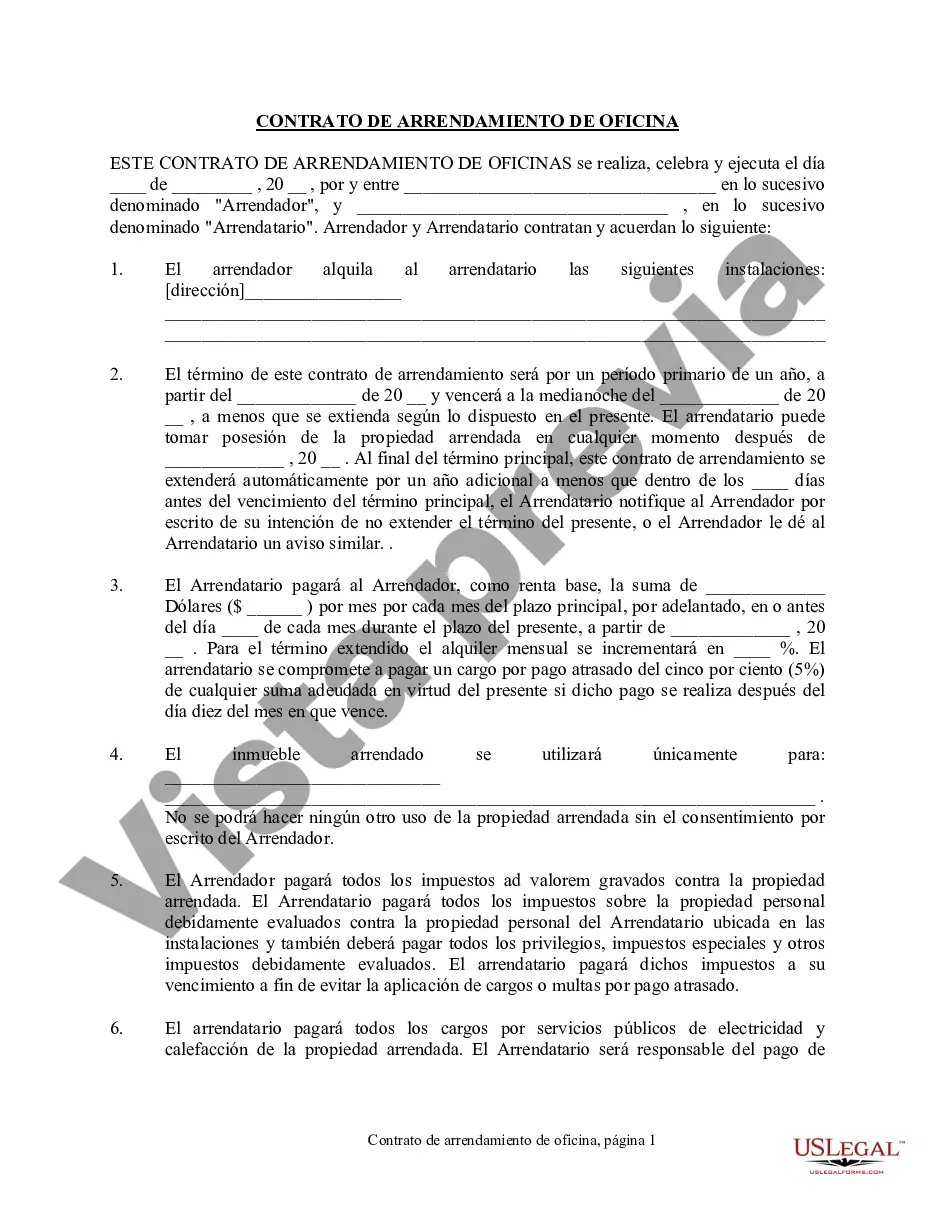

This form is a contract to Lease office space from property owner to tenant. This contract will include lease terms that are compliant with state statutory law. Tenant must abide by terms of the lease and its conditions as agreed.

A Cincinnati Ohio Office Lease Agreement is a legal document that outlines the terms and conditions for renting an office space in Cincinnati, Ohio. It serves as a contract between the landlord, who owns the office space, and the tenant, who will be using the space for business purposes. This agreement helps protect the rights and obligations of both parties involved in the leasing process. The Cincinnati Ohio Office Lease Agreement typically includes essential details such as the duration of the lease, the monthly rent amount, security deposit requirements, maintenance responsibilities, and any additional fees or charges. It also specifies the permitted use of the office space, whether it is for general office purposes or specific activities such as professional services, retail, or healthcare. There may be different types of Cincinnati Ohio Office Lease Agreements, depending on the specific requirements of the tenant and landlord. Some common types include: 1. Gross Lease: This type of lease agreement sets a fixed monthly rent amount that encompasses all costs associated with the office space, including utilities, maintenance, and property taxes. The landlord is responsible for covering these expenses. 2. Net Lease: In a net lease agreement, the tenant is responsible for paying additional expenses on top of the base rent. These expenses may include property taxes, insurance, utilities, and maintenance costs. There are various types of net leases, such as single net lease, double net lease, and triple net lease, each specifying different responsibilities for the tenant. 3. Full-Service Lease: This type of lease, also known as a modified gross lease, combines elements of both gross and net leases. The rent amount includes the base rent and some additional expenses, such as utilities and maintenance. However, the tenant may still be responsible for specific costs, such as property taxes and insurance. 4. Short-Term Lease: A short-term lease agreement is typically used for temporary office space needs or when the tenant prefers flexibility. It has a shorter duration, usually ranging from a few months to a year, and may have different terms and conditions compared to long-term leases. Before signing a Cincinnati Ohio Office Lease Agreement, it is crucial for both parties to carefully review and understand all the clauses, rights, and obligations mentioned in the agreement. Seeking legal counsel or professional guidance can ensure that the lease agreement accurately reflects the intentions and protects the interests of both the landlord and the tenant.A Cincinnati Ohio Office Lease Agreement is a legal document that outlines the terms and conditions for renting an office space in Cincinnati, Ohio. It serves as a contract between the landlord, who owns the office space, and the tenant, who will be using the space for business purposes. This agreement helps protect the rights and obligations of both parties involved in the leasing process. The Cincinnati Ohio Office Lease Agreement typically includes essential details such as the duration of the lease, the monthly rent amount, security deposit requirements, maintenance responsibilities, and any additional fees or charges. It also specifies the permitted use of the office space, whether it is for general office purposes or specific activities such as professional services, retail, or healthcare. There may be different types of Cincinnati Ohio Office Lease Agreements, depending on the specific requirements of the tenant and landlord. Some common types include: 1. Gross Lease: This type of lease agreement sets a fixed monthly rent amount that encompasses all costs associated with the office space, including utilities, maintenance, and property taxes. The landlord is responsible for covering these expenses. 2. Net Lease: In a net lease agreement, the tenant is responsible for paying additional expenses on top of the base rent. These expenses may include property taxes, insurance, utilities, and maintenance costs. There are various types of net leases, such as single net lease, double net lease, and triple net lease, each specifying different responsibilities for the tenant. 3. Full-Service Lease: This type of lease, also known as a modified gross lease, combines elements of both gross and net leases. The rent amount includes the base rent and some additional expenses, such as utilities and maintenance. However, the tenant may still be responsible for specific costs, such as property taxes and insurance. 4. Short-Term Lease: A short-term lease agreement is typically used for temporary office space needs or when the tenant prefers flexibility. It has a shorter duration, usually ranging from a few months to a year, and may have different terms and conditions compared to long-term leases. Before signing a Cincinnati Ohio Office Lease Agreement, it is crucial for both parties to carefully review and understand all the clauses, rights, and obligations mentioned in the agreement. Seeking legal counsel or professional guidance can ensure that the lease agreement accurately reflects the intentions and protects the interests of both the landlord and the tenant.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.