Franklin Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Franklin, Ohio, individuals have the opportunity to transfer their financial accounts to a Living Trust, ensuring the smooth distribution of assets and the avoidance of probate. By creating a Living Trust, you can establish a clear plan for the management and transfer of your accounts to designated beneficiaries upon your death or incapacitation. This article will outline the process, benefits, and different types of Franklin Ohio Financial Account Transfer to Living Trust. The process of transferring financial accounts to a Living Trust entails several crucial steps. First, it is essential to create a comprehensive Living Trust document with the help of an experienced estate planning attorney. This document will detail your wishes regarding the distribution of your financial assets, including bank accounts, investments, retirement funds, and other financial holdings. Once the Living Trust is established, the next step is to identify and designate specific financial accounts that will be transferred into the Trust. The benefits of a Franklin Ohio Financial Account Transfer to Living Trust are numerous. Firstly, it enables you to maintain greater control over your financial assets during your lifetime and ensures they are managed according to your wishes. Additionally, transferring accounts to a Living Trust can help you avoid probate, a time-consuming and costly legal process. The assets held in a Living Trust can be immediately distributed to beneficiaries upon your passing, bypassing the probate process altogether. Furthermore, Living Trusts offer increased privacy as the transfer of assets occurs outside the public probate court records. Several types of Franklin Ohio Financial Account Transfer to Living Trust exist, providing individuals with flexibility and tailored estate planning solutions. These include: 1. Bank Accounts: You can transfer various types of bank accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), to your Living Trust. This ensures seamless management of funds and easy access for the Trustee. 2. Investment Accounts: Transferring investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, to your Living Trust allows for the continued growth and management of these assets while offering clear instructions on their distribution to beneficiaries. 3. Retirement Accounts: If you hold Individual Retirement Accounts (IRAs), 401(k)s, or other retirement accounts, you can designate your Living Trust as the primary or contingent beneficiary. This ensures that the accounts are managed according to your estate plan and can provide potential tax advantages to your beneficiaries. 4. Life Insurance Policies: By designating your Living Trust as the beneficiary of life insurance policies, the proceeds can be distributed according to your wishes, avoiding potential complications or delays. By comprehensively understanding the process, benefits, and different types of Franklin Ohio Financial Account Transfer to Living Trust, individuals can make informed decisions about their estate planning. It is crucial to consult with an experienced estate planning attorney or financial advisor who specializes in Living Trusts to ensure that your specific needs and goals are met. With careful preparation and the establishment of a Living Trust, you can have peace of mind knowing that your financial accounts will be transferred seamlessly to your chosen beneficiaries while avoiding probate.

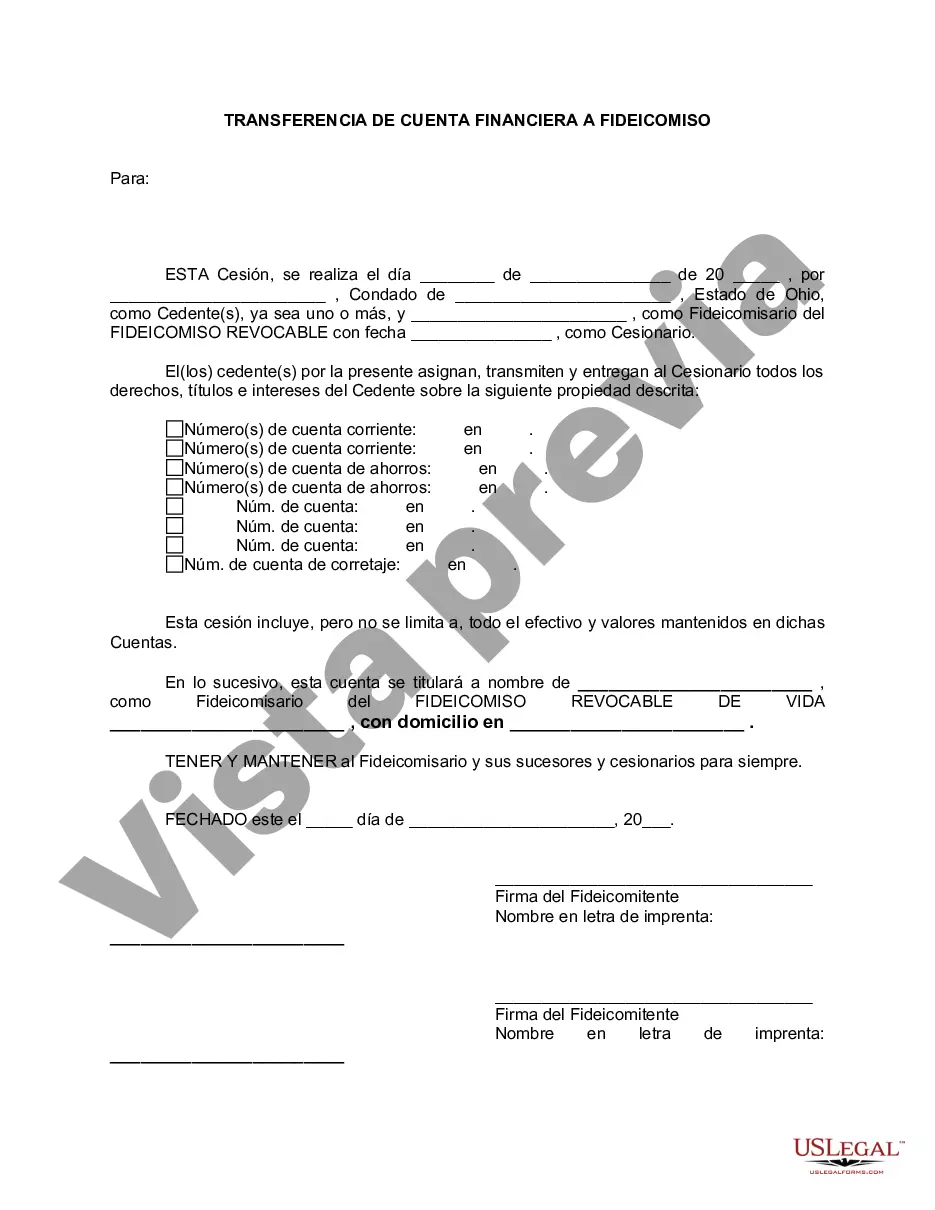

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Transferencia de cuenta financiera a fideicomiso en vida - Ohio Financial Account Transfer to Living Trust

State:

Ohio

County:

Franklin

Control #:

OH-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Franklin Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Franklin, Ohio, individuals have the opportunity to transfer their financial accounts to a Living Trust, ensuring the smooth distribution of assets and the avoidance of probate. By creating a Living Trust, you can establish a clear plan for the management and transfer of your accounts to designated beneficiaries upon your death or incapacitation. This article will outline the process, benefits, and different types of Franklin Ohio Financial Account Transfer to Living Trust. The process of transferring financial accounts to a Living Trust entails several crucial steps. First, it is essential to create a comprehensive Living Trust document with the help of an experienced estate planning attorney. This document will detail your wishes regarding the distribution of your financial assets, including bank accounts, investments, retirement funds, and other financial holdings. Once the Living Trust is established, the next step is to identify and designate specific financial accounts that will be transferred into the Trust. The benefits of a Franklin Ohio Financial Account Transfer to Living Trust are numerous. Firstly, it enables you to maintain greater control over your financial assets during your lifetime and ensures they are managed according to your wishes. Additionally, transferring accounts to a Living Trust can help you avoid probate, a time-consuming and costly legal process. The assets held in a Living Trust can be immediately distributed to beneficiaries upon your passing, bypassing the probate process altogether. Furthermore, Living Trusts offer increased privacy as the transfer of assets occurs outside the public probate court records. Several types of Franklin Ohio Financial Account Transfer to Living Trust exist, providing individuals with flexibility and tailored estate planning solutions. These include: 1. Bank Accounts: You can transfer various types of bank accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), to your Living Trust. This ensures seamless management of funds and easy access for the Trustee. 2. Investment Accounts: Transferring investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, to your Living Trust allows for the continued growth and management of these assets while offering clear instructions on their distribution to beneficiaries. 3. Retirement Accounts: If you hold Individual Retirement Accounts (IRAs), 401(k)s, or other retirement accounts, you can designate your Living Trust as the primary or contingent beneficiary. This ensures that the accounts are managed according to your estate plan and can provide potential tax advantages to your beneficiaries. 4. Life Insurance Policies: By designating your Living Trust as the beneficiary of life insurance policies, the proceeds can be distributed according to your wishes, avoiding potential complications or delays. By comprehensively understanding the process, benefits, and different types of Franklin Ohio Financial Account Transfer to Living Trust, individuals can make informed decisions about their estate planning. It is crucial to consult with an experienced estate planning attorney or financial advisor who specializes in Living Trusts to ensure that your specific needs and goals are met. With careful preparation and the establishment of a Living Trust, you can have peace of mind knowing that your financial accounts will be transferred seamlessly to your chosen beneficiaries while avoiding probate.

Free preview

How to fill out Franklin Ohio Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and save the Franklin Ohio Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Franklin Ohio Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!