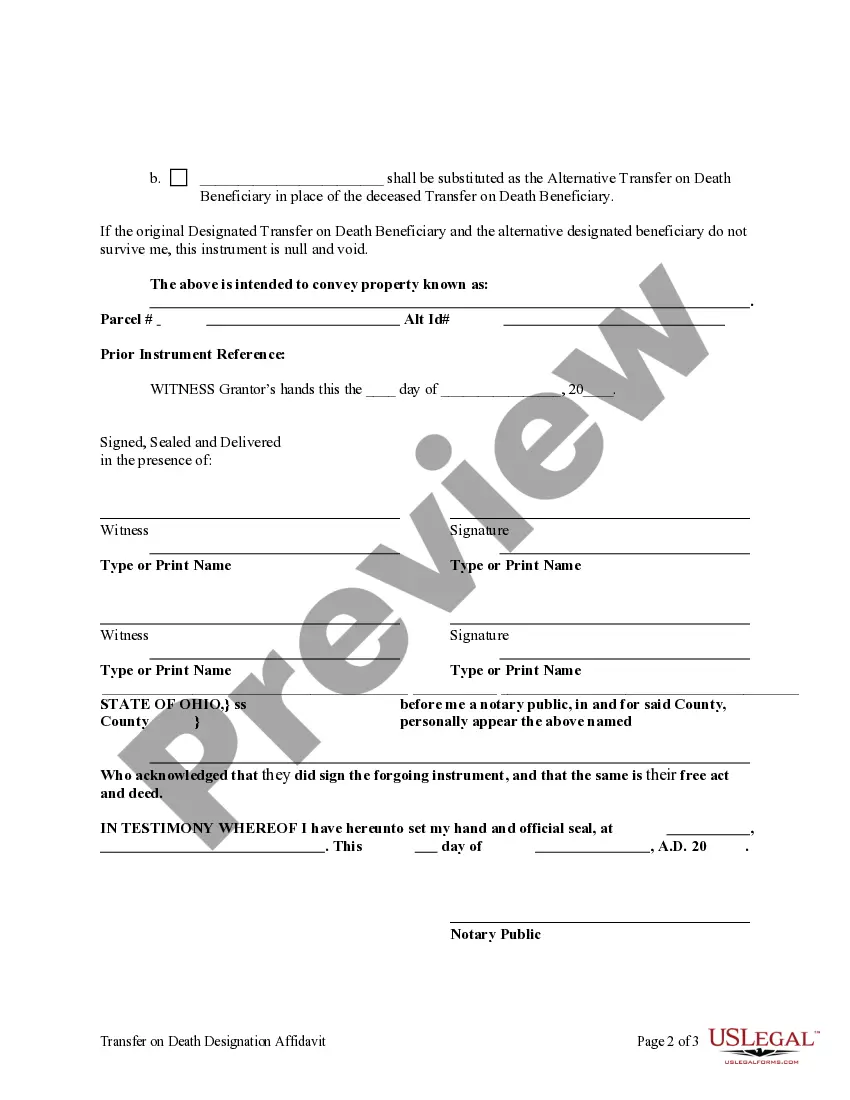

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the grantee is an individual. The transfer to the designated beneficiary is not effective until the death of both grantors. The affidavit may be canceled by designating a new transfer on death beneficiary in a new affidavit, selling the property, etc. This deed complies with all state statutory laws.

Dayton Ohio Transfer on Death Designation Affidavit (TOD) is a legal document that allows individuals to transfer their real estate properties or assets after their death to a designated individual without the need for probate. This affidavit is specifically used by married couples in Dayton, Ohio, who wish to designate a specific person as the beneficiary of their property. The primary purpose of the transfer on death designation affidavit is to provide a seamless transfer of real property to the beneficiary upon the death of both spouses. It helps avoid the time-consuming and costly probate process, ensuring a hassle-free transfer of assets. There are different types of Dayton Ohio Transfer on Death Designation Affidavits available based on the specific circumstances of the married couple: 1. TOD from Husband and Wife to Individual — This type allows both spouses to designate a single individual as the beneficiary of their property after their deaths. It is commonly used when a couple wants to leave their real estate or assets to a trusted family member, friend, or loved one. 2. TOD from Husband and Wife to Joint Tenants with Rights of Survivorship (TWOS) — This type enables both spouses to transfer their real property to each other as joint tenants with rights of survivorship. In case of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. This option provides a seamless transfer of assets between spouses. 3. TOD from Husband and Wife to Revocable Living Trust — This variation allows couples to transfer their assets to a revocable living trust rather than an individual beneficiary. A revocable living trust provides flexibility and control over the assets during the couple's lifetime and outlines how the assets will be distributed after their deaths. To create a valid Dayton Ohio Transfer on Death Designation Affidavit, certain essential details must be included, such as the names and contact information of the husband and wife, the designated beneficiary, a description of the property or assets to be transferred, and the legal description of the property. It is crucial to consult with an attorney or a legal expert to ensure that the Transfer on Death Designation Affidavit complies with all the necessary legal requirements and is consistent with the couple's estate planning goals. Expert guidance helps avoid any potential issues or disputes that may arise after the passing of the husband and wife. Overall, Dayton Ohio Transfer on Death Designation Affidavit provides a practical and effective way for married couples to transfer their real estate or personal assets to a designated individual or entity after their deaths. Utilizing this legal tool helps streamline the transfer process, providing peace of mind for the couple and their chosen beneficiary.Dayton Ohio Transfer on Death Designation Affidavit (TOD) is a legal document that allows individuals to transfer their real estate properties or assets after their death to a designated individual without the need for probate. This affidavit is specifically used by married couples in Dayton, Ohio, who wish to designate a specific person as the beneficiary of their property. The primary purpose of the transfer on death designation affidavit is to provide a seamless transfer of real property to the beneficiary upon the death of both spouses. It helps avoid the time-consuming and costly probate process, ensuring a hassle-free transfer of assets. There are different types of Dayton Ohio Transfer on Death Designation Affidavits available based on the specific circumstances of the married couple: 1. TOD from Husband and Wife to Individual — This type allows both spouses to designate a single individual as the beneficiary of their property after their deaths. It is commonly used when a couple wants to leave their real estate or assets to a trusted family member, friend, or loved one. 2. TOD from Husband and Wife to Joint Tenants with Rights of Survivorship (TWOS) — This type enables both spouses to transfer their real property to each other as joint tenants with rights of survivorship. In case of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. This option provides a seamless transfer of assets between spouses. 3. TOD from Husband and Wife to Revocable Living Trust — This variation allows couples to transfer their assets to a revocable living trust rather than an individual beneficiary. A revocable living trust provides flexibility and control over the assets during the couple's lifetime and outlines how the assets will be distributed after their deaths. To create a valid Dayton Ohio Transfer on Death Designation Affidavit, certain essential details must be included, such as the names and contact information of the husband and wife, the designated beneficiary, a description of the property or assets to be transferred, and the legal description of the property. It is crucial to consult with an attorney or a legal expert to ensure that the Transfer on Death Designation Affidavit complies with all the necessary legal requirements and is consistent with the couple's estate planning goals. Expert guidance helps avoid any potential issues or disputes that may arise after the passing of the husband and wife. Overall, Dayton Ohio Transfer on Death Designation Affidavit provides a practical and effective way for married couples to transfer their real estate or personal assets to a designated individual or entity after their deaths. Utilizing this legal tool helps streamline the transfer process, providing peace of mind for the couple and their chosen beneficiary.