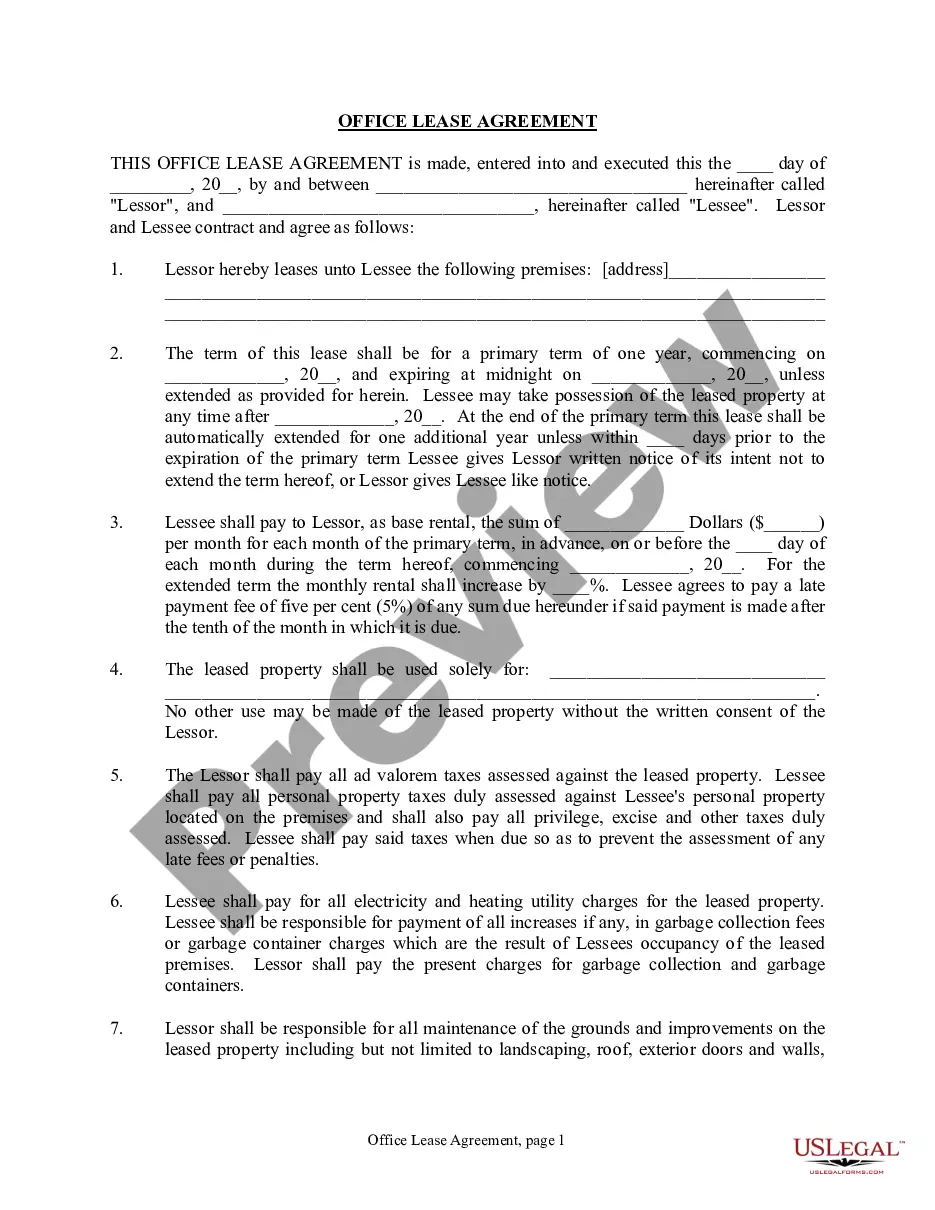

This form is a contract to Lease office space from property owner to tenant. This contract will include lease terms that are compliant with state statutory law. Tenant must abide by terms of the lease and its conditions as agreed.

Akron Ohio Office Lease Agreement

Description

How to fill out Ohio Office Lease Agreement?

Regardless of social or professional standing, completing law-related documents is a regrettable necessity in today’s society.

Often, it’s nearly unattainable for individuals lacking legal education to generate such paperwork from scratch, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Verify that the form you selected is applicable to your region, as the regulations of one state or area do not apply to another.

Examine the document and read through a brief description (if available) of the scenarios the document can be utilized for.

- Our platform provides an extensive selection with over 85,000 ready-to-use state-specific forms that are suitable for nearly every legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisors seeking to save time by using our DIY forms.

- Whether you need the Akron Ohio Office Lease Agreement or any other documentation valid in your jurisdiction, US Legal Forms has everything readily available.

- Here’s how to obtain the Akron Ohio Office Lease Agreement swiftly using our reputable platform.

- If you are already a subscriber, feel free to Log In to your account to access the necessary form.

- However, if you are new to our collection, follow these steps prior to downloading the Akron Ohio Office Lease Agreement.

Form popularity

FAQ

Filing city taxes in Akron, Ohio involves a few straightforward steps. First, gather all necessary documentation, such as your W-2s and other income statements. Then, you can complete your tax forms online or by mail. If you are managing an office space under an Akron Ohio Office Lease Agreement, understanding local tax obligations is crucial for your financial planning and compliance.

Yes, in Akron, Ohio, a permit is generally required to erect a fence. Before starting your project, it’s important to check the local zoning regulations to ensure compliance. Different types of fences may have specific guidelines, so reviewing these regulations can save you time and potential hassles. If you are navigating the complexities of property agreements, our Akron Ohio Office Lease Agreement can help you understand your rights and responsibilities concerning property modifications.

The fence code in Akron, Ohio, specifies regulations regarding fence height, style, and placement, aiming to maintain aesthetic standards within the community. Homeowners must review local ordinances before erecting any fence. For those involved in property management or rental agreements, knowing these codes can impact decisions related to the Akron Ohio Office Lease Agreement.

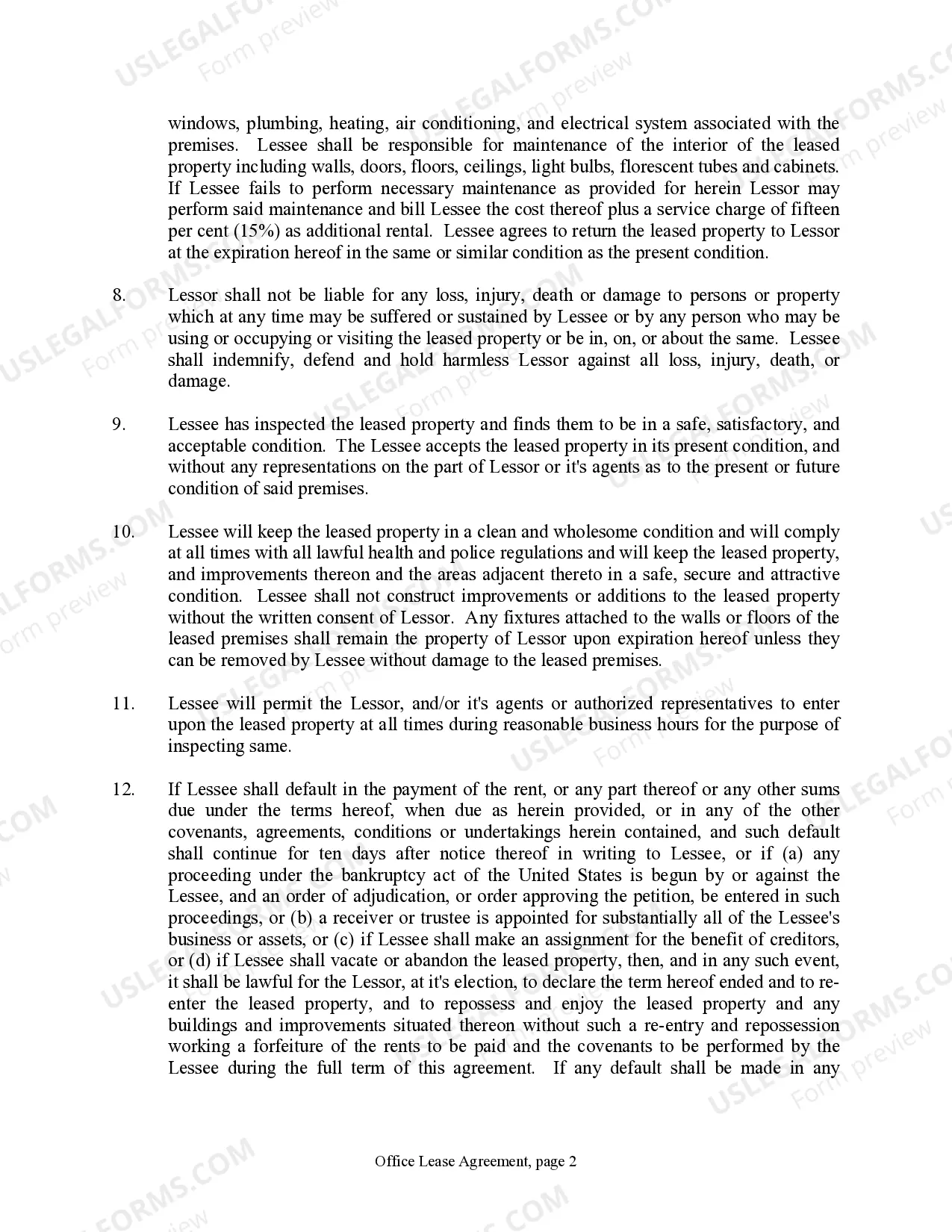

A legally binding lease in Ohio must include essential elements like mutual agreement, consideration, and lawful purpose. It should clearly outline the rights and responsibilities of both the landlord and tenant. When formalizing your Akron Ohio Office Lease Agreement, ensure that all terms are understood and agreed upon to prevent future disputes.

Airbnb operators in Ohio must comply with local regulations, including registration, tax payments, and adherence to safety standards. In Akron, these rules align closely with broader short-term rental regulations. Moreover, an Akron Ohio Office Lease Agreement must be reviewed to ensure compliance when you list properties on Airbnb.

term lease agreement in Ohio is a rental contract lasting less than one year, typically used for vacation rentals or temporary stays. This type of agreement outlines the specific terms, including duration, payment, and responsibilities of both parties. When drafting such an agreement, especially for locations in Akron, it’s wise to consult resources that align with the Akron Ohio Office Lease Agreement.

Breaking a lease in Ohio can be challenging and typically requires legal grounds, such as a significant breach of contract. Landlords often include terms in the Akron Ohio Office Lease Agreement that specify penalties for early termination. It's vital to understand these terms before making decisions. Consulting with a legal expert can provide clarity on your options.

Yes, Cleveland permits short-term rentals, but owners must adhere to specific regulations, including obtaining a permit. Similar to Akron, zoning regulations also impact how properties can be used. If you are managing properties under an Akron Ohio Office Lease Agreement and thinking about expanding, consider these Cleveland regulations too.

To start a short-term rental business in Ohio, begin by researching local regulations, including those specific to Akron. Securing the proper licenses and permits is essential to ensure compliance. Additionally, review the terms of the Akron Ohio Office Lease Agreement to confirm that your lease allows for such rentals. This sets a strong foundation for your business.

In Akron, Ohio, short-term rental regulations focus on licensing and safety standards. Property owners must register their rentals with the city and comply with health and safety inspections. Additionally, there may be restrictions on zoning and property usage related to the Akron Ohio Office Lease Agreement, which is crucial if you are considering renting space for such business.