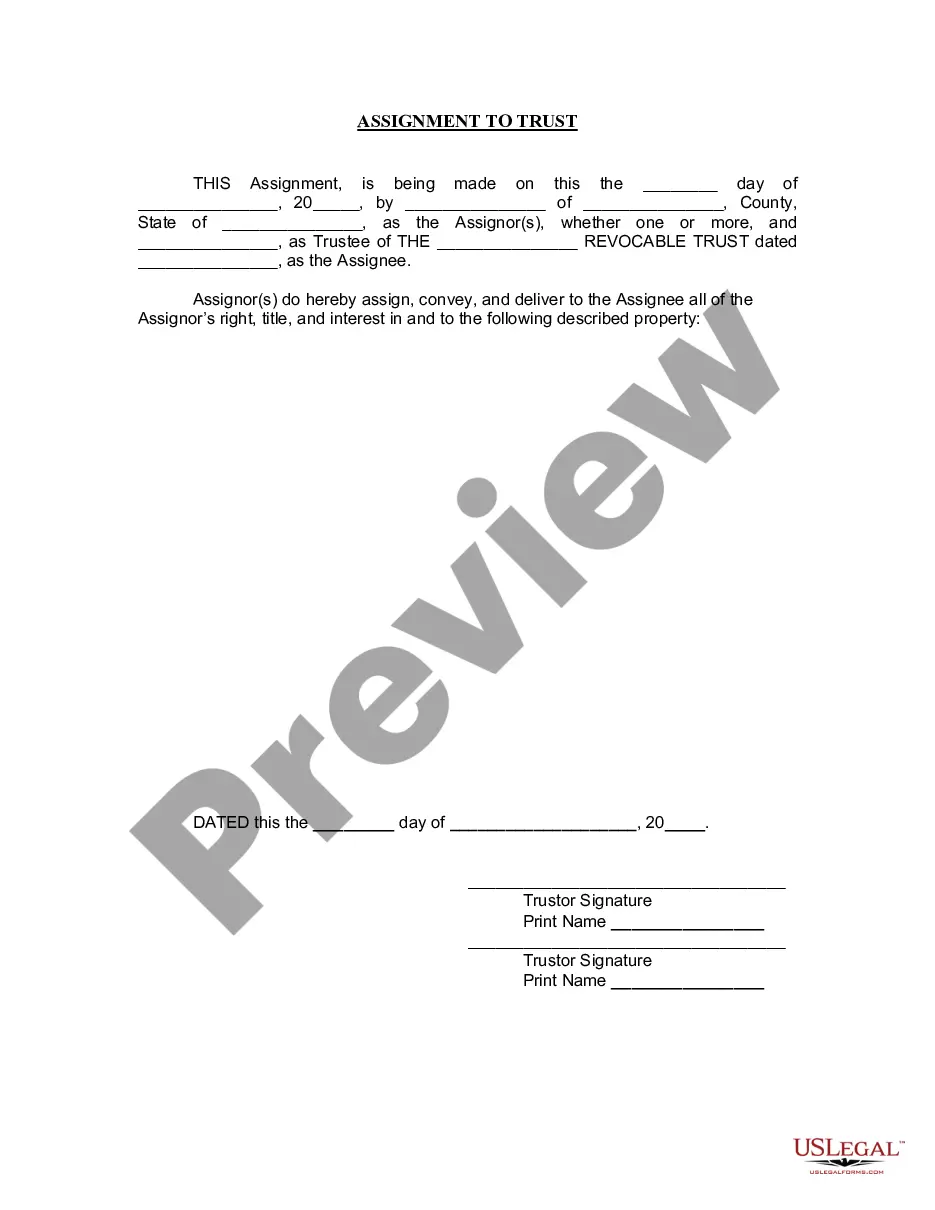

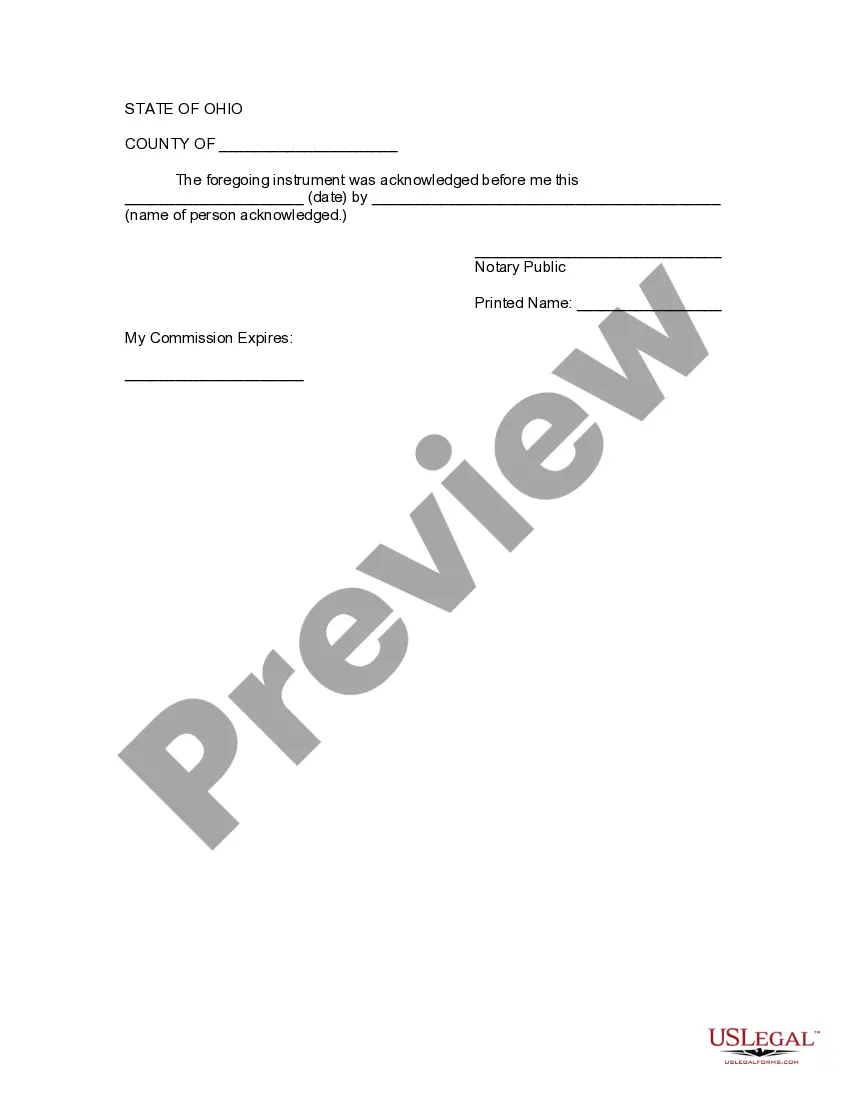

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Akron Ohio Assignment to Living Trust

Description

How to fill out Ohio Assignment To Living Trust?

Are you in search of a dependable and cost-effective provider for legal forms to obtain the Akron Ohio Assignment to Living Trust? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish rules for cohabiting with your partner or a bundle of documents to facilitate your separation or divorce through the court, we have you covered. Our platform presents over 85,000 current legal document templates for both personal and business applications. All the templates we provide are tailored and structured according to the specifications of individual states and counties.

To retrieve the document, you need to Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download your previously acquired document templates anytime from the My documents section.

Is this your first visit to our website? No need to worry. You can create an account in minutes, but before proceeding, ensure to do the following.

Now you can register your account. Next, choose the subscription plan and proceed to payment. Once the payment is completed, download the Akron Ohio Assignment to Living Trust in any available format. You can revisit the website whenever needed to redownload the document at no extra charge.

Accessing current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending hours researching legal papers online once and for all.

- Verify if the Akron Ohio Assignment to Living Trust complies with the laws of your state and locality.

- Review the form’s specifics (if available) to determine who and what the document is applicable for.

- Restart your search if the template doesn’t suit your legal needs.

Form popularity

FAQ

Setting up a living trust in Ohio involves several key steps. First, determine what assets you want to include in your Akron Ohio Assignment to Living Trust. Next, choose a trustee, who will manage the trust, and then create and sign the trust document, often using templates from platforms like US Legal Forms. Finally, transfer your assets into the trust, ensuring everything is legally documented for a smooth transition.

Yes, you can create your own living trust in Ohio, allowing you to manage your assets and streamline the transfer process. However, accurately setting up an Akron Ohio Assignment to Living Trust requires careful attention to detail to ensure it meets legal standards. You can use resources like US Legal Forms to streamline this process and access templates that guide you. Always consider seeking legal advice to ensure your trust aligns with your estate planning goals.

Deciding whether to have a will or a trust in Ohio depends on your specific needs. A will distributes assets after your passing, while a trust, including the Akron Ohio Assignment to Living Trust, can manage assets during your lifetime and after. Trusts often avoid probate, saving time and costs, which can be beneficial for your heirs. Consider consulting with legal professionals to understand which option suits you better.

In Ohio, a trust, such as an Akron Ohio Assignment to Living Trust, functions as a legal arrangement that holds your assets for the benefit of your chosen beneficiaries. You, as the grantor, establish the trust and can designate yourself as the trustee, allowing you to manage the assets. After your death, the trust assets are distributed according to the terms you've set, avoiding probate and providing a clear plan for your estate.

Ohio is not traditionally considered a deed of trust state; it primarily uses mortgages for securing property loans. However, it is important to understand how an Akron Ohio Assignment to Living Trust can work with your property ownership. Consulting with a legal expert can clarify the relationship between trusts and real estate in Ohio.

The best trust for your house often depends on your specific needs, but an Akron Ohio Assignment to Living Trust is a popular choice. This type of trust allows you to retain control of your property during your lifetime while simplifying the transfer to your heirs after your passing. It also provides privacy and can protect your home from probate.

Yes, an Akron Ohio Assignment to Living Trust generally helps you avoid probate. When you place your assets in a living trust, those assets do not pass through the probate process upon your death. This means your beneficiaries can receive their inheritance more quickly, without the delays and costs associated with probate court.

In the UK, parents often overlook tax implications when establishing a trust fund. Failing to account for taxes can lead to unexpected liabilities that diminish the fund's value. Although this question references the UK, understanding these issues is important for parents considering an Akron Ohio Assignment to Living Trust to avoid similar pitfalls.

Transferring property into a trust in Ohio involves completing a deed that specifies the trust as the new owner. This requires clear documentation to ensure the property is correctly titled. An Akron Ohio Assignment to Living Trust can effectively manage such property transfers while providing peace of mind.

To file a living trust in Ohio, you must first create the trust document, naming a trustee and beneficiaries. Then, you need to transfer the desired assets into the trust. Using resources from platforms like uslegalforms can simplify the process of establishing an Akron Ohio Assignment to Living Trust.