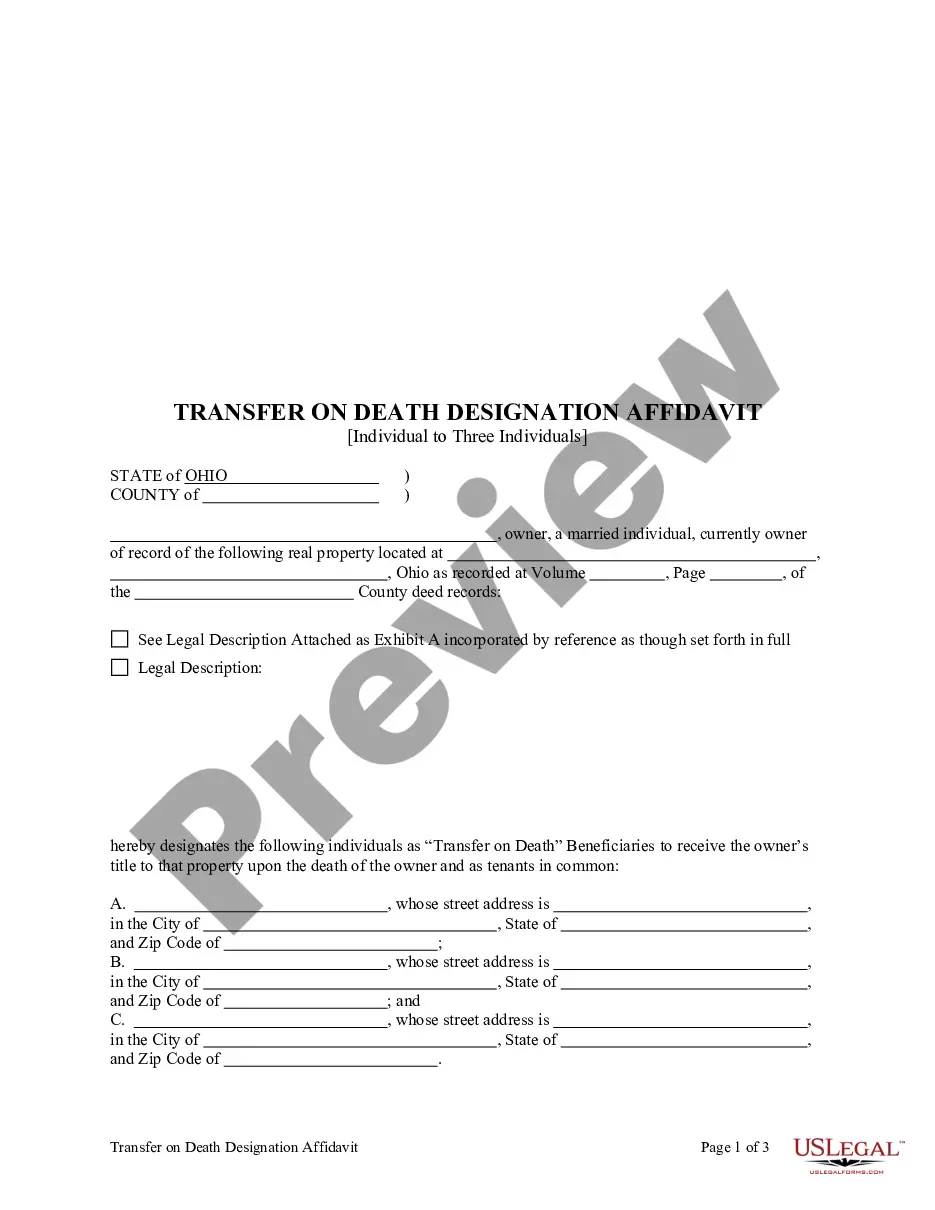

This form is a Transfer on Death Designation Affidavit where the affiant is an individual and the beneficiaries are three individuals. This affidavit of designation is revocable by affiant until afiant's death and effective only upon the death of the affiant. The beneficiaries take the property as tenants in common or jointly with a survivorship interest. This deed complies with all state statutory laws.

Dayton Ohio Transfer on Death Designation Affidavit, also known as TOD Affidavit, is a legal document used to specify the beneficiaries who will receive ownership of an individual's assets after their death. This article will provide a descriptive overview of the process and types of Transfer on Death Designation Affidavit available in Dayton, Ohio, with a focus on the Individual Affine to Three Individuals Beneficiaries. In Dayton, Ohio, individuals have the option to utilize the Transfer on Death Designation Affidavit to plan for the distribution of their assets upon their demise. This legal tool allows the individual, known as the Affine, to assign specific beneficiaries who will inherit their designated assets without having to go through probate court. The Transfer on Death Designation Affidavit in Dayton, Ohio, is commonly used when an individual wants to pass on assets such as real estate, bank accounts, or investments to three different beneficiaries. By completing this affidavit, the Affine clearly outlines their wishes and the intended recipients of their assets. The Individual Affine to Three Individuals Beneficiaries designation is suitable for those with complex asset allocation requirements. This type of TOD Affidavit ensures that the individual's assets are divided among three distinct beneficiaries according to their specified shares. Each beneficiary will receive their allocated share without the need for court involvement or probate proceedings. It is important to note that there may be other variations of the Dayton Ohio Transfer on Death Designation Affidavit available, depending on the number of beneficiaries involved. For example, an Affine might wish to designate only one beneficiary or allocate assets to a larger group, such as five individuals. Each variation has its own specific requirements and must be prepared with precision to ensure the desired distribution is accurately executed. To create a Dayton Ohio Transfer on Death Designation Affidavit, the Affine must follow the state's legal guidelines. They should gather the necessary information about their assets, including addresses, legal descriptions, and account numbers. It is advisable to consult with an experienced attorney to ensure compliance with all legal requirements and to have the document properly executed and notarized. In summary, the Transfer on Death Designation Affidavit is an essential estate planning tool for individuals residing in Dayton, Ohio, who wish to outline the beneficiaries of their assets. The Individual Affine to Three Individuals Beneficiaries variation specifically caters to those who have three intended beneficiaries. Other variants may exist, accommodating a different number of beneficiaries. Regardless of the type selected, the TOD Affidavit avoids probate, simplifies the asset transfer process, and ensures a smooth transition of ownership to the specified individuals.Dayton Ohio Transfer on Death Designation Affidavit, also known as TOD Affidavit, is a legal document used to specify the beneficiaries who will receive ownership of an individual's assets after their death. This article will provide a descriptive overview of the process and types of Transfer on Death Designation Affidavit available in Dayton, Ohio, with a focus on the Individual Affine to Three Individuals Beneficiaries. In Dayton, Ohio, individuals have the option to utilize the Transfer on Death Designation Affidavit to plan for the distribution of their assets upon their demise. This legal tool allows the individual, known as the Affine, to assign specific beneficiaries who will inherit their designated assets without having to go through probate court. The Transfer on Death Designation Affidavit in Dayton, Ohio, is commonly used when an individual wants to pass on assets such as real estate, bank accounts, or investments to three different beneficiaries. By completing this affidavit, the Affine clearly outlines their wishes and the intended recipients of their assets. The Individual Affine to Three Individuals Beneficiaries designation is suitable for those with complex asset allocation requirements. This type of TOD Affidavit ensures that the individual's assets are divided among three distinct beneficiaries according to their specified shares. Each beneficiary will receive their allocated share without the need for court involvement or probate proceedings. It is important to note that there may be other variations of the Dayton Ohio Transfer on Death Designation Affidavit available, depending on the number of beneficiaries involved. For example, an Affine might wish to designate only one beneficiary or allocate assets to a larger group, such as five individuals. Each variation has its own specific requirements and must be prepared with precision to ensure the desired distribution is accurately executed. To create a Dayton Ohio Transfer on Death Designation Affidavit, the Affine must follow the state's legal guidelines. They should gather the necessary information about their assets, including addresses, legal descriptions, and account numbers. It is advisable to consult with an experienced attorney to ensure compliance with all legal requirements and to have the document properly executed and notarized. In summary, the Transfer on Death Designation Affidavit is an essential estate planning tool for individuals residing in Dayton, Ohio, who wish to outline the beneficiaries of their assets. The Individual Affine to Three Individuals Beneficiaries variation specifically caters to those who have three intended beneficiaries. Other variants may exist, accommodating a different number of beneficiaries. Regardless of the type selected, the TOD Affidavit avoids probate, simplifies the asset transfer process, and ensures a smooth transition of ownership to the specified individuals.