The Bend Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate, commonly referred to as a Land or Executory Contract, is a legally binding agreement between a buyer and seller for the purchase of real estate in the city of Bend, Oregon. This contract outlines the terms and conditions under which the sale will take place, including the purchase price, payment arrangements, transfer of ownership, and other relevant provisions. Keywords: Bend Oregon, agreement, contract for deed, sale, purchase, real estate, land, executory contract. This agreement is designed to provide a flexible financing option for buyers who may not qualify for traditional mortgage loans or prefer an alternative method of property acquisition. It allows the buyer to make periodic payments directly to the seller, acting as the lender, with the property serving as collateral until the full purchase price is paid. Different variations of the Bend Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate include: 1. Standard Contract for Deed: This is the most common type of contract for deed, where the seller retains legal ownership of the property until the buyer fulfills all payment obligations and the contract is fully executed. Once the agreed-upon terms are met, the buyer receives the deed to the property. 2. Lease Option Agreement: Also known as a Lease with Option to Purchase, this type of contract allows the buyer to lease the property for a specific period with an option to buy it at a later date. A portion of the lease payments may be credited towards the purchase price if the buyer decides to exercise the option. 3. Installment Land Contract: This contract structure involves the buyer making regular installment payments to the seller, similar to a mortgage, until the full purchase price is paid. However, unlike a traditional mortgage, the buyer does not hold legal title to the property until the final payment is made. The Bend Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate serves as a valuable tool for both parties involved, providing an alternative financing method for the buyer and a secure investment for the seller. It is essential to consult with legal professionals familiar with Bend, Oregon real estate laws to ensure compliance and protect the interests of all parties involved in such transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.- US Legal Forms

- Localized forms in Spanish

- Oregon

- Bend

-

Oregon Acuerdo o Contrato de Escritura de Venta y Compra de Bienes...

Bend Oregon Acuerdo o Contrato de Escritura de Venta y Compra de Bienes Raíces a/k/a Terreno o Contrato de Ejecución - Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Description

Related forms

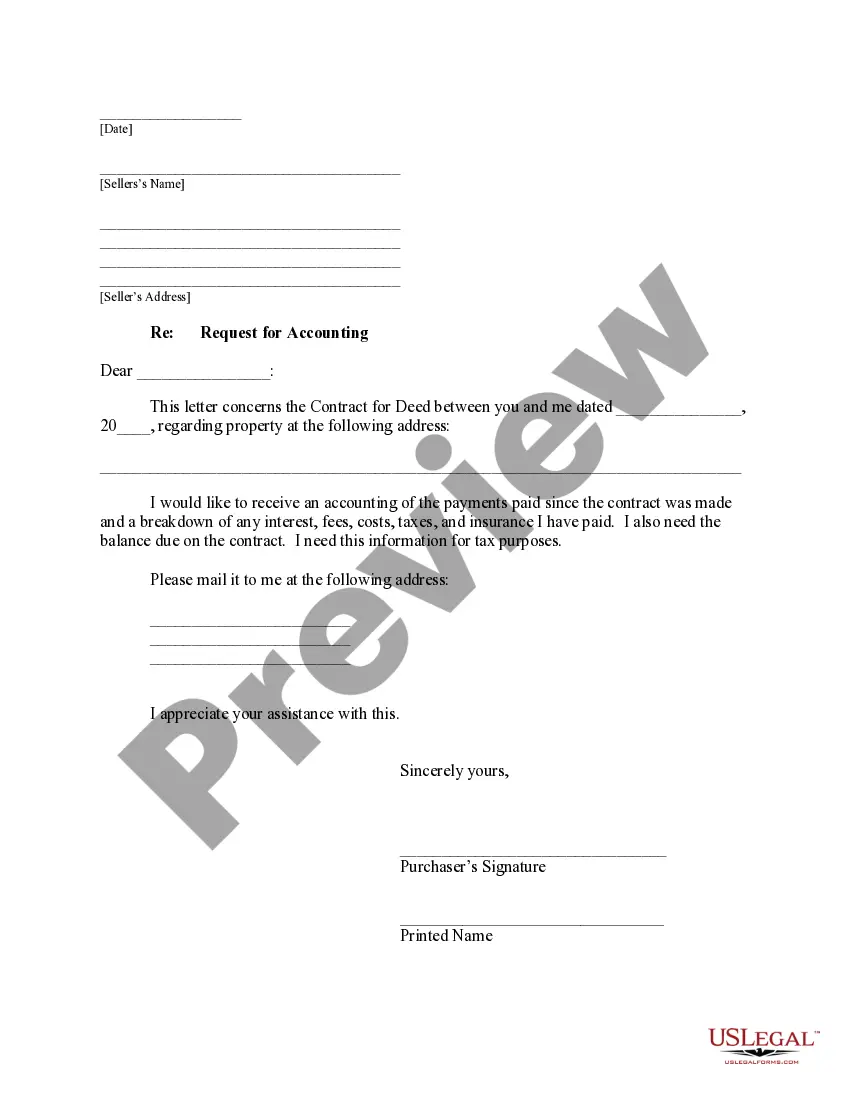

View Solicitud del Comprador para la Contabilidad del Vendedor bajo el Contrato de Escritura

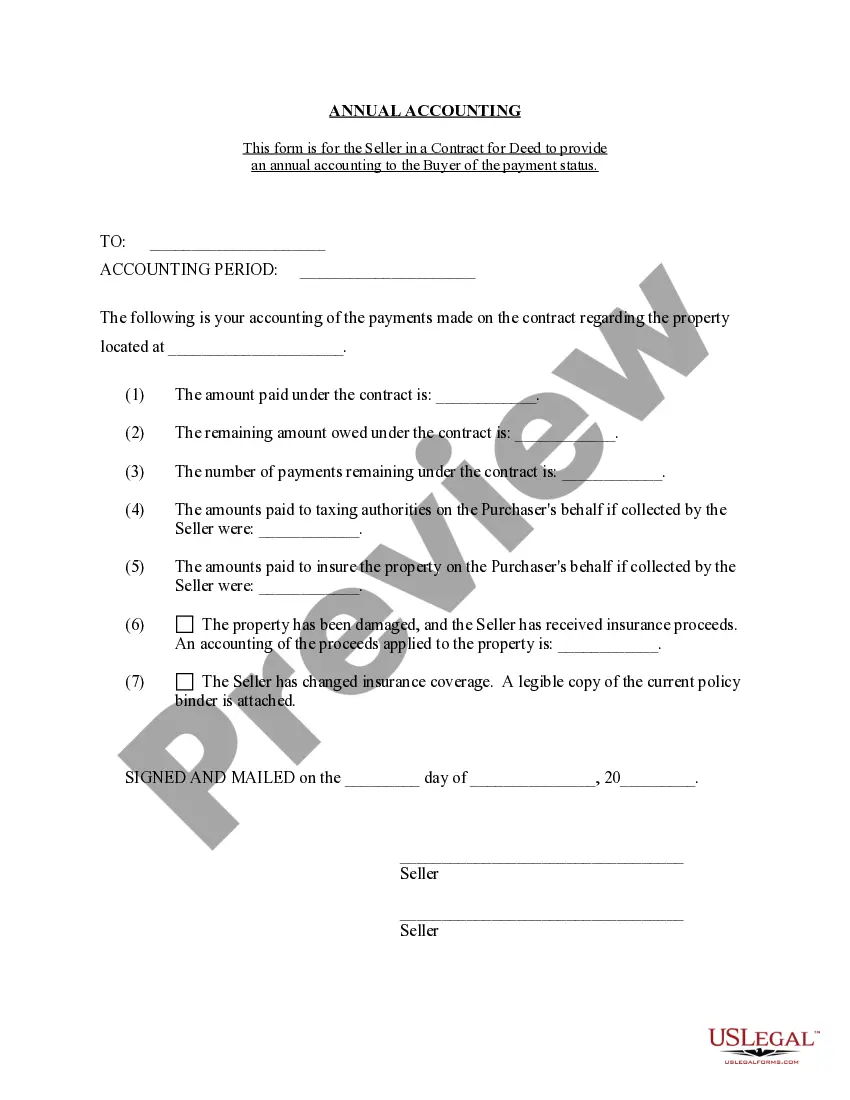

View Contrato de Escrituración Estado Contable Anual del Vendedor

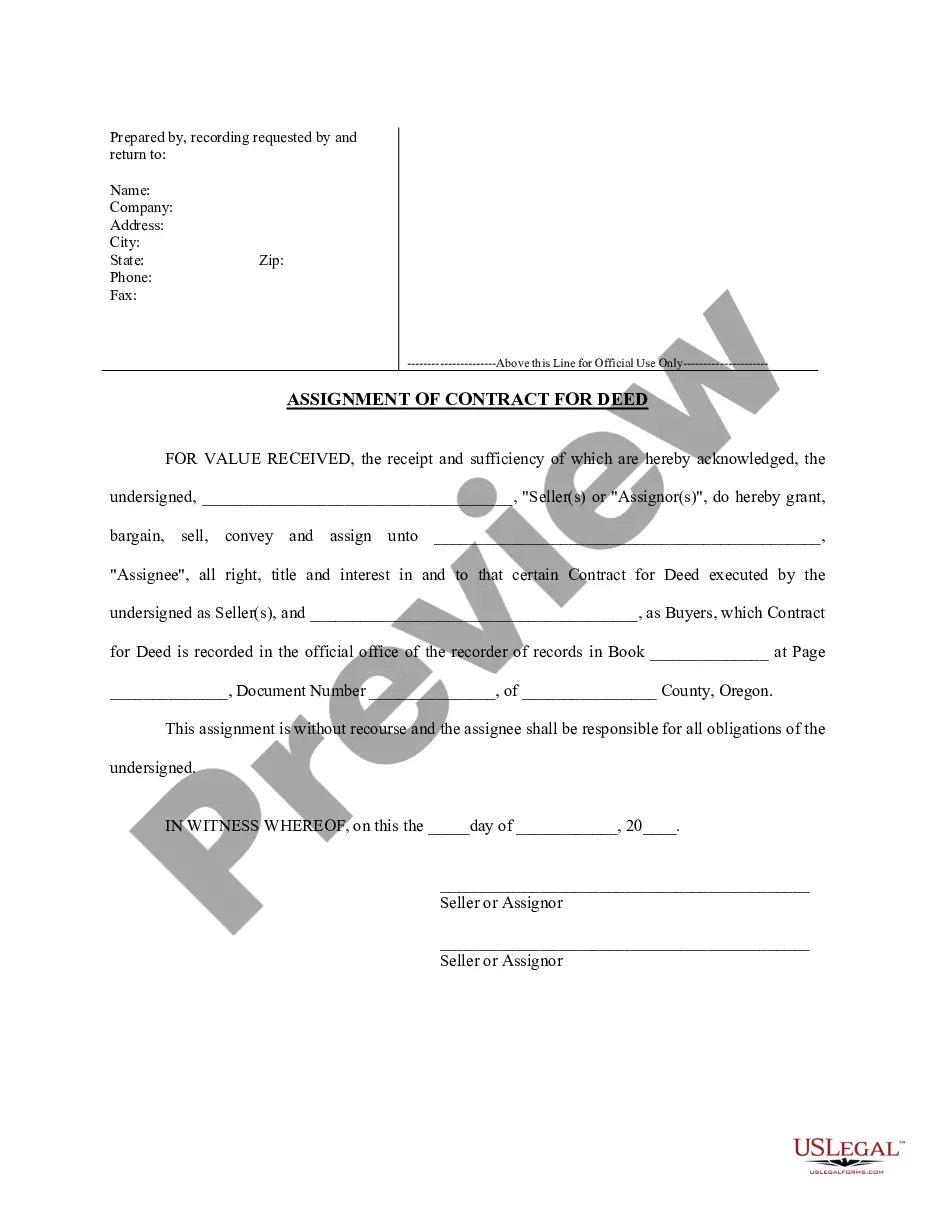

View Cesión del contrato de escritura por parte del vendedor

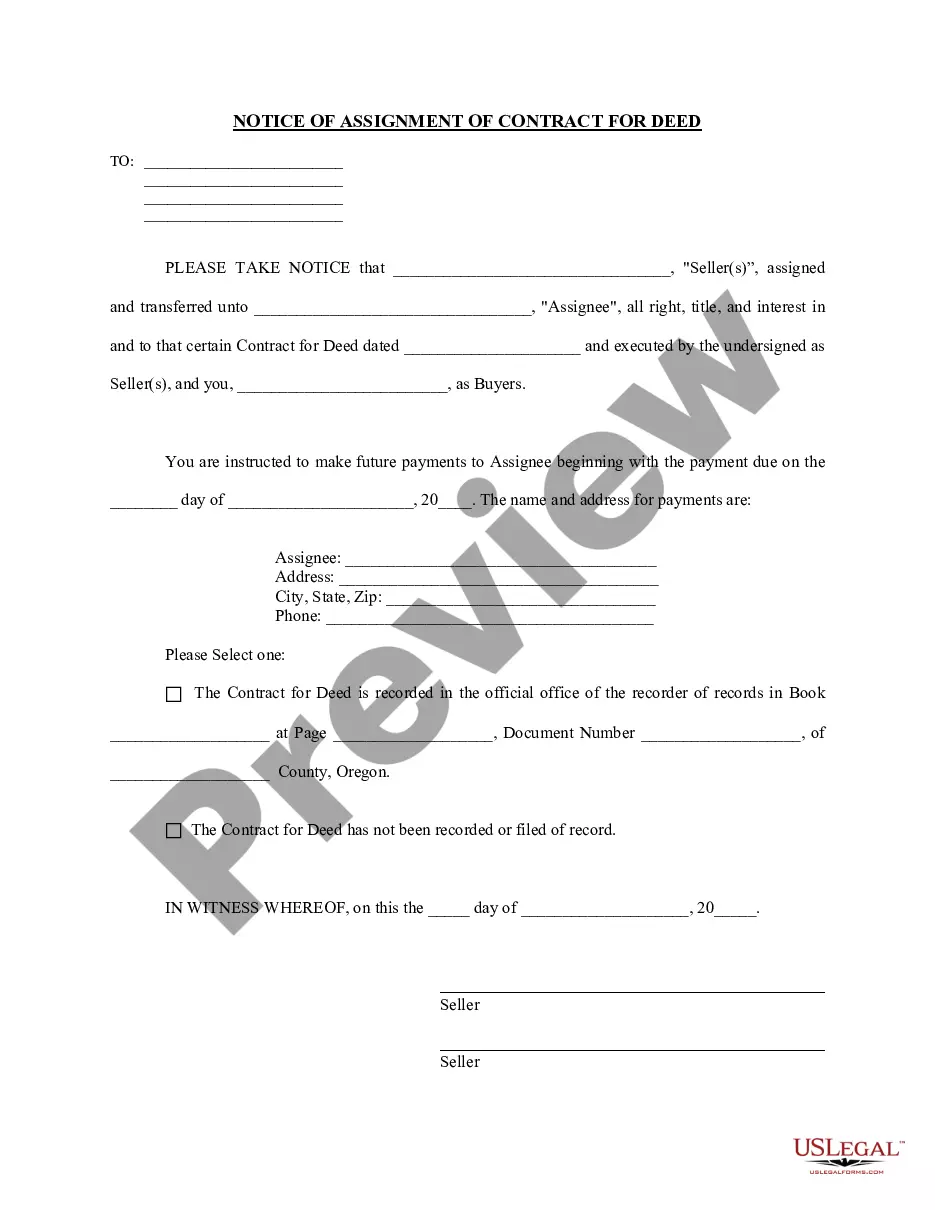

View Aviso de cesión de contrato de escritura

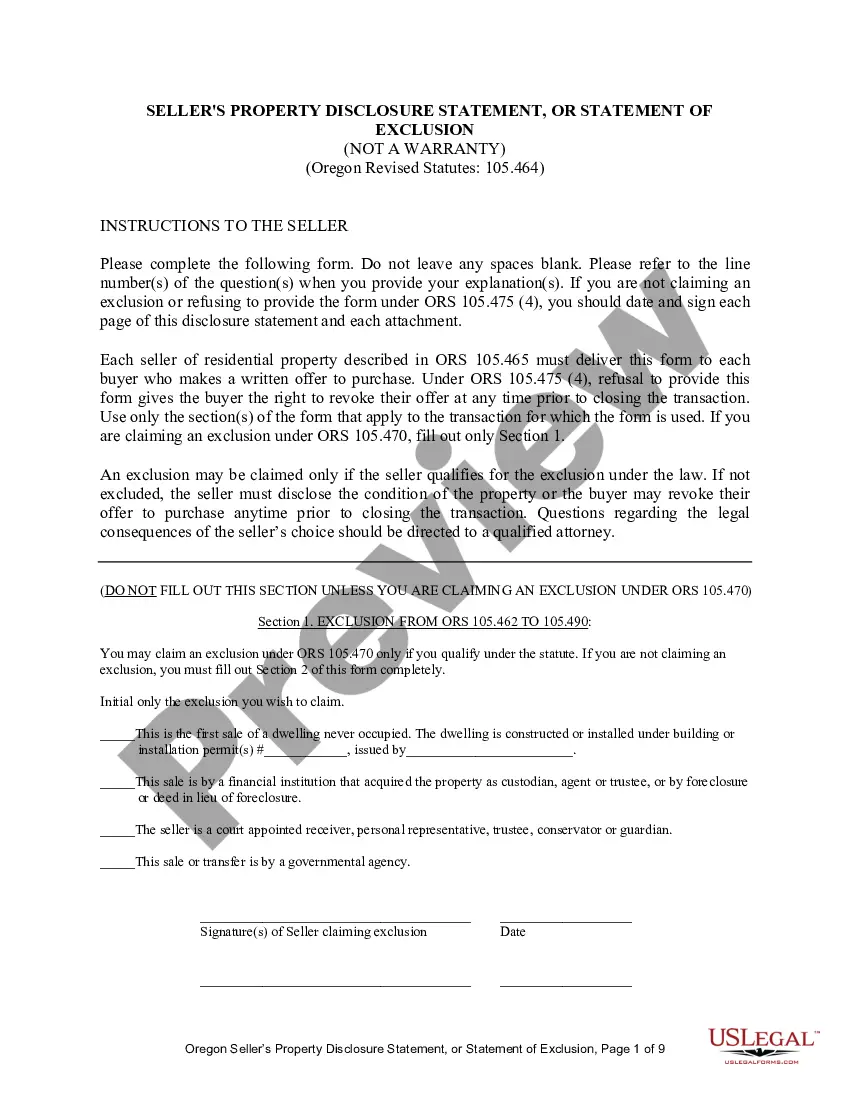

View Declaración de Divulgación de Ventas de Bienes Raíces Residenciales

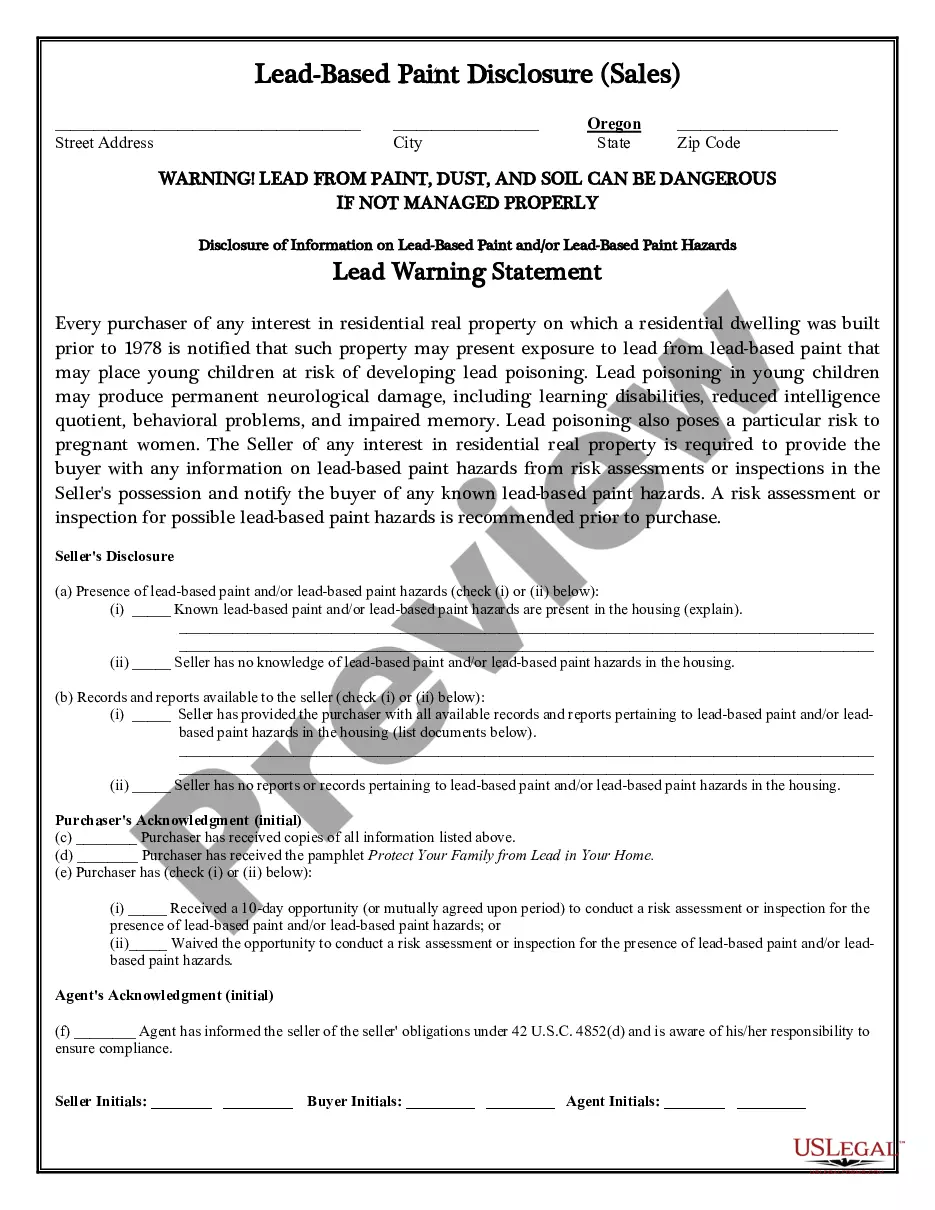

View Divulgación de pintura a base de plomo para transacciones de venta

View Santa Ana Assignment of Legacy in Order to Pay Indebtedness

View Saint Paul Assignment of Legacy in Order to Pay Indebtedness

View Raleigh Assignment of Legacy in Order to Pay Indebtedness

View Portland Assignment of Legacy in Order to Pay Indebtedness

View Plano Assignment of Legacy in Order to Pay Indebtedness

Related legal definitions

Viewed forms

How to fill out Bend Oregon Acuerdo O Contrato De Escritura De Venta Y Compra De Bienes Raíces A/k/a Terreno O Contrato De Ejecución?

If you’ve already utilized our service before, log in to your account and save the Bend Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Bend Oregon Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

Form Rating

Form popularity

Interesting Questions

A Bend Agreement or Contract for Deed is a legal agreement between a buyer and seller for the sale and purchase of real estate, also known as land. This agreement outlines the terms and conditions of the transaction.

In a Bend Agreement or Contract for Deed, the buyer agrees to make regular payments to the seller over a specified period of time. The buyer does not receive the full ownership of the property until all the payments are made as per the agreement.

If the buyer fails to make the agreed payments, the seller may have the right to terminate the agreement and retain any payments already made by the buyer. This depends on the terms stated in the Bend Agreement or Contract for Deed.

No, the property cannot be transferred to the buyer until all payments are made in accordance with the Bend Agreement or Contract for Deed. The seller remains the legal owner of the property during the payment period.

Yes, there can be advantages for both the buyer and seller. For the buyer, it may provide an opportunity to purchase a property without the need for a large down payment or qualifying for a traditional mortgage. For the seller, it can generate a steady income and potentially sell a property that may be difficult to sell through other means.

Once all payments are made as per the Bend Agreement or Contract for Deed, the seller transfers the full ownership rights of the property to the buyer. This typically involves recording a deed or similar document.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Oregon

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 93 - CONVEYANCING AND RECORDING

93.010 Conveyances, how made.

Conveyances of lands, or of any estate or interest therein, may be made by deed, signed by the person of lawful age from whom the estate or interest is intended to pass, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded without any other act or ceremony. No seal of the grantor, corporate or otherwise, shall be required on the deed. [Amended by 1965 c.502 §4]

93.020 Creating, transferring or declaring estates or interests in realty.

(1) No estate or interest in real property, other than a lease for term not exceeding one year, nor any trust or power concerning such property, can be created, transferred or declared otherwise than by operation of law or by a conveyance or other instrument in writing, subscribed by the party creating, transferring or declaring it, or by the lawful agent of the party under written authority, and executed with such formalities as are required by law.

(2) This section does not affect the power of a testator in the disposition of real property by a last will and testament, nor to prevent a trust from arising or being extinguished by implication or operation of law, nor to affect the power of a court to compel the specific performance of an agreement in relation to such property.

93.030 Contracts to convey, instruments of conveyance and related memoranda to state consideration.

(1) As used in this section, "consideration" includes the amount of cash and the amount of any lien, mortgage, contract, indebtedness or other encumbrance existing against the property to which the property remains subject or which the purchaser agrees to pay or assume.

(2) All instruments conveying or contracting to convey fee title to any real estate, and all memoranda of such instruments, shall state on the face of the instruments the true and actual consideration paid for the transfer, stated in terms of dollars. However, if the actual consideration consists of or includes other property or other value given or promised, neither the monetary value nor a description of the other property or value need be stated so long as it is noted on the face of the instrument that other property or value was either part or the whole consideration.

(3) The statement of consideration as required by subsection (2) of this section shall be made by a grantor or a grantee. Failure to make such statement does not invalidate the conveyance.

(4) If the statement of consideration is in the body of the instrument preceding the signatures, execution of the instrument shall constitute a certification of the truth of the statement. If there is a separate statement of consideration on the face of the instrument, it shall be signed separately from the instrument, and such execution shall constitute a certification of the truth of the statement by the person signing. A particular form is not required for the statement so long as the requirements of this section are reasonably met.

(5) An instrument conveying or contracting to convey fee title to any real estate or a memorandum of the instrument may not be accepted for recording by any county clerk or recording officer in this state unless the statement of consideration required by this section is included on the face of the instrument.

(6) A transfer of death deed and an instrument revoking a transfer of death deed are not instruments subject to this section. [1967 c.462 §§1,3; 1967 s.s. c.7 §1; 1977 c.605 §1; 1999 c.654 §7; 2011 c.212 §23]

93.040 Mandatory statements for sales agreements, earnest money receipts or other instruments for conveyance of fee title to real property; liability of drafter and recorder.

(1) The following statement shall be included in the body of an instrument transferring or contracting to transfer fee title to real property except for owner's sale agreements or earnest money receipts, or both, as provided in subsection (2) of this section: "BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON'S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010. THIS INSTRUMENT DOES NOT ALLOW USE OF THE PROPERTY DESCRIBED IN THIS INSTRUMENT IN VIOLATION OF APPLICABLE LAND USE LAWS AND REGULATIONS. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO DETERMINE ANY LIMITS ON LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010."

(2) In all owner's sale agreements and earnest money receipts, there shall be included in the body of the instrument the following statement: "THE PROPERTY DESCRIBED IN THIS INSTRUMENT MAY NOT BE WITHIN A FIRE PROTECTION DISTRICT PROTECTING STRUCTURES. THE PROPERTY IS SUBJECT TO LAND USE LAWS AND REGULATIONS THAT, IN FARM OR FOREST ZONES, MAY NOT AUTHORIZE CONSTRUCTION OR SITING OF A RESIDENCE AND THAT LIMIT LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, IN ALL ZONES. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON'S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO VERIFY THE EXISTENCE OF FIRE PROTECTION FOR STRUCTURES AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010."

(3) In all owners' sale agreements and earnest money receipts subject to ORS 358.505, there shall be included in the body of the instrument or by addendum the following statement: "THE PROPERTY DESCRIBED IN THIS INSTRUMENT IS SUBJECT TO SPECIAL ASSESSMENT UNDER ORS 358.505."

(4) An action may not be maintained against the county recording officer for recording an instrument that does not contain the statement required in subsection (1) or (2) of this section.

(5) An action may not be maintained against any person for failure to include in the instrument the statement required in subsection (1) or (2) of this section, or for recording an instrument that does not contain the

USLegal Home

Information

Services

Products

Log In

Help

About

Privacy Policy

USLegal

LEGAL HELP

Toggle navigation

Questions: Add/Edit Answer

Live (Public):

No Yes

Email:

Author Email

First Name:

Author First Name

Last Name:

Author Last Name

Home Phone:

Author Home Phone

Cell Phone:

Author Cell Phone

Work Phone:

Author Work Phone

Legal Question:

Question Text

Heading:

Question Title

Assign To:

Category:

State:

Answer Date:

Notify Author:

Notify Author by Email on Answer

Answer:

statement required in subsection (1) or (2) of this section, unless the person acquiring or agreeing to acquire fee title to the real property would not have executed or accepted the instrument but for the absence in the instrument of the statement required by subsection (1) or (2) of this section. An action may not be maintained by the person acquiring or agreeing to acquire fee title to the real property against any person other than the person transferring or contracting to transfer fee title to the real property.<br />

<br />

(6) A transfer of death deed and an instrument revoking a transfer of death deed are not instruments subject to this section. [1983 c.718 §2; 1985 c.719 §1; 1989 c.366 §1; 1993 c.792 §40; 1995 c.5 §17; 2005 c.311 §1; 2007 c.424 §23; 2007 c.866 §7; 2009 c.892 §19; 2011 c.212 §24]<br />

<br />

93.050 Gift or conveyance of life estate.<br />

<br />

A gift or conveyance of property under deed or other writing executed after June 30, 1993, to any person for the term of the life of the person, and after the death of the person to the children or heirs of the person, vests an estate or interest for life only in the grantee or person receiving the gift or conveyance, and remainder in the children or heirs. [1991 c.850 §3]<br />

<br />

OREGON STATUTES<br />

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS<br />

CHAPTER 93 — CONVEYANCING AND RECORDING<br />

SPECIAL MATTERS IN PARTICULAR CONVEYANCES<br />

<br />

93.110 Quitclaim deed sufficient to pass estate.<br />

<br />

A deed of quitclaim and release, of the form in common use, is sufficient to pass all the estate which the grantor could lawfully convey by a deed of bargain and sale.<br />

<br />

93.120 Words of inheritance unnecessary to convey fee; conveyances deemed to convey all grantor’s estate.<br />

<br />

The term “heirs,” or other words of inheritance, is not necessary to create or convey an estate in fee simple. Any conveyance of real estate passes all the estate of the grantor, unless the intent to pass a lesser estate appears by express terms, or is necessarily implied in the terms of the grant.<br />

<br />

93.130 Conveyance of land in adverse possession of another.<br />

<br />

No grant or conveyance of lands or interest therein is void for the reason that at the time of its execution the lands were in the actual possession of another claiming adversely.<br />

<br />

93.140 Implied covenants.<br />

<br />

No covenant shall be implied in any conveyance of real estate, whether it contains special covenants or not, except as provided by ORS 93.850 to 93.870. [Amended by 1973 c.194 §6]<br />

<br />

93.150 Conveyance by tenant of greater estate than that possessed.<br />

<br />

A conveyance made by a tenant for life or years, purporting to grant a greater estate than the tenant possesses or could lawfully convey, does not work a forfeiture of the estate of the tenant, but passes to the grantee all the estate which the tenant could lawfully convey.<br />

<br />

93.160 Conveyance by reversioners and remainderpersons to life tenant vests fee.<br />

<br />

When real property has been devised to a person for life, and in case of the death of the life tenant without leaving lawful issue born alive and living at the time of death, then to other heirs of the testator, a conveyance to the life tenant from all reversioners or remainderpersons and all issue of the life tenant as are in being, of all their interest in the real property, vests a fee simple estate in the life tenant. [Amended by 2003 c.14 §35]<br />

<br />

93.180 Forms of tenancy in conveyance or devise to two or more persons.<br />

<br />

(1) A conveyance or devise of real property, or an interest in real property, that is made to two or more persons:<br />

<br />

(a) Creates a tenancy in common unless the conveyance or devise clearly and expressly declares that the grantees or devisees take the real property with right of survivorship.<br />

<br />

(b) Creates a tenancy by the entirety if the conveyance or devise is to spouses married to each other unless the conveyance or devise clearly and expressly declares otherwise.<br />

<br />

(c) Creates a joint tenancy as described in ORS 93.190 if the conveyance or devise is to a trustee or personal representative.<br />

<br />

(2) A declaration of a right to survivorship creates a tenancy in common in the life estate with cross-contingent remainders in the fee simple.<br />

<br />

(3) Except as provided in ORS 93.190, joint tenancy in real property is abolished and the use in a conveyance or devise of the words “joint tenants” or similar words without any other indication of an intent to create a right of survivorship creates a tenancy in common. [Amended by 1983 c.555 §1; 2007 c.64 §1; 2015 c.629 §5]<br />

<br />

93.210 Presumption respecting deed from trustee of undisclosed beneficiary.<br />

<br />

If a deed to real estate has been made to a grantee in trust or designating the grantee as trustee, and no beneficiary is indicated or named in the deed, a deed thereafter executed by such grantee conveying the property is presumed to have been executed with full right and authority and conveys prima facie title to the property. The grantee in the last-mentioned deed is under no duty whatsoever to see to the application of the purchase price. If the last-mentioned deed is recorded after June 7, 1937, after five years from its recording or, if it was recorded prior to June 7, 1937, then after June 7, 1942, the presumption is conclusive as to any undisclosed beneficiary and the title to the real estate, based upon the last-mentioned deed, shall not be called in question by any one claiming as beneficiary under the first-mentioned deed.<br />

<br />

93.220 Release, limitation or restriction of power of appointment.<br />

<br />

(1) Any person to whom there has been granted or reserved any power of appointment or other power by which the person may elect to take any action affecting the disposition of property may at any time release, or, from time to time, limit or restrict such power in whole or in part by an instrument in writing evidencing that purpose and subscribed by the person.<br />

<br />

(2) If the power is one to affect title to real property, the instrument shall be executed, acknowledged, proved and recorded, or filed with the registrar of title in each county in which the land is situated in the same manner as a conveyance of real property.<br />

<br />

(3) If the power is of such nature that its exercise may affect the duty of any trustee or other fiduciary, such trustee or other fiduciary is not bound to take notice thereof unless the trustee or other fiduciary has received the original or an executed duplicate of the release or a copy thereof certified by the county clerk or county recorder of the county in which it has been recorded.<br />

<br />

93.230 Copy of Department of State Lands deed or patent given when original lost.<br />

<br />

(1) If parties to whom deeds have been issued by the Department of State Lands have lost such deeds before they were placed on record in the county wherein the land conveyed is located, the Director of the Department of State Lands, on application of the party entitled thereto, shall cause a certified copy of the record of the deed in the office of the department to be issued under its seal.<br />

<br />

(2) If parties to whom patents for lands have been issued by the United States for lands in the State of Oregon have lost such patents before they were placed on record in the county wherein the land conveyed is located, such parties, or their successors in interest, may apply to and obtain from the Bureau of Land Management, or its successor agency, copies of the records of such patents, duly certified to be correct copies of the original patents, or of the record thereof, by the appropriate federal officer.<br />

<br />

(3) Every certified copy issued in accordance with subsection (1) or (2) of this section is entitled to record in the proper county with like effect as the original deed or patent. Every such copy so certified may be read in evidence in any court in this state without further proof thereof. The record of any such certified copy, or a transcript thereof certified by the county clerk in whose office it may have been recorded, may be read in evidence in any court in this state with like effect as the original thereof or the original lost deed or patent. [Amended by 1967 c.421 §197]<br />

<br />

93.240 Rights to deferred installments of purchase price where two or more persons join as sellers of real property.<br />

<br />

(1) Subject to the provisions contained in this section, whenever two or more persons join as sellers in the execution of a contract of sale of real property or sell and convey title to real property in exchange for a note for all or a part of the purchase price secured by either a mortgage or trust deed on the real property, unless a contrary purpose is expressed in the contract, note, mortgage or trust deed, the right to receive payment of deferred installments of the purchase price and the mortgage or trust deed, shall be owned by them in the same proportions, and with the same incidents, as title to the real property was vested in them immediately preceding the execution of the contract of sale or conveyance.<br />

<br />

(2) If immediately prior to the execution of a contract of sale of real property, or a sale or conveyance of title to real property in exchange for a note for all or a part of the purchase price secured by a mortgage or trust deed on the real property, title to any interest in the property therein described was vested in the sellers or some of the sellers as tenants by the entirety or was otherwise subject to any right of survivorship, then, unless a contrary purpose is expressed in the contract, note, mortgage or trust deed, the right to receive payment of deferred installments of the purchase price of the property and the mortgage and trust deed shall likewise be subject to like rights of survivorship. [1957 c.402 §§1,2; 1969 c.591 §276; 1989 c.74 §1; 1997 c.99 §21]<br />

<br />

93.250 Effect of conveyance creating fee simple conditional or fee tail.<br />

<br />

Every conveyance or devise of lands, or interest therein, made subsequent to September 9, 1971, using language appropriate to create a fee simple conditional or fee tail estate shall create an estate in fee simple absolute in the grantees or devisees of such conveyances or devises. Any future interest limited upon such an interest is a limitation upon the fee simple absolute and its validity is determined accordingly. [1971 c.382 §1]<br />

<br />

93.260 Tax statement information required in conveyancing instrument.<br />

<br />

(1) All instruments prepared for the purpose of conveying or contracting to convey fee title to any real estate shall contain on the face of such instruments a statement in substantially the following form:<br />

<br />

Until a change is requested, all tax statements shall be sent to the following address:<br />

<br />

(2) Failure to contain the statement required by this section does not invalidate the conveyance and if an instrument is recorded without the statement required by this section, the recording is valid.<br />

<br />

(3) This section applies to all instruments executed after January 1, 1974. [1973 c.422 §2]<br />

<br />

93.270 Certain discriminatory restrictions in conveyancing instruments prohibited; restriction on right of action.<br />

<br />

(1) A person conveying or contracting to convey fee title to real property may not include in an instrument for that purpose a provision:<br />

<br />

(a) Restricting the use of the real property by any person or group of persons by reason of race, color, religion, sex, sexual orientation, national origin or disability.<br />

<br />

(b) Restricting the use of the real property by any home or facility that is licensed under ORS 443.400 to 443.455 or 443.705 to 443.825 to provide residential care alone or in conjunction with treatment or training or a combination thereof.<br />

<br />

(2) Any provision in an instrument executed in violation of subsection (1) of this section is void and unenforceable.<br />

<br />

(3) An instrument that contains a provision restricting the use of real property in a manner listed in subsection (1)(b) of this section does not give rise to any public or private right of action to enforce the restriction.<br />

<br />

(4)(a) An instrument that contains a provision restricting the use of real property by requiring roofing materials with a lower fire rating than that required in the state building code established under ORS chapter 455 does not give rise to any public or private right of action to enforce the restriction in an area determined by a local jurisdiction as a wildfire hazard zone. Prohibitions on public or private right of action under this paragraph are limited solely to considerations of fire rating.<br />

<br />

(b) As used in this subsection, “wildfire hazard zones” are areas that are legally declared by a governmental agency having jurisdiction over the area to have special hazards caused by a combination of combustible natural fuels, topography and climatic conditions that result in a significant hazard of catastrophic fire over relatively long periods each year. Wildfire hazard zones shall be determined using criteria established by the State Forestry Department. [1973 c.258 §1; 1989 c.437 §1; 1991 c.801 §7; 1993 c.311 §1; 1993 c.430 §3; 2007 c.70 §20; 2007 c.100 §16; 2009 c.595 §61]<br />

<br />

OREGON STATUTES<br />

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS<br />

CHAPTER 93 — CONVEYANCING AND RECORDING DEED FORMS<br />

<br />

93.850 Warranty deed form; effect.<br />

<br />

(1) Warranty deeds may be in the following form:<br />

<br />

_____, Grantor, conveys and warrants to_____, Grantee, the following described real property free of encumbrances except as specifically set forth herein: (Describe the property conveyed.)<br />

<br />

(If there are to be exceptions to the covenants described in ORS 93.850 (2)(c), here insert such exceptions.)<br />

<br />

(Following statement of exceptions, here insert statement required under ORS 93.040 (1).)<br />

<br />

The true consideration for this conveyance is $_____. (Here comply with the requirements of ORS 93.030.)<br />

<br />

Dated this _____ day of_____, 2___.<br />

<br />

(2) A deed in the form of subsection (1) of this section shall have the following effect:<br />

<br />

(a) It shall convey the entire interest in the described property at the date of the deed which the deed purports to convey.<br />

<br />

(b) The grantor, the heirs, successors and assigns of the grantor, shall be forever estopped from asserting that the grantor had, at the date of the deed, an estate or interest in the land less than that estate or interest which the deed purported to convey and the deed shall pass any and all after acquired title.<br />

<br />

(c) It shall include the following covenants, each of which shall run in favor of the grantee and the successors in title of the grantee as if written in the deed:<br />

<br />

(A) That at the time of the delivery of the deed the grantor is seized of the estate in the property which the grantor purports to convey and that the grantor has good right to convey the same.<br />

<br />

(B) That at the time of the delivery of the deed the property is free from encumbrances except as specifically set forth on the deed.<br />

<br />

(C) That the grantor warrants and will defend the title to the property against all persons who may lawfully claim the same.<br />

<br />

(3) If the grantor desires to exclude any encumbrances or other interests from the scope of the covenants of the grantor, such exclusions must be expressly set forth on the deed. [1973 c.194 §1; 1999 c.214 §1]<br />

<br />

93.855 Special warranty deed form; effect.<br />

<br />

(1) Special warranty deeds may be in the following form:<br />

<br />

_____, Grantor, conveys and specially warrants to_____, Grantee, the following described real property free of encumbrances created or suffered by the grantor except as specifically set forth herein: (Describe the property conveyed.)<br />

<br />

(If there are to be exceptions to the covenants described in ORS 93.855 (2), here insert such exceptions.)<br />

<br />

(Following statement of exceptions, here insert statement required under ORS 93.040 (1).)<br />

<br />

The true consideration for this conveyance is $_____. (Here comply with the requirements of ORS 93.030.)<br />

<br />

Dated this _____ day of_____, 2___.<br />

<br />

(2) A deed in the form of subsection (1) of this section shall have the same effect as a warranty deed as described in ORS 93.850, except that the covenant of freedom from encumbrances shall be limited to those encumbrances created or suffered by the grantor and the covenant of warranty shall be limited to read: “That the grantor warrants and will defend the title to the property against all persons who may lawfully claim the same by, through or under the grantor.”<br />

<br />

(3) If the grantor desires to exclude any encumbrances or other interests from the scope of the covenants of the grantor, such exclusions must be expressly set forth on the deed. [1973 c.194 §2; 1999 c.214 §2]<br />

<br />

93.860 Bargain and sale deed form; effect.<br />

<br />

(1) Bargain and sale deeds may be in the following form:<br />

<br />

_____, Grantor, conveys to_____, Grantee, the following described real property: (Describe the property conveyed.)<br />

<br />

(Following description of property, here insert statement required under ORS 93.040 (1).)<br />

<br />

The true consideration for this conveyance is $_____. (Here comply with the requirements of ORS 93.030.)<br />

<br />

Dated this _____ day of_____, 2___.<br />

<br />

(2) A deed in the form of subsection (1) of this section shall have the following effect:<br />

<br />

(a) It shall convey the entire interest in the described property at the date of the deed which the deed purports to convey.<br />

<br />

(b) The grantor, the heirs, successors and assigns of the grantor, shall be forever estopped from asserting that the grantor had, at the date of the deed, an estate or interest in the land less than that estate or interest which the deed purported to convey and the deed shall pass any and all after acquired title.<br />

<br />

(3) A bargain and sale deed shall not operate to provide any covenants of title in the grantee and the successors of the grantee. [1973 c.194 §3; 1999 c.214 §3]<br />

<br />

93.865 Quitclaim deed form; effect.<br />

<br />

(1) Quitclaim deeds may be in the following form:<br />

<br />

_____, Grantor, releases and quitclaims to_____, Grantee, all right, title and interest in and to the following described real property: (Describe the property conveyed.)<br />

<br />

(Following description of property, here insert statement required under ORS 93.040 (1).)<br />

<br />

The true consideration for this conveyance is $_____. (Here comply with the requirements of ORS 93.030.)<br />

<br />

Dated this _____ day of_____, 2___.<br />

<br />

(2) A deed in the form of subsection (1) of this section shall have the effect of conveying whatever title or interest, legal or equitable, the grantor may have in the described property at the date of the deed but shall not transfer any title or interest which the grantor may thereafter obtain nor shall it operate as an estoppel.<br />

<br />

(3) A grantee taking title by way of a quitclaim deed shall not, merely because of receipt of title by or through such a deed, be denied the status of a good faith purchaser for value. [1973 c.194 §4; 1999 c.214 §4]<br />

<br />

93.870 Statutory deed forms optional.<br />

<br />

The form of deeds set forth in ORS 93.850 to 93.865 are permissive and not mandatory. Other forms of deeds may be used for the conveyance of real property. [1973 c.194 §5]<br />

<br />

OREGON STATUTES<br />

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS<br />

CHAPTER 93 — CONVEYANCING AND RECORDING<br />

FORFEITURE UNDER LAND SALES CONTRACT<br />

<br />

93.905 Definitions for ORS 93.905 to 93.940.<br />

<br />

As used in ORS 93.905 to 93.940, unless the context requires otherwise:<br />

<br />

(1) “Contract for transfer or conveyance of an interest in real property” shall not include earnest money or preliminary sales agreements, options or rights of first refusal.<br />

<br />

(2) “Forfeiture remedy” means the nonjudicial remedy whereby the seller cancels the contract for default, declares the purchaser’s rights under the contract to be forfeited, extinguishes the debt and retains sums previously paid thereunder by the buyer.<br />

<br />

(3) “Purchase price” means the total price for the interest in the real property as stated in the contract, including but not limited to down payment, other property or value given or promised for which a dollar value is stated in the contract and the balance of the purchase price payable in installments, not including interest. If the contract provides for the conveyance of an interest in more than one parcel of property, the purchase price shall include only the portion of the price attributable to the remaining, unconveyed interest in real property, if the value thereof is separately stated or can be determined from the terms of the contract.<br />

<br />

(4) “Purchaser” means any person who by voluntary transfer acquires a contractual interest in real property, any successor in interest to all or any part of the purchaser’s contract rights of whom the seller has actual or constructive notice, and any person having a subordinate lien or encumbrance of record, including, but not limited to, a mortgagee, a beneficiary under a trust deed and a purchaser under a subordinate contract for transfer or conveyance of an interest in real property.<br />

<br />

(5) “Seller” means any person who transfers or conveys an interest in real property, or any successor in interest of the seller.<br />

<br />

(6) “Unpaid balance” means the sum of the unpaid principal balance, accrued unpaid interest and any sums actually paid by the seller on behalf of the purchaser for items required to be paid by the purchaser, including amounts paid for delinquent taxes, assessments or liens, or to obtain or reinstate required insurance. [1985 c.718 §1]<br />

<br />

93.910 Enforcement of forfeiture remedy after notice of default.<br />

<br />

Whenever a contract for transfer or conveyance of an interest in real property provides a forfeiture remedy, whether the remedy is self-executing or is optional, forfeiture of the interest of a purchaser in default under the contract may be enforced only after notice of the default has been given to the purchaser as provided in ORS 93.915, notwithstanding any provision in the contract to the contrary. [1985 c.718 §2]<br />

<br />

93.913 Forfeiture allowed for default under certain collateral assignments of interest.<br />

<br />

In the event of a default under a collateral assignment of the interest of a seller or purchaser in a land sale contract, including a collateral assignment of the proceeds thereof, the assignee may enforce a remedy of forfeiture, as set forth in ORS 93.905 to 93.945, unless the agreement between the parties otherwise prohibits such remedy. [1989 c.516 §3]<br />

<br />

Note: 93.913 and 93.918 were added to and made a part of ORS chapter 93 by legislative action but were not added to any series therein. See Preface to Oregon Revised Statutes for further explanation.<br />

<br />

93.915 Notice of default; contents; recordation; time of forfeiture; interim measures.<br />

<br />

(1) In the event of a default under a contract for conveyance of real property, a seller who wishes to enforce a forfeiture remedy must give written notice of default by service pursuant to ORCP 7 D(2) and 7 D(3), or by both first class and certified mail with return receipt requested, to the last-known address of the following persons or their legal representatives, if any:<br />

<br />

(a) The purchaser.<br />

<br />

(b) An occupant of the property.<br />

<br />

(c) Any person who has caused to be filed for record in the county clerk’s office of a county in which any part or parcel of the real property is situated, a duly acknowledged request for a copy of any notice of default served upon or mailed to the purchaser. The request shall contain the name and address of the person requesting copies of the notice and shall identify the contract by stating the names of the parties to the contract, the date of recordation of the contract and the book and page where the contract is recorded. The county clerk shall immediately make a cross-reference of the request to the contract, either on the margin of the page where the contract is recorded or in some other suitable place. No request, statement or notation placed on the record pursuant to this section shall affect title to the property or be deemed notice to any person that any person so recording the request has any right, title, interest in, lien or charge upon the property referred to in the contract.<br />

<br />

(2) Notices served by mail are effective when mailed.<br />

<br />

(3) The notice shall specify the nature of the default, the amount of the default if the default is in the payment terms, the date after which the contract will be forfeited if the purchaser does not cure the default and the name and address of the seller or the attorney for the seller. The period specified in the notice after which the contract will be forfeited may not be less than:<br />

<br />

(a) Sixty days, when the purchaser has reduced the unpaid balance to an amount greater than 75 percent of the purchase price;<br />

<br />

(b) Ninety days, when the purchaser has reduced the unpaid balance to an amount which is more than 50 percent but less than 75 percent of the purchase price; or<br />

<br />

(c) One hundred twenty days, when the purchaser has reduced the unpaid balance to an amount which is 50 percent or less of the purchase price.<br />

<br />

(4) The seller shall cause to be recorded in the real property records of each county in which any part of the property is located a copy of the notice, together with an affidavit of service or mailing of the notice of default, reciting the date the notice was served or mailed and the name and address of each person to whom it was given. From the date of recording, the notice and affidavit shall constitute constructive notice to third persons of the pending forfeiture. If, not later than one year after the time for cure stated in a recorded notice and affidavit or any recorded extension thereof, no declaration of forfeiture based upon the recorded notice and affidavit has been recorded and no extension of time for cure executed by the seller has been recorded, the notice and affidavit shall not be effective for any purpose nor shall it impart any constructive or other notice to third persons acquiring an interest in the purchaser’s interest in the contract or the property or any portion of either. Any extension of time for cure executed by the seller shall be recorded in the same manner as the original notice and affidavit.<br />

<br />

(5) The statement contained in the notice as to the time after which the contract will be forfeited if the default is not cured shall conclusively be presumed to be correct, and the notice adequate, unless one or more recipients of such notice notifies the seller or the attorney for the seller, by registered or certified mail, that such recipient claims the right to a longer period of time in which to cure the default.<br />

<br />

(6) Subject to the procedural requirements of the Oregon Rules of Civil Procedure, an action may be instituted to appoint a receiver or to obtain a temporary restraining order during forfeiture under a land sale contract, except that a receiver shall not be appointed with respect to a single-family residence which is occupied at the time the notice of default is given, as the principal residence of the purchaser, the purchaser’s spouse or the purchaser’s minor dependent children. [1985 c.718 §3; 1987 c.717 §1; 1991 c.12 §1]<br />

<br />

93.918 Continuation of proceedings after certain types of stay ordered by court; procedures.<br />

<br />

(1) Except when a seller has participated in obtaining a stay, contract forfeiture proceedings that are stayed by order of the court, by proceedings in bankruptcy or for any other lawful reason, shall continue after release from the stay as if uninterrupted, if within 30 days after release the seller gives written amended notice of default by certified mail with return receipt requested, to the last-known address of those persons listed in ORS 93.915 (1). The amended notice of default shall:<br />

<br />

(a) Be given at least 20 days prior to the amended date of forfeiture;<br />

<br />

(b) Specify an amended date after which the contract will be forfeited, which may be the same as the original forfeiture date;<br />

<br />

(c) Conform to the requirements of ORS 93.915 (3), except the time periods set forth therein; and<br />

<br />

(d) State that the original forfeiture proceedings were stayed and the date the stay terminated.<br />

<br />

(2) The new date of forfeiture shall not be sooner than the date of forfeiture as set forth in the seller’s notice of default which was subject to the stay.<br />

<br />

(3) Prior to the date of forfeiture, the seller shall cause to be recorded in the real property records of each county in which any part of the property is located, a copy of the amended notice of default, together with an affidavit of service or mailing of the amended notice of default, reciting the date the amended notice of default was served or mailed and the name and address of each person to whom it was given. From the date of its recording, the amended notice of default shall be subject to the provisions of ORS 93.915 (4) and (5). [1989 c.516 §4]<br />

<br />

Note: See note under 93.913.<br />

<br />

93.920 Curing default to avoid forfeiture; payment of costs and expenses.<br />

<br />

A purchaser in default may avoid a forfeiture under the contract by curing the default or defaults before expiration of the notice period provided in ORS 93.915. If the default consists of a failure to pay sums when due under the contract, the default may be cured by paying the entire amount due, other than sums that would not then be due had no default occurred, at the time of cure under the terms of the contract. Any other default under the contract may be cured by tendering the performance required under the contract. In addition to paying the sums or tendering the performance necessary to cure the default, the person effecting the cure of the default shall pay all costs and expenses actually incurred in enforcing the contract, including, but not limited to, late charges, attorney fees not to exceed $350 and costs of title search. [1985 c.718 §4; 1987 c.717 §2]<br />

<br />

93.925 Failure to cure default; exclusiveness of notice.<br />

<br />

Notwithstanding a seller’s waiver of prior defaults, if notice is given and purchaser does not cure the default within the period specified in ORS 93.915, the contract forfeiture remedy may be exercised and the contract shall not be reinstated by any subsequent offer or tender of performance. The notice required in ORS 93.915 shall be in lieu of any notice that may be required under the terms of the contract itself, except where greater notice or notice to persons other than those described in ORS 93.915 is required by the terms of the contract, in which case notice shall be given for such longer period of time and to such additional persons as required by the contract. [1985 c.718 §5]<br />

<br />

93.930 Recording affidavit after forfeiture; affidavit as evidence.<br />

<br />

(1) When a contract for conveyance of real property has been forfeited in accordance with its terms after the seller has given notice to the purchaser as provided in ORS 93.915, the seller shall record an affidavit with the property description, a copy of the notice of default and proof of mailing attached, setting forth that the default of the purchaser under the terms of the contract was not cured within the time period provided in ORS 93.915 and that the contract has been forfeited. When the affidavit is recorded in the deed records of the county where the property described therein is located, the recitals contained in the affidavit shall be prima facie evidence in any court of the truth of the matters set forth therein, but the recitals shall be conclusive in favor of a purchaser for value in good faith relying upon them.<br />

<br />

(2) Except as otherwise provided in ORS 93.905 to 93.945 and except to the extent otherwise provided in the contract or other agreement with the seller, forfeiture of a contract under ORS 93.905 to 93.930 shall have the following effects:<br />

<br />

(a) The purchaser and all persons claiming through the purchaser who were given the required notices pursuant to ORS 93.915, shall have no further rights in the contract or the property and no person shall have any right, by statute or otherwise, to redeem the property. The failure to give notice to any of these persons shall not affect the validity of the forfeiture as to persons so notified;<br />

<br />

(b) All sums previously paid under the contract by or on behalf of the purchaser shall belong to and be retained by the seller or other person to whom paid; and<br />

<br />

(c) All of the rights of the purchaser to all improvements made to the property at the time the declaration of forfeiture is recorded shall be forfeited to the seller and the seller shall be entitled to possession of the property on the 10th day after the declaration of forfeiture is recorded. Any persons remaining in possession after that day under any interest, except one prior to the contract, shall be deemed to be tenants at sufferance. Such persons may be removed from possession by following the procedures set out in ORS 105.105 to 105.168 or other applicable judicial procedures.<br />

<br />

(3) After the declaration of forfeiture is recorded, the seller shall have no claim against the purchaser and the purchaser shall not be liable to the seller for any portion of the purchase price unpaid or for any other breach of the purchaser’s obligations under the contract. [1985 c.718 §6; 1987 c.717 §3]<br />

<br />

93.935 Effect of purchaser’s abandonment or reconveyance on interest, lien or claim.<br />

<br />

(1) In the event of a default under a contract for conveyance of real property, the recorded interest, lien or claim of a person with respect to the real property, by virtue of an assignment, conveyance, contract, mortgage, trust deed or other lien or claim from or through a purchaser, shall not be affected by the purchaser’s abandonment or reconveyance to the seller unless the person is given notice in the manner specified in ORS 93.915.<br />

<br />

(2) The notice shall specify the nature of the default, the amount of the default if the default is in the payment terms, the date after which the purchaser’s interest in the real property will be abandoned or reconveyed to the seller and the name and address of the seller or the attorney for the seller. The period specified in the notice after which the purchaser’s interest will be abandoned or reconveyed to the seller may not be less than:<br />

<br />

(a) Sixty days, when the purchaser has reduced the unpaid balance to an amount greater than 75 percent of the purchase price;<br />

<br />

(b) Ninety days, when the purchaser has reduced the unpaid balance to an amount which is more than 50 percent but less than 75 percent of the purchase price; or<br />

<br />

(c) One hundred twenty days, when the purchaser has reduced the unpaid balance to an amount which is 50 percent or less of the purchase price.<br />

<br />

(3) If the person having an interest, lien or claim with respect to the real property, by virtue of an assignment, conveyance, contract, mortgage, trust deed or other lien or claim from or through a purchaser whose interest arises under a contract for conveyance of real property, cures the default as provided in ORS 93.920 then such person’s interest, lien or claim with respect to the real property shall not be affected by the purchaser’s abandonment or reconveyance to the seller. [1985 c.718 §7; 1987 c.225 §3]<br />

<br />

93.940 Effect of seller’s foreclosure or other action on interest, lien or claim.<br />

<br />

The recorded interest, lien or claim of a person with respect to the real property, by virtue of an assignment, conveyance, contract, mortgage, trust deed or other lien or claim from or through a purchaser whose interest arises under a contract for conveyance of real property, shall be not affected by the seller’s foreclosure or other action on the contract unless such person is made a party to the action brought by the seller to enforce or foreclose the contract. In such action, such person shall be entitled to the same rights and opportunities to cure the purchaser’s default or satisfy the purchaser’s obligations as are granted the purchaser. [1985 c.718 §8; 1987 c.225 §4]<br />

<br />

93.945 Application of ORS 93.910 to 93.940.<br />

<br />

(1) The provisions of ORS 93.910 to 93.930 shall apply only to forfeiture remedies enforced after July 13, 1985. The date that the initial written notice of a default is given to the purchaser shall be the date of enforcement of the forfeiture remedy.<br />

<br />

(2) The provisions of ORS 93.935 and 93.940 shall apply to all contracts for transfer or conveyance of an interest in real property, whether executed on, before or after July 13, 1985. [1985 c.718 §§9,10]<br />

<br />

OREGON CASE LAW<br />

<br />

Under a land sale contract, the seller agrees by contract to convey title upon receipt of the full purchase price, but the buyer has the right to possession before the price is paid. The contract remains in existence for a substantial term before the buyer completes payment. The buyer generally will make installment payments during this term. In effect, the buyer borrows the purchase price from the seller.. If the buyer defaults on an installment payment, the seller has the right to declare the contract at an end, repossess the property, and retain any payments made to date. Bedortha v. Sunridge Land Co. 312 Ore. 307, (1991)<br />

<br />

The land sale contract is an effective method of real property financing because the vendor’s right to receive contract payments is secured by the right to possession of the property if the purchaser fails to make payments timely.Id.<br />

<br />

Parties to a breached land sale contract may choose to seek rescission, specific performance, or contract damages. Rescission and specific performance claims involve equitable principles of justice and fairness and a weighing of the relative responsibility of the parties. However, if a party elects a legal remedy for breach of a land sale contract, contract principles apply. Combs v. Loebner, 315 Ore. 444 (1993)<br />

<br />

The burden is upon the defendant purchasers to allege and prove that they were purchasers for valuable consideration, without notice of the equitable claim of the plaintiff. Nelson v. Hughs, 290 Ore.653 (1981)

© Copyright 1997-2016 US Legal, Inc.

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 93 - CONVEYANCING AND RECORDING

93.010 Conveyances, how made.

Conveyances of lands, or of any estate or interest therein, may be made by deed, signed by the person of lawful age from whom the estate or interest is intended to pass, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded without any other act or ceremony. No seal of the grantor, corporate or otherwise, shall be required on the deed. [Amended by 1965 c.502 §4]

93.020 Creating, transferring or declaring estates or interests in realty.

(1) No estate or interest in real property, other than a lease for term not exceeding one year, nor any trust or power concerning such property, can be created, transferred or declared otherwise than by operation of law or by a conveyance or other instrument in writing, subscribed by the party creating, transferring or declaring it, or by the lawful agent of the party under written authority, and executed with such formalities as are required by law.

(2) This section does not affect the power of a testator in the disposition of real property by a last will and testament, nor to prevent a trust from arising or being extinguished by implication or operation of law, nor to affect the power of a court to compel the specific performance of an agreement in relation to such property.

93.030 Contracts to convey, instruments of conveyance and related memoranda to state consideration.

(1) As used in this section, "consideration" includes the amount of cash and the amount of any lien, mortgage, contract, indebtedness or other encumbrance existing against the property to which the property remains subject or which the purchaser agrees to pay or assume.

(2) All instruments conveying or contracting to convey fee title to any real estate, and all memoranda of such instruments, shall state on the face of the instruments the true and actual consideration paid for the transfer, stated in terms of dollars. However, if the actual consideration consists of or includes other property or other value given or promised, neither the monetary value nor a description of the other property or value need be stated so long as it is noted on the face of the instrument that other property or value was either part or the whole consideration.

(3) The statement of consideration as required by subsection (2) of this section shall be made by a grantor or a grantee. Failure to make such statement does not invalidate the conveyance.

(4) If the statement of consideration is in the body of the instrument preceding the signatures, execution of the instrument shall constitute a certification of the truth of the statement. If there is a separate statement of consideration on the face of the instrument, it shall be signed separately from the instrument, and such execution shall constitute a certification of the truth of the statement by the person signing. A particular form is not required for the statement so long as the requirements of this section are reasonably met.

(5) An instrument conveying or contracting to convey fee title to any real estate or a memorandum of the instrument may not be accepted for recording by any county clerk or recording officer in this state unless the statement of consideration required by this section is included on the face of the instrument.

(6) A transfer of death deed and an instrument revoking a transfer of death deed are not instruments subject to this section. [1967 c.462 §§1,3; 1967 s.s. c.7 §1; 1977 c.605 §1; 1999 c.654 §7; 2011 c.212 §23]

93.040 Mandatory statements for sales agreements, earnest money receipts or other instruments for conveyance of fee title to real property; liability of drafter and recorder.

(1) The following statement shall be included in the body of an instrument transferring or contracting to transfer fee title to real property except for owner's sale agreements or earnest money receipts, or both, as provided in subsection (2) of this section: "BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON'S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010. THIS INSTRUMENT DOES NOT ALLOW USE OF THE PROPERTY DESCRIBED IN THIS INSTRUMENT IN VIOLATION OF APPLICABLE LAND USE LAWS AND REGULATIONS. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO DETERMINE ANY LIMITS ON LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010."

(2) In all owner's sale agreements and earnest money receipts, there shall be included in the body of the instrument the following statement: "THE PROPERTY DESCRIBED IN THIS INSTRUMENT MAY NOT BE WITHIN A FIRE PROTECTION DISTRICT PROTECTING STRUCTURES. THE PROPERTY IS SUBJECT TO LAND USE LAWS AND REGULATIONS THAT, IN FARM OR FOREST ZONES, MAY NOT AUTHORIZE CONSTRUCTION OR SITING OF A RESIDENCE AND THAT LIMIT LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, IN ALL ZONES. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON'S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO VERIFY THE EXISTENCE OF FIRE PROTECTION FOR STRUCTURES AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010."

(3) In all owners' sale agreements and earnest money receipts subject to ORS 358.505, there shall be included in the body of the instrument or by addendum the following statement: "THE PROPERTY DESCRIBED IN THIS INSTRUMENT IS SUBJECT TO SPECIAL ASSESSMENT UNDER ORS 358.505."

(4) An action may not be maintained against the county recording officer for recording an instrument that does not contain the statement required in subsection (1) or (2) of this section.

(5) An action may not be maintained against any person for failure to include in the instrument the statement required in subsection (1) or (2) of this section, or for recording an instrument that does not contain the

USLegal Home

Information

Services

Products

Log In

Help

About

Privacy Policy

USLegal

LEGAL HELP

Toggle navigation

Questions: Add/Edit Answer

Live (Public):

No Yes

Email:

Author Email

First Name:

Author First Name

Last Name:

Author Last Name

Home Phone:

Author Home Phone

Cell Phone:

Author Cell Phone

Work Phone:

Author Work Phone

Legal Question:

Question Text

Heading:

Question Title

Assign To:

Category:

State:

Answer Date:

Notify Author:

Notify Author by Email on Answer

Answer:

statement required in subsection (1) or (2) of this section, unless the person acquiring or agreeing to acquire fee title to the real property would not have executed or accepted the instrument but for the absence in the instrument of the statement required by subsection (1) or (2) of this section. An action may not be maintained by the person acquiring or agreeing to acquire fee title to the real property against any person other than the person transferring or contracting to transfer fee title to the real property.<br />

<br />

(6) A transfer of death deed and an instrument revoking a transfer of death deed are not instruments subject to this section. [1983 c.718 §2; 1985 c.719 §1; 1989 c.366 §1; 1993 c.792 §40; 1995 c.5 §17; 2005 c.311 §1; 2007 c.424 §23; 2007 c.866 §7; 2009 c.892 §19; 2011 c.212 §24]<br />

<br />

93.050 Gift or conveyance of life estate.<br />

<br />

A gift or conveyance of property under deed or other writing executed after June 30, 1993, to any person for the term of the life of the person, and after the death of the person to the children or heirs of the person, vests an estate or interest for life only in the grantee or person receiving the gift or conveyance, and remainder in the children or heirs. [1991 c.850 §3]<br />

<br />

OREGON STATUTES<br />

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS<br />

CHAPTER 93 — CONVEYANCING AND RECORDING<br />

SPECIAL MATTERS IN PARTICULAR CONVEYANCES<br />

<br />

93.110 Quitclaim deed sufficient to pass estate.<br />

<br />

A deed of quitclaim and release, of the form in common use, is sufficient to pass all the estate which the grantor could lawfully convey by a deed of bargain and sale.<br />

<br />

93.120 Words of inheritance unnecessary to convey fee; conveyances deemed to convey all grantor’s estate.<br />

<br />

The term “heirs,” or other words of inheritance, is not necessary to create or convey an estate in fee simple. Any conveyance of real estate passes all the estate of the grantor, unless the intent to pass a lesser estate appears by express terms, or is necessarily implied in the terms of the grant.<br />

<br />

93.130 Conveyance of land in adverse possession of another.<br />

<br />

No grant or conveyance of lands or interest therein is void for the reason that at the time of its execution the lands were in the actual possession of another claiming adversely.<br />

<br />

93.140 Implied covenants.<br />

<br />

No covenant shall be implied in any conveyance of real estate, whether it contains special covenants or not, except as provided by ORS 93.850 to 93.870. [Amended by 1973 c.194 §6]<br />

<br />

93.150 Conveyance by tenant of greater estate than that possessed.<br />

<br />

A conveyance made by a tenant for life or years, purporting to grant a greater estate than the tenant possesses or could lawfully convey, does not work a forfeiture of the estate of the tenant, but passes to the grantee all the estate which the tenant could lawfully convey.<br />

<br />

93.160 Conveyance by reversioners and remainderpersons to life tenant vests fee.<br />

<br />

When real property has been devised to a person for life, and in case of the death of the life tenant without leaving lawful issue born alive and living at the time of death, then to other heirs of the testator, a conveyance to the life tenant from all reversioners or remainderpersons and all issue of the life tenant as are in being, of all their interest in the real property, vests a fee simple estate in the life tenant. [Amended by 2003 c.14 §35]<br />

<br />

93.180 Forms of tenancy in conveyance or devise to two or more persons.<br />

<br />

(1) A conveyance or devise of real property, or an interest in real property, that is made to two or more persons:<br />

<br />

(a) Creates a tenancy in common unless the conveyance or devise clearly and expressly declares that the grantees or devisees take the real property with right of survivorship.<br />

<br />

(b) Creates a tenancy by the entirety if the conveyance or devise is to spouses married to each other unless the conveyance or devise clearly and expressly declares otherwise.<br />

<br />

(c) Creates a joint tenancy as described in ORS 93.190 if the conveyance or devise is to a trustee or personal representative.<br />

<br />

(2) A declaration of a right to survivorship creates a tenancy in common in the life estate with cross-contingent remainders in the fee simple.<br />

<br />

(3) Except as provided in ORS 93.190, joint tenancy in real property is abolished and the use in a conveyance or devise of the words “joint tenants” or similar words without any other indication of an intent to create a right of survivorship creates a tenancy in common. [Amended by 1983 c.555 §1; 2007 c.64 §1; 2015 c.629 §5]<br />

<br />

93.210 Presumption respecting deed from trustee of undisclosed beneficiary.<br />

<br />

If a deed to real estate has been made to a grantee in trust or designating the grantee as trustee, and no beneficiary is indicated or named in the deed, a deed thereafter executed by such grantee conveying the property is presumed to have been executed with full right and authority and conveys prima facie title to the property. The grantee in the last-mentioned deed is under no duty whatsoever to see to the application of the purchase price. If the last-mentioned deed is recorded after June 7, 1937, after five years from its recording or, if it was recorded prior to June 7, 1937, then after June 7, 1942, the presumption is conclusive as to any undisclosed beneficiary and the title to the real estate, based upon the last-mentioned deed, shall not be called in question by any one claiming as beneficiary under the first-mentioned deed.<br />

<br />

93.220 Release, limitation or restriction of power of appointment.<br />

<br />

(1) Any person to whom there has been granted or reserved any power of appointment or other power by which the person may elect to take any action affecting the disposition of property may at any time release, or, from time to time, limit or restrict such power in whole or in part by an instrument in writing evidencing that purpose and subscribed by the person.<br />

<br />

(2) If the power is one to affect title to real property, the instrument shall be executed, acknowledged, proved and recorded, or filed with the registrar of title in each county in which the land is situated in the same manner as a conveyance of real property.<br />

<br />

(3) If the power is of such nature that its exercise may affect the duty of any trustee or other fiduciary, such trustee or other fiduciary is not bound to take notice thereof unless the trustee or other fiduciary has received the original or an executed duplicate of the release or a copy thereof certified by the county clerk or county recorder of the county in which it has been recorded.<br />

<br />

93.230 Copy of Department of State Lands deed or patent given when original lost.<br />

<br />

(1) If parties to whom deeds have been issued by the Department of State Lands have lost such deeds before they were placed on record in the county wherein the land conveyed is located, the Director of the Department of State Lands, on application of the party entitled thereto, shall cause a certified copy of the record of the deed in the office of the department to be issued under its seal.<br />

<br />

(2) If parties to whom patents for lands have been issued by the United States for lands in the State of Oregon have lost such patents before they were placed on record in the county wherein the land conveyed is located, such parties, or their successors in interest, may apply to and obtain from the Bureau of Land Management, or its successor agency, copies of the records of such patents, duly certified to be correct copies of the original patents, or of the record thereof, by the appropriate federal officer.<br />

<br />

(3) Every certified copy issued in accordance with subsection (1) or (2) of this section is entitled to record in the proper county with like effect as the original deed or patent. Every such copy so certified may be read in evidence in any court in this state without further proof thereof. The record of any such certified copy, or a transcript thereof certified by the county clerk in whose office it may have been recorded, may be read in evidence in any court in this state with like effect as the original thereof or the original lost deed or patent. [Amended by 1967 c.421 §197]<br />

<br />

93.240 Rights to deferred installments of purchase price where two or more persons join as sellers of real property.<br />

<br />

(1) Subject to the provisions contained in this section, whenever two or more persons join as sellers in the execution of a contract of sale of real property or sell and convey title to real property in exchange for a note for all or a part of the purchase price secured by either a mortgage or trust deed on the real property, unless a contrary purpose is expressed in the contract, note, mortgage or trust deed, the right to receive payment of deferred installments of the purchase price and the mortgage or trust deed, shall be owned by them in the same proportions, and with the same incidents, as title to the real property was vested in them immediately preceding the execution of the contract of sale or conveyance.<br />

<br />

(2) If immediately prior to the execution of a contract of sale of real property, or a sale or conveyance of title to real property in exchange for a note for all or a part of the purchase price secured by a mortgage or trust deed on the real property, title to any interest in the property therein described was vested in the sellers or some of the sellers as tenants by the entirety or was otherwise subject to any right of survivorship, then, unless a contrary purpose is expressed in the contract, note, mortgage or trust deed, the right to receive payment of deferred installments of the purchase price of the property and the mortgage and trust deed shall likewise be subject to like rights of survivorship. [1957 c.402 §§1,2; 1969 c.591 §276; 1989 c.74 §1; 1997 c.99 §21]<br />

<br />

93.250 Effect of conveyance creating fee simple conditional or fee tail.<br />

<br />

Every conveyance or devise of lands, or interest therein, made subsequent to September 9, 1971, using language appropriate to create a fee simple conditional or fee tail estate shall create an estate in fee simple absolute in the grantees or devisees of such conveyances or devises. Any future interest limited upon such an interest is a limitation upon the fee simple absolute and its validity is determined accordingly. [1971 c.382 §1]<br />

<br />

93.260 Tax statement information required in conveyancing instrument.<br />

<br />

(1) All instruments prepared for the purpose of conveying or contracting to convey fee title to any real estate shall contain on the face of such instruments a statement in substantially the following form:<br />

<br />

Until a change is requested, all tax statements shall be sent to the following address:<br />

<br />

(2) Failure to contain the statement required by this section does not invalidate the conveyance and if an instrument is recorded without the statement required by this section, the recording is valid.<br />

<br />

(3) This section applies to all instruments executed after January 1, 1974. [1973 c.422 §2]<br />

<br />

93.270 Certain discriminatory restrictions in conveyancing instruments prohibited; restriction on right of action.<br />

<br />

(1) A person conveying or contracting to convey fee title to real property may not include in an instrument for that purpose a provision:<br />

<br />

(a) Restricting the use of the real property by any person or group of persons by reason of race, color, religion, sex, sexual orientation, national origin or disability.<br />

<br />

(b) Restricting the use of the real property by any home or facility that is licensed under ORS 443.400 to 443.455 or 443.705 to 443.825 to provide residential care alone or in conjunction with treatment or training or a combination thereof.<br />

<br />

(2) Any provision in an instrument executed in violation of subsection (1) of this section is void and unenforceable.<br />

<br />

(3) An instrument that contains a provision restricting the use of real property in a manner listed in subsection (1)(b) of this section does not give rise to any public or private right of action to enforce the restriction.<br />

<br />

(4)(a) An instrument that contains a provision restricting the use of real property by requiring roofing materials with a lower fire rating than that required in the state building code established under ORS chapter 455 does not give rise to any public or private right of action to enforce the restriction in an area determined by a local jurisdiction as a wildfire hazard zone. Prohibitions on public or private right of action under this paragraph are limited solely to considerations of fire rating.<br />

<br />