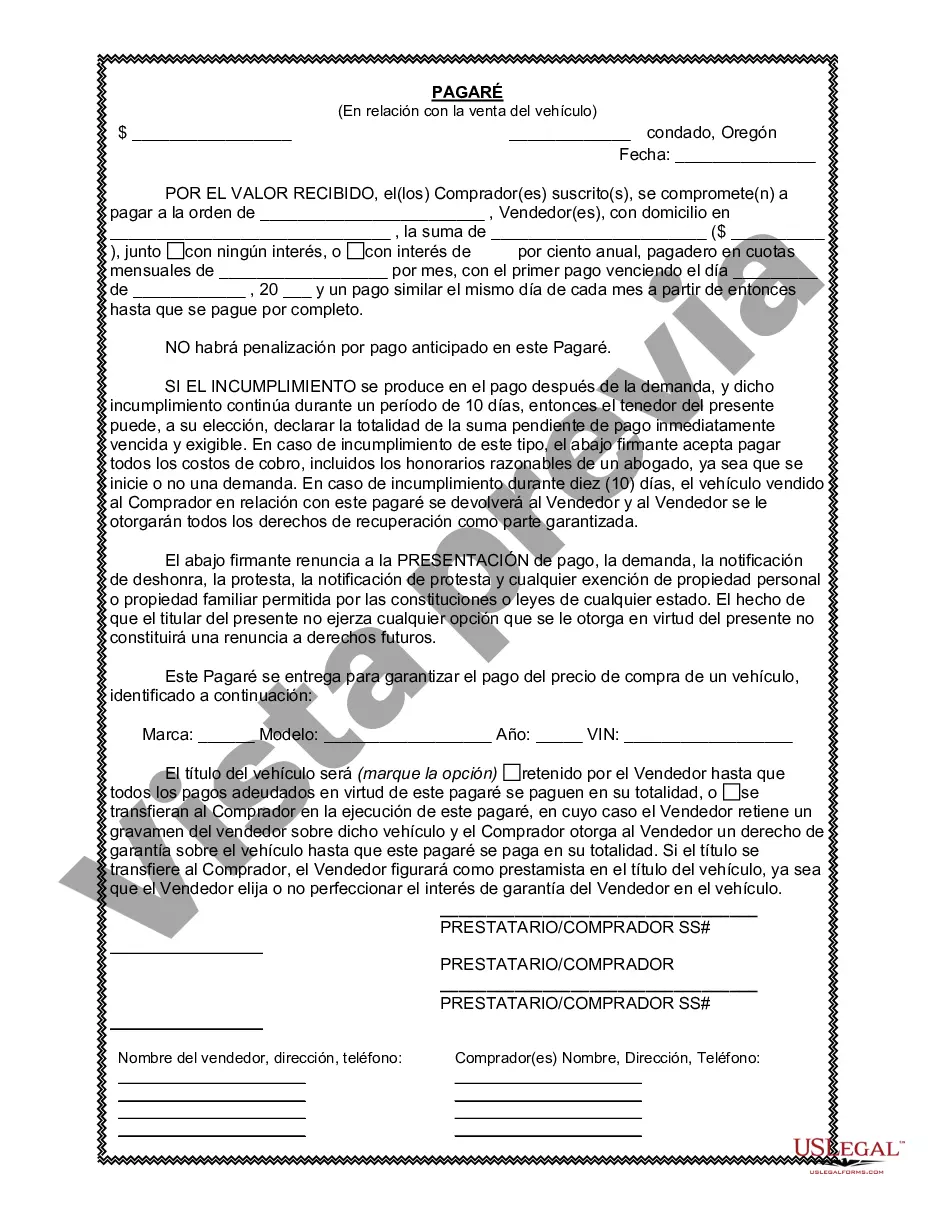

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties: the lender and the borrower. In the context of Eugene, Oregon, promissory notes are commonly used in connection with the sale of vehicles or automobiles. This article will provide a detailed description of Eugene Oregon promissory notes, highlighting their types and key terms associated with the sale of vehicles. 1. Promissory Note Definition: A Eugene Oregon promissory note, in connection with the sale of a vehicle or automobile, is a written agreement that sets out the terms, conditions, and obligations of the buyer and seller in a vehicle purchase transaction where the buyer defers payment over a certain period. 2. Terms and Conditions: Eugene Oregon promissory notes in connection with vehicle sales typically include crucial details such as the parties involved, the vehicle's description (make, model, VIN), the purchase amount, interest rates (if any), payment due dates, penalty clauses for late payments, and any warranties or guarantees agreed upon. 3. Types of Promissory Notes: There are several types of Eugene Oregon promissory notes used during vehicle sales, depending on the specific agreement and conditions: a. Installment Promissory Note: This type of promissory note is commonly used when the buyer agrees to make payments in installments over a set period, typically monthly or quarterly. It outlines the payment schedule and interest rates (if applicable). b. Balloon Promissory Note: This note allows for smaller periodic payments throughout the loan term, with a larger "balloon" payment due at the end. This type of promissory note might be arranged when buyers wish to have smaller installments during the loan period but plan to pay off the remaining balance in one substantial payment. c. Secured Promissory Note: A secured promissory note includes collateral, such as the vehicle itself, to protect the lender's interests in case of default. If the borrower fails to repay the loan, the lender can take possession of the collateral as repayment. d. Unsecured Promissory Note: Without any collateral, an unsecured promissory note relies solely on the borrower's creditworthiness and trustworthiness. This type of note may have higher interest rates to compensate for the lender's increased risk. 4. Legal Considerations: Eugene Oregon promissory notes should conform to local laws and regulations governing vehicle sales. Both parties must carefully review and understand the terms outlined in the promissory note before signing. It's advisable to consult legal counsel or experienced professionals to ensure compliance with Oregon's specific requirements. In conclusion, Eugene Oregon promissory notes in connection with the sale of vehicles play a vital role in documenting the terms of a loan agreement between a buyer and seller. By clearly establishing the obligations of both parties, these notes provide legal protection and ensure transparency in vehicle transactions. Whether it's an installment, balloon, secured, or unsecured promissory note, careful consideration and professional guidance are essential to facilitate a smooth and fair vehicle sale transaction.A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties: the lender and the borrower. In the context of Eugene, Oregon, promissory notes are commonly used in connection with the sale of vehicles or automobiles. This article will provide a detailed description of Eugene Oregon promissory notes, highlighting their types and key terms associated with the sale of vehicles. 1. Promissory Note Definition: A Eugene Oregon promissory note, in connection with the sale of a vehicle or automobile, is a written agreement that sets out the terms, conditions, and obligations of the buyer and seller in a vehicle purchase transaction where the buyer defers payment over a certain period. 2. Terms and Conditions: Eugene Oregon promissory notes in connection with vehicle sales typically include crucial details such as the parties involved, the vehicle's description (make, model, VIN), the purchase amount, interest rates (if any), payment due dates, penalty clauses for late payments, and any warranties or guarantees agreed upon. 3. Types of Promissory Notes: There are several types of Eugene Oregon promissory notes used during vehicle sales, depending on the specific agreement and conditions: a. Installment Promissory Note: This type of promissory note is commonly used when the buyer agrees to make payments in installments over a set period, typically monthly or quarterly. It outlines the payment schedule and interest rates (if applicable). b. Balloon Promissory Note: This note allows for smaller periodic payments throughout the loan term, with a larger "balloon" payment due at the end. This type of promissory note might be arranged when buyers wish to have smaller installments during the loan period but plan to pay off the remaining balance in one substantial payment. c. Secured Promissory Note: A secured promissory note includes collateral, such as the vehicle itself, to protect the lender's interests in case of default. If the borrower fails to repay the loan, the lender can take possession of the collateral as repayment. d. Unsecured Promissory Note: Without any collateral, an unsecured promissory note relies solely on the borrower's creditworthiness and trustworthiness. This type of note may have higher interest rates to compensate for the lender's increased risk. 4. Legal Considerations: Eugene Oregon promissory notes should conform to local laws and regulations governing vehicle sales. Both parties must carefully review and understand the terms outlined in the promissory note before signing. It's advisable to consult legal counsel or experienced professionals to ensure compliance with Oregon's specific requirements. In conclusion, Eugene Oregon promissory notes in connection with the sale of vehicles play a vital role in documenting the terms of a loan agreement between a buyer and seller. By clearly establishing the obligations of both parties, these notes provide legal protection and ensure transparency in vehicle transactions. Whether it's an installment, balloon, secured, or unsecured promissory note, careful consideration and professional guidance are essential to facilitate a smooth and fair vehicle sale transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.