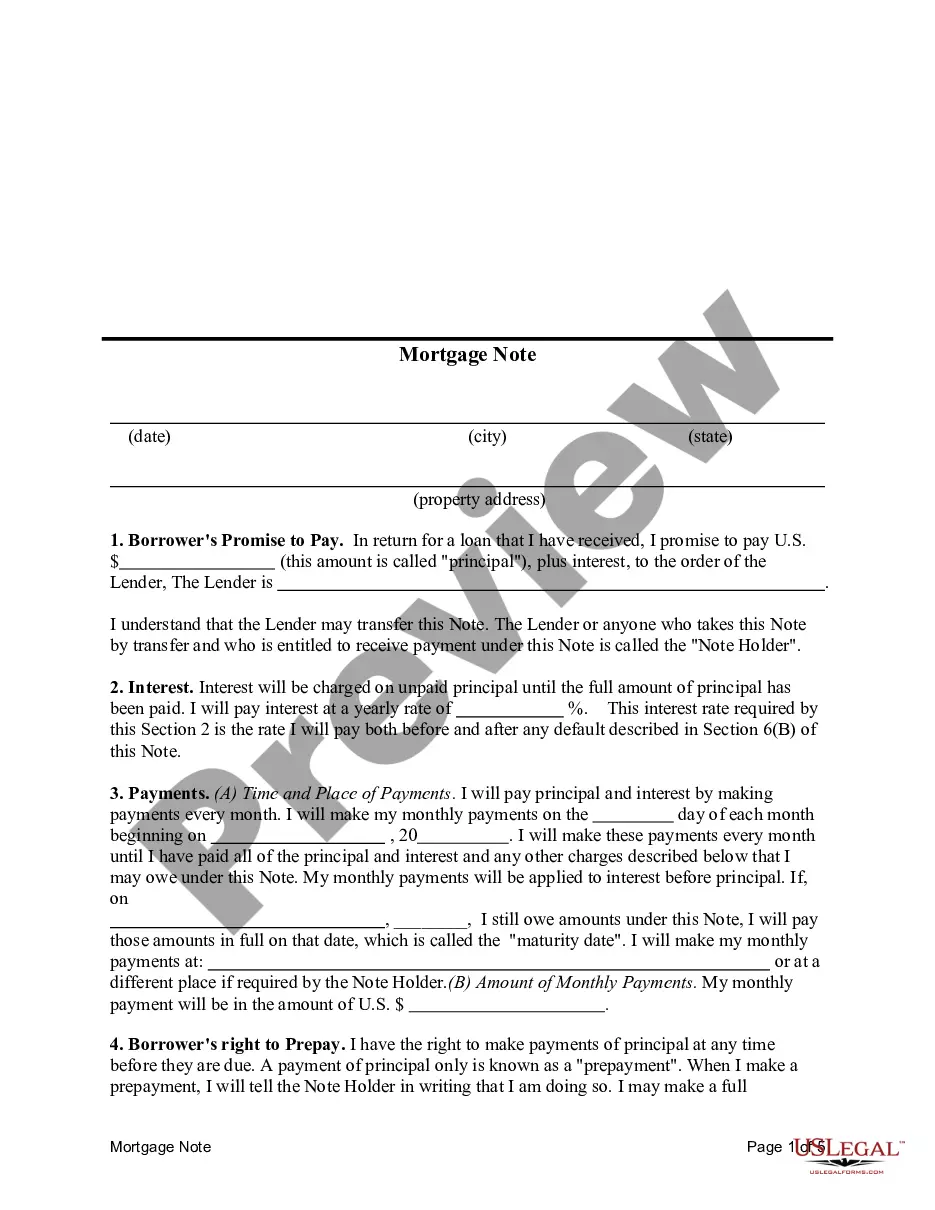

This sample form, a Mortgage Note, is for use in home financing in Ohio. Available in Word format.

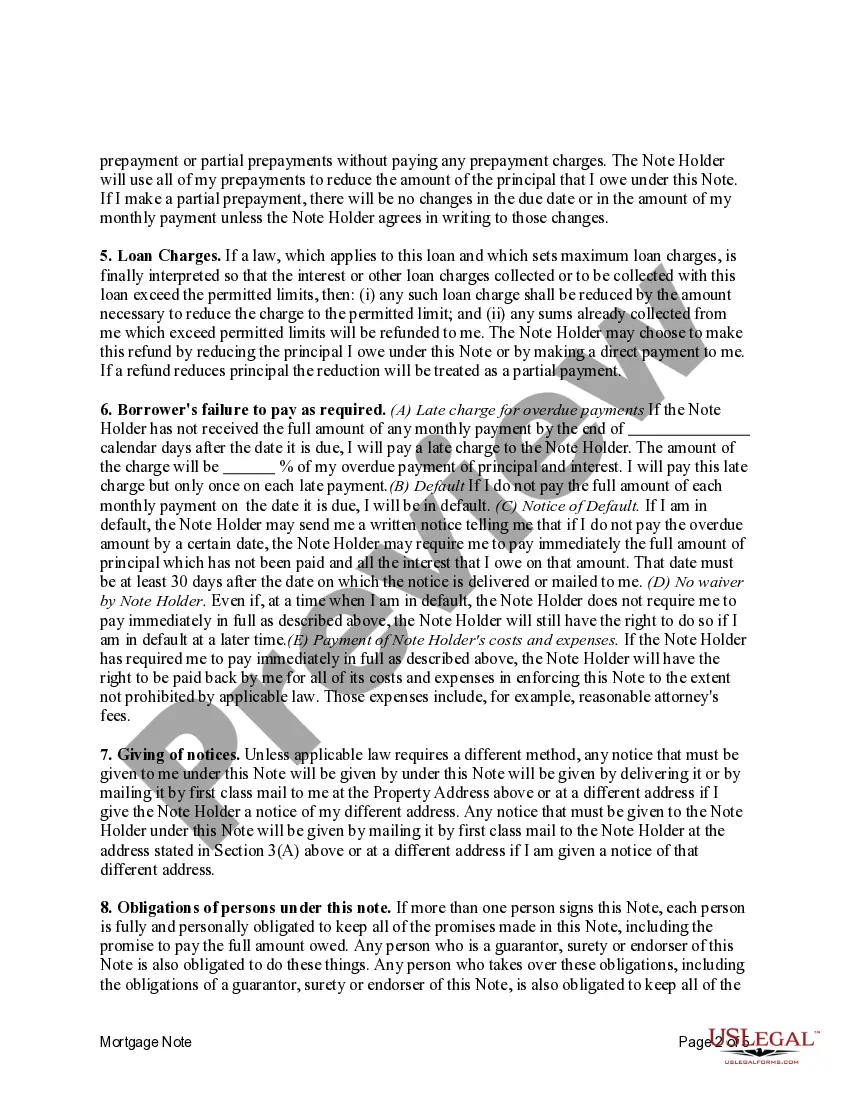

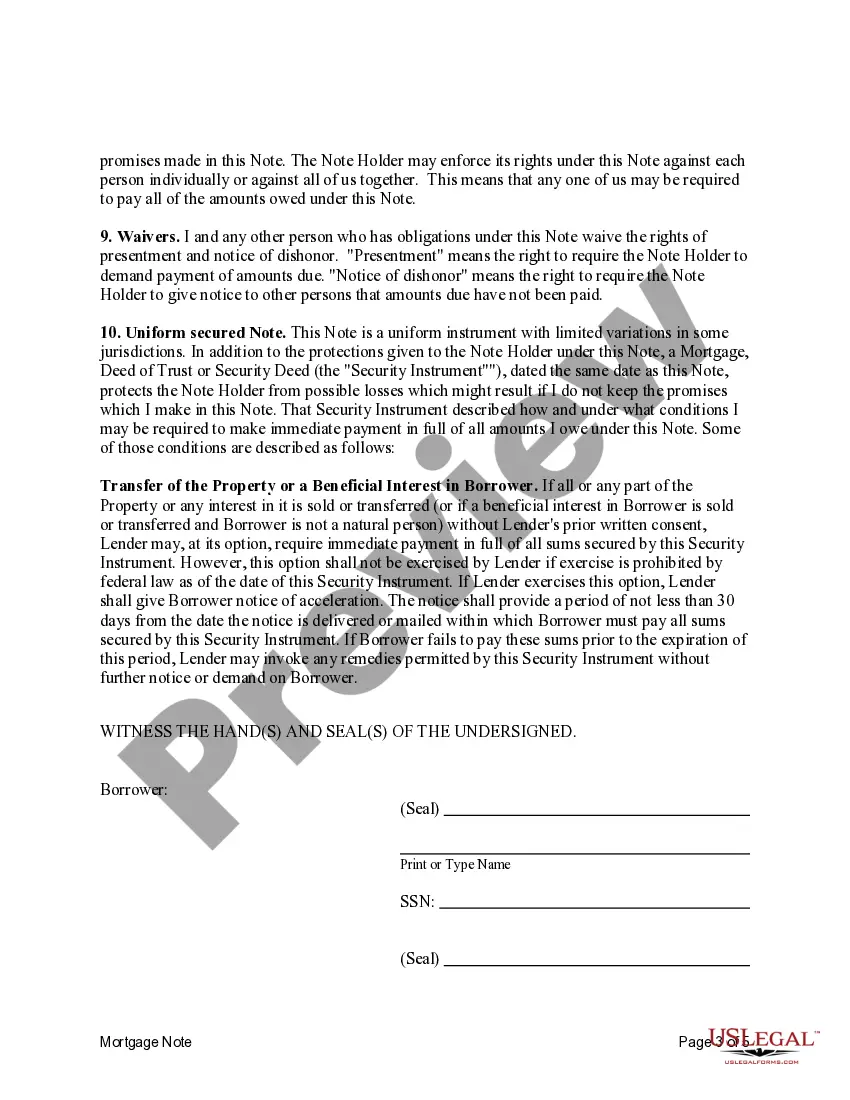

A Cuyahoga Ohio Mortgage Note refers to a legal document that serves as evidence of a loan agreement between a borrower and a lender in relation to a property located in Cuyahoga County, Ohio. This note outlines the specific terms and conditions of the mortgage loan, along with the borrower's commitment to repay the borrowed amount. The Cuyahoga Ohio Mortgage Note typically includes crucial information that includes the principal amount borrowed, the interest rate, the repayment schedule, and any additional provisions or requirements agreed upon by the borrower and lender. There are several types of Cuyahoga Ohio Mortgage Notes that individuals may encounter: 1. Fixed-Rate Mortgage Note: This type of mortgage note maintains a fixed interest rate throughout the loan term, ensuring that borrowers have consistent monthly payments. 2. Adjustable-Rate Mortgage (ARM) Note: An ARM note features an interest rate that may fluctuate based on specific market conditions. The interest rate typically starts lower than a fixed rate, but it may rise or fall over time, causing monthly payments to change accordingly. 3. Balloon Mortgage Note: A balloon note is characterized by lower monthly payments for a specified period, usually five to seven years, following which the remaining balance becomes due as a lump sum payment. This type of mortgage note may be suitable for borrowers who anticipate refinancing or selling the property before the balloon payment is due. 4. Interest-Only Mortgage Note: With an interest-only note, borrowers only pay the interest on the loan for a predetermined period, usually 5, 7, or 10 years. After this initial period, monthly payments typically increase to cover both principal and interest. 5. Reverse Mortgage Note: This note is specifically designed for homeowners aged 62 or older who wish to convert a portion of their home equity into cash without selling the property. The reverse mortgage note allows borrowers to receive payments from the lender, deferring repayment until the borrower no longer occupies the property. It is essential for borrowers in Cuyahoga County, Ohio, to thoroughly review and understand their specific mortgage note, ensuring compliance with the agreed-upon terms and timely repayment. Consulting with a qualified mortgage professional or attorney can provide further clarity and guidance regarding the nuances of different Cuyahoga Ohio Mortgage Notes.A Cuyahoga Ohio Mortgage Note refers to a legal document that serves as evidence of a loan agreement between a borrower and a lender in relation to a property located in Cuyahoga County, Ohio. This note outlines the specific terms and conditions of the mortgage loan, along with the borrower's commitment to repay the borrowed amount. The Cuyahoga Ohio Mortgage Note typically includes crucial information that includes the principal amount borrowed, the interest rate, the repayment schedule, and any additional provisions or requirements agreed upon by the borrower and lender. There are several types of Cuyahoga Ohio Mortgage Notes that individuals may encounter: 1. Fixed-Rate Mortgage Note: This type of mortgage note maintains a fixed interest rate throughout the loan term, ensuring that borrowers have consistent monthly payments. 2. Adjustable-Rate Mortgage (ARM) Note: An ARM note features an interest rate that may fluctuate based on specific market conditions. The interest rate typically starts lower than a fixed rate, but it may rise or fall over time, causing monthly payments to change accordingly. 3. Balloon Mortgage Note: A balloon note is characterized by lower monthly payments for a specified period, usually five to seven years, following which the remaining balance becomes due as a lump sum payment. This type of mortgage note may be suitable for borrowers who anticipate refinancing or selling the property before the balloon payment is due. 4. Interest-Only Mortgage Note: With an interest-only note, borrowers only pay the interest on the loan for a predetermined period, usually 5, 7, or 10 years. After this initial period, monthly payments typically increase to cover both principal and interest. 5. Reverse Mortgage Note: This note is specifically designed for homeowners aged 62 or older who wish to convert a portion of their home equity into cash without selling the property. The reverse mortgage note allows borrowers to receive payments from the lender, deferring repayment until the borrower no longer occupies the property. It is essential for borrowers in Cuyahoga County, Ohio, to thoroughly review and understand their specific mortgage note, ensuring compliance with the agreed-upon terms and timely repayment. Consulting with a qualified mortgage professional or attorney can provide further clarity and guidance regarding the nuances of different Cuyahoga Ohio Mortgage Notes.