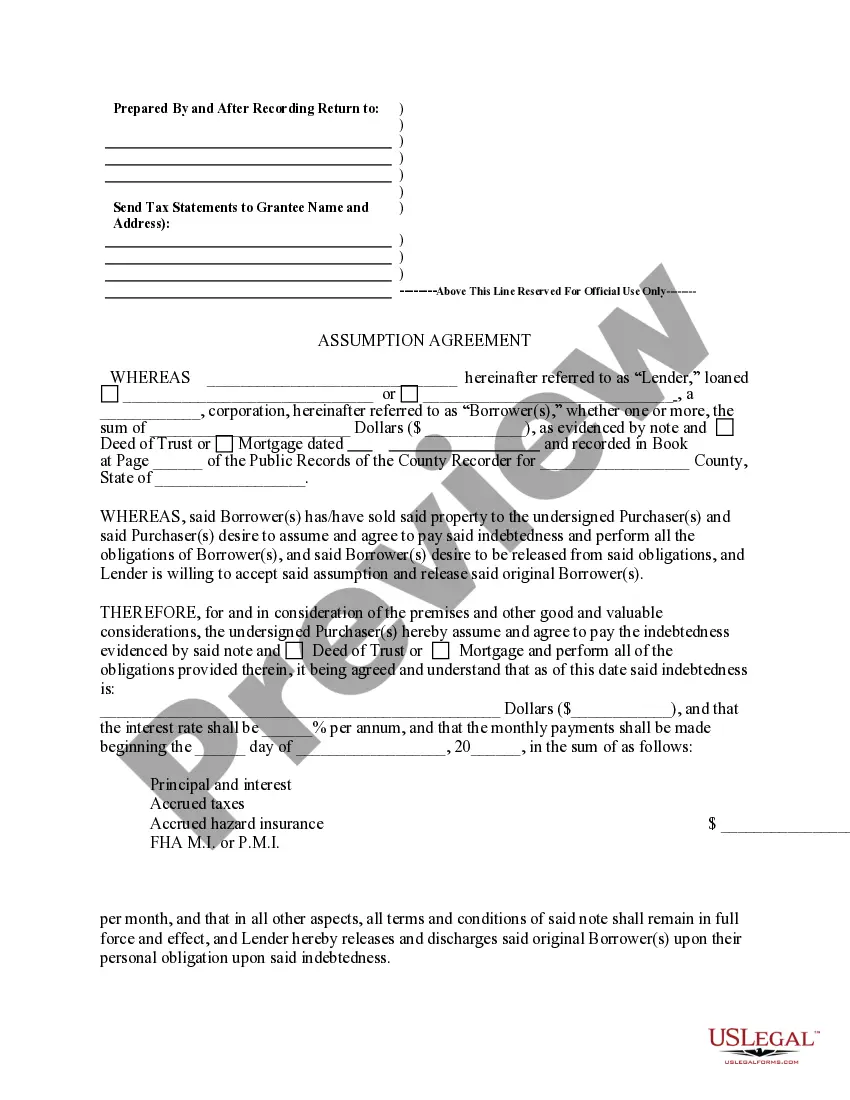

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the transfer of mortgage responsibility from the original mortgagor to another party, known as the assumption. This agreement typically occurs when the original mortgagor wishes to sell their property but still has an outstanding mortgage balance. In this agreement, both parties agree to the terms and conditions of the mortgage assumption, including the remaining mortgage balance, interest rate, repayment terms, and any additional fees or penalties associated with the transfer. It is important to note that the lender must also approve the assumption agreement before it becomes legally binding. There are different types of Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors based on the specific circumstances involved: 1. Full Assumption Agreement: This type of agreement occurs when the assumption takes full responsibility for the mortgage, including both the principal balance and any associated interest. 2. Partial Assumption Agreement: In a partial assumption agreement, the assumption agrees to assume responsibility for a portion of the outstanding mortgage balance, while the original mortgagor retains responsibility for the remaining amount. 3. Subject to Assumption Agreement: This agreement is commonly used in situations where the assumption takes over the property without formally assuming the mortgage. The original mortgagor remains liable for the mortgage payments, but the property title is transferred to the assumption. The Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is essential in protecting the interests of all parties involved in the mortgage transfer. It ensures that the assumption assumes the responsibility for the mortgage and releases the original mortgagor from any future liability. It is recommended that both parties seek legal advice and carefully review the agreement before signing to fully understand their rights and obligations.The Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the transfer of mortgage responsibility from the original mortgagor to another party, known as the assumption. This agreement typically occurs when the original mortgagor wishes to sell their property but still has an outstanding mortgage balance. In this agreement, both parties agree to the terms and conditions of the mortgage assumption, including the remaining mortgage balance, interest rate, repayment terms, and any additional fees or penalties associated with the transfer. It is important to note that the lender must also approve the assumption agreement before it becomes legally binding. There are different types of Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors based on the specific circumstances involved: 1. Full Assumption Agreement: This type of agreement occurs when the assumption takes full responsibility for the mortgage, including both the principal balance and any associated interest. 2. Partial Assumption Agreement: In a partial assumption agreement, the assumption agrees to assume responsibility for a portion of the outstanding mortgage balance, while the original mortgagor retains responsibility for the remaining amount. 3. Subject to Assumption Agreement: This agreement is commonly used in situations where the assumption takes over the property without formally assuming the mortgage. The original mortgagor remains liable for the mortgage payments, but the property title is transferred to the assumption. The Franklin Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is essential in protecting the interests of all parties involved in the mortgage transfer. It ensures that the assumption assumes the responsibility for the mortgage and releases the original mortgagor from any future liability. It is recommended that both parties seek legal advice and carefully review the agreement before signing to fully understand their rights and obligations.