Akron Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Akron, Ohio, financial planning and estate management are crucial elements for individuals looking to protect their assets and ensure a smooth transition of wealth to their beneficiaries. One notable strategy that residents often consider is transferring financial accounts to a living trust. This process allows enhanced control over their assets and facilitates a seamless transfer of funds upon their passing. 1. Akron Ohio Financial Account Transfer: The Akron Ohio Financial Account Transfer refers to the process of moving various financial accounts, such as savings accounts, checking accounts, investment portfolios, retirement funds, and even real estate holdings, into a living trust. This transfer is carried out to ensure that these assets are managed and distributed according to the granter's wishes, typically with little to no involvement of probate court. 2. Living Trust: A living trust, also known as a revocable trust or an inter vivos trust, is a legally binding document that enables individuals, referred to as granters, to transfer their assets to a separate entity during their lifetime. The granter retains full control over the trust, including the ability to make changes or revoke it entirely. Upon the granter's death, the appointed trustee takes over the management and distribution of the trust assets as outlined in the trust agreement. 3. Benefits of Akron Ohio Financial Account Transfer to a Living Trust: — Avoidance of Probate: Transferring financial accounts to a living trust can help bypass the time-consuming and costly probate process. By doing so, the granter's assets can be distributed efficiently to beneficiaries specified in the trust agreement, without court interference. — Privacy: Probate proceedings are public records, potentially exposing sensitive financial information and personal details. Utilizing a living trust allows for a private transfer, maintaining confidentiality for both granters and beneficiaries. — Continuity and Asset Management: In the event of incapacity, the appointed successor trustee steps in to manage the trust assets, ensuring a smooth continuation of financial affairs without the need for court-appointed guardianship or conservatorship. — Estate Tax Planning: Akron Ohio Financial Account Transfer to a living trust can be an effective strategy for minimizing estate taxes, potentially reducing the tax burden on beneficiaries. 4. Types of Akron Ohio Financial Account Transfer to Living Trust: While the basic concept of transferring financial accounts to a living trust remains the same, different types of accounts may require specific procedures. These may include: — Bank Accounts: Savings accounts, checking accounts, money market accounts, and certificates of deposit can be transferred by updating the account registration to the trust name. — Investment Portfolios: Stocks, bonds, mutual funds, and other investment holdings can be transferred by re-registering the securities or account with the living trust. — Retirement Funds: IRAs, 401(k)s, and other retirement accounts may require additional steps, such as naming the trust as a beneficiary or creating a standalone retirement trust to hold these assets. — Real Estate: Real estate properties can be transferred by executing a new deed in the name of the trust and recording it with the appropriate county office. In conclusion, for Akron, Ohio residents seeking an effective estate planning tool, the Akron Ohio Financial Account Transfer to a Living Trust offers numerous advantages, including probate avoidance, privacy protection, and centralized asset management. Understanding the various types of accounts that can be transferred to a living trust allows individuals to create a comprehensive plan tailored to their specific financial situation.

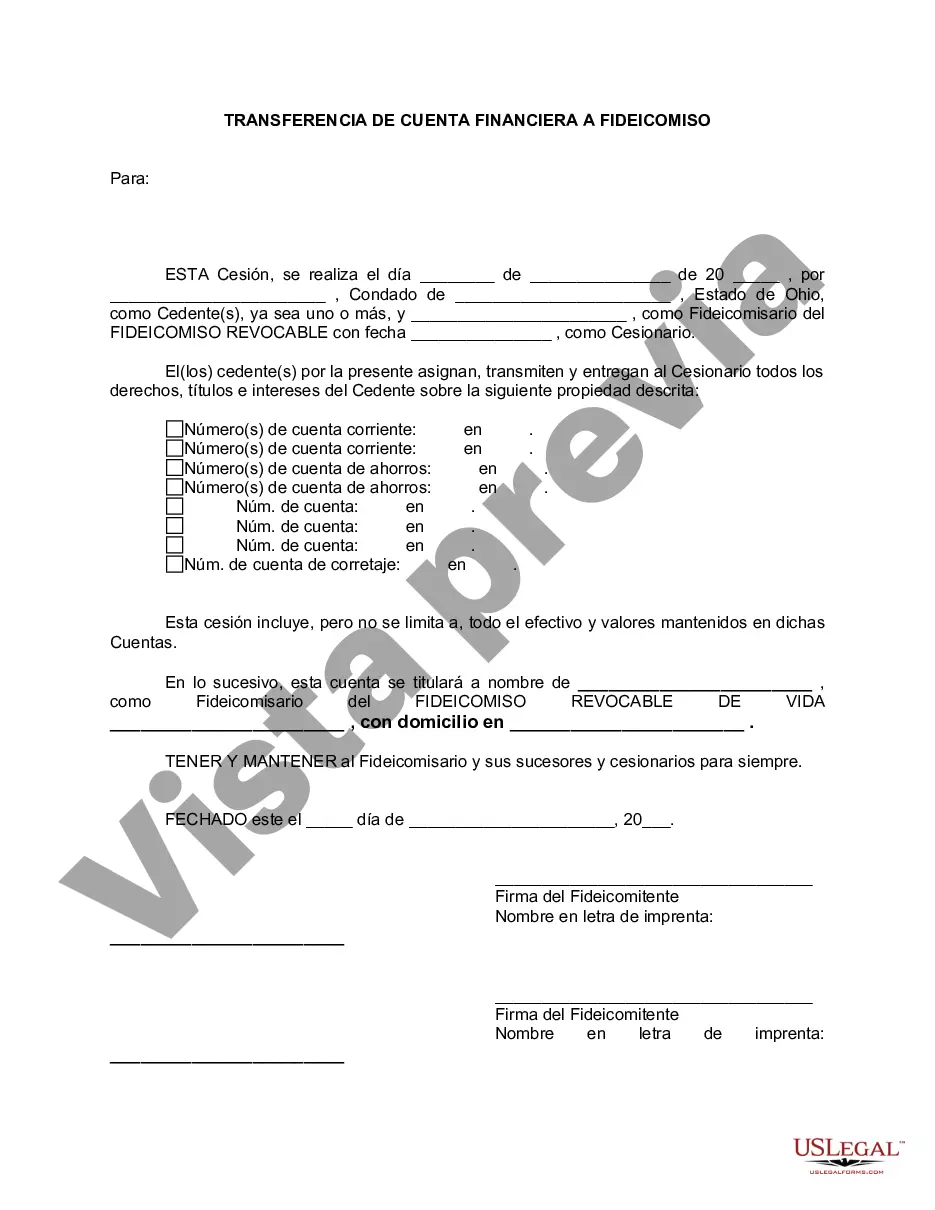

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Akron Ohio Transferencia de cuenta financiera a fideicomiso en vida - Ohio Financial Account Transfer to Living Trust

Description

How to fill out Akron Ohio Transferencia De Cuenta Financiera A Fideicomiso En Vida?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law background to draft such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive library with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Akron Ohio Financial Account Transfer to Living Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Akron Ohio Financial Account Transfer to Living Trust in minutes using our trustworthy service. In case you are presently a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are new to our platform, ensure that you follow these steps before downloading the Akron Ohio Financial Account Transfer to Living Trust:

- Be sure the template you have chosen is good for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the form and read a short outline (if provided) of cases the paper can be used for.

- In case the form you selected doesn’t meet your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Pick the payment method and proceed to download the Akron Ohio Financial Account Transfer to Living Trust as soon as the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. In case you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.