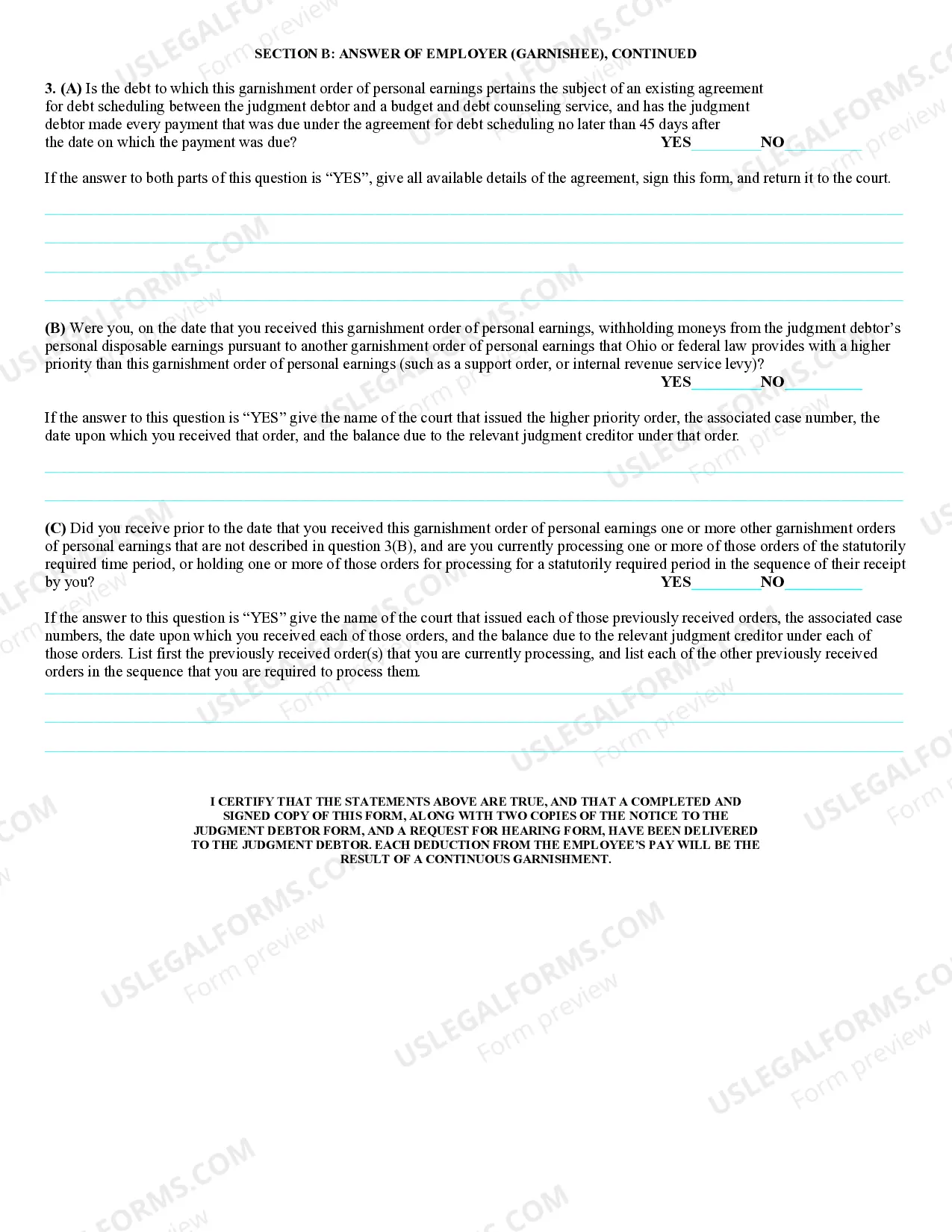

The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document used in Franklin, Ohio to initiate a wage garnishment process for the collection of outstanding debts. This document serves as a formal notification to an individual's employer that a portion of their wages must be withheld and paid towards the debt owed. The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings is typically issued by a creditor or debt collector who has obtained a judgment against the debtor in a court of law. By filing this affidavit, the creditor seeks to enforce payment of the debt by garnishing the debtor's wages. Keywords: Franklin Ohio, affidavit, notice, garnishment, personal earnings, answer of employer, debt collection, wage garnishment, outstanding debts, formal notification, creditor, debtor, judgment, court of law, filing. There are a few different types of Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, depending on the specific circumstances and intent of the garnishment: 1. Regular Garnishment: This type of garnishment occurs when a creditor initiates the process to collect outstanding debts from the debtor's wages. The affidavit and notice are filed with the court, and upon approval, the employer is legally required to withhold a certain portion of the employee's earnings and remit it to the creditor. 2. Child Support Garnishment: In cases where the debtor owes child support payments, the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings is used by the Ohio Child Support Enforcement Agency (SEA). This allows them to collect the owed child support directly from the debtor's wages. 3. Tax Garnishment: The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings can also be used by government agencies, such as the Internal Revenue Service (IRS), to collect unpaid taxes. In this case, the garnishment process enables the agency to deduct the owed taxes directly from the debtor's wages. 4. Student Loan Garnishment: If a debtor defaults on their student loan payments, the Department of Education or a loan servicing agency may file the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings to collect the overdue loan payments from the debtor's wages. This type of garnishment is specifically related to outstanding student loan debts. Keywords: Regular garnishment, child support garnishment, tax garnishment, student loan garnishment, Ohio Child Support Enforcement Agency, owed child support, Internal Revenue Service, unpaid taxes, Department of Education, loan servicing agency, default, student loan payments, overdue loan payments. It is important for the employer to carefully review and respond to the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings to ensure compliance with the legal requirements and avoid any potential consequences. Employers are generally required to complete the Answer of Employer section of the document, providing detailed information about the employee's wages and employment status. By understanding the purpose and various types of the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, employers can effectively navigate the garnishment process and fulfill their legal obligations. Keywords: Legal requirements, compliance, consequence, answer of employer, employee's wages, employment status, navigate, fulfill, legal obligations.The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer is a legal document used in Franklin, Ohio to initiate a wage garnishment process for the collection of outstanding debts. This document serves as a formal notification to an individual's employer that a portion of their wages must be withheld and paid towards the debt owed. The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings is typically issued by a creditor or debt collector who has obtained a judgment against the debtor in a court of law. By filing this affidavit, the creditor seeks to enforce payment of the debt by garnishing the debtor's wages. Keywords: Franklin Ohio, affidavit, notice, garnishment, personal earnings, answer of employer, debt collection, wage garnishment, outstanding debts, formal notification, creditor, debtor, judgment, court of law, filing. There are a few different types of Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, depending on the specific circumstances and intent of the garnishment: 1. Regular Garnishment: This type of garnishment occurs when a creditor initiates the process to collect outstanding debts from the debtor's wages. The affidavit and notice are filed with the court, and upon approval, the employer is legally required to withhold a certain portion of the employee's earnings and remit it to the creditor. 2. Child Support Garnishment: In cases where the debtor owes child support payments, the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings is used by the Ohio Child Support Enforcement Agency (SEA). This allows them to collect the owed child support directly from the debtor's wages. 3. Tax Garnishment: The Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings can also be used by government agencies, such as the Internal Revenue Service (IRS), to collect unpaid taxes. In this case, the garnishment process enables the agency to deduct the owed taxes directly from the debtor's wages. 4. Student Loan Garnishment: If a debtor defaults on their student loan payments, the Department of Education or a loan servicing agency may file the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings to collect the overdue loan payments from the debtor's wages. This type of garnishment is specifically related to outstanding student loan debts. Keywords: Regular garnishment, child support garnishment, tax garnishment, student loan garnishment, Ohio Child Support Enforcement Agency, owed child support, Internal Revenue Service, unpaid taxes, Department of Education, loan servicing agency, default, student loan payments, overdue loan payments. It is important for the employer to carefully review and respond to the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings to ensure compliance with the legal requirements and avoid any potential consequences. Employers are generally required to complete the Answer of Employer section of the document, providing detailed information about the employee's wages and employment status. By understanding the purpose and various types of the Franklin Ohio Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer, employers can effectively navigate the garnishment process and fulfill their legal obligations. Keywords: Legal requirements, compliance, consequence, answer of employer, employee's wages, employment status, navigate, fulfill, legal obligations.