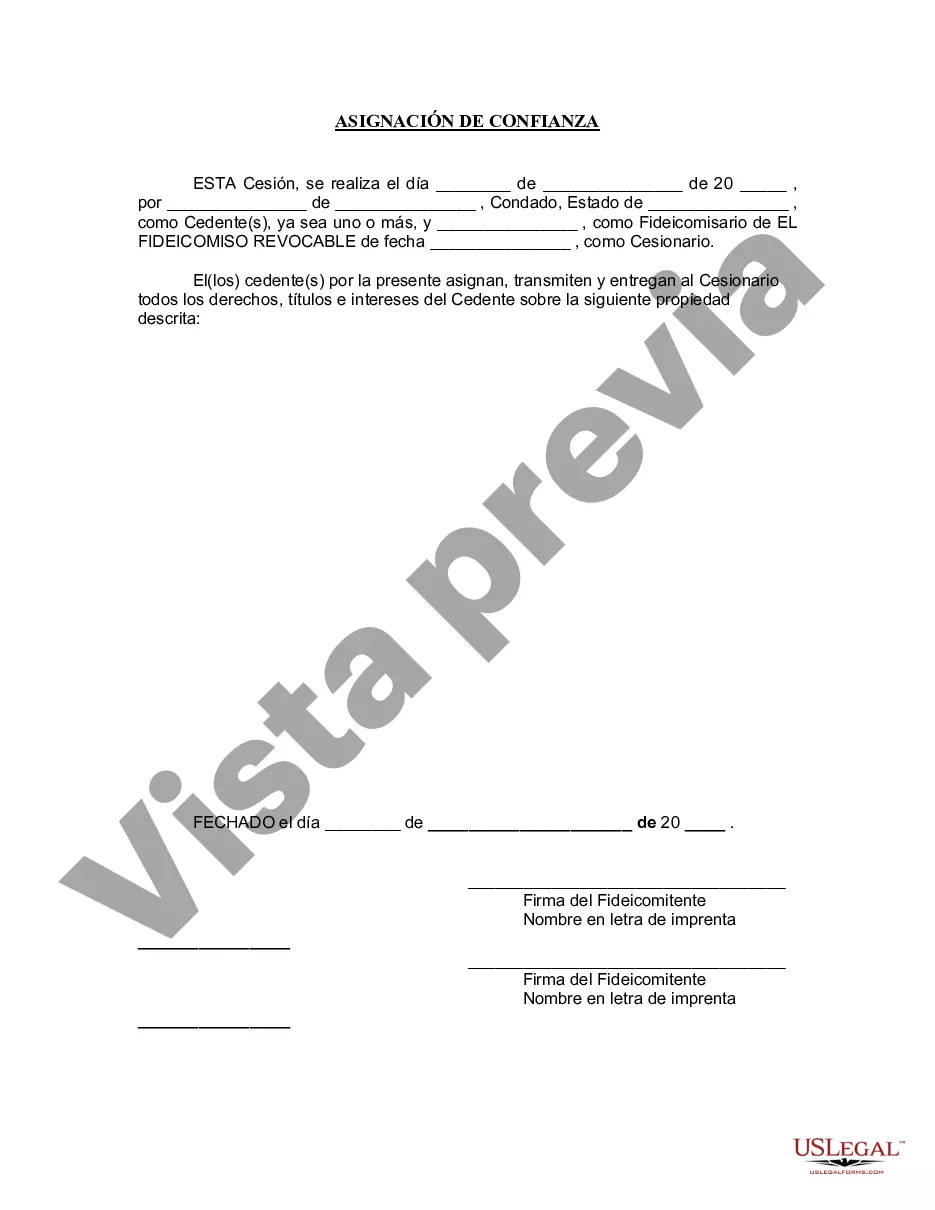

Franklin Ohio Assignment to Living Trust is an important legal process that allows individuals to properly plan for the distribution of their assets and avoid probate. A living trust, also known as a revocable trust, is created during the granter's lifetime and allows them to transfer their assets into the trust for the eventual benefit of their designated beneficiaries. In Franklin, Ohio, an assignment to a living trust involves the transfer of ownership of various assets, such as real estate, bank accounts, investments, and personal property, from an individual to their trust. This assignment is typically accomplished by executing a legally binding document called an "assignment deed" or "assignment of title," which details the specific assets being transferred and designates the living trust as the new owner. There are several types of Franklin Ohio assignments to living trusts, including: 1. Real Estate Assignment: This involves transferring ownership of residential or commercial properties in Franklin, Ohio, from the individual to their living trust. The assignment deed must be filed with the County Recorder's Office to ensure proper documentation. 2. Financial Account Assignment: This type of assignment applies to bank accounts, brokerage accounts, retirement accounts, and other financial instruments owned by the individual. By assigning these assets to the living trust, the granter ensures seamless management and distribution to their beneficiaries. 3. Personal Property Assignment: Individuals who want to pass on valuable personal belongings, such as jewelry, artwork, heirlooms, or vehicles, can assign these assets to their living trust. The assignment ensures that their treasured possessions are distributed according to their wishes, bypassing the probate process. 4. Business Interest Assignment: If an individual owns a business in Franklin, Ohio, they can assign their ownership interest in the company to their living trust. This ensures a smooth transition of business control and benefits to the designated beneficiaries upon their passing without interrupting daily operations. It is important to consult with an experienced estate planning attorney in Franklin, Ohio, to ensure that the assignment to a living trust is properly executed according to state laws. The attorney can guide individuals through the process, help them draft the necessary legal documents, and ensure that their assets are effectively transferred to the trust. Overall, when crafting a detailed description of Franklin Ohio Assignment to Living Trust, it is essential to use relevant keywords such as trust assignment, revocable trust, probate avoidance, real estate transfer, financial account transfer, personal property distribution, business interest assignment, and estate planning attorney. These keywords will help readers to understand the significance of Franklin Ohio Assignment to Living Trust and its various types.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Asignación a un fideicomiso en vida - Ohio Assignment to Living Trust

Description

How to fill out Franklin Ohio Asignación A Un Fideicomiso En Vida?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no legal background to draft such papers from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Franklin Ohio Assignment to Living Trust or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Franklin Ohio Assignment to Living Trust quickly employing our trustworthy platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, in case you are unfamiliar with our library, make sure to follow these steps prior to obtaining the Franklin Ohio Assignment to Living Trust:

- Be sure the template you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Preview the form and go through a brief outline (if provided) of cases the document can be used for.

- In case the form you picked doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Franklin Ohio Assignment to Living Trust once the payment is completed.

You’re good to go! Now you can go ahead and print out the form or fill it out online. Should you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.