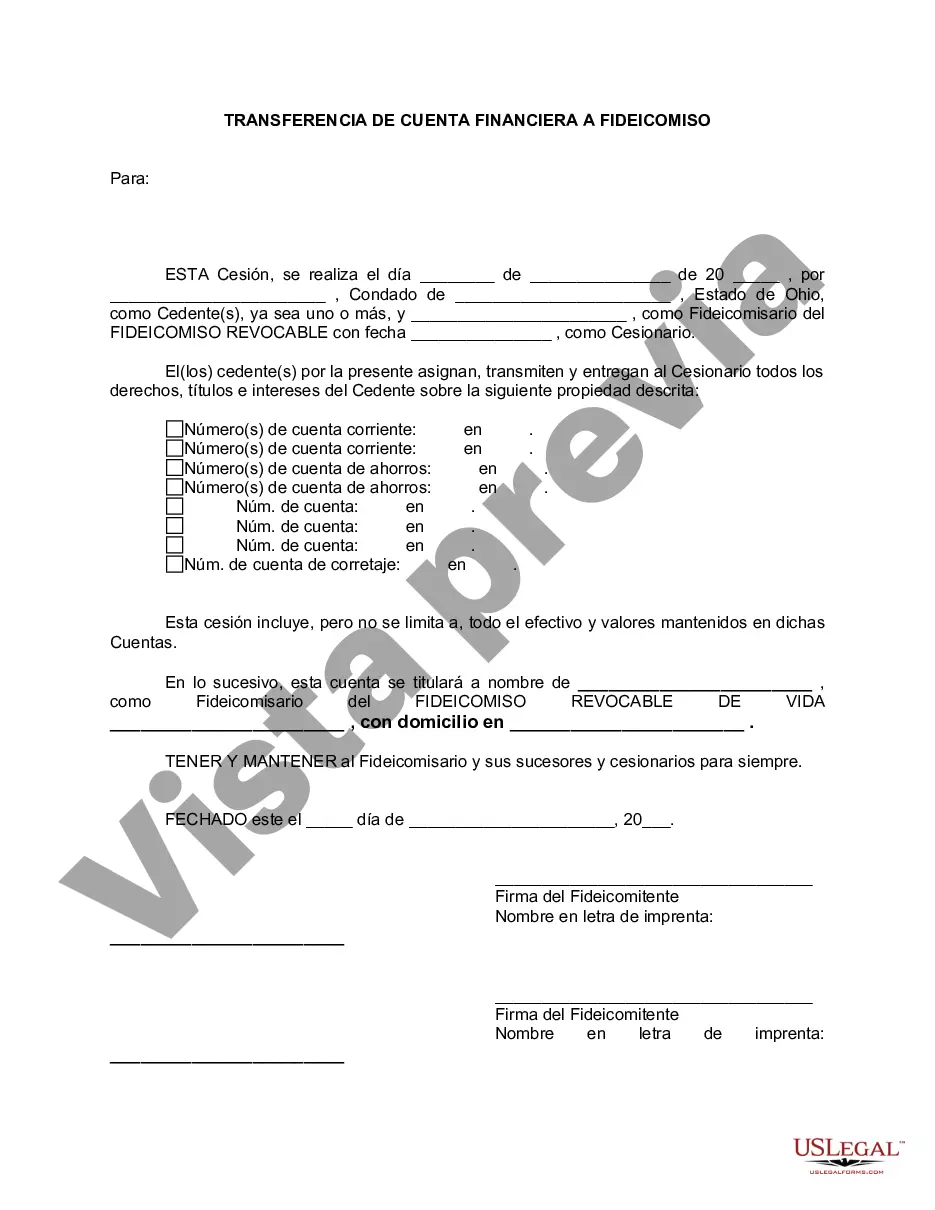

Cuyahoga Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Cuyahoga County, Ohio, individuals have the option to transfer their financial accounts into a living trust as part of their estate planning strategy. This process of transferring ownership of financial assets to a trust offers various advantages and can provide greater control over the distribution of assets upon the account owner's incapacity or passing. Types of Cuyahoga Ohio Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type of account transfer involves transferring ownership and control of bank accounts, such as checking and savings accounts, to a living trust. By doing so, the account owner ensures that their designated trustee can manage the funds in the account, paying bills, or making necessary transactions on their behalf. 2. Investment Account Transfer: Individuals in Cuyahoga County may also choose to transfer their investment accounts, which include stocks, bonds, mutual funds, and other securities, into a living trust. This transfer enables the appointed trustee to manage the investment portfolio according to the account owner's predetermined instructions, ensuring seamless transition and continuous management upon the owner's incapacity or death. 3. Retirement Account Transfer: Certain retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, can also be transferred to a living trust in Cuyahoga County. This transfer allows the trustee to administer the retirement funds and distribute them in accordance with the owner's wishes, potentially reducing tax liabilities and providing beneficiaries with a smooth transition of inherited retirement assets. 4. Insurance Policy Transfer: In some cases, individuals may wish to transfer the ownership of life insurance policies into a living trust. This transfer ensures that the proceeds from the policy are efficiently managed and distributed according to the trust's terms, providing a reliable financial resource for beneficiaries. To initiate a Cuyahoga Ohio Financial Account Transfer to Living Trust, individuals must follow a series of steps. Firstly, consult with an experienced estate planning attorney familiar with Ohio laws to understand the specifics of the process. Prepare the necessary legal documents, including a trust agreement and a transfer document, which outlines the assets being transferred. Next, contact the financial institutions holding the accounts within Cuyahoga County and request their specific requirements and necessary paperwork for transferring the ownership to a living trust. This may involve completing account transfer forms, providing a copy of the trust agreement, or obtaining a medallion signature guarantee. Once the accounts are successfully transferred, it is crucial to ensure that all relevant financial institutions reflect the new ownership details. Regularly review and update the trust and its provisions as financial circumstances or preferences change over time. In conclusion, Cuyahoga Ohio Financial Account Transfer to Living Trust offers a valuable estate planning tool for individuals to maintain control of their financial assets and ensure desired distribution upon their incapacity or demise. By transferring different types of financial accounts, including bank accounts, investment accounts, retirement accounts, and insurance policies, individuals in Cuyahoga County can create a comprehensive plan for the future management and distribution of their wealth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Transferencia de cuenta financiera a fideicomiso en vida - Ohio Financial Account Transfer to Living Trust

Description

How to fill out Cuyahoga Ohio Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any legal education to create such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a massive library with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Cuyahoga Ohio Financial Account Transfer to Living Trust or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Cuyahoga Ohio Financial Account Transfer to Living Trust in minutes using our trusted platform. In case you are presently an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps before obtaining the Cuyahoga Ohio Financial Account Transfer to Living Trust:

- Ensure the form you have chosen is good for your area since the regulations of one state or area do not work for another state or area.

- Preview the form and go through a quick description (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start again and look for the suitable document.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Cuyahoga Ohio Financial Account Transfer to Living Trust once the payment is through.

You’re all set! Now you can go on and print out the form or complete it online. Should you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.