Cincinnati Ohio Assignment to Living Trust: A Comprehensive Guide What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows you to transfer your assets and properties into a trust during your lifetime. By establishing this trust, you can dictate how your assets will be managed and distributed while avoiding the often lengthy and costly probate process. In Cincinnati, Ohio, individuals often choose to create living trusts as part of their estate planning strategy. Types of Cincinnati Ohio Assignment to Living Trust: 1. Revocable Living Trusts: The most common type of living trust, it allows the creator, also known as the granter, to make changes, amendments, or revoke the trust entirely during their lifetime. 2. Irrevocable Living Trusts: Unlike a revocable trust, an irrevocable living trust cannot be altered or terminated by the granter once it has been established. This type of trust provides certain tax benefits and serves as an excellent asset protection tool, ensuring your assets are shielded from potential creditors and allowing for potential Medicaid planning. 3. Testamentary Trusts: While not technically a living trust, a testamentary trust is created within a will and becomes effective only upon the granter's death. It allows you to specify how your assets will be distributed, offering more control and flexibility in the process. 4. Special Needs Trusts: These trusts are designed to benefit individuals with disabilities or special needs. The funds within the trust are carefully managed to ensure that the beneficiary can maintain eligibility for government aid programs while still receiving additional financial support. 5. Charitable Remainder Trusts: For those interested in philanthropy, a charitable remainder trust allows the granter to donate assets to a charitable organization while retaining an income stream for themselves or their beneficiaries. Creating an Assignment to Living Trust in Cincinnati, Ohio: To create a Cincinnati Ohio Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney. They will guide you through the process, ensuring that all legal requirements are met, and that the trust is tailored to your unique circumstances and objectives. This includes drafting the trust document, identifying assets to be assigned to the trust, and choosing potential beneficiaries and trustees. Benefits of an Assignment to Living Trust: 1. Avoiding Probate: Assets assigned to a living trust can pass to beneficiaries without going through probate, saving time and money. 2. Privacy: Unlike a will, which becomes a public record after probate, a living trust allows for confidential asset distribution. 3. Incapacity Planning: A revocable living trust can provide for the event of your incapacity, ensuring your chosen trustee can seamlessly take over the management of your assets. 4. Potential Tax Savings: Certain types of trusts, such as irrevocable trusts, can offer tax advantages by reducing estate taxes or protecting assets from creditors. By understanding the different types of Cincinnati Ohio Assignment to Living Trusts and their benefits, you can make informed decisions when it comes to drafting your estate plan and protecting your assets for future generations.

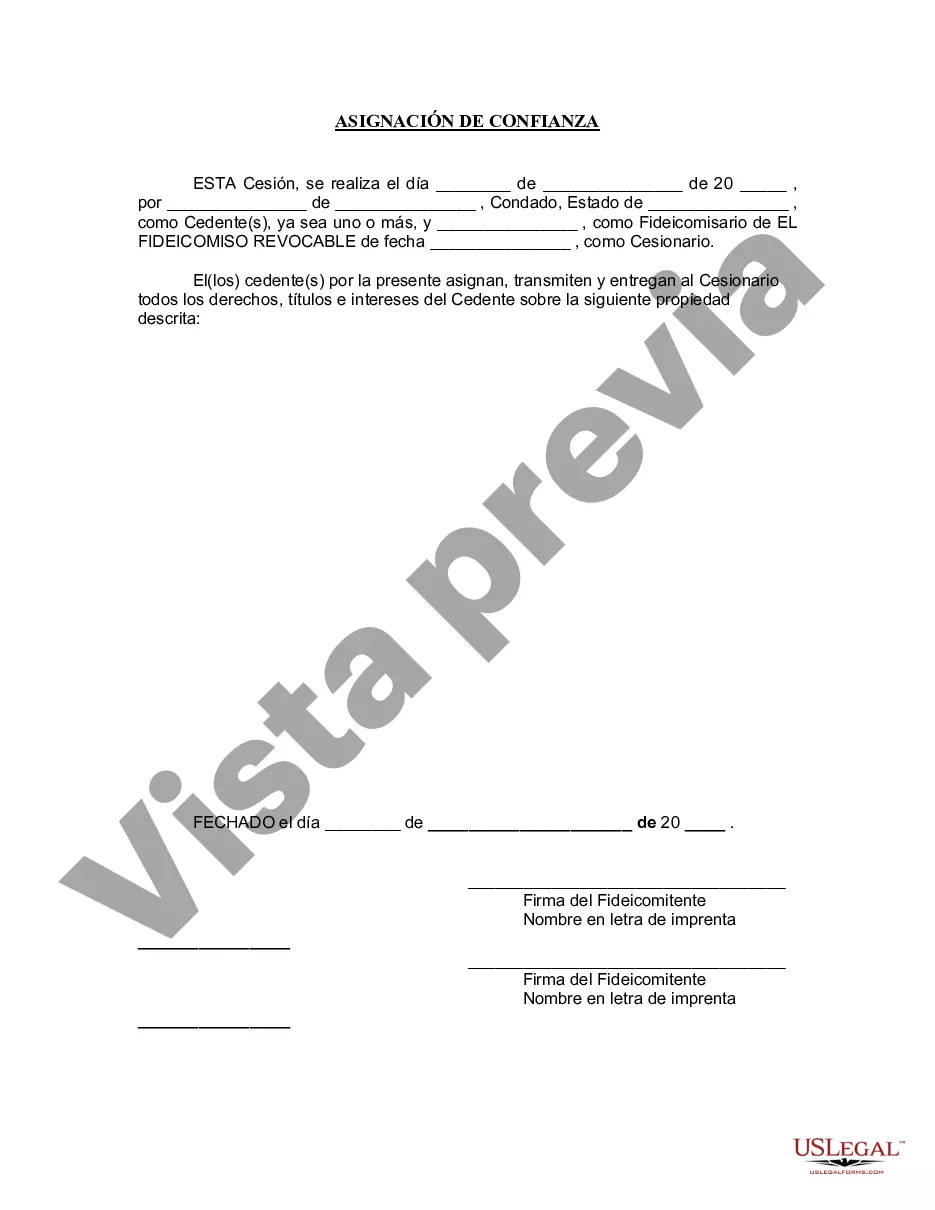

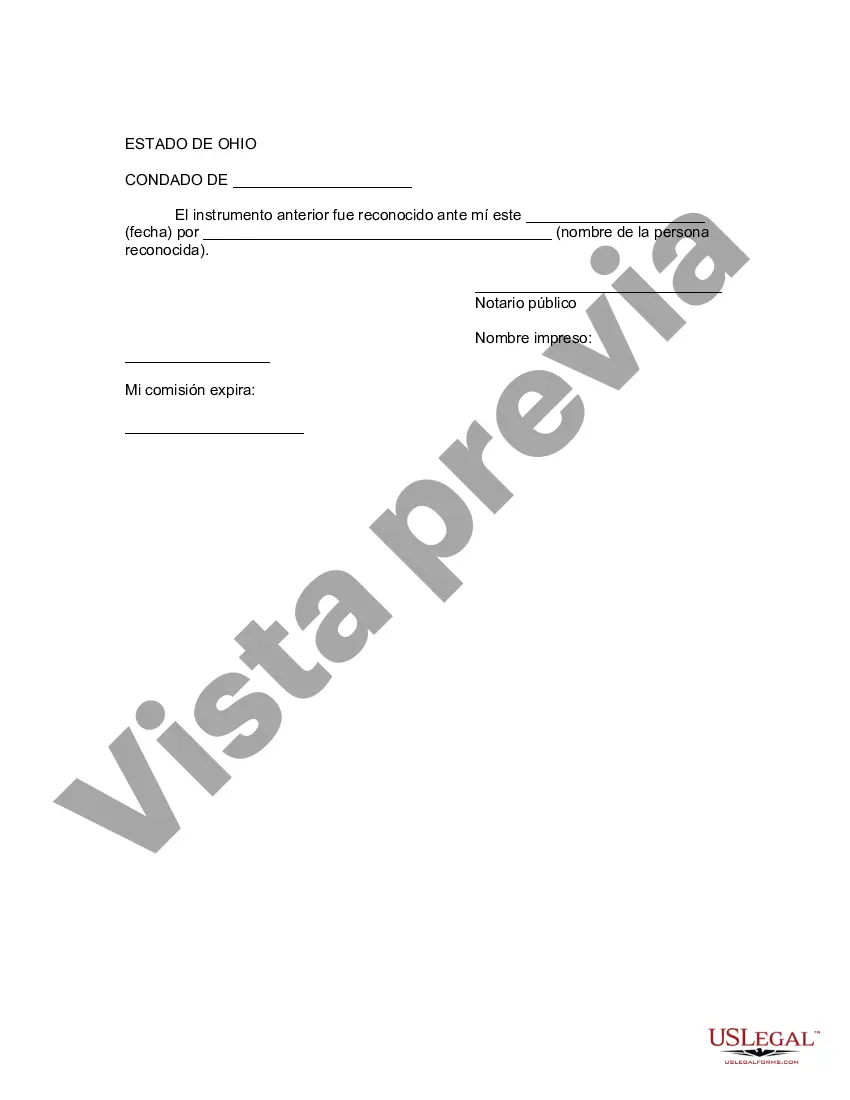

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cincinnati Ohio Asignación a un fideicomiso en vida - Ohio Assignment to Living Trust

Description

How to fill out Cincinnati Ohio Asignación A Un Fideicomiso En Vida?

Are you looking for a reliable and inexpensive legal forms provider to get the Cincinnati Ohio Assignment to Living Trust? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and area.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Cincinnati Ohio Assignment to Living Trust conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is good for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Cincinnati Ohio Assignment to Living Trust in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online once and for all.