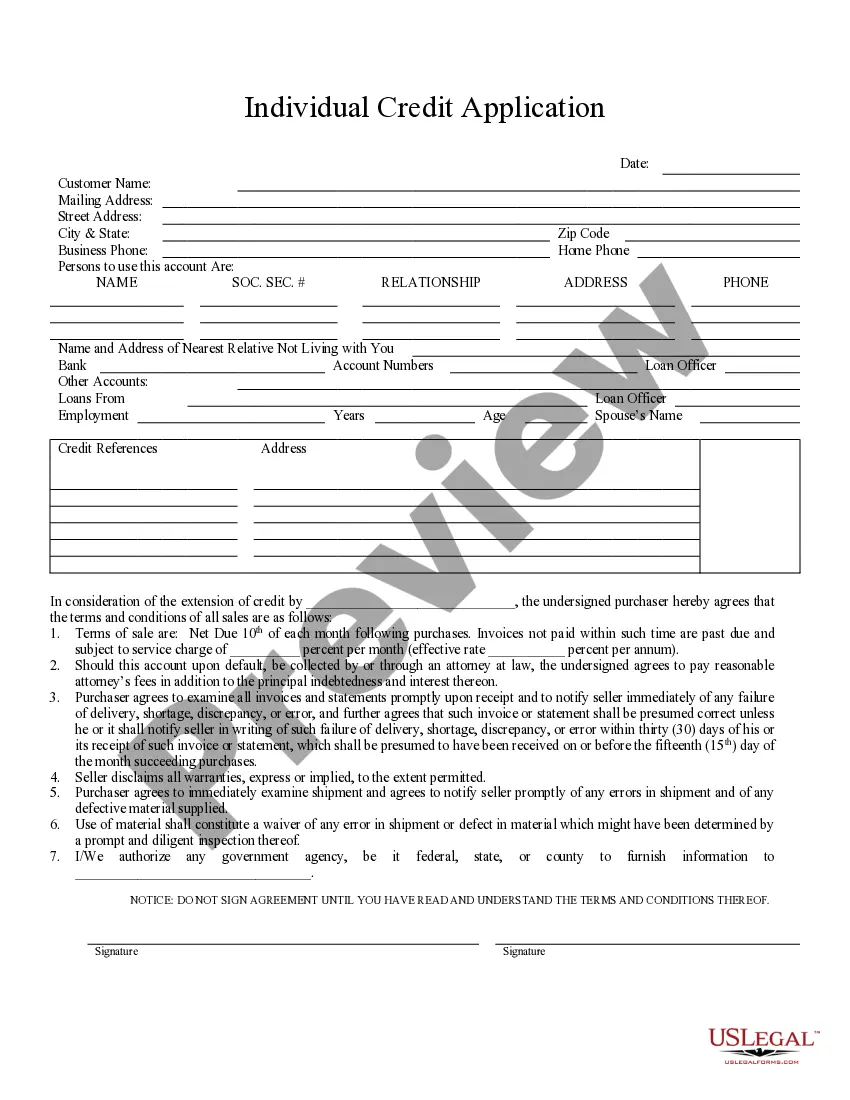

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Akron Ohio Individual Credit Application is a formal document used by individuals in Akron, Ohio, to apply for credit from various financial institutions and lenders. This application captures personal and financial information required by credit providers to assess an individual's creditworthiness and determine their eligibility for loans, credit cards, or any other form of credit. The Akron Ohio Individual Credit Application typically includes sections where the applicant must furnish personal details such as their full name, current address, contact information, social security number, date of birth, and other identifying information. Additionally, applicants are required to provide employment details, including their current employer's name, job title, duration of employment, and monthly income. In terms of the financial aspect, the application requests information related to the applicant's bank accounts, including the institution's name, account numbers, and balances. It also asks for details about any outstanding debts, such as mortgages, car loans, student loans, or credit card balances. A comprehensive Akron Ohio Individual Credit Application may also inquire about the applicant's monthly living expenses, including rent or mortgage payments, utility bills, insurance premiums, and other regular bills. This information helps lenders evaluate an individual's ability to manage and repay borrowed funds. It is important to note that different lenders or financial institutions may have their own specific credit application forms tailored to their policies and requirements. Therefore, there may be variations in the Akron Ohio Individual Credit Application for specific lenders or institutions. These variations may include additional sections or questions specific to the lender's needs or services. Some examples of specific Akron Ohio Individual Credit Applications may include: 1. Akron Bank Individual Credit Application: This application is specific to a particular bank in Akron, Ohio, and may include questions specific to that bank's lending policies and offerings. 2. Akron Credit Union Individual Credit Application: Credit unions may have their own unique credit application forms, tailored to the services and requirements of the credit union. 3. Akron Auto Loan Individual Credit Application: This application is designed specifically for individuals applying for auto loans in Akron, Ohio. It may include sections related to the vehicle being financed, such as make, model, and VIN number. In conclusion, the Akron Ohio Individual Credit Application is a detailed document that collects personal and financial information from individuals applying for credit in Akron, Ohio. Different lenders or institutions may have their own variations of this application, depending on their specific requirements and services.Akron Ohio Individual Credit Application is a formal document used by individuals in Akron, Ohio, to apply for credit from various financial institutions and lenders. This application captures personal and financial information required by credit providers to assess an individual's creditworthiness and determine their eligibility for loans, credit cards, or any other form of credit. The Akron Ohio Individual Credit Application typically includes sections where the applicant must furnish personal details such as their full name, current address, contact information, social security number, date of birth, and other identifying information. Additionally, applicants are required to provide employment details, including their current employer's name, job title, duration of employment, and monthly income. In terms of the financial aspect, the application requests information related to the applicant's bank accounts, including the institution's name, account numbers, and balances. It also asks for details about any outstanding debts, such as mortgages, car loans, student loans, or credit card balances. A comprehensive Akron Ohio Individual Credit Application may also inquire about the applicant's monthly living expenses, including rent or mortgage payments, utility bills, insurance premiums, and other regular bills. This information helps lenders evaluate an individual's ability to manage and repay borrowed funds. It is important to note that different lenders or financial institutions may have their own specific credit application forms tailored to their policies and requirements. Therefore, there may be variations in the Akron Ohio Individual Credit Application for specific lenders or institutions. These variations may include additional sections or questions specific to the lender's needs or services. Some examples of specific Akron Ohio Individual Credit Applications may include: 1. Akron Bank Individual Credit Application: This application is specific to a particular bank in Akron, Ohio, and may include questions specific to that bank's lending policies and offerings. 2. Akron Credit Union Individual Credit Application: Credit unions may have their own unique credit application forms, tailored to the services and requirements of the credit union. 3. Akron Auto Loan Individual Credit Application: This application is designed specifically for individuals applying for auto loans in Akron, Ohio. It may include sections related to the vehicle being financed, such as make, model, and VIN number. In conclusion, the Akron Ohio Individual Credit Application is a detailed document that collects personal and financial information from individuals applying for credit in Akron, Ohio. Different lenders or institutions may have their own variations of this application, depending on their specific requirements and services.