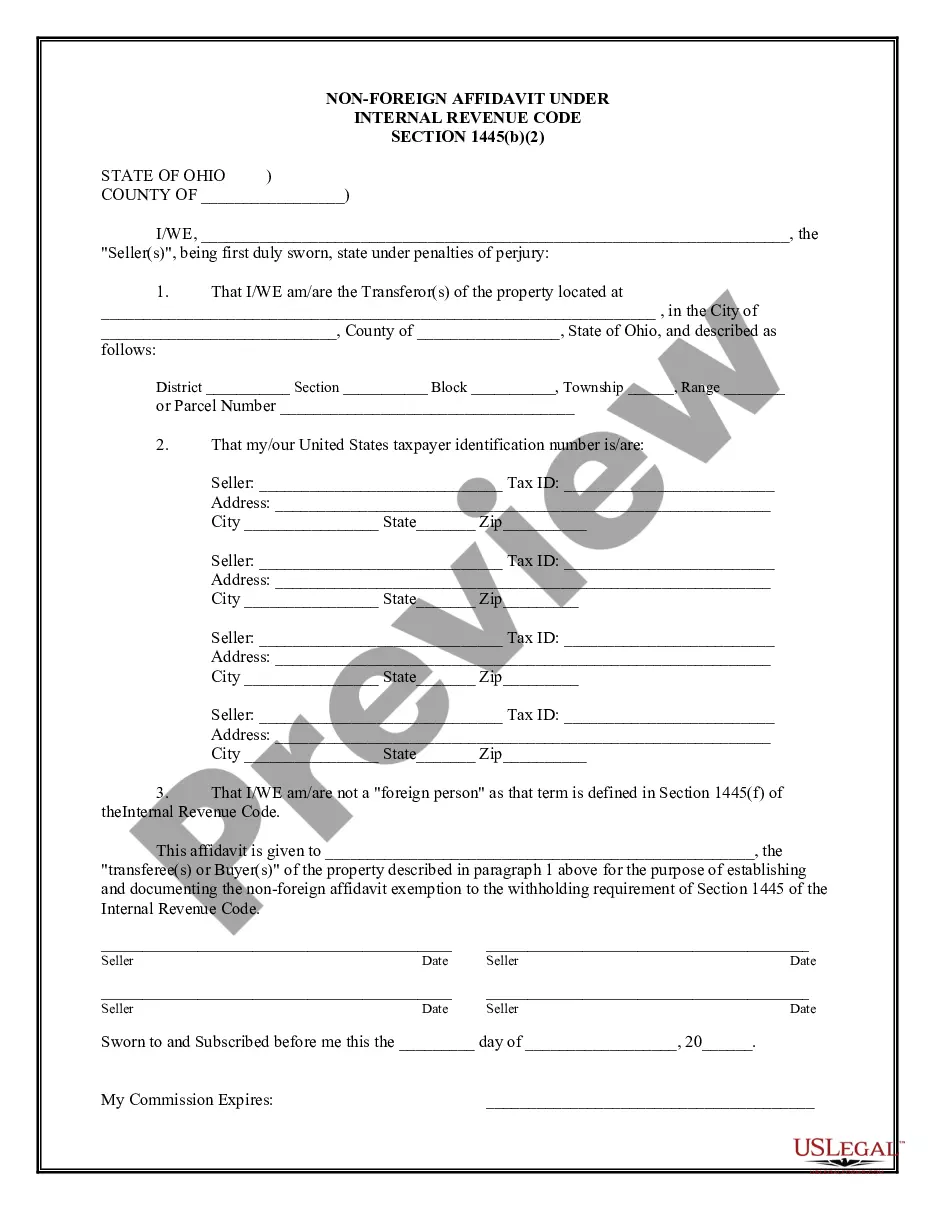

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Dayton Ohio Non-Foreign Affidavit Under IRC 1445: Explained and Types The Dayton Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for real estate transactions involving non-U.S. citizens. This affidavit is designed to ensure compliance with the provisions of Section 1445 of the Internal Revenue Code (IRC), which imposes withholding duties on the transfer of U.S. real property interests by non-foreign individuals. When a non-U.S. citizen sells or transfers real property in Dayton, Ohio, they may be subject to withholding tax obligations. To verify their status as a non-foreign individual, the seller or transferor must submit the Dayton Ohio Non-Foreign Affidavit Under IRC 1445. This affidavit assures the buyer and the IRS that the transferor is exempt from withholding under Section 1445. Keywords: Dayton Ohio, Non-Foreign Affidavit, IRC 1445, real estate transactions, non-U.S. citizens, Internal Revenue Service, compliance, withholding duties, U.S. real property interests, non-foreign individuals, selling real property, transferring real property, withholding tax obligations, seller, transferor, buyer, exemption, Section 1445. Types of Dayton Ohio Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is a non-U.S. citizen, sells or transfers real property in Dayton, Ohio. The affidavit provides confirmation that the individual is exempt from withholding tax obligations under Section 1445 of the IRC. 2. Corporate Non-Foreign Affidavit: In cases where a corporation, which is non-foreign, is involved in real estate transactions, a Corporate Non-Foreign Affidavit is required. This affidavit ensures that the corporation is exempt from withholding tax obligations when selling or transferring real property. 3. Partnership/LLC Non-Foreign Affidavit: If a partnership or limited liability company (LLC) with non-foreign ownership is involved in a real estate transaction in Dayton, Ohio, a Partnership/LLC Non-Foreign Affidavit must be submitted. This affidavit confirms that the partnership or LLC, as a non-foreign entity, is exempt from withholding under Section 1445. 4. Trust Non-Foreign Affidavit: When a trust with non-foreign beneficiaries is involved in a real estate transaction, a Trust Non-Foreign Affidavit is necessary. This affidavit serves as proof that the trust qualifies for an exemption from withholding tax obligations under IRC Section 1445. It is crucial for both buyers and sellers involved in Dayton, Ohio real estate transactions to understand the requirements of the Dayton Ohio Non-Foreign Affidavit Under IRC 1445. By complying with these obligations, both parties can ensure a smooth and legally sound transfer of the property ownership while meeting IRS regulations.Dayton Ohio Non-Foreign Affidavit Under IRC 1445: Explained and Types The Dayton Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for real estate transactions involving non-U.S. citizens. This affidavit is designed to ensure compliance with the provisions of Section 1445 of the Internal Revenue Code (IRC), which imposes withholding duties on the transfer of U.S. real property interests by non-foreign individuals. When a non-U.S. citizen sells or transfers real property in Dayton, Ohio, they may be subject to withholding tax obligations. To verify their status as a non-foreign individual, the seller or transferor must submit the Dayton Ohio Non-Foreign Affidavit Under IRC 1445. This affidavit assures the buyer and the IRS that the transferor is exempt from withholding under Section 1445. Keywords: Dayton Ohio, Non-Foreign Affidavit, IRC 1445, real estate transactions, non-U.S. citizens, Internal Revenue Service, compliance, withholding duties, U.S. real property interests, non-foreign individuals, selling real property, transferring real property, withholding tax obligations, seller, transferor, buyer, exemption, Section 1445. Types of Dayton Ohio Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is a non-U.S. citizen, sells or transfers real property in Dayton, Ohio. The affidavit provides confirmation that the individual is exempt from withholding tax obligations under Section 1445 of the IRC. 2. Corporate Non-Foreign Affidavit: In cases where a corporation, which is non-foreign, is involved in real estate transactions, a Corporate Non-Foreign Affidavit is required. This affidavit ensures that the corporation is exempt from withholding tax obligations when selling or transferring real property. 3. Partnership/LLC Non-Foreign Affidavit: If a partnership or limited liability company (LLC) with non-foreign ownership is involved in a real estate transaction in Dayton, Ohio, a Partnership/LLC Non-Foreign Affidavit must be submitted. This affidavit confirms that the partnership or LLC, as a non-foreign entity, is exempt from withholding under Section 1445. 4. Trust Non-Foreign Affidavit: When a trust with non-foreign beneficiaries is involved in a real estate transaction, a Trust Non-Foreign Affidavit is necessary. This affidavit serves as proof that the trust qualifies for an exemption from withholding tax obligations under IRC Section 1445. It is crucial for both buyers and sellers involved in Dayton, Ohio real estate transactions to understand the requirements of the Dayton Ohio Non-Foreign Affidavit Under IRC 1445. By complying with these obligations, both parties can ensure a smooth and legally sound transfer of the property ownership while meeting IRS regulations.