When it comes to estate planning for individuals who are single, divorced, or widowed (or widower) with children, a Cincinnati Ohio Living Trust offers a practical and beneficial solution. This detailed description aims to shed light on what a Cincinnati Ohio Living Trust is, how it functions, and its various types. A living trust, also known as a revocable trust, is a legal arrangement in which an individual (known as the granter) transfers their assets into a trust during their lifetime. The granter can serve as the trustee, managing their assets just as they would normally. However, if the granter becomes incapacitated or passes away, a successor trustee takes over the management and distribution of the assets, ensuring they are distributed according to the granter's wishes. For individuals who are single, divorced, or widowed (or widower) with children, a Cincinnati Ohio Living Trust can provide several advantages. Primarily, it allows for the seamless transfer of assets to beneficiaries while avoiding probate, which can be time-consuming and costly. Additionally, a living trust provides privacy as probate proceedings are public record, whereas a trust remains confidential. In Cincinnati, Ohio, there are different types of living trusts available for those mentioned above: 1. Single Individual Living Trust: Specifically tailored for individuals who are single, this type of trust allows the granter to maintain full control over their assets during their lifetime. Upon their death, the trust assets pass directly to the named beneficiaries, avoiding probate. 2. Divorced Individual Living Trust: This living trust is designed for individuals who have gone through a divorce. It enables the granter to protect their assets and dictate their precise distribution upon death, ensuring that the ex-spouse or ex-partner does not inherit undesired assets. It provides peace of mind and financial security for the granter's children. 3. Widow or Widower Individual Living Trust: Following the loss of a spouse, a widow or widower may opt for a living trust to manage and distribute their assets according to their wishes. This trust allows them to designate their children as beneficiaries or choose alternate individuals if necessary. By avoiding probate, this type of trust can expedite the transfer of assets and minimize expenses. Regardless of the type of Cincinnati Ohio Living Trust chosen, engaging the services of an experienced estate planning attorney is crucial. They can help draft the trust document, ensure it complies with Ohio state laws, and provide professional guidance throughout the process. In conclusion, a Cincinnati Ohio Living Trust for individuals who are single, divorced, or widowed (or widower) with children offers flexibility, control, and efficient distribution of assets while avoiding probate. It safeguards important financial matters and provides peace of mind, ensuring that loved ones are taken care of appropriately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cincinnati Ohio Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos (o Viudos) con Hijos - Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Cincinnati Ohio Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos (o Viudos) Con Hijos?

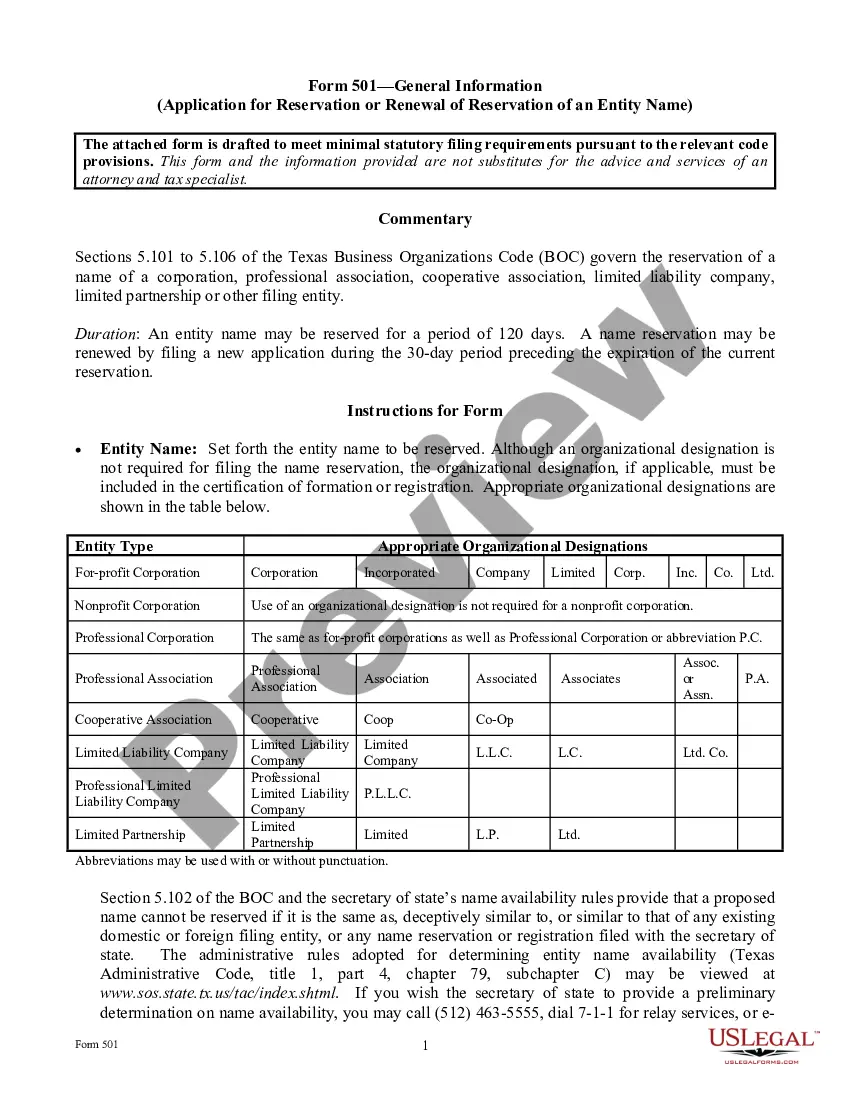

Benefit from the US Legal Forms and obtain immediate access to any form template you need. Our beneficial website with thousands of documents makes it simple to find and get virtually any document sample you require. It is possible to export, complete, and certify the Cincinnati Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children in a matter of minutes instead of browsing the web for hours looking for an appropriate template.

Utilizing our collection is a great strategy to raise the safety of your record submissions. Our experienced lawyers regularly check all the documents to make certain that the forms are appropriate for a particular state and compliant with new laws and regulations.

How do you get the Cincinnati Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you view. Moreover, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you need. Make certain that it is the template you were hoping to find: examine its title and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Indicate the format to get the Cincinnati Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy template libraries on the web. We are always ready to help you in virtually any legal case, even if it is just downloading the Cincinnati Ohio Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

Feel free to benefit from our platform and make your document experience as straightforward as possible!