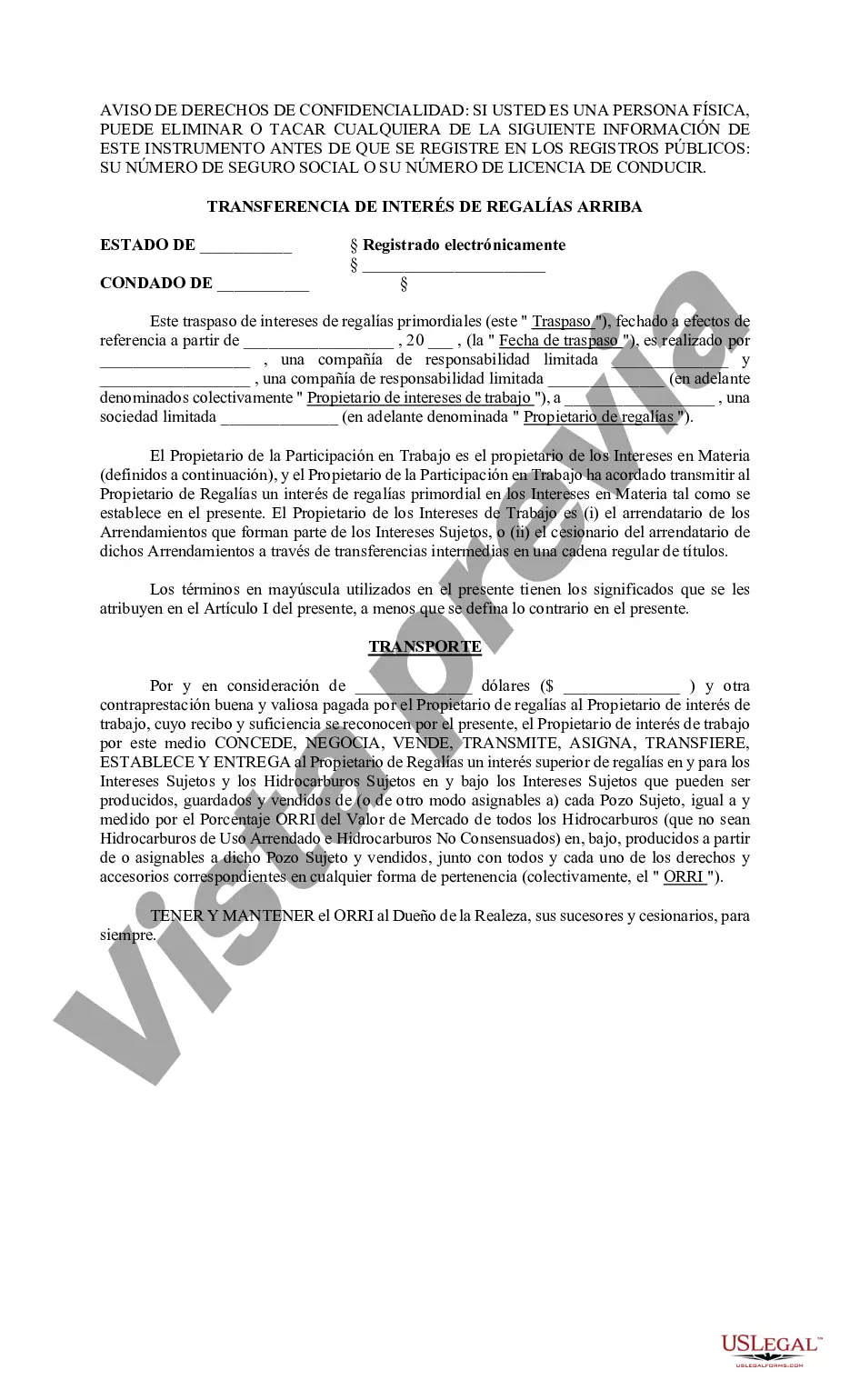

Cincinnati Ohio Conveyance of Overriding Royalty Interest is a legal document that outlines the transfer of a specified portion of royalty interest in oil, gas, or mineral rights to another party, known as the overriding royalty interest owner. This conveyance allows the overriding royalty interest owner to receive a proportional share of the revenue generated from the production of these resources. In Cincinnati, Ohio, there are several types of Conveyance of Overriding Royalty Interest agreements, each serving specific purposes: 1. Nonparticipating Royalty Interest (NPR): This type of Conveyance of Overriding Royalty Interest grants the owner the right to receive a percentage of the gross production or revenue generated from the leased property, without any operational or financial obligations. NPR holders do not have the authority to make decisions regarding the development or management of the property. 2. Carried Interest: Carried Interest refers to a Conveyance of Overriding Royalty Interest where one party, often a working interest owner or operator, carries another party's interest through the drilling and production process. The carried interest owner shares in the production revenue but does not bear the associated costs. 3. Net Profits Interest (NPI): NPI is a Conveyance of Overriding Royalty Interest that entitles the interest owner to a percentage share of net profits generated from the leased property. Unlike an overriding royalty interest, NPI owners bear a proportionate share of the costs of exploration, development, and production. 4. Working Interest (WI) Conveyance: Although not an overriding royalty interest, it is worth mentioning that WI refers to the ownership interest in the exploration, development, and production of oil, gas, or minerals. Unlike other types of conveyances, a working interest owner is responsible for a portion of the costs and liabilities associated with the project. The Cincinnati Ohio Conveyance of Overriding Royalty Interest typically includes essential details such as the parties involved, the percentage of the interest conveyed, the duration of the conveyance, terms of payment, and any restrictions or stipulations on the use of the leased property. It is important for both parties involved in such an agreement to consult legal professionals with expertise in mineral rights and conveyancing to ensure a thorough understanding of their respective rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cincinnati Ohio Transmisión de intereses de regalías primordiales - Ohio Conveyance of Overriding Royalty Interest

Description

How to fill out Cincinnati Ohio Transmisión De Intereses De Regalías Primordiales?

If you are searching for a valid form, it’s impossible to choose a better service than the US Legal Forms website – probably the most considerable libraries on the web. With this library, you can get thousands of document samples for organization and individual purposes by types and regions, or key phrases. Using our advanced search function, finding the newest Cincinnati Ohio Conveyance of Overriding Royalty Interest is as elementary as 1-2-3. Moreover, the relevance of every document is verified by a team of skilled attorneys that on a regular basis review the templates on our website and revise them based on the latest state and county demands.

If you already know about our system and have an account, all you should do to receive the Cincinnati Ohio Conveyance of Overriding Royalty Interest is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

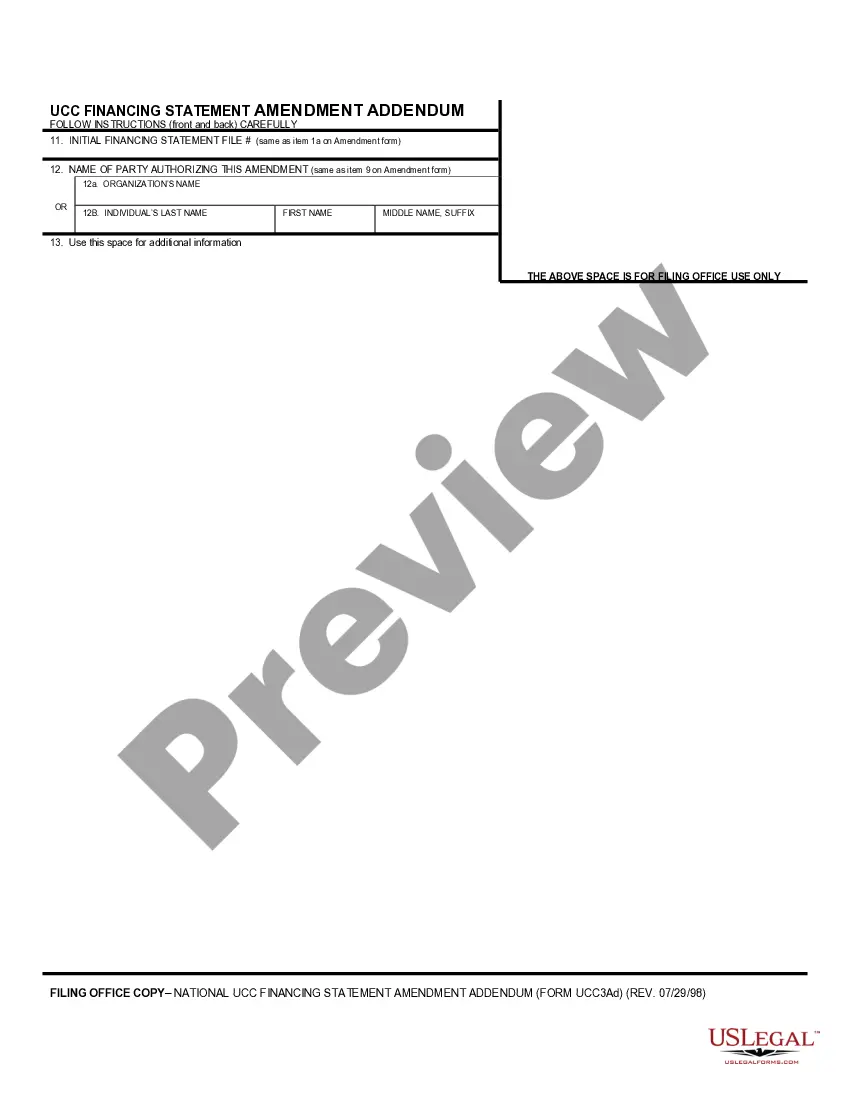

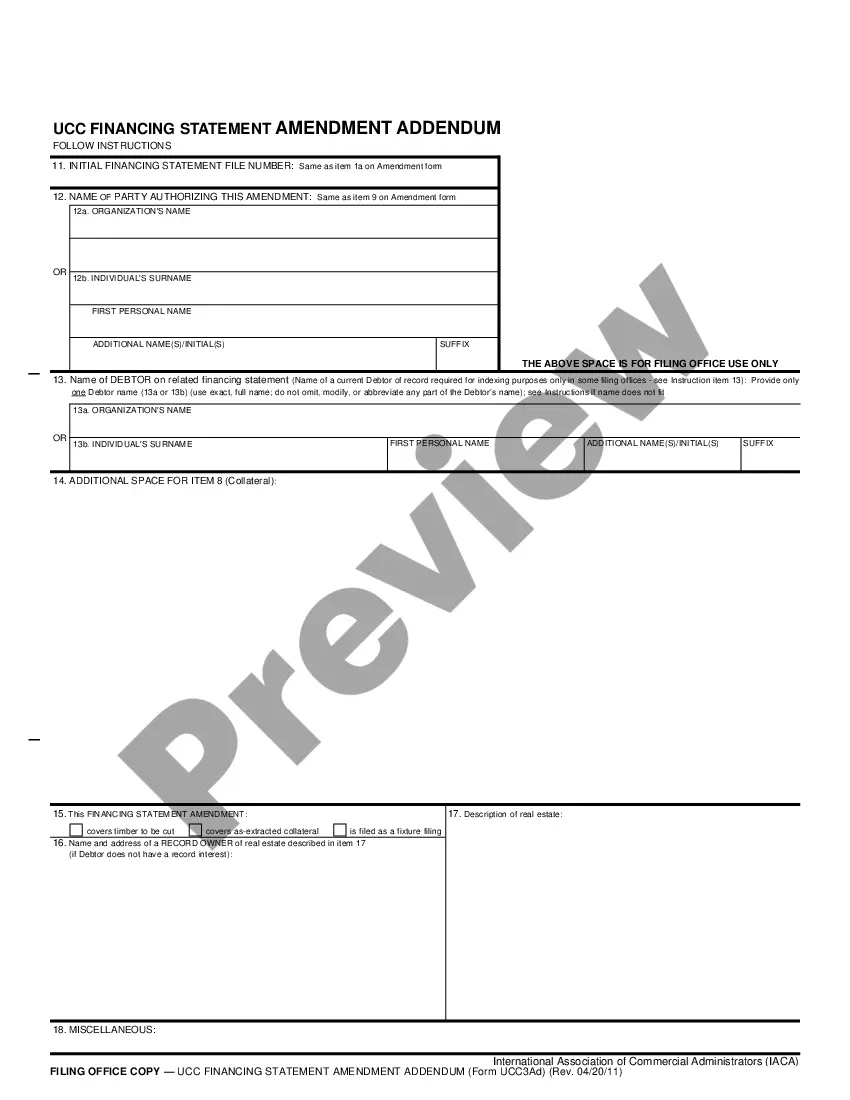

- Make sure you have found the form you need. Check its information and utilize the Preview option (if available) to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the proper document.

- Confirm your selection. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Pick the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Cincinnati Ohio Conveyance of Overriding Royalty Interest.

Each and every template you save in your user profile does not have an expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you want to receive an additional copy for editing or creating a hard copy, feel free to return and export it again at any time.

Make use of the US Legal Forms extensive collection to get access to the Cincinnati Ohio Conveyance of Overriding Royalty Interest you were seeking and thousands of other professional and state-specific samples on one platform!