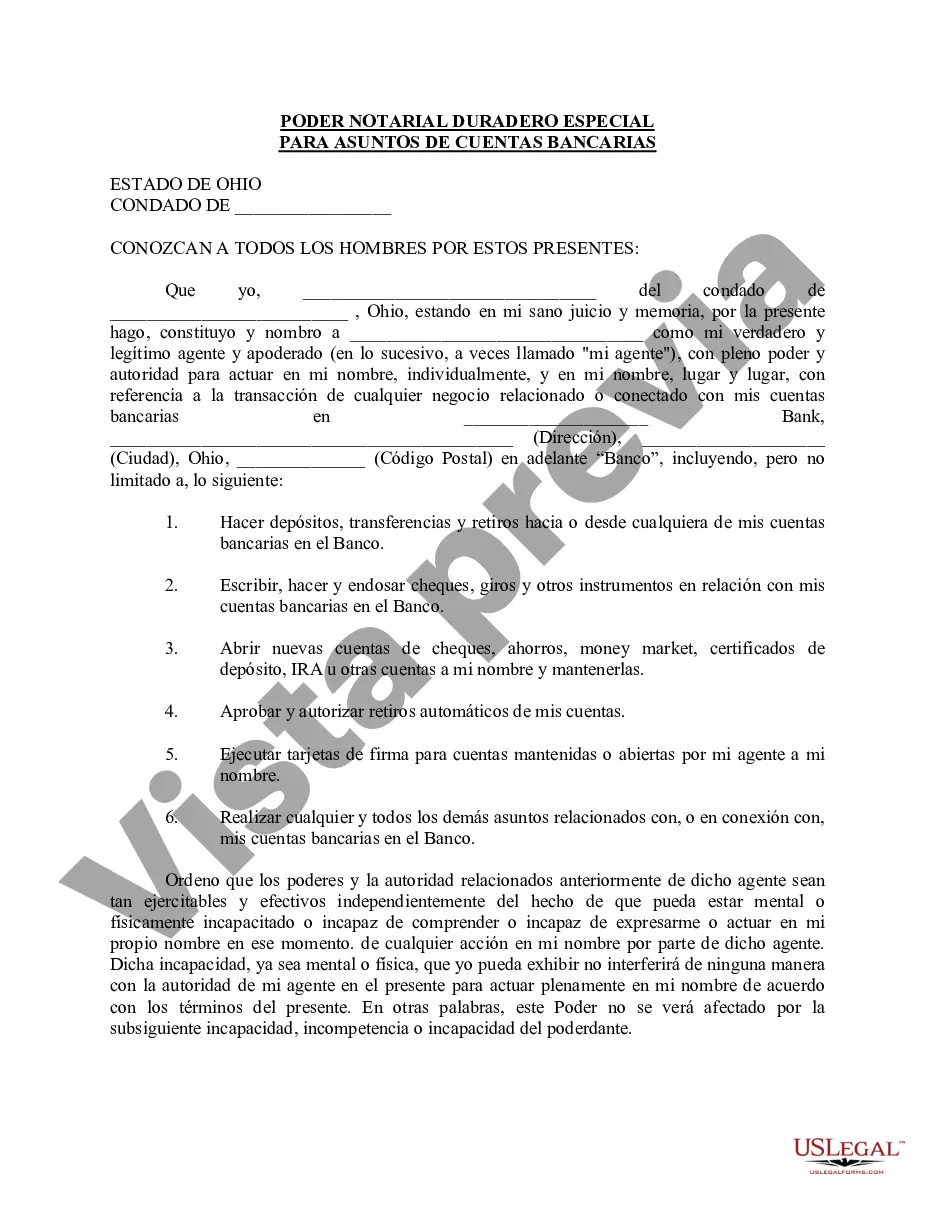

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

The Columbus Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants authority to an individual, known as the attorney-in-fact or agent, to handle specific bank account-related matters on behalf of the principal. This power of attorney specifically focuses on bank account-related matters and allows the agent to act in a fiduciary capacity, making financial decisions and conducting transactions pertaining to the principal's bank accounts. The Special Durable Power of Attorney for Bank Account Matters is designed to provide flexibility and control to the principal while addressing their specific needs. The document allows the principal to tailor the scope of authority granted to the agent, ensuring that only the desired bank account matters are covered. Some common bank account matters that can be included in this power of attorney are depositing funds, withdrawing funds, writing checks, making electronic transfers, managing investments related to the bank accounts, and accessing online banking services. The agent may also be authorized to open or close bank accounts, apply for credit cards, reconcile bank statements, handle disputes, and manage other banking-related tasks. Different types of Columbus Ohio Special Durable Power of Attorney for Bank Account Matters may exist based on the specific needs and preferences of the principal. For instance, there could be variations that specify authority over specific types of bank accounts, such as checking accounts, savings accounts, or investment accounts. Additionally, different versions of this power of attorney may allow the agent to handle specific financial institutions or banks. It's important to note that the Special Durable Power of Attorney for Bank Account Matters is "durable," which means it remains in effect even if the principal becomes incapacitated or mentally incompetent. This type of power of attorney empowers the agent to continue acting on behalf of the principal, ensuring the continuity of financial management in case of any disability. Keywords: Columbus Ohio, special durable power of attorney, bank account matters, attorney-in-fact, agent, fiduciary capacity, financial decisions, transactions, bank accounts, flexibility, control, depositing funds, withdrawing funds, writing checks, electronic transfers, investments, online banking services, open bank accounts, close bank accounts, credit cards, reconcile bank statements, disputes, managing banking tasks, checking accounts, savings accounts, investment accounts, financial institutions, durable, incapacitated, mentally incompetent, continuity, financial management.The Columbus Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants authority to an individual, known as the attorney-in-fact or agent, to handle specific bank account-related matters on behalf of the principal. This power of attorney specifically focuses on bank account-related matters and allows the agent to act in a fiduciary capacity, making financial decisions and conducting transactions pertaining to the principal's bank accounts. The Special Durable Power of Attorney for Bank Account Matters is designed to provide flexibility and control to the principal while addressing their specific needs. The document allows the principal to tailor the scope of authority granted to the agent, ensuring that only the desired bank account matters are covered. Some common bank account matters that can be included in this power of attorney are depositing funds, withdrawing funds, writing checks, making electronic transfers, managing investments related to the bank accounts, and accessing online banking services. The agent may also be authorized to open or close bank accounts, apply for credit cards, reconcile bank statements, handle disputes, and manage other banking-related tasks. Different types of Columbus Ohio Special Durable Power of Attorney for Bank Account Matters may exist based on the specific needs and preferences of the principal. For instance, there could be variations that specify authority over specific types of bank accounts, such as checking accounts, savings accounts, or investment accounts. Additionally, different versions of this power of attorney may allow the agent to handle specific financial institutions or banks. It's important to note that the Special Durable Power of Attorney for Bank Account Matters is "durable," which means it remains in effect even if the principal becomes incapacitated or mentally incompetent. This type of power of attorney empowers the agent to continue acting on behalf of the principal, ensuring the continuity of financial management in case of any disability. Keywords: Columbus Ohio, special durable power of attorney, bank account matters, attorney-in-fact, agent, fiduciary capacity, financial decisions, transactions, bank accounts, flexibility, control, depositing funds, withdrawing funds, writing checks, electronic transfers, investments, online banking services, open bank accounts, close bank accounts, credit cards, reconcile bank statements, disputes, managing banking tasks, checking accounts, savings accounts, investment accounts, financial institutions, durable, incapacitated, mentally incompetent, continuity, financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.