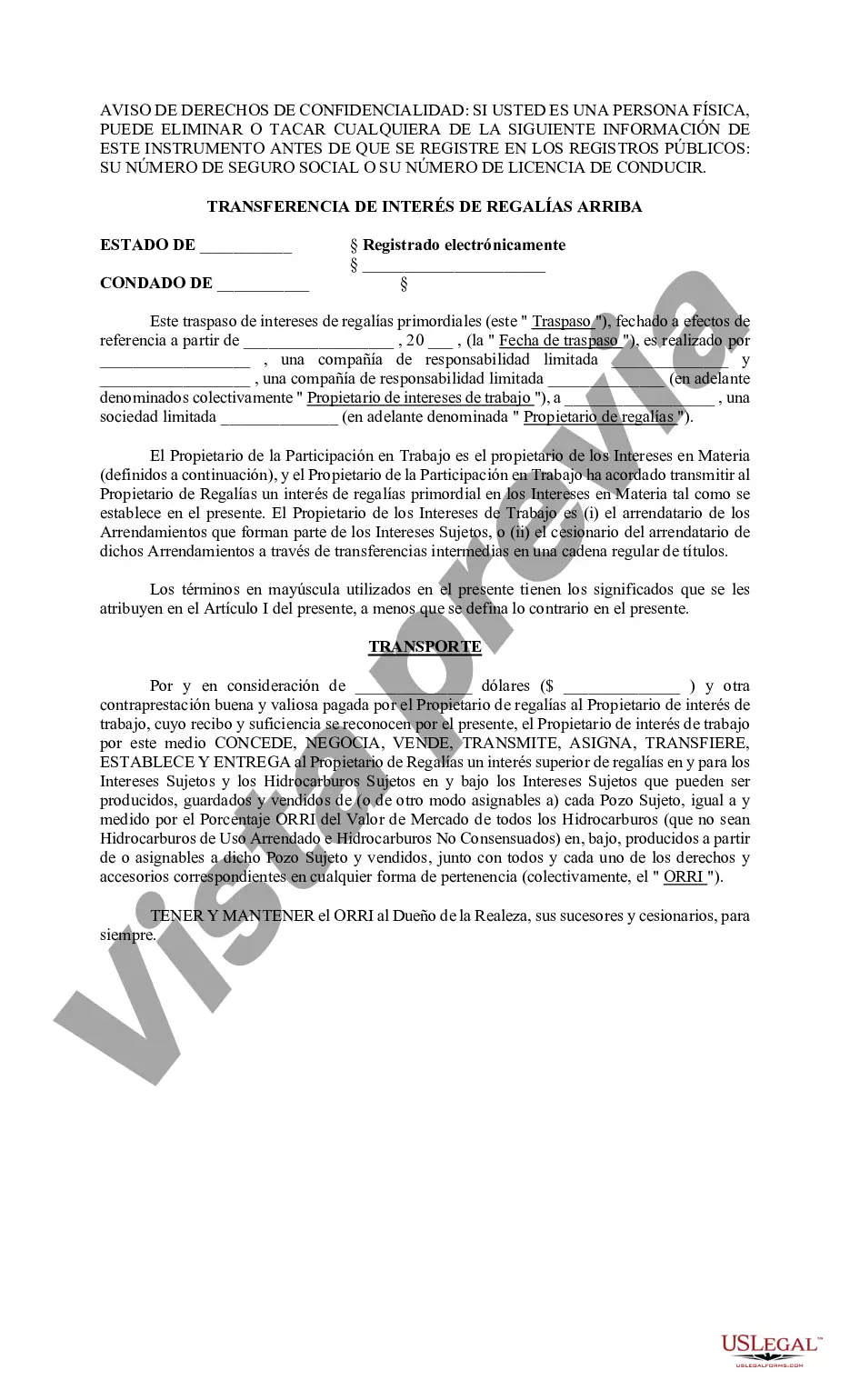

Franklin Ohio Conveyance of Overriding Royalty Interest refers to a legal document that transfers the entitlement to a portion of the revenue generated from oil, gas, or mineral production in the Franklin County, Ohio area. This type of conveyance is significant for individuals or entities seeking to benefit financially from the extraction and exploration of natural resources. Keywords: Franklin Ohio, Conveyance, Overriding Royalty Interest, mineral production, oil, gas, exploration, extraction, revenue, benefits, legal document. There are different types of Franklin Ohio Conveyance of Overriding Royalty Interest, including: 1. Limited Conveyance: This type of conveyance grants a specific percentage or fixed amount of overriding royalty interest to the grantee. It usually has a defined duration or may be restricted to specific mineral deposits or wells. 2. Full Conveyance: In a full conveyance, all overriding royalty interest associated with a particular property or mineral rights is transferred to the grantee. 3. Partial Conveyance: This type of conveyance allows for transferring a partial interest in the overriding royalty, typically represented as a percentage or fraction, while the granter retains the remaining portion. 4. Perpetual Conveyance: A perpetually conveyed overriding royalty interest means that it lasts indefinitely. The grantee will continue receiving the designated portion of revenue for as long as the mineral production continues. 5. Temporal Conveyance: Unlike perpetual conveyance, temporal conveyance refers to a time-limited transfer of overriding royalty interest, subject to a predetermined expiration date or conditions. In conclusion, the Franklin Ohio Conveyance of Overriding Royalty Interest is a legal agreement that enables the transfer of a portion of revenue from mineral production in Franklin County, Ohio. It allows individuals or entities to benefit financially from the exploration and extraction of natural resources, with different types of conveyance offering various durations, amounts, or restrictions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Transmisión de intereses de regalías primordiales - Ohio Conveyance of Overriding Royalty Interest

Description

How to fill out Franklin Ohio Transmisión De Intereses De Regalías Primordiales?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Franklin Ohio Conveyance of Overriding Royalty Interest or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Franklin Ohio Conveyance of Overriding Royalty Interest adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Franklin Ohio Conveyance of Overriding Royalty Interest is proper for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!