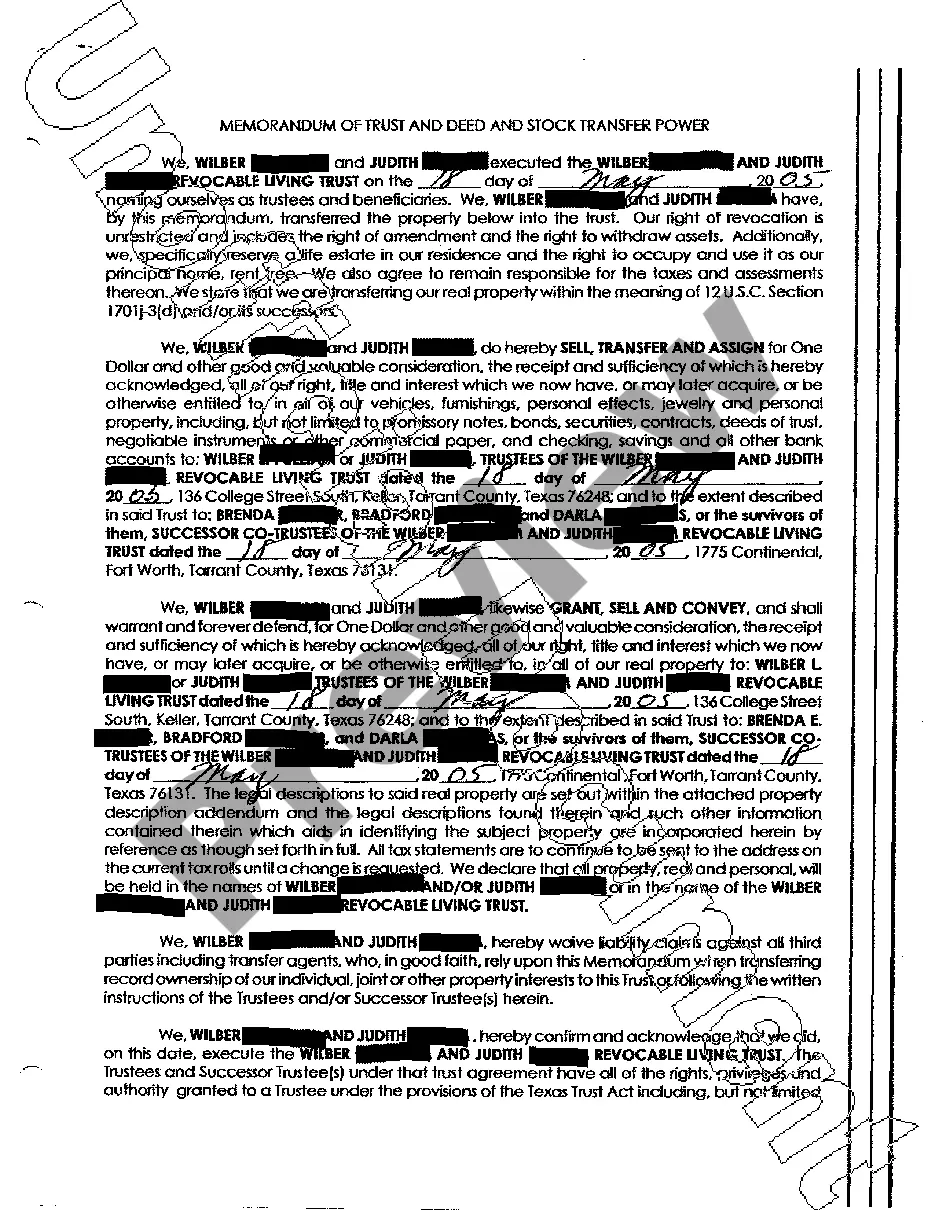

Toledo Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide When it comes to estate planning, transferring financial accounts to a living trust can be a beneficial step for individuals in Toledo, Ohio. This process ensures that your assets are protected and distributed according to your wishes, while avoiding the costly and time-consuming probate process. In this detailed description, we will explore the ins and outs of the Toledo Ohio Financial Account Transfer to Living Trust, highlighting different types and key aspects to consider. 1. Understanding the Living Trust: A living trust, also known as a revocable trust, is a legal document that allows you to transfer the ownership of your assets, including financial accounts, to a trust during your lifetime. By doing so, you become the trustee, retaining control over the assets, and maintaining the ability to amend or revoke the trust at any time. In the event of your incapacity or passing, the trust's appointed successor trustee manages and distributes the assets as outlined in the trust. 2. Accounts Eligible for Transfer: Various financial accounts can be transferred to a living trust, including bank accounts, investment portfolios, retirement accounts like IRAs or 401(k)s, stocks, bonds, mutual funds, and more. However, certain accounts like health savings accounts (Has) and annuities may have limitations or restrictions on transferability. It is important to consult with a qualified estate planning attorney or financial advisor to determine the transferability of specific accounts. 3. Potential Benefits and Considerations: Transferring financial accounts to a living trust offers several advantages, such as: a) Probate Avoidance: By holding assets in a living trust, they bypass the probate process, allowing for a faster and more private distribution of assets to beneficiaries. b) Incapacity Protection: In the event of incapacity, the appointed successor trustee seamlessly takes over the management of trust assets without the need for court intervention or conservatorship proceedings. c) Privacy: Unlike a will, which becomes a matter of public record during probate, a living trust provides confidentiality, keeping the details of your estate plan away from the public eye. d) Flexibility: One can modify or revoke a living trust during their lifetime, making it more adaptable to changing circumstances or preferences. However, some factors to consider include potential costs associated with creating and maintaining the trust, as well as the time and effort required to transfer all eligible accounts into the trust. 4. Different Types of Toledo Ohio Financial Account Transfer to Living Trust: There are no specific variations or types of financial account transfers to a living trust exclusive to Toledo, Ohio. The process remains consistent with general practices followed in estate planning across jurisdictions. However, there might be local regulations or requirements specific to Ohio that individuals need to consider while executing the transfer. In conclusion, a Toledo area resident can benefit greatly from transferring financial accounts to a living trust. By seeking professional guidance and understanding the process, individuals can protect their assets, ensure a smoother transition of wealth, and provide for their loved ones in accordance with their wishes.

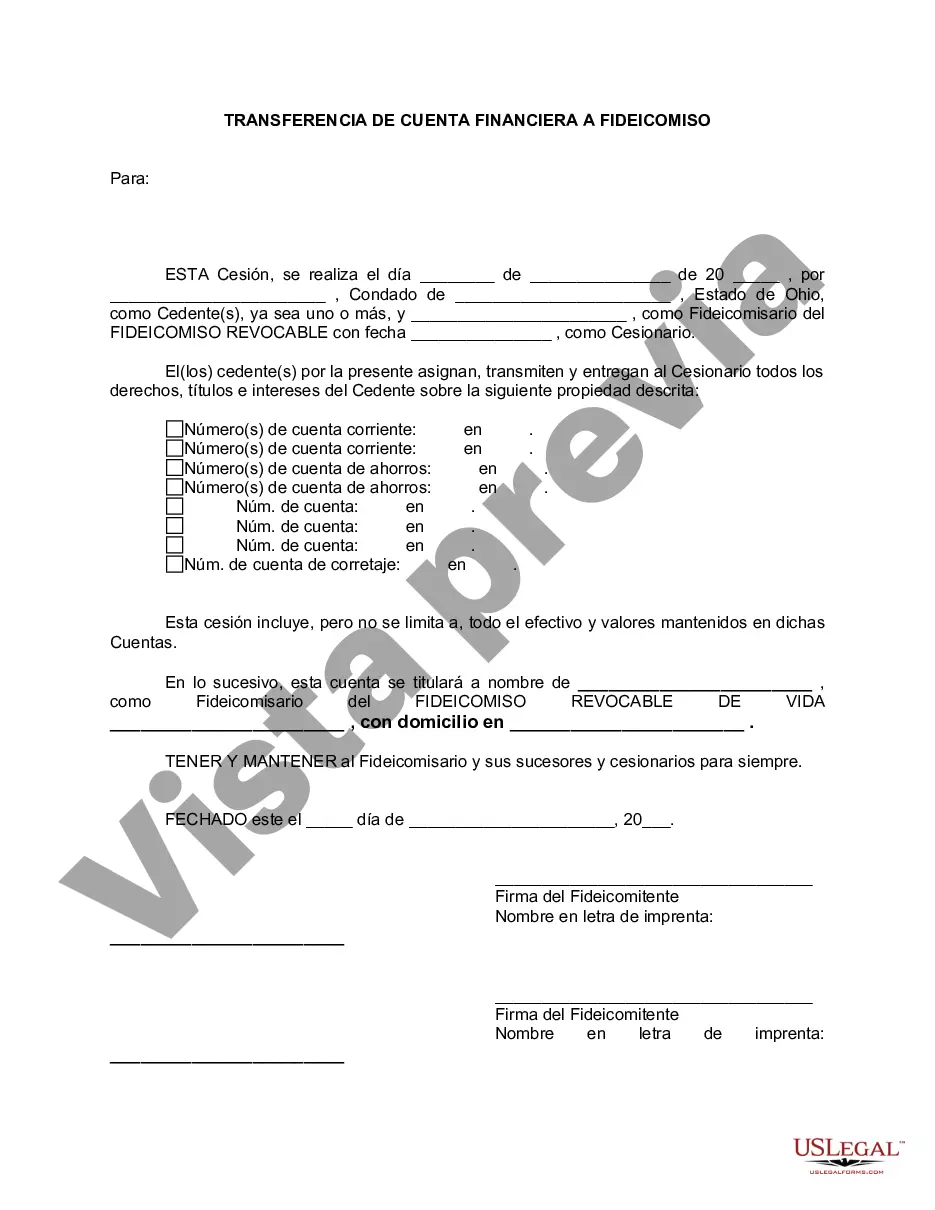

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Toledo Ohio Transferencia de cuenta financiera a fideicomiso en vida - Ohio Financial Account Transfer to Living Trust

Description

How to fill out Toledo Ohio Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our beneficial website with thousands of documents enables you to discover and obtain nearly any document example you need.

You can save, complete, and sign the Toledo Ohio Financial Account Transfer to Living Trust in just a few minutes rather than spending hours online in search of an appropriate template.

Using our collection is a superb method to enhance the security of your form submissions.

The Download button will be activated on all documents you access. Furthermore, you can locate all previously saved documents in the My documents section.

If you do not yet have an account, follow the guidelines outlined below.

- Our skilled attorneys frequently review all documents to ensure that the forms are pertinent to a specific area and adhere to up-to-date regulations and policies.

- How can you acquire the Toledo Ohio Financial Account Transfer to Living Trust.

- If you already have an account, simply Log In to your profile.

Form popularity

FAQ

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

Most banks prefer that you and your spouse come to a local branch of the bank and complete their trust transfer form. Typically this is a one or two page document that will ask you to list the name of your trust, the date of the trust and who the current trustees are.

Having a separate account makes it easier to move funds into the accounts and keep track of related expenses. Being able to disperse funds quickly and easily is important, especially if the trust was created to handle immediate needs, like the death of a parent or guardian, or urgent medical expenses.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

In most cases, the trustee who manages the funds and assets in the account acts as a fiduciary, meaning the trustee has a legal responsibility to manage the account prudently and manage assets in the best interests of the beneficiary.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

Recommended for you To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. A Trust-Based Estate Plan is the most secure way to make your last wishes known while protecting your assets and loved ones.