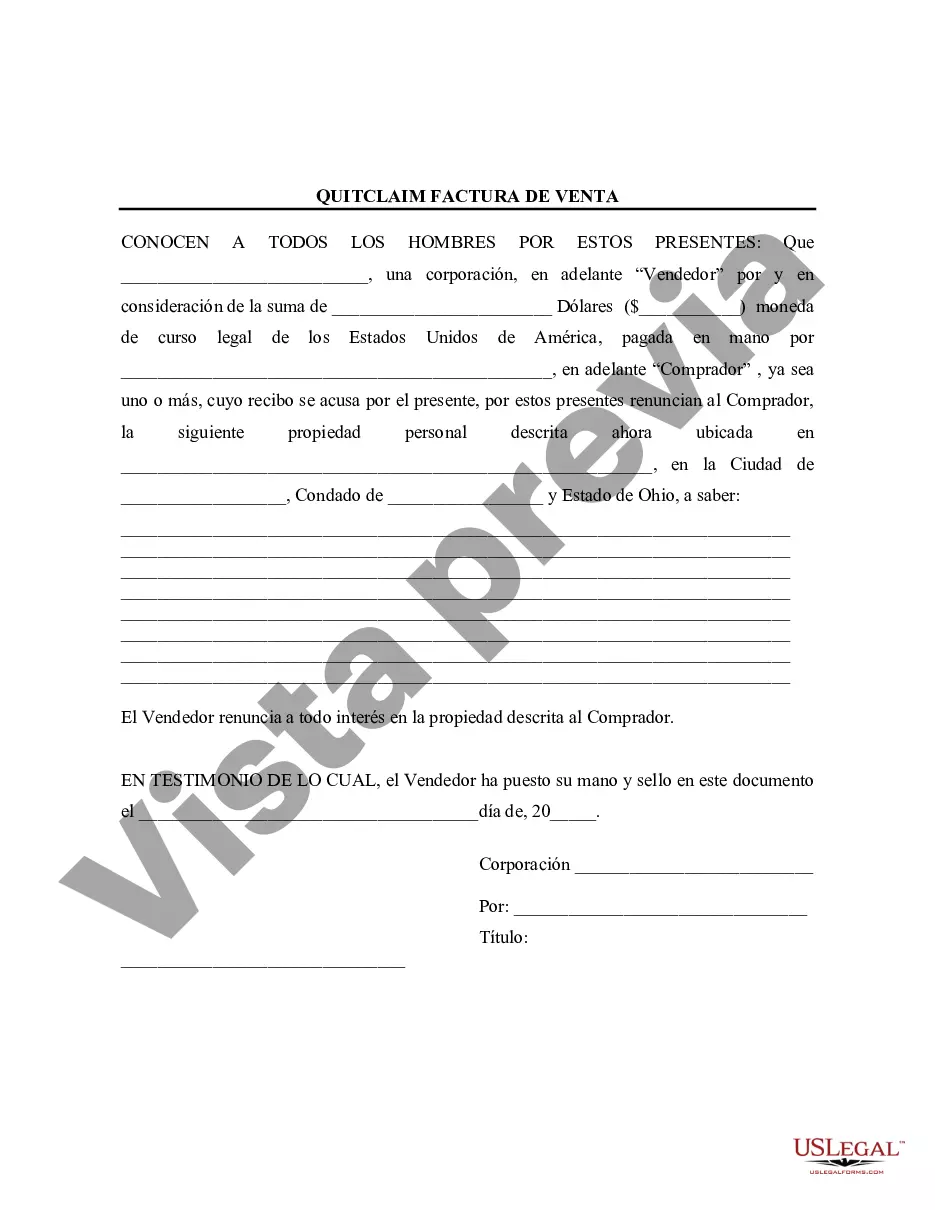

A Columbus Ohio Bill of Sale without Warranty by Corporate Seller is a legal document that serves as proof of transfer of ownership of a specific item or property from a corporate seller to a buyer. This type of bill of sale clearly states that the corporate seller provides no warranty or guarantee on the item being sold. The primary purpose of a Bill of Sale without Warranty is to protect the corporate seller from any future claims or liabilities that may arise after the sale. By explicitly stating that the seller does not provide any warranty, it ensures that the buyer acquires the item in its current condition, with no expectations of repairs or replacements from the seller. Some key elements that should be included in a Columbus Ohio Bill of Sale without Warranty by Corporate Seller are: 1. Parties involved: The bill of sale should clearly identify the corporate seller and buyer, including their legal names, addresses, and contact information. 2. Description of the item: A detailed description of the item being sold should be provided. This may include its make, model, year, serial number, and any other relevant characteristics that uniquely identify the item. 3. Purchase price: The agreed-upon purchase price for the item should be clearly stated in the bill of sale. This helps avoid any future disputes regarding the cost of the transaction. 4. Payment terms: The method of payment, whether it is cash, check, or other means, should be specified in the document. Additionally, any payment terms, such as installment payments or a payment schedule, should be clearly outlined. 5. Seller's representation: The bill of sale may include a statement by the corporate seller that they are the legal owner of the item being sold and have the right to transfer ownership to the buyer. 6. No warranty clause: The bill of sale should explicitly state that the corporate seller is selling the item "as-is" without any warranties or guarantees. This clause protects the seller from any future claims regarding the condition or functionality of the item. 7. Signatures and notarization: Both the corporate seller and buyer should sign the bill of sale to indicate their agreement to the terms stated. Depending on local legal requirements, notarization may be necessary to give the document legal validity. Different types of Bill of Sale without Warranty by Corporate Seller in Columbus, Ohio may vary based on the type of item being sold. Common variations include bill of sale forms for vehicles, real estate, equipment, machinery, and personal property. Each type of bill of sale may have specific requirements and additional information that need to be included to ensure a complete and valid document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Columbus Ohio Factura de venta sin garantía por parte del vendedor corporativo - Ohio Bill of Sale without Warranty by Corporate Seller

Description

How to fill out Columbus Ohio Factura De Venta Sin Garantía Por Parte Del Vendedor Corporativo?

Do you need a reliable and inexpensive legal forms provider to buy the Columbus Ohio Bill of Sale without Warranty by Corporate Seller? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of particular state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Columbus Ohio Bill of Sale without Warranty by Corporate Seller conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Columbus Ohio Bill of Sale without Warranty by Corporate Seller in any provided file format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online for good.