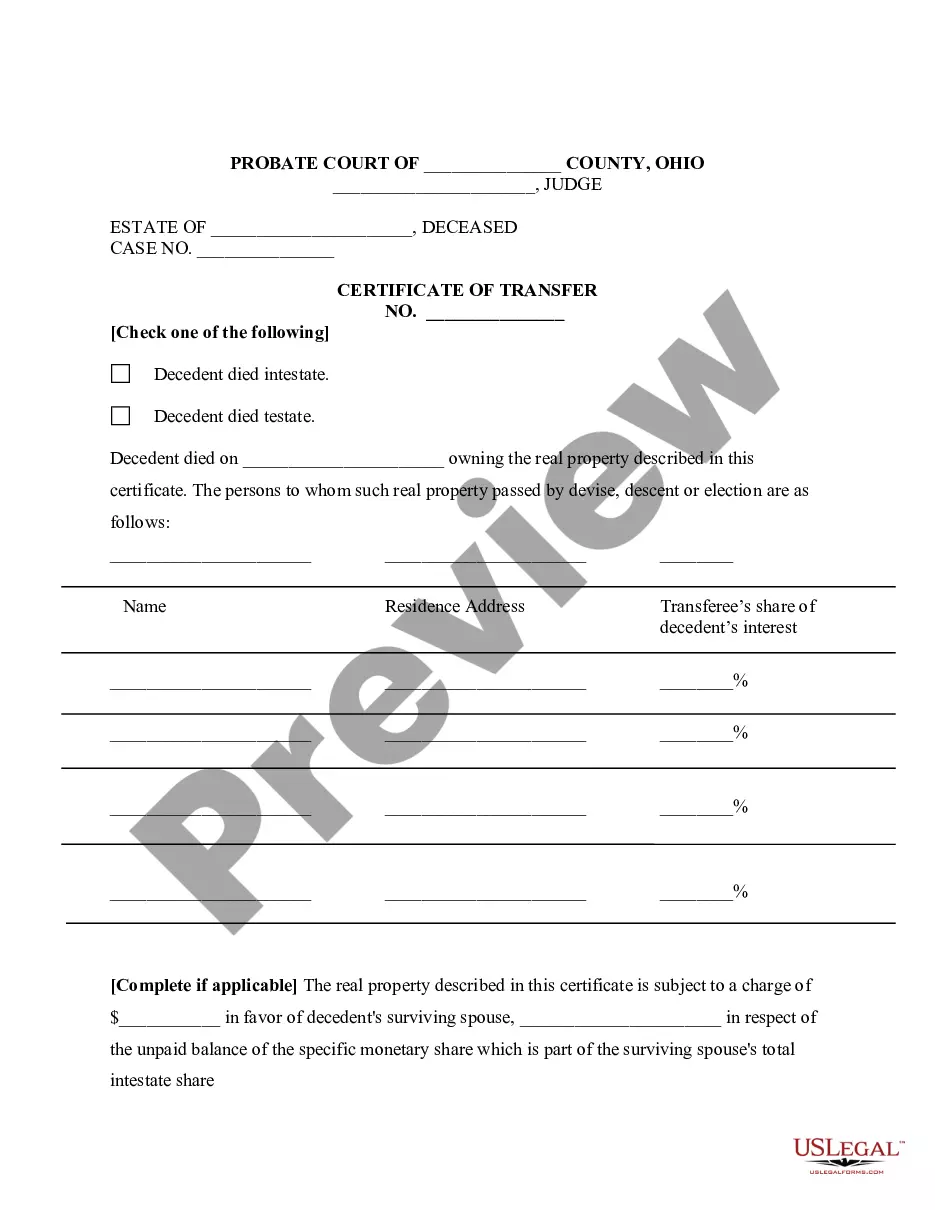

Dayton Ohio Certificate of Transfer

Description

How to fill out Ohio Certificate Of Transfer?

Take advantage of the US Legal Forms and gain instant access to any form sample you need.

Our valuable website featuring thousands of documents streamlines the process of locating and obtaining nearly any document sample you desire.

You can save, complete, and authenticate the Dayton Ohio Certificate of Transfer in mere minutes instead of spending hours online searching for a suitable template.

Utilizing our catalog is an excellent approach to enhancing the security of your form submissions.

Locate the form you need. Verify that it is the form you were looking for: check its title and description, and use the Preview feature if it's available.

Initiate the download process. Click Buy Now and select the pricing plan that fits you best. Then, create an account and place your order using a credit card or PayPal.

- Our experienced attorneys frequently evaluate all the documents to guarantee that the templates are suitable for a specific state and comply with updated laws and regulations.

- How can you acquire the Dayton Ohio Certificate of Transfer.

- If you already possess an account, just Log In to your profile. The Download option will show up on all the samples you view.

- Moreover, you can locate all the previously saved documents in the My documents section.

- If you have not registered an account yet, follow the instructions below.

Form popularity

FAQ

Montgomery County imposes a sales tax rate of 7.5%, which is among the standard rates in Ohio. This rate applies to most purchases made within the county. It's vital to understand this when planning your finances, especially if you are considering a transaction that may involve a Dayton Ohio Certificate of Transfer. Always check for any updates or changes that may affect this rate.

To obtain a copy of your birth certificate in Dayton, Ohio, you can visit the Montgomery County Vital Statistics office. They provide certified copies of birth certificates upon request. Additionally, you can request your certificate online or through the mail, ensuring you have the necessary identification and payment. Remember, having your birth certificate is often important for various legal purposes, including obtaining a Dayton Ohio Certificate of Transfer.

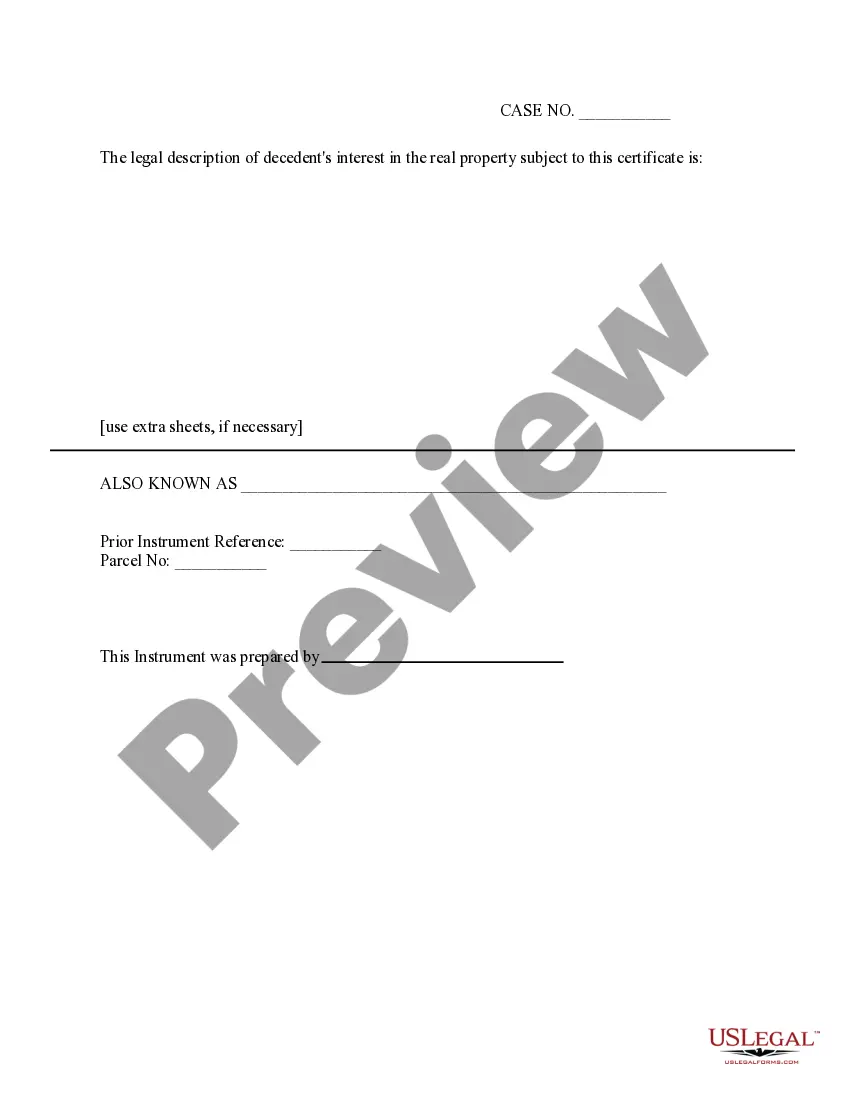

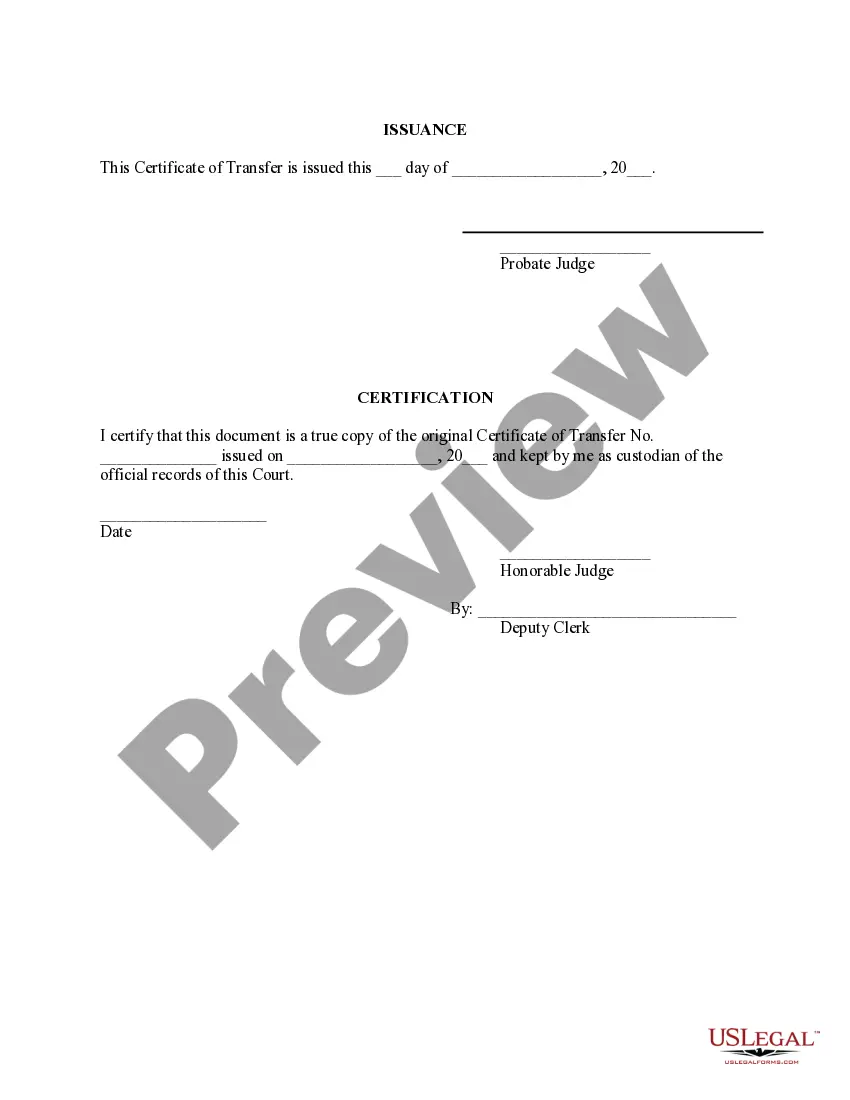

A certificate of transfer in Ohio is a legal document that allows an executor to transfer real estate ownership after a person's death. This document acts as proof that the executor has the authority to execute the transfer, simplifying the pathway for new ownership. It plays a crucial role in estate management, ensuring all transfers are documented correctly. Utilizing platforms like US Legal Forms can help simplify obtaining a Dayton Ohio Certificate of Transfer.

Yes, property can be transferred without probate in Ohio in certain situations, such as with joint ownership or through a transfer on death designation. This method allows owners to designate beneficiaries who automatically inherit property upon death. It's important to plan ahead and understand these options. If probate is required later, the Dayton Ohio Certificate of Transfer will facilitate the ownership change during this process.

To transfer a property deed from a deceased relative in Ohio, the executor must first probate the will. They will gather necessary documents, including the death certificate and the will. Then, they can fill out a Dayton Ohio Certificate of Transfer, which is submitted to the county recorder. This ensures that the new deed reflects the rightful owner's name.

An executor has the authority to transfer property as directed by the will or the probate court. Their role is to administer the estate, which includes managing assets and distributing them according to legal requirements. For real estate transactions, obtaining a Dayton Ohio Certificate of Transfer is essential to ensure the new owner is officially recognized in public records.

Yes, an executor can sell property without unanimous approval from all beneficiaries in Ohio. They act according to the terms of the will and the authority granted to them in probate court. However, it is often best practice to communicate with beneficiaries to avoid disputes. The Dayton Ohio Certificate of Transfer can be part of this process, making the sale official.