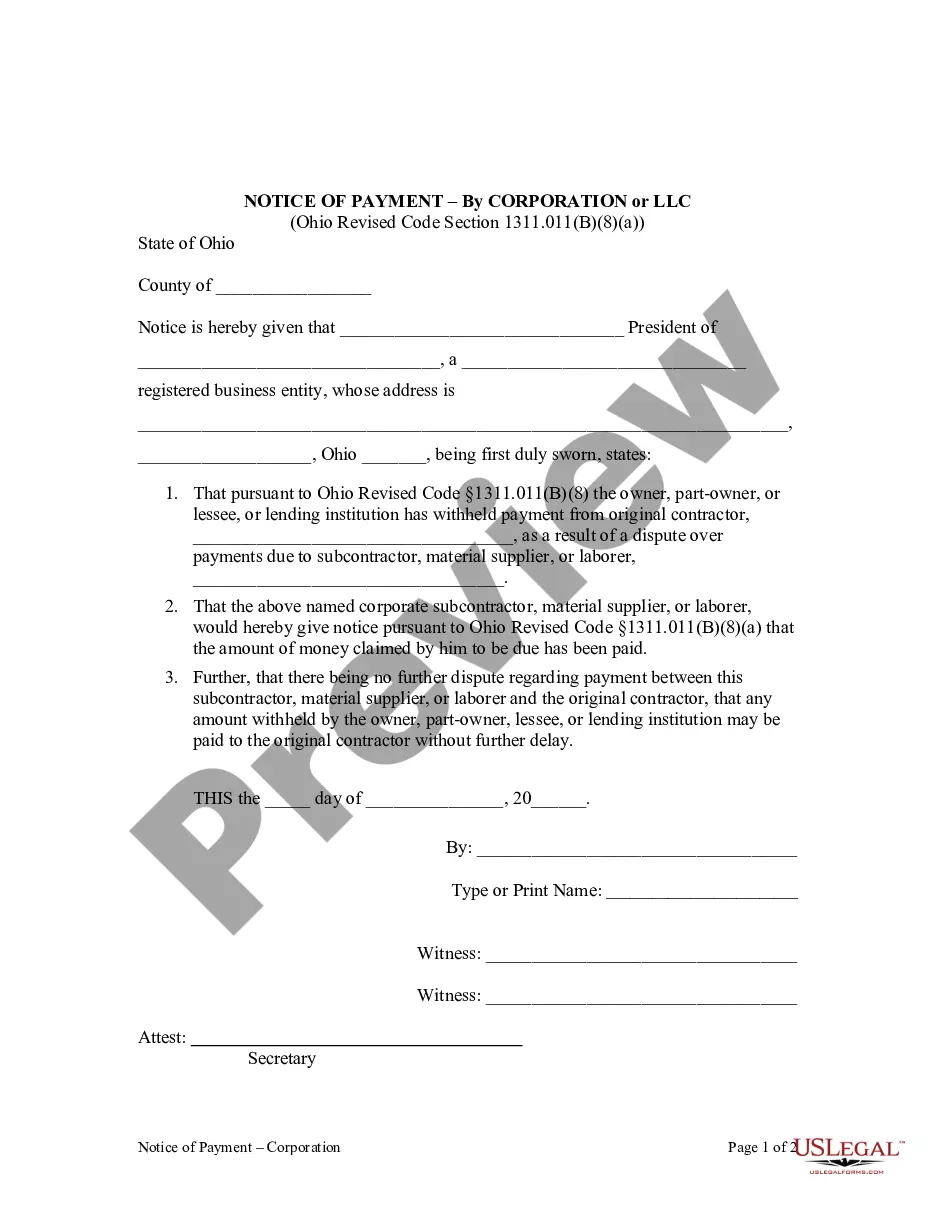

When a lending institution or an owner, part-owner, or lessee withholds payment from an original contractor due to a dispute over payment between the contractor and the subcontractor, materialman, or laborer, this form serves to notify the owner or lending institution that payment has been made to the subcontractor, materialman, or laborer, and that the owner and lender may now release funds to the original contractor.

Dayton Ohio Notice of Payment — Corporation or LLC The Dayton Ohio Notice of Payment is a crucial document that corporations and limited liability companies (LCS) in Dayton, Ohio, are required to file to report and remit their respective payments to the appropriate authorities. This notice serves as proof of compliance with local regulations and helps maintain accurate financial records for corporations and LCS operating within the jurisdiction. There are different types of Dayton Ohio Notice of Payment — Corporation or LLC, categorized based on the specific nature and purpose of the payment being reported. Some key types include: 1. Annual Franchise Tax Payment Notice: Dayton-based Corporations and LCS are obligated to file an Annual Franchise Tax Payment Notice, also known as the Commercial Activity Tax (CAT) Notice. This notice requires corporations or LCS to provide detailed information about their commercial activities in Dayton, along with the corresponding calculated tax owed for the specified period. It ensures that corporations and LCS fulfill their tax obligations and contribute to the local economy. 2. Quarterly Estimated Tax Payment Notice: Dayton-based Corporations and LCS that expect to owe a significant amount in income taxes are required to file a Quarterly Estimated Tax Payment Notice. This notice mandates periodic payments to the tax authorities throughout the fiscal year, ensuring timely tax collections and reducing the burden of a lump sum payment. 3. Sales Tax Payment Notice: Corporations or LCS engaged in retail or wholesale activities within Dayton are required to file a Sales Tax Payment Notice. This notice outlines the sales made within the jurisdiction during a specified period and calculates the associated sales tax liability. By submitting this notice, corporations and LCS ensure compliance with sales tax regulations and contribute to the funding of local public services. 4. Employee Withholding Tax Payment Notice: Dayton-based corporations or LCS with employees, including regular staff and independent contractors, are mandated to file an Employee Withholding Tax Payment Notice. This notice outlines the amount of income tax withheld from employees' wages, including payroll taxes, social security contributions, and other deductions. By submitting this notice, corporations and LCS fulfill their obligations as employers and help facilitate income tax collections at the local level. It is imperative that corporations and LCS in Dayton, Ohio, understand the specific types of Notice of Payment applicable to their business activities and ensure timely and accurate filings. Failure to comply with these requirements can result in penalties, fines, or legal consequences. Therefore, it is recommended to consult with a qualified tax professional or legal advisor to ensure accurate completion of the Dayton Ohio Notice of Payment, tailored to the specific circumstances of the corporation or LLC.Dayton Ohio Notice of Payment — Corporation or LLC The Dayton Ohio Notice of Payment is a crucial document that corporations and limited liability companies (LCS) in Dayton, Ohio, are required to file to report and remit their respective payments to the appropriate authorities. This notice serves as proof of compliance with local regulations and helps maintain accurate financial records for corporations and LCS operating within the jurisdiction. There are different types of Dayton Ohio Notice of Payment — Corporation or LLC, categorized based on the specific nature and purpose of the payment being reported. Some key types include: 1. Annual Franchise Tax Payment Notice: Dayton-based Corporations and LCS are obligated to file an Annual Franchise Tax Payment Notice, also known as the Commercial Activity Tax (CAT) Notice. This notice requires corporations or LCS to provide detailed information about their commercial activities in Dayton, along with the corresponding calculated tax owed for the specified period. It ensures that corporations and LCS fulfill their tax obligations and contribute to the local economy. 2. Quarterly Estimated Tax Payment Notice: Dayton-based Corporations and LCS that expect to owe a significant amount in income taxes are required to file a Quarterly Estimated Tax Payment Notice. This notice mandates periodic payments to the tax authorities throughout the fiscal year, ensuring timely tax collections and reducing the burden of a lump sum payment. 3. Sales Tax Payment Notice: Corporations or LCS engaged in retail or wholesale activities within Dayton are required to file a Sales Tax Payment Notice. This notice outlines the sales made within the jurisdiction during a specified period and calculates the associated sales tax liability. By submitting this notice, corporations and LCS ensure compliance with sales tax regulations and contribute to the funding of local public services. 4. Employee Withholding Tax Payment Notice: Dayton-based corporations or LCS with employees, including regular staff and independent contractors, are mandated to file an Employee Withholding Tax Payment Notice. This notice outlines the amount of income tax withheld from employees' wages, including payroll taxes, social security contributions, and other deductions. By submitting this notice, corporations and LCS fulfill their obligations as employers and help facilitate income tax collections at the local level. It is imperative that corporations and LCS in Dayton, Ohio, understand the specific types of Notice of Payment applicable to their business activities and ensure timely and accurate filings. Failure to comply with these requirements can result in penalties, fines, or legal consequences. Therefore, it is recommended to consult with a qualified tax professional or legal advisor to ensure accurate completion of the Dayton Ohio Notice of Payment, tailored to the specific circumstances of the corporation or LLC.