Introduction: The Franklin Ohio Bill of Sale is a legal document used in the state of Ohio when an individual or a corporate seller is selling a business. It serves as proof of the transfer of ownership from the seller to the buyer. This detailed description will cover the importance of the Franklin Ohio Bill of Sale in connection with the sale of a business, its key elements, and potential variations. Key Elements of Franklin Ohio Bill of Sale: 1. Identification: The Franklin Ohio Bill of Sale includes the identification details of both the seller and the buyer, including their names, addresses, and contact information. 2. Business Description: A comprehensive description of the business being sold is provided, including its name, location, and any additional assets included in the sale such as equipment, inventory, or property. 3. Purchase Price: The agreed-upon purchase price is clearly stated in the Bill of Sale, ensuring transparency between the parties involved. 4. Payment Terms: The document outlines the specific terms of payment, including the payment method, installment plans, or any other agreed-upon conditions. 5. Representations and Warranties: The seller may include representations and warranties in the Bill of Sale to ensure that the business is being sold in a truthful and accurate manner, protecting the buyer from any future disputes or undisclosed issues. 6. Liabilities and Indemnification: The Bill of Sale may address any existing liabilities or debts related to the business and specify if the seller or the buyer will assume these obligations. It may also include indemnification clauses, protecting the parties involved from any potential legal claims. 7. Contingencies: Any contingencies or conditions that need to be met before the sale can be finalized are included in the Bill of Sale to provide clarity and avoid potential complications. Types of Franklin Ohio Bill of Sale for Sale of Business: 1. Individual Seller — Asset Sale: This type of Bill of Sale is used when an individual seller is selling a business and specifically transferring only the assets and rights associated with it, rather than the entire entity. 2. Individual Seller — Stock Sale: In a stock sale, an individual seller transfers the ownership of the entire business, including all its assets, liabilities, and legal obligations to the buyer. 3. Corporate Seller — Asset Sale: When a corporation is selling its business assets, this type of Bill of Sale is used to transfer the assets and rights to the buyer while keeping the corporate entity intact. 4. Corporate Seller — Stock Sale: In a stock sale conducted by a corporate seller, the buyer acquires all the shares and ownership of the corporation, including its assets, liabilities, and legal obligations. Conclusion: The Franklin Ohio Bill of Sale is a crucial legal document used when a business is being sold by an individual or a corporate seller in the state of Ohio. It contains essential information such as identification details, purchase price, payment terms, representations and warranties, liabilities, and contingencies. The type of Bill of Sale may vary depending on the specific circumstances, distinguishing between asset sales and stock sales, whether conducted by an individual or a corporate seller. Overall, this document ensures a transparent and legally binding transfer of business ownership.

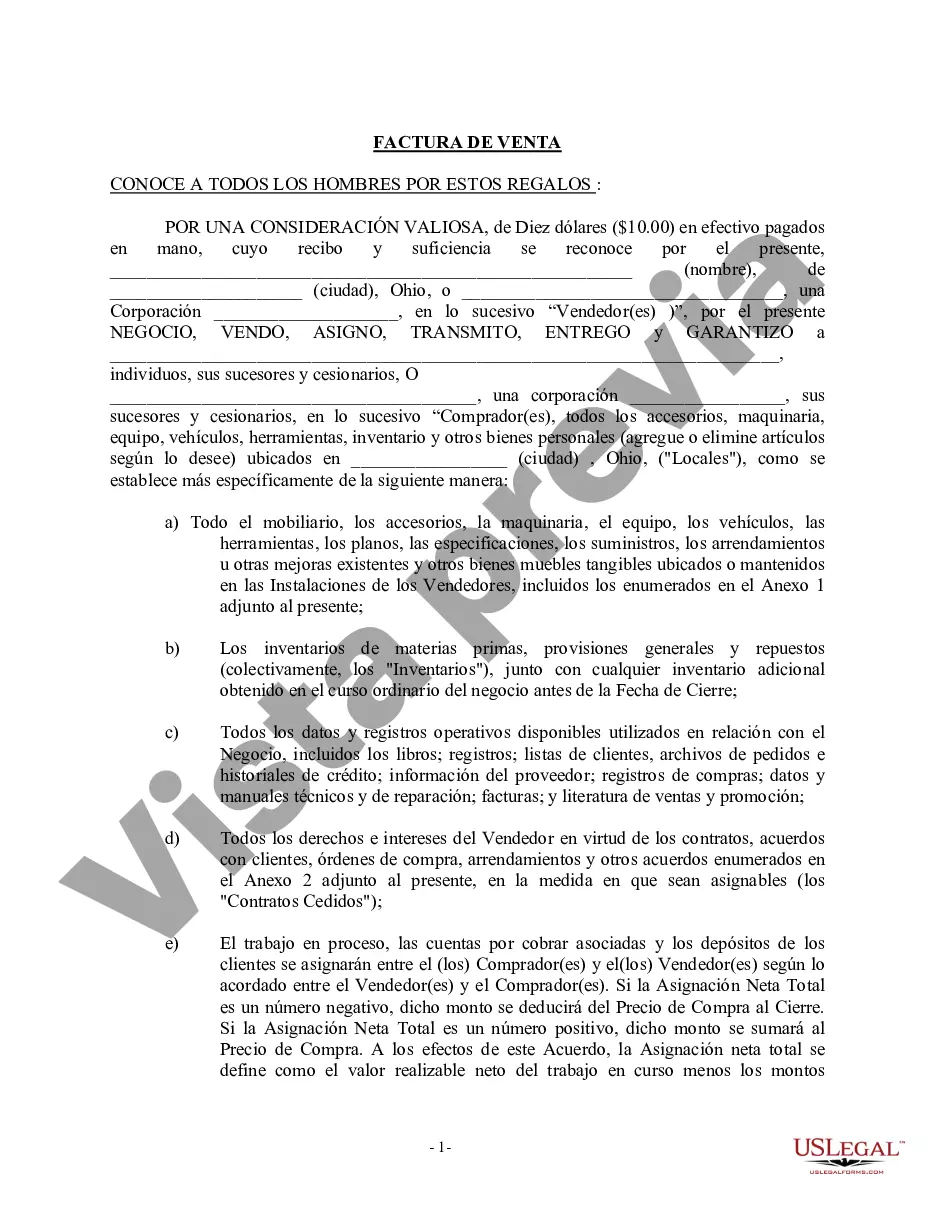

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Factura de venta en relación con la venta del negocio por parte del vendedor individual o corporativo - Ohio Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Franklin Ohio Factura De Venta En Relación Con La Venta Del Negocio Por Parte Del Vendedor Individual O Corporativo?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Franklin Ohio Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Franklin Ohio Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Franklin Ohio Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!