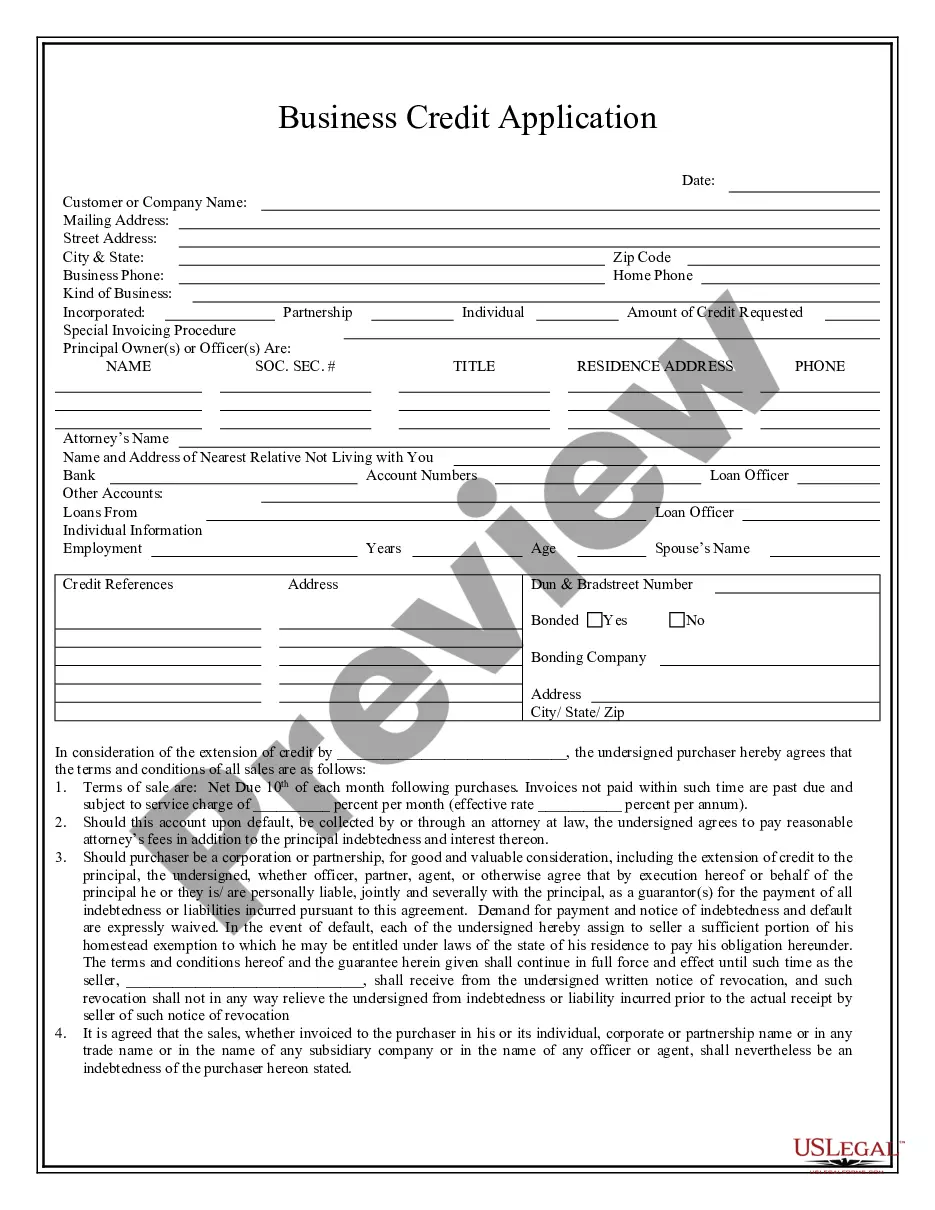

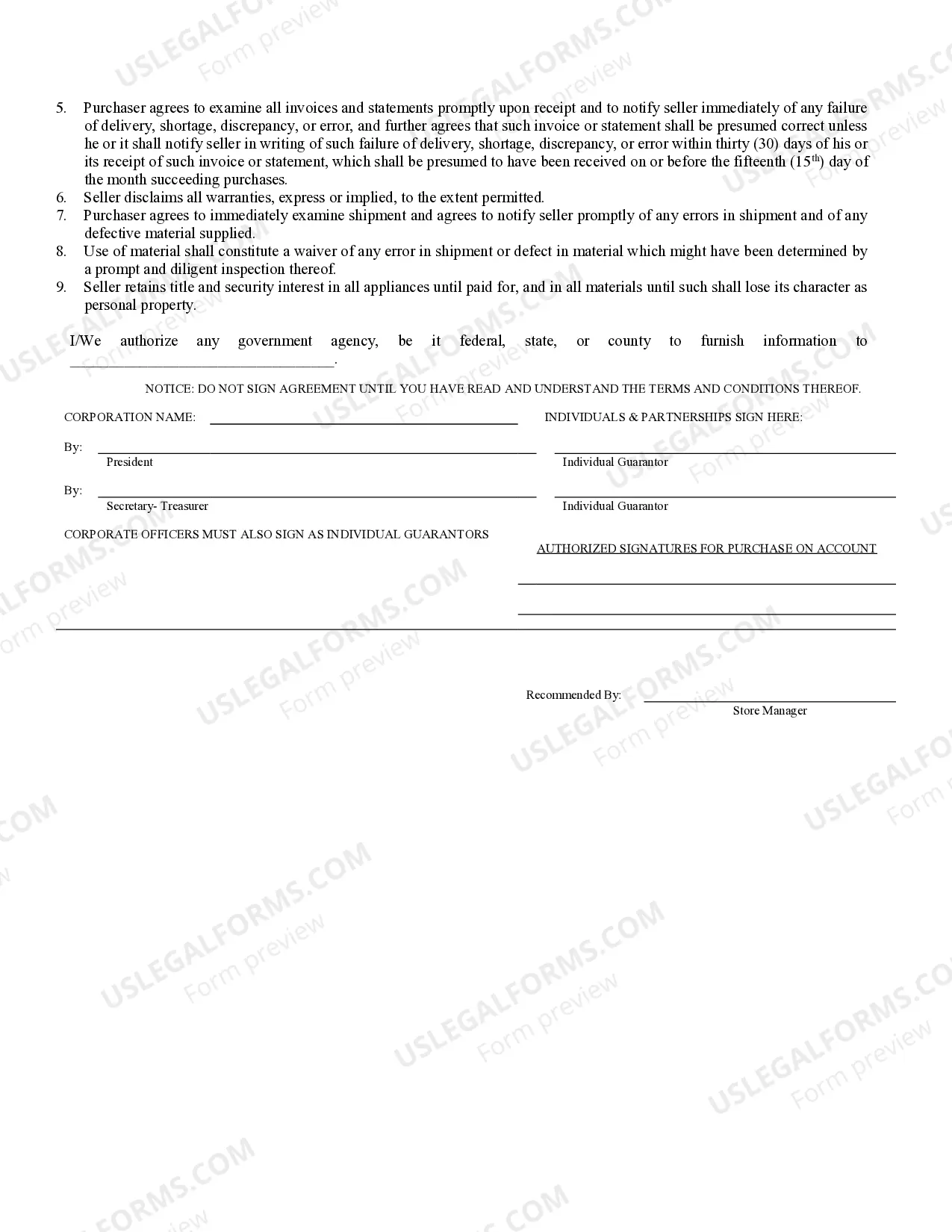

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Dayton Ohio Business Credit Application, also known as Dayton OH Business Credit Application or simply Dayton Business Credit Application, refers to a comprehensive document utilized by businesses in Dayton, Ohio, that enables them to apply for credit from financial institutions, lenders, or suppliers. This application serves as a formal request for credit, allowing businesses to access funds or products on credit terms rather than making immediate payments. The Dayton Ohio Business Credit Application typically includes essential information needed for a credit evaluation. This information may include the business's legal name, business structure (such as sole proprietorship, partnership, or corporation), contact details (phone number, email, address), tax identification number (TIN), and any relevant licenses or permits. Furthermore, the application might require detailed financial information, including the business's annual revenue, operating expenses, profit margins, and financial statements. These financial statements often include a balance sheet, income statement, and cash flow statement, providing the lender with a comprehensive understanding of the applicant's financial health. Additionally, Dayton Ohio Business Credit Applications might inquire about the business's history, length of operation, industry sector, and the purpose for which credit is sought. This could involve specifying whether the credit is needed for working capital, equipment purchase or lease, expansion, inventory procurement, or other business-related expenses. Different types of Dayton Ohio Business Credit Applications may exist, catering to specific industries or credit requirements. For instance: 1. Small Business Credit Application: Designed for startups or small businesses in Dayton, Ohio, looking for credit options to support their business operations, growth, or specific projects. 2. Commercial Credit Application: Tailored for larger corporations and companies seeking substantial credit amounts for expansion plans, mergers and acquisitions, or capital-intensive projects. 3. Supplier Credit Application: Targeting businesses in Dayton that need to establish credit terms with suppliers to procure necessary inventory, raw materials, or services on credit. 4. Personal Guarantee Credit Application: In situations where business credit is limited, lenders might require a personal guarantee from the business owner(s) to secure the credit. This type of application includes provisions for personal credit evaluation alongside the business's financial information. It is important to note that each lender or financial institution might have its own variation of the Dayton Ohio Business Credit Application, incorporating specific terms, conditions, and requirements. Therefore, it is advisable for businesses in Dayton, Ohio, to gather relevant information and review application forms provided by potential credit providers to ensure accuracy and completeness while applying for credit.Dayton Ohio Business Credit Application, also known as Dayton OH Business Credit Application or simply Dayton Business Credit Application, refers to a comprehensive document utilized by businesses in Dayton, Ohio, that enables them to apply for credit from financial institutions, lenders, or suppliers. This application serves as a formal request for credit, allowing businesses to access funds or products on credit terms rather than making immediate payments. The Dayton Ohio Business Credit Application typically includes essential information needed for a credit evaluation. This information may include the business's legal name, business structure (such as sole proprietorship, partnership, or corporation), contact details (phone number, email, address), tax identification number (TIN), and any relevant licenses or permits. Furthermore, the application might require detailed financial information, including the business's annual revenue, operating expenses, profit margins, and financial statements. These financial statements often include a balance sheet, income statement, and cash flow statement, providing the lender with a comprehensive understanding of the applicant's financial health. Additionally, Dayton Ohio Business Credit Applications might inquire about the business's history, length of operation, industry sector, and the purpose for which credit is sought. This could involve specifying whether the credit is needed for working capital, equipment purchase or lease, expansion, inventory procurement, or other business-related expenses. Different types of Dayton Ohio Business Credit Applications may exist, catering to specific industries or credit requirements. For instance: 1. Small Business Credit Application: Designed for startups or small businesses in Dayton, Ohio, looking for credit options to support their business operations, growth, or specific projects. 2. Commercial Credit Application: Tailored for larger corporations and companies seeking substantial credit amounts for expansion plans, mergers and acquisitions, or capital-intensive projects. 3. Supplier Credit Application: Targeting businesses in Dayton that need to establish credit terms with suppliers to procure necessary inventory, raw materials, or services on credit. 4. Personal Guarantee Credit Application: In situations where business credit is limited, lenders might require a personal guarantee from the business owner(s) to secure the credit. This type of application includes provisions for personal credit evaluation alongside the business's financial information. It is important to note that each lender or financial institution might have its own variation of the Dayton Ohio Business Credit Application, incorporating specific terms, conditions, and requirements. Therefore, it is advisable for businesses in Dayton, Ohio, to gather relevant information and review application forms provided by potential credit providers to ensure accuracy and completeness while applying for credit.