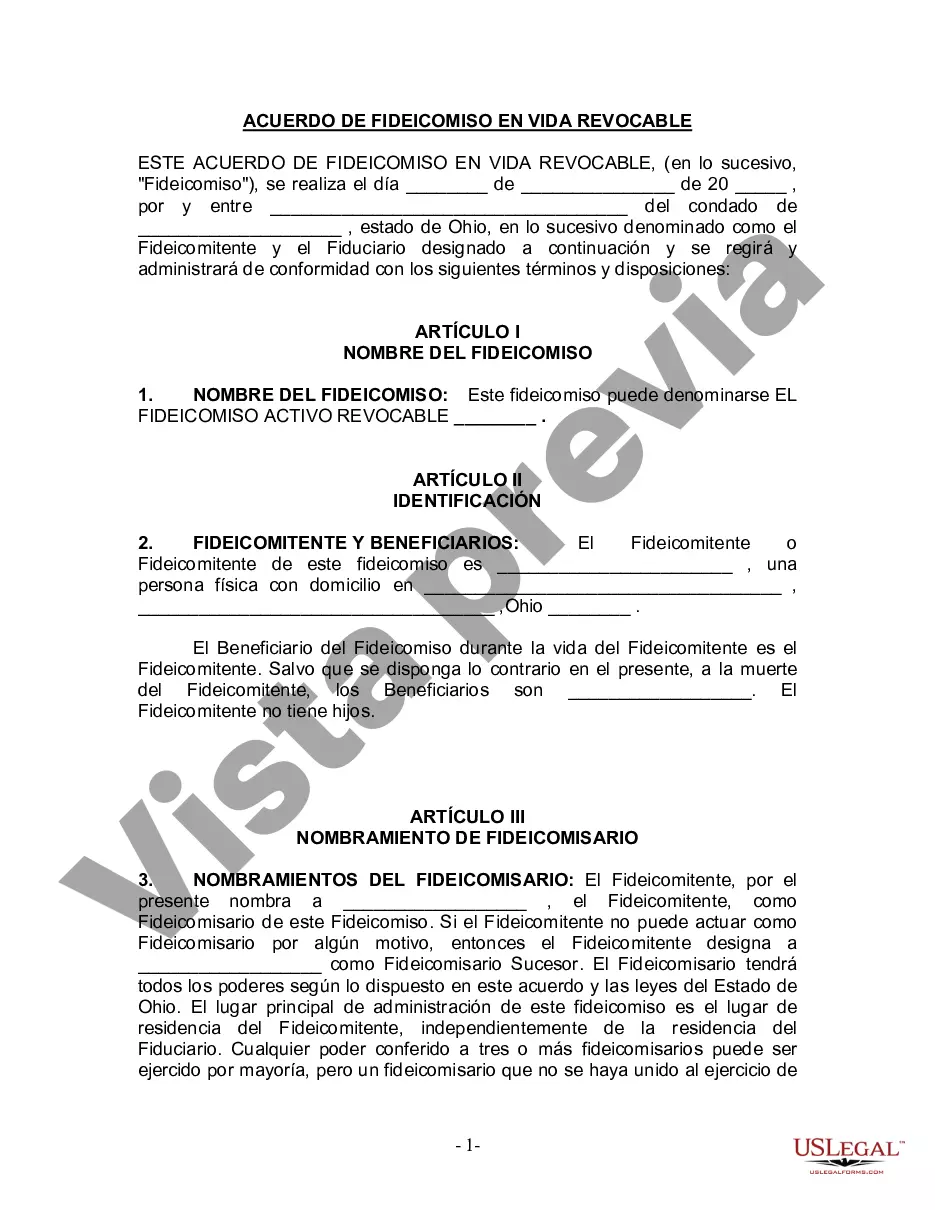

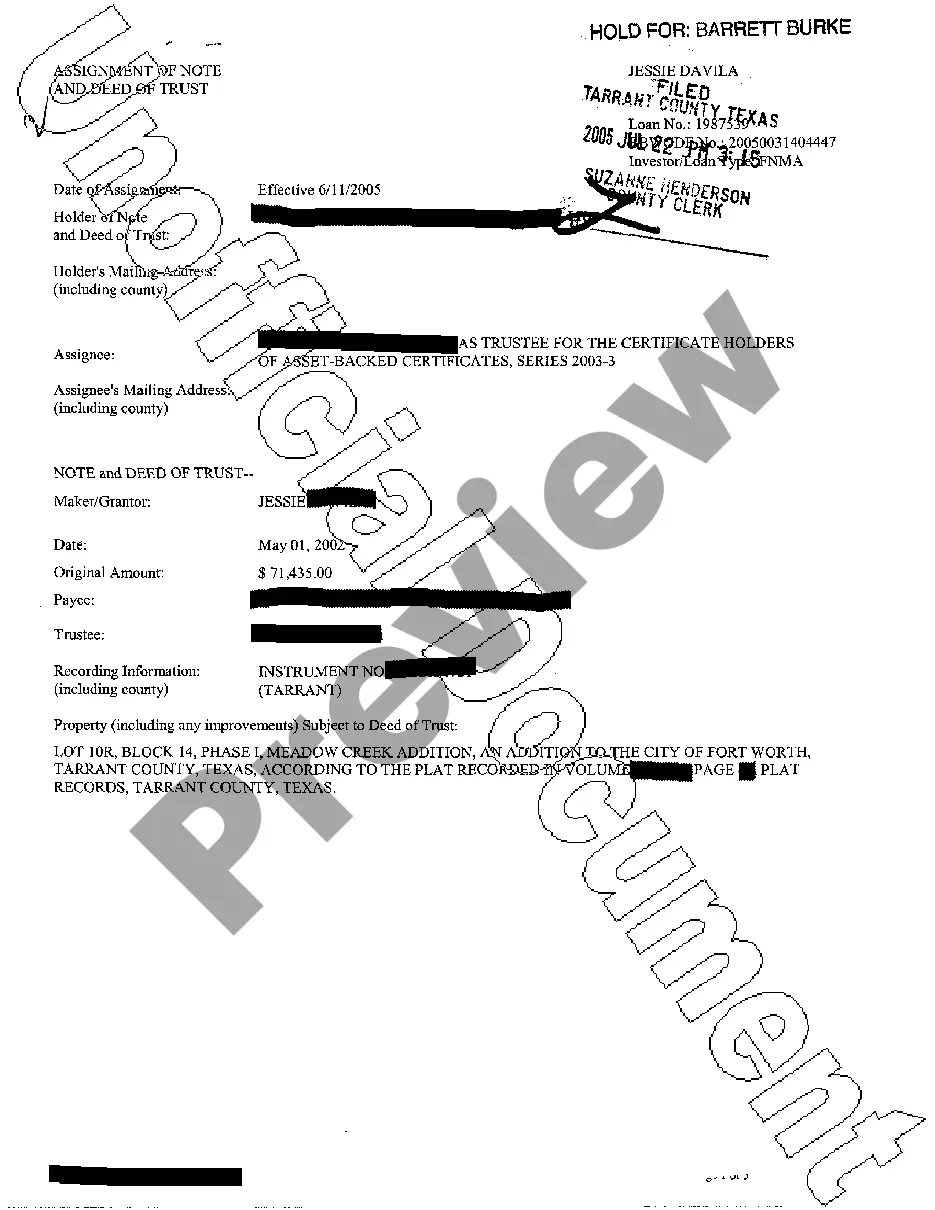

Toledo Ohio Living Trust for Individuals Who are Single, Divorced or Widowed (or Widowers) with No Children A living trust is a legal document that allows individuals to protect and manage their assets during their lifetime and distribute them efficiently after their passing. For individuals in Toledo, Ohio who are single, divorced, or widowed (or widowers) with no children, creating a living trust can offer numerous benefits in terms of asset protection, privacy, and control of their estate. Here are several types of Toledo Ohio living trusts that cater specifically to individuals who are single, divorced, or widowed with no children: 1. Revocable Living Trust: A revocable living trust is the most common type of trust, which allows individuals to retain control over their assets and make changes or modifications as needed during their lifetime. It offers flexibility and convenience, allowing the trust creator (also known as the granter) to manage and enjoy their assets while providing a seamless transition of assets upon their passing. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be changed or revoked once executed, except under certain circumstances. This type of trust offers added asset protection benefits, as the assets transferred into the trust are no longer considered part of the granter's estate. It can also be an effective tool for Medicaid planning, ensuring that assets are preserved for future beneficiaries while potentially qualifying the granter for government assistance if needed. 3. Testamentary Trust: A testamentary trust is established through a will and takes effect only upon the granter's death. It allows individuals to specify how their assets should be distributed and managed for the benefit of their chosen beneficiaries, such as charities, friends, or other loved ones. 4. Special Needs Trust: For individuals who have disabilities and may require government benefits such as Medicaid or Supplemental Security Income (SSI), a special needs trust ensures that assets intended to enhance their quality of life do not disqualify them from receiving need-based assistance. It protects the individual's eligibility for government benefits while providing additional financial support. 5. Charitable Remainder Trust: A charitable remainder trust allows individuals to donate assets to a charitable organization while retaining an income stream from those assets during their lifetime. This type of trust offers both tax benefits and the satisfaction of supporting a favored charitable cause. Regardless of the type of living trust chosen, it is vital for individuals who are single, divorced, or widowed (or widowers) with no children in Toledo, Ohio to consult with an experienced estate planning attorney. The attorney can provide personalized guidance to ensure that the trust aligns with their specific goals and addresses any unique circumstances or concerns. Keywords: Toledo Ohio, living trust, single, divorced, widowed, widower, no children, revocable living trust, irrevocable living trust, testamentary trust, special needs trust, charitable remainder trust, asset protection, estate planning, Medicaid planning, government benefits, tax benefits, estate distribution, asset management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Toledo Ohio Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos (o Viudos) sin Hijos - Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

How to fill out Toledo Ohio Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos (o Viudos) Sin Hijos?

Make use of the US Legal Forms and have immediate access to any form sample you want. Our helpful website with a huge number of documents makes it easy to find and obtain almost any document sample you need. It is possible to download, fill, and sign the Toledo Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children in just a matter of minutes instead of surfing the Net for several hours searching for a proper template.

Utilizing our catalog is a great way to increase the safety of your form filing. Our professional attorneys on a regular basis check all the documents to make certain that the templates are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Toledo Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instruction listed below:

- Find the template you need. Make certain that it is the form you were hoping to find: verify its title and description, and make use of the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the document. Indicate the format to get the Toledo Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children and edit and fill, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy form libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Toledo Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children.

Feel free to make the most of our platform and make your document experience as efficient as possible!