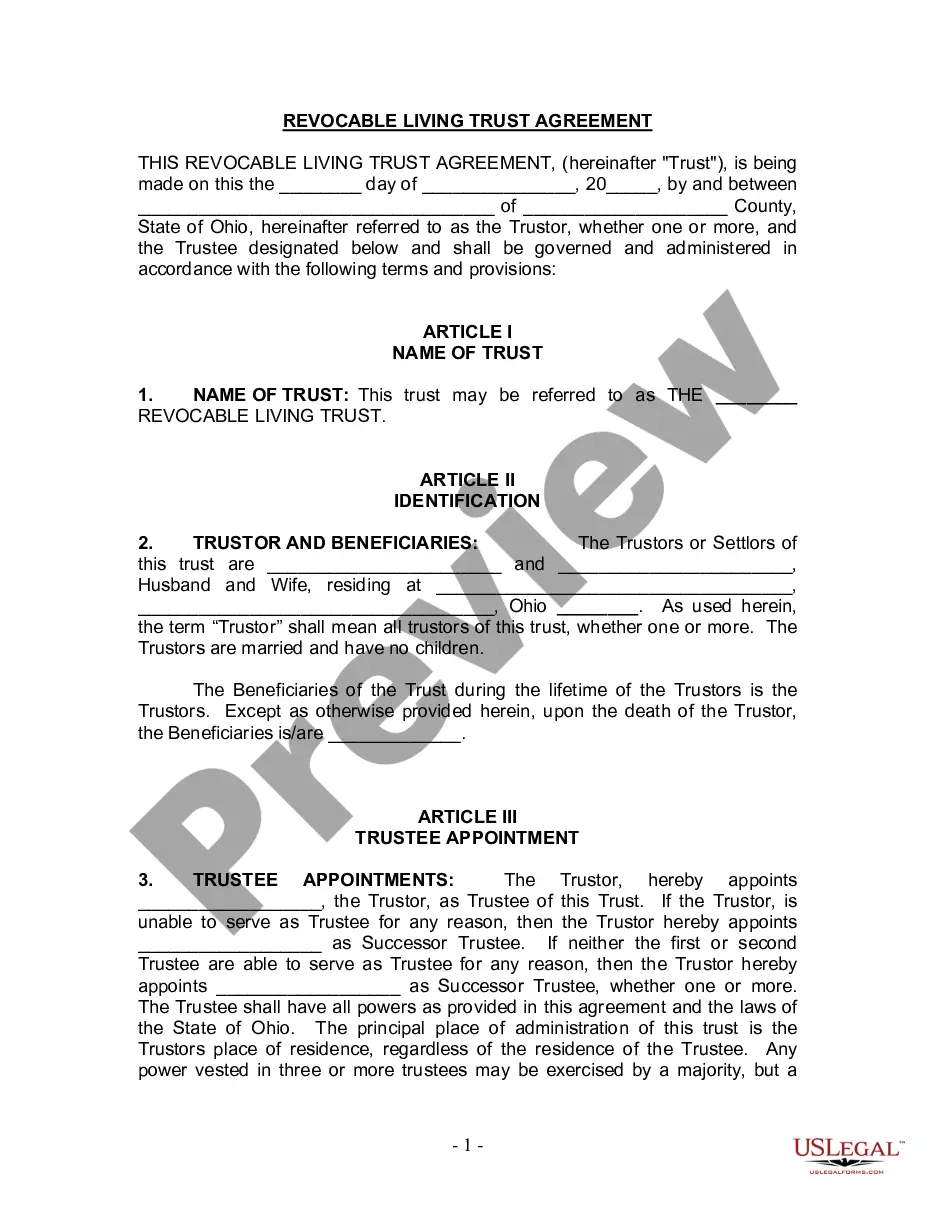

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Akron Ohio Living Trust for Husband and Wife with No Children

Description

How to fill out Ohio Living Trust For Husband And Wife With No Children?

Locating confirmed templates tailored to your local regulations can be challenging unless you access the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and professional purposes and various real-world situations.

All the files are accurately organized by field of application and jurisdictional areas, making the search for the Akron Ohio Living Trust for Husband and Wife with No Children as straightforward as possible.

Enter your credit card information or use your PayPal account to complete the payment for the service. Download the Akron Ohio Living Trust for Husband and Wife with No Children. Store the template on your device to proceed with its completion and access it in the My documents section of your profile whenever you need it again. Maintaining documentation accurately and in accordance with legal obligations is crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirements within reach!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that aligns with your requirements and fully complies with your local jurisdiction standards.

- Seek an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the following step.

- Purchase the document.

Form popularity

FAQ

Yes, you can write your own trust in Ohio, but it is advisable to seek professional guidance. Crafting an Akron Ohio Living Trust for Husband and Wife with No Children requires attention to detail to ensure it meets legal standards. Utilizing platforms like uslegalforms can provide you with the necessary templates and support to create a valid trust that accurately reflects your intentions.

Choosing between a will and a trust in Ohio depends on your specific needs. A will directs how your assets will be distributed after your death, but a living trust, like an Akron Ohio Living Trust for Husband and Wife with No Children, allows for more control and can avoid the lengthy probate process. Many find that a trust offers more privacy and can manage assets during your lifetime, which may suit your situation better.

A living will and a living trust serve different purposes in Ohio. A living will outlines your medical preferences if you become unable to communicate your wishes. In contrast, an Akron Ohio Living Trust for Husband and Wife with No Children deals with the management and distribution of your assets during your life and after your death. Understanding these differences can help you choose the right options for your estate planning.

When a husband dies in Ohio, the wife is entitled to a portion of the estate, especially if there is no will. She generally has rights to the marital property and may also receive additional allowances for living expenses. To better manage these situations, couples can set up an Akron Ohio Living Trust for Husband and Wife with No Children, which can streamline the process and ensure the wife receives her rightful inheritance without delays. This proactive approach minimizes stress during a challenging time.

In Ohio, the next of kin order determines how assets are distributed when someone passes away without a will. Typically, the order starts with the spouse, followed by children, parents, and siblings. For couples without children, establishing an Akron Ohio Living Trust for Husband and Wife with No Children can simplify this process and clearly define asset distribution. It removes ambiguity and helps couples achieve their specific estate planning goals.

If a husband dies without a will in Ohio, the distribution of his assets follows state intestacy laws. In this situation, the wife may inherit a significant portion of the estate, but not necessarily everything, depending on other surviving relatives. Utilizing tools like the Akron Ohio Living Trust for Husband and Wife with No Children can offer a more tailored approach, ensuring that both partners have clearly defined rights and protections. This solution helps couples avoid uncertainty during difficult times.

In Ohio, when a wife passes away, her husband has specific rights regarding her estate. These rights include the right to a portion of her assets, especially if there is no will present. If a living trust exists, like an Akron Ohio Living Trust for Husband and Wife with No Children, the husband is often named as a beneficiary, ensuring he receives what was intended for him. It's essential for couples to discuss these matters and consider legal guidance to ensure clarity on entitlements.

For a trust to be valid in Ohio, it must be created by a competent individual and must have a clear purpose and defined beneficiaries. Additionally, it should be properly funded with assets to ensure its effectiveness. If you are considering an Akron Ohio Living Trust for Husband and Wife with No Children, understanding these requirements will help in creating a legally sound and effective trust.

Creating a living trust in Ohio involves several steps: deciding on the type of trust, drafting the trust document, transferring assets into the trust, and naming a trustee. You can either do this on your own or use a reliable service like uslegalforms to simplify the paperwork. If you're particularly focused on an Akron Ohio Living Trust for Husband and Wife with No Children, ensure the document reflects your specific goals and requirements.

The best living trust for a married couple is typically a joint revocable living trust. This type of trust allows both partners to manage and control their shared assets together, simplifying the distribution process after one spouse passes. When it involves planning for an Akron Ohio Living Trust for Husband and Wife with No Children, this trust can ensure that both partners' wishes are respected and assets are smoothly transitioned.