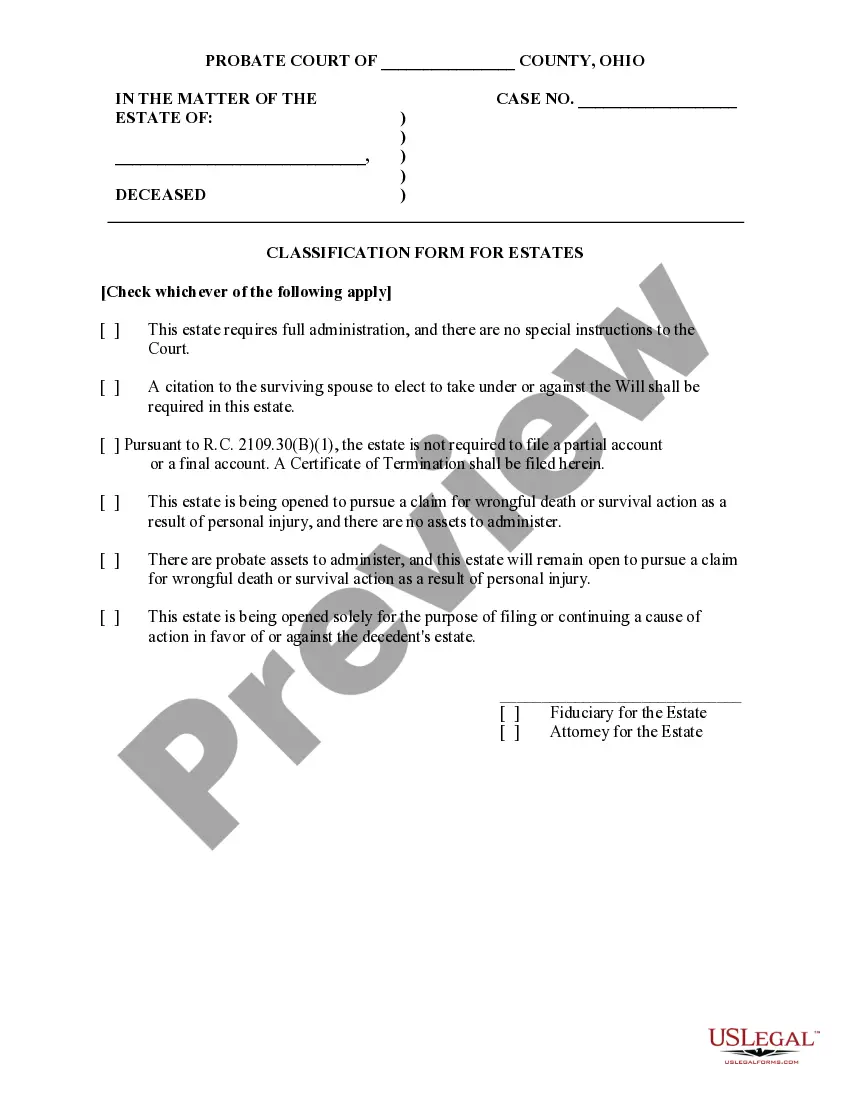

This sample form is a Classification Form for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

The Akron Ohio Classification Form for Estates is a crucial document that helps classify and categorize estates in Akron, Ohio. This detailed classification form plays a significant role in estate planning and administration processes. It is designed to ensure accurate identification and efficient management of various types of estates in accordance with the laws and regulations of Ohio. The Akron Ohio Classification Form for Estates contains several key sections which provide comprehensive information about the estate. This includes detailed sections covering: 1. Estate Information: This section prompts the estate administrator to provide basic details such as the estate name, address, and contact information. It also requests information about the decedent, including their full name, date of death, and social security number. 2. Estate Classification: This section is dedicated to classifying the estate type based on specific criteria. The form may include a checklist or require the administrator to provide narrative descriptions to determine whether it is a simple estate, small estate, taxable estate, or any other specialized type. 3. Assets and Liabilities: In this section, the administrator is required to provide an exhaustive list of all assets and liabilities associated with the estate. This may include bank accounts, real estate, investments, personal property, outstanding debts, mortgages, and more. The administrator may need to provide documentation or supporting evidence for accuracy. 4. Beneficiary Information: Here, the form may request information about the beneficiaries of the estate, including their names, addresses, relationships to the decedent, and any specific conditions or instructions related to their inheritance. 5. Legal Representation: This section is dedicated to identifying any legal representatives involved in handling the estate. It may require the name of the attorney or law firm representing the estate and their contact information. Different types of Akron Ohio Classification Forms for Estates may exist, catering to specific estate circumstances. These variations include: 1. Simple Estate Classification Form: Designed for estates with straightforward assets and limited complexities. 2. Small Estate Classification Form: Catering to estates with assets falling below a certain monetary threshold specified by Ohio law. 3. Taxable Estate Classification Form: Intended for estates that meet specific criteria requiring estate tax evaluation and reporting. 4. Trust Estate Classification Form: For estates held in trust, ensuring proper classification and management. 5. Probate Estate Classification Form: Focusing on estates that undergo probate proceedings. It is essential to carefully fill out the Akron Ohio Classification Form for Estates, as accurate classification impacts subsequent estate administration processes, tax obligations, and legal requirements. Estate administrators must seek professional guidance or consult with legal experts to ensure compliance with Ohio laws and regulations throughout the classification process.The Akron Ohio Classification Form for Estates is a crucial document that helps classify and categorize estates in Akron, Ohio. This detailed classification form plays a significant role in estate planning and administration processes. It is designed to ensure accurate identification and efficient management of various types of estates in accordance with the laws and regulations of Ohio. The Akron Ohio Classification Form for Estates contains several key sections which provide comprehensive information about the estate. This includes detailed sections covering: 1. Estate Information: This section prompts the estate administrator to provide basic details such as the estate name, address, and contact information. It also requests information about the decedent, including their full name, date of death, and social security number. 2. Estate Classification: This section is dedicated to classifying the estate type based on specific criteria. The form may include a checklist or require the administrator to provide narrative descriptions to determine whether it is a simple estate, small estate, taxable estate, or any other specialized type. 3. Assets and Liabilities: In this section, the administrator is required to provide an exhaustive list of all assets and liabilities associated with the estate. This may include bank accounts, real estate, investments, personal property, outstanding debts, mortgages, and more. The administrator may need to provide documentation or supporting evidence for accuracy. 4. Beneficiary Information: Here, the form may request information about the beneficiaries of the estate, including their names, addresses, relationships to the decedent, and any specific conditions or instructions related to their inheritance. 5. Legal Representation: This section is dedicated to identifying any legal representatives involved in handling the estate. It may require the name of the attorney or law firm representing the estate and their contact information. Different types of Akron Ohio Classification Forms for Estates may exist, catering to specific estate circumstances. These variations include: 1. Simple Estate Classification Form: Designed for estates with straightforward assets and limited complexities. 2. Small Estate Classification Form: Catering to estates with assets falling below a certain monetary threshold specified by Ohio law. 3. Taxable Estate Classification Form: Intended for estates that meet specific criteria requiring estate tax evaluation and reporting. 4. Trust Estate Classification Form: For estates held in trust, ensuring proper classification and management. 5. Probate Estate Classification Form: Focusing on estates that undergo probate proceedings. It is essential to carefully fill out the Akron Ohio Classification Form for Estates, as accurate classification impacts subsequent estate administration processes, tax obligations, and legal requirements. Estate administrators must seek professional guidance or consult with legal experts to ensure compliance with Ohio laws and regulations throughout the classification process.