Oklahoma City, also known as OK, is the capital and largest city of the state of Oklahoma. It serves as a major economic and cultural hub, attracting businesses from various industries. For businesses looking to establish a presence in this vibrant city, it is crucial to understand the Oklahoma City Oklahoma Office Lease Agreement. An Oklahoma City Oklahoma Office Lease Agreement is a legally binding contract between the landlord, who owns the office space, and the tenant, who wishes to rent it for commercial purposes. This agreement sets forth the terms and conditions that govern the use of the office space, including rent, duration of the lease, maintenance responsibilities, and termination clauses. There are different types of Oklahoma City Oklahoma Office Lease Agreements, tailored to meet the specific needs of various businesses. Here are a few notable types: 1. Gross Lease Agreement: This type of lease agreement requires the tenant to pay a fixed amount of rent to the landlord, who is responsible for covering all expenses related to the office space, including utilities, maintenance, and property taxes. 2. Net Lease Agreement: In contrast to a gross lease agreement, a net lease agreement obligates the tenant to pay a base rent along with additional expenses, such as property taxes, insurance, and maintenance costs. There are three primary variations of net leases: a. Single Net Lease: The tenant pays the base rent plus a portion of the property taxes. b. Double Net Lease: In addition to the base rent and property taxes, the tenant also covers a portion of the insurance premiums. c. Triple Net Lease: The tenant is responsible for paying the base rent along with property taxes, insurance premiums, and all maintenance costs. 3. Full-Service Lease Agreement: With a full-service lease agreement, the landlord offers a comprehensive package in which the rent includes utilities, maintenance, property taxes, and insurance costs. It provides convenience for the tenant as they need not worry about separate payments for each expense. 4. Modified Gross Lease Agreement: This type of lease agreement combines elements of both the gross lease and net lease formats. Typically, the tenant pays a base rent, and the landlord covers certain expenses while passing the remaining expenses to the tenant. These are just a few of the variations of Oklahoma City Oklahoma Office Lease Agreements. It is crucial for both tenants and landlords to carefully review and negotiate the terms of the lease to ensure a fair and mutually beneficial arrangement. Seeking legal advice and conducting thorough research on local regulations is highly recommended ensuring compliance and protection of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma City Oklahoma Contrato de arrendamiento de oficina - Oklahoma Office Lease Agreement

Description

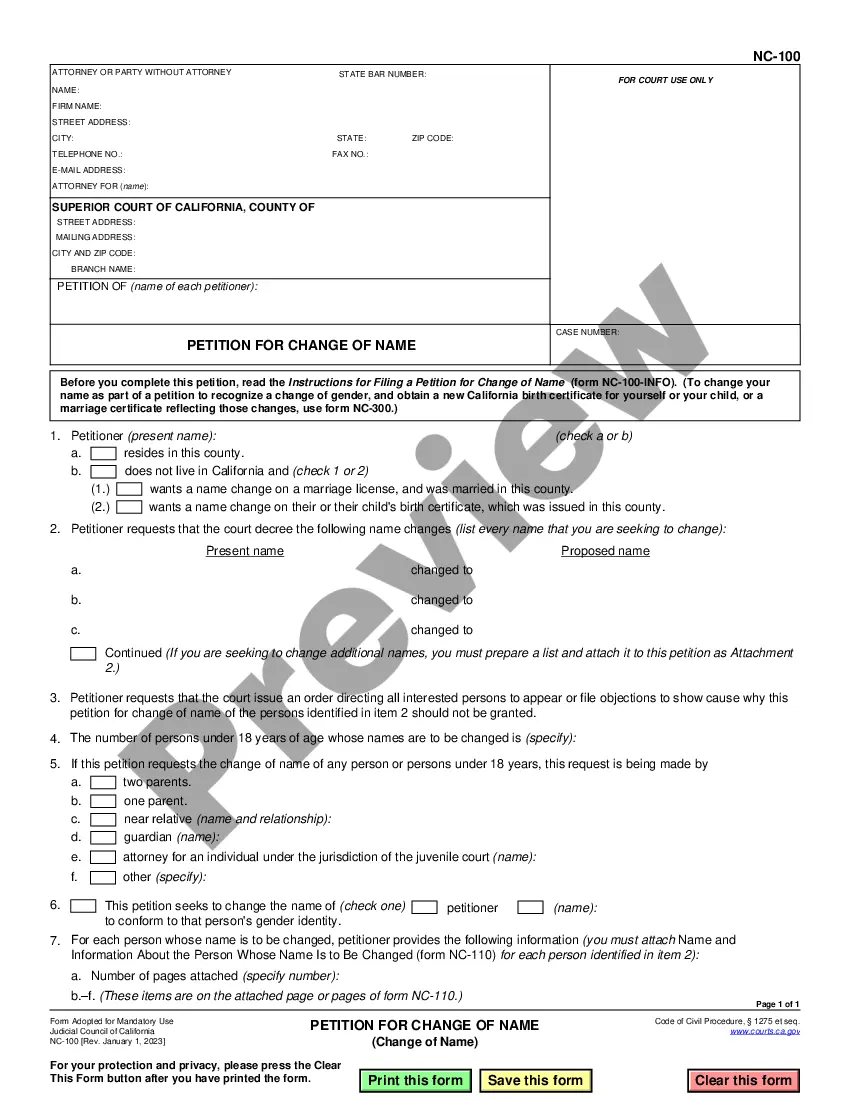

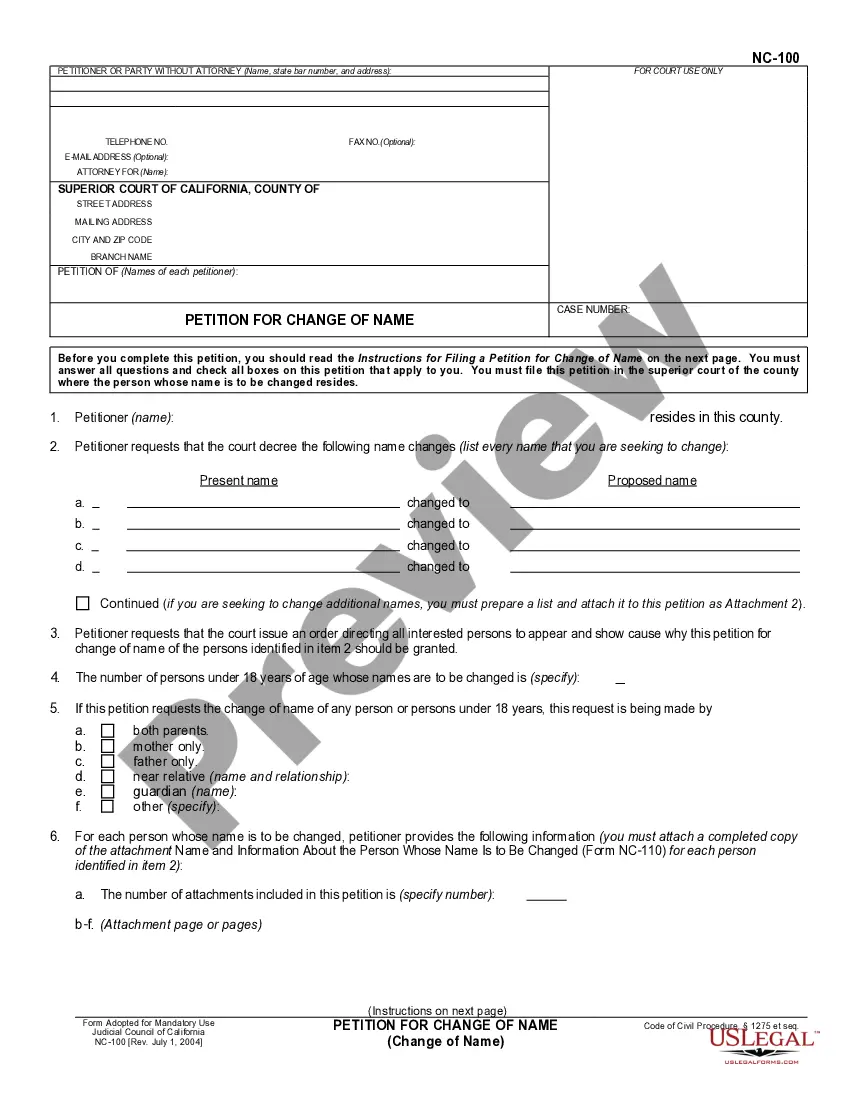

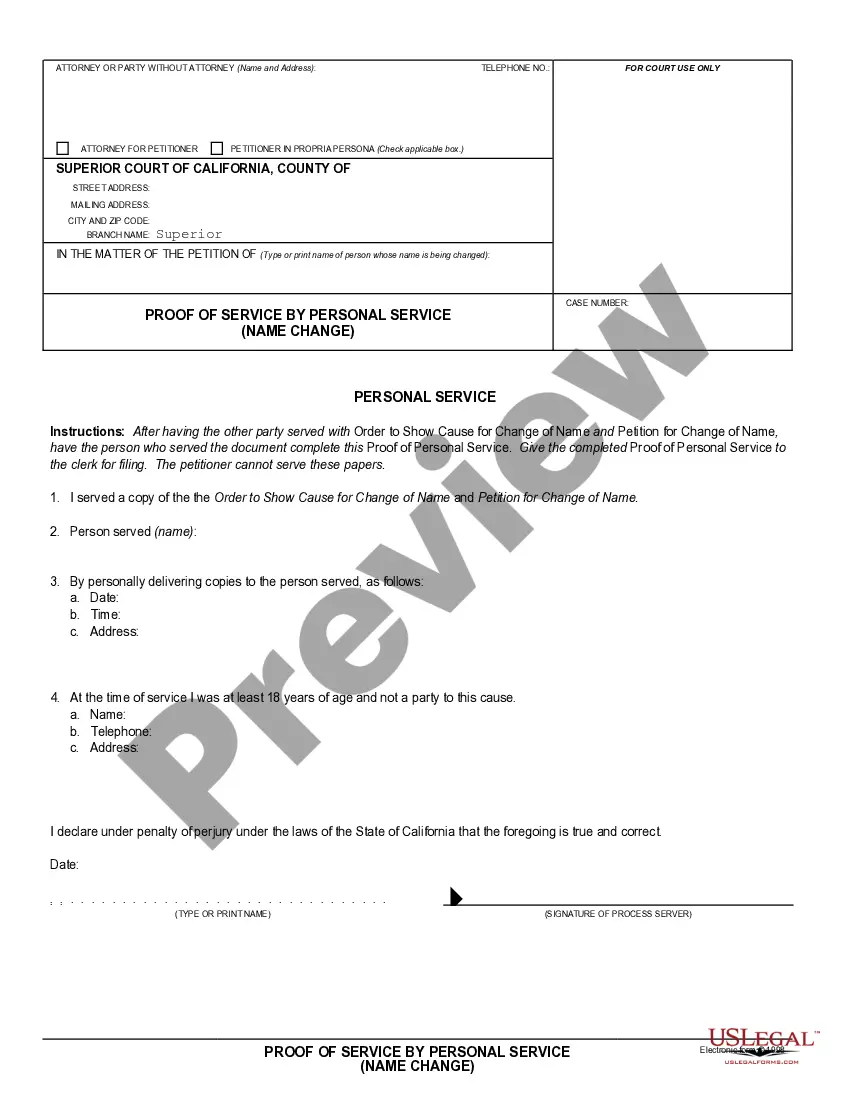

How to fill out Oklahoma City Oklahoma Contrato De Arrendamiento De Oficina?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Oklahoma City Oklahoma Office Lease Agreement becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Oklahoma City Oklahoma Office Lease Agreement takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

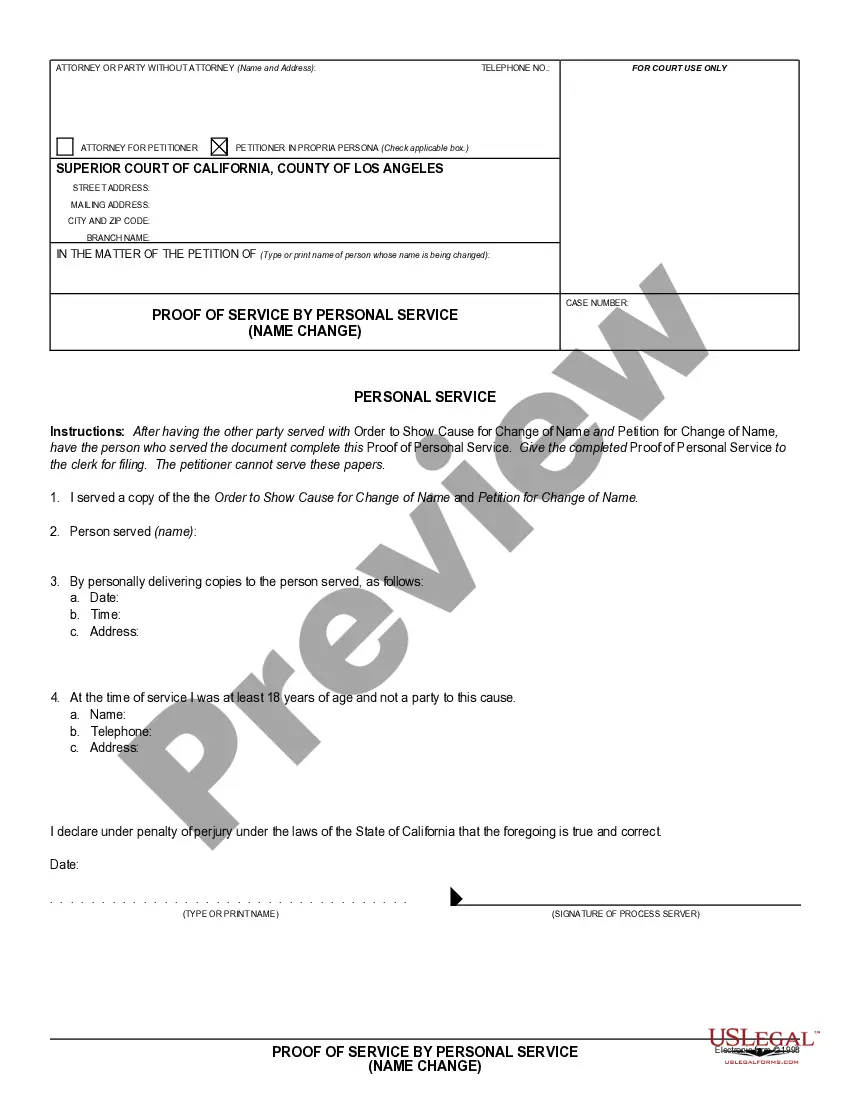

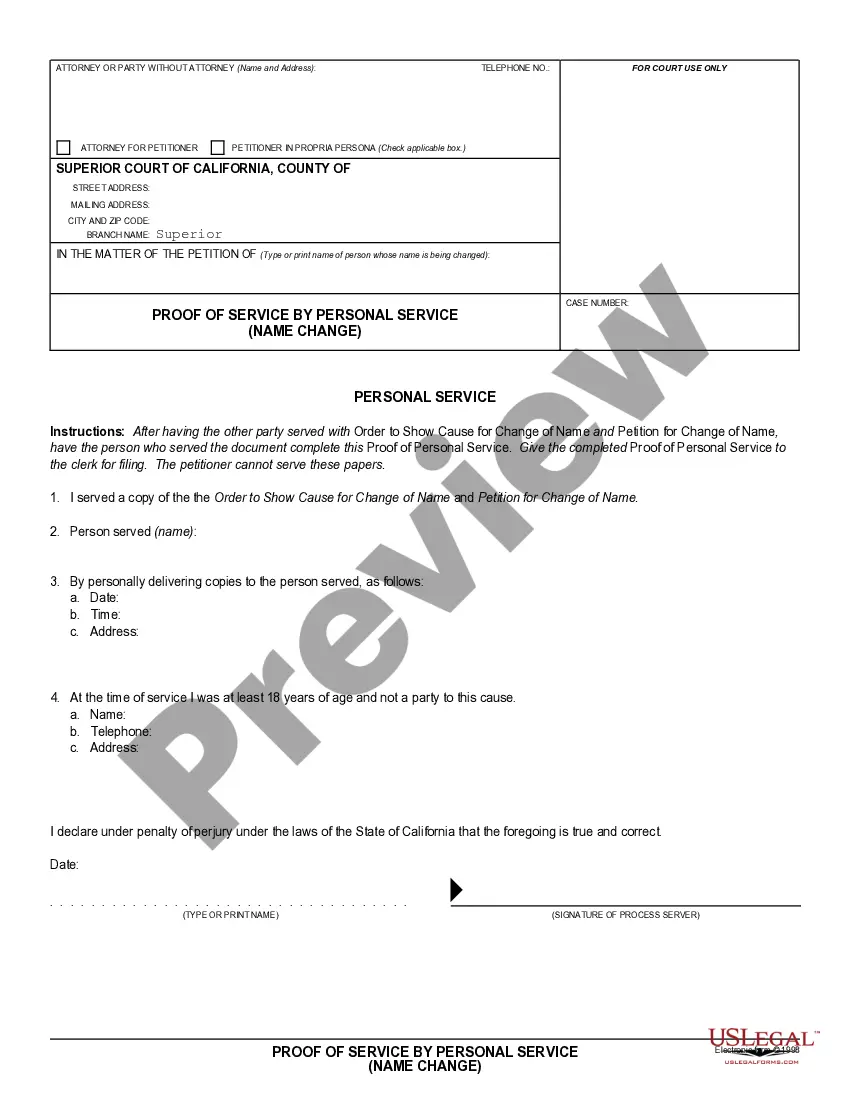

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Oklahoma City Oklahoma Office Lease Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!