Toledo, Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty: A Comprehensive Overview The Toledo, Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty is a legal agreement that allows for the transfer of the rights and interests of oil and gas royalties in the Toledo, Ohio region. This assignment grants the assignee the perpetual ownership of royalties on oil and gas production from specified properties. In Toledo, Ohio, there are different types of assignments of perpetual, non-executory oil and gas royalties that individuals and companies may encounter. These may include: 1. Mineral Lease Assignment: This type of assignment transfers the rights and interests of a mineral lease, allowing the assignee to collect royalties on any oil and gas production from the leased property. 2. Production Royalty Assignment: This assignment focuses specifically on the transfer of the production royalties related to oil and gas extraction. It grants the assignee the rights to receive a percentage of the revenue generated from the sale of oil and gas produced on the assigned property. 3. Overriding Royalty Interest Assignment: This type of assignment involves the transfer of an overriding royalty interest (ORRIS). An ORRIS grants the assignee the right to receive a specified percentage of the revenue from oil and gas production, usually calculated after the deduction of other royalties or expenses. 4. Net Profits Interest Assignment: In this type of assignment, the assignee acquires a net profits interest (NPI) in oil and gas production. A NPI entitles the assignee to a designated percentage of the net profits generated from the sale of oil and gas, often after the deduction of costs such as production expenses. 5. Working Interest Assignment: A working interest assignment is different from the previously mentioned assignments, as it pertains to the transfer of an ownership interest in the operation of the oil and gas lease. The assignee assumes both the benefits and the obligations associated with the extraction and production activities. It is essential to understand the nature and specific terms of the Toledo, Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty before entering into any agreement. Each type of assignment may have varying conditions, including royalty rates, assignment fees, and obligations for the assignee. Consulting legal professionals with expertise in oil and gas law is highly recommended ensuring compliance with local regulations and to protect the rights and interests of all parties involved. In conclusion, the Toledo, Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty encompasses various types of assignments, including mineral lease assignments, production royalty assignments, overriding royalty interest assignments, net profits interest assignments, and working interest assignments. Understanding the unique qualities and implications of each assignment is crucial when engaging in oil and gas transactions in Toledo, Ohio.

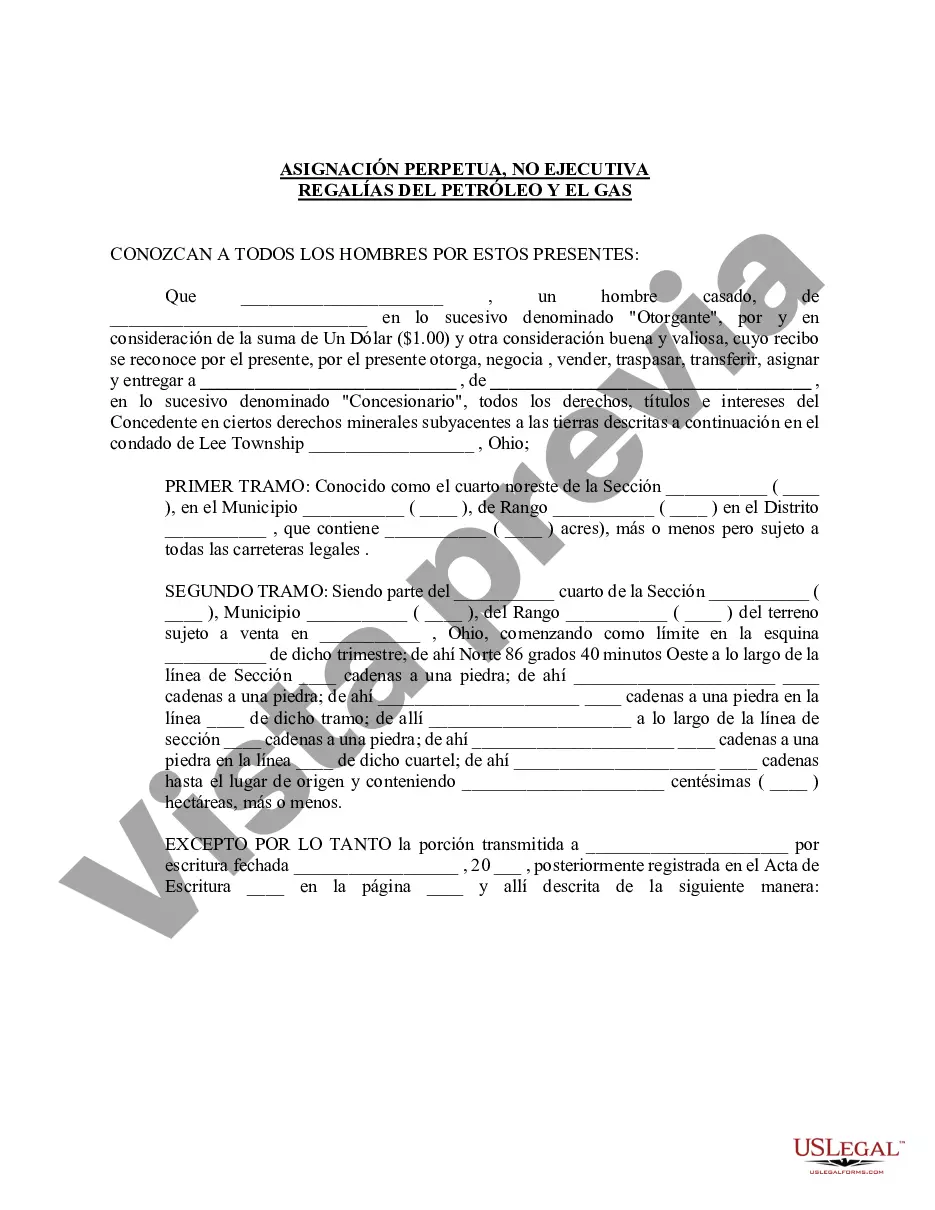

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Toledo Ohio Asignación de Regalías Perpetuas, No Ejecutivas de Petróleo y Gas - Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty

Description

How to fill out Toledo Ohio Asignación De Regalías Perpetuas, No Ejecutivas De Petróleo Y Gas?

If you are looking for a valid form, it’s impossible to choose a better service than the US Legal Forms website – probably the most extensive online libraries. With this library, you can get a large number of templates for organization and personal purposes by categories and regions, or key phrases. With the high-quality search function, finding the newest Toledo Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty is as easy as 1-2-3. Moreover, the relevance of each file is proved by a group of expert attorneys that on a regular basis check the templates on our platform and revise them based on the latest state and county demands.

If you already know about our platform and have a registered account, all you need to get the Toledo Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the form you want. Look at its description and utilize the Preview option to explore its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the needed file.

- Confirm your decision. Click the Buy now button. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Select the format and download it to your system.

- Make adjustments. Fill out, modify, print, and sign the obtained Toledo Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty.

Each template you save in your profile has no expiry date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to get an additional copy for enhancing or printing, feel free to return and download it again whenever you want.

Take advantage of the US Legal Forms extensive library to gain access to the Toledo Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty you were looking for and a large number of other professional and state-specific samples in a single place!