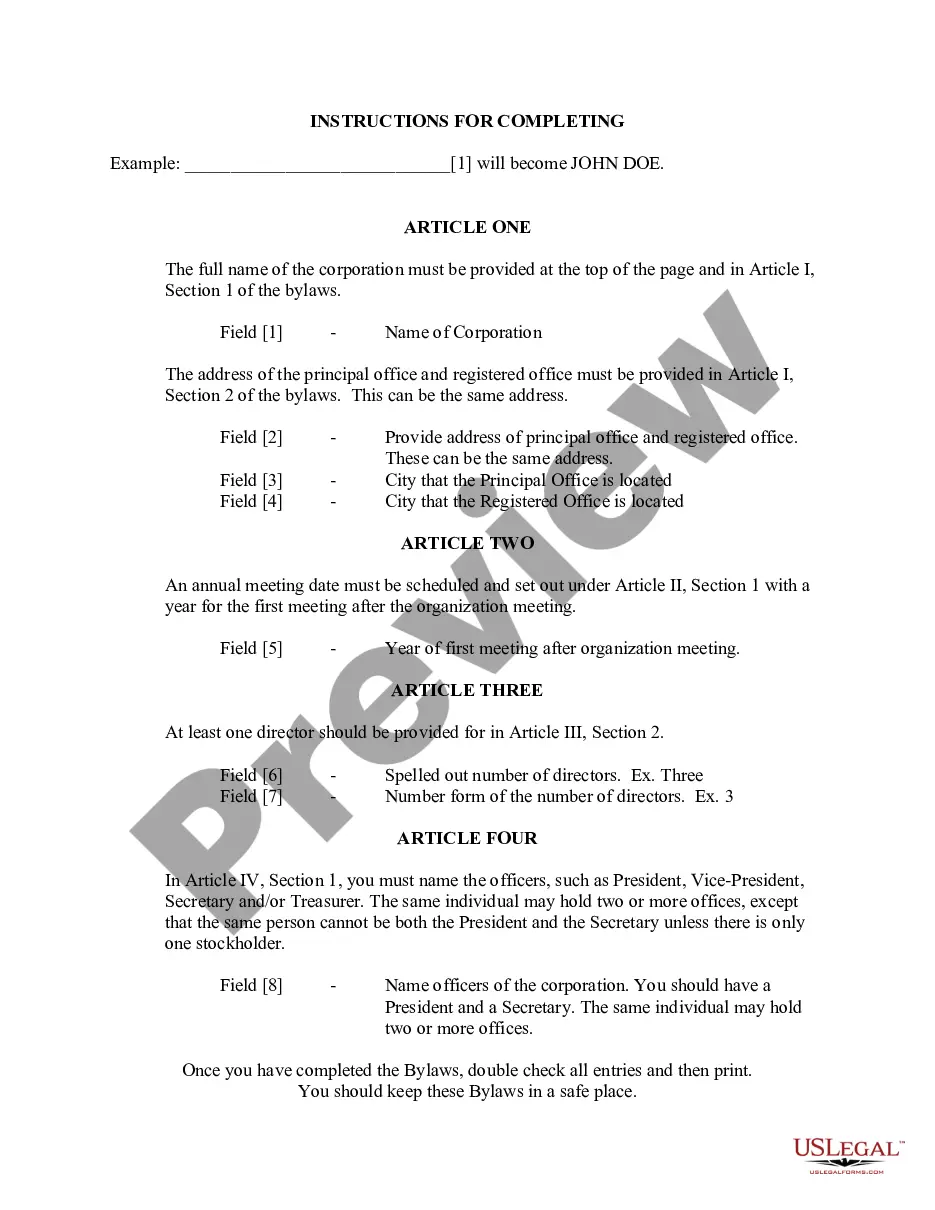

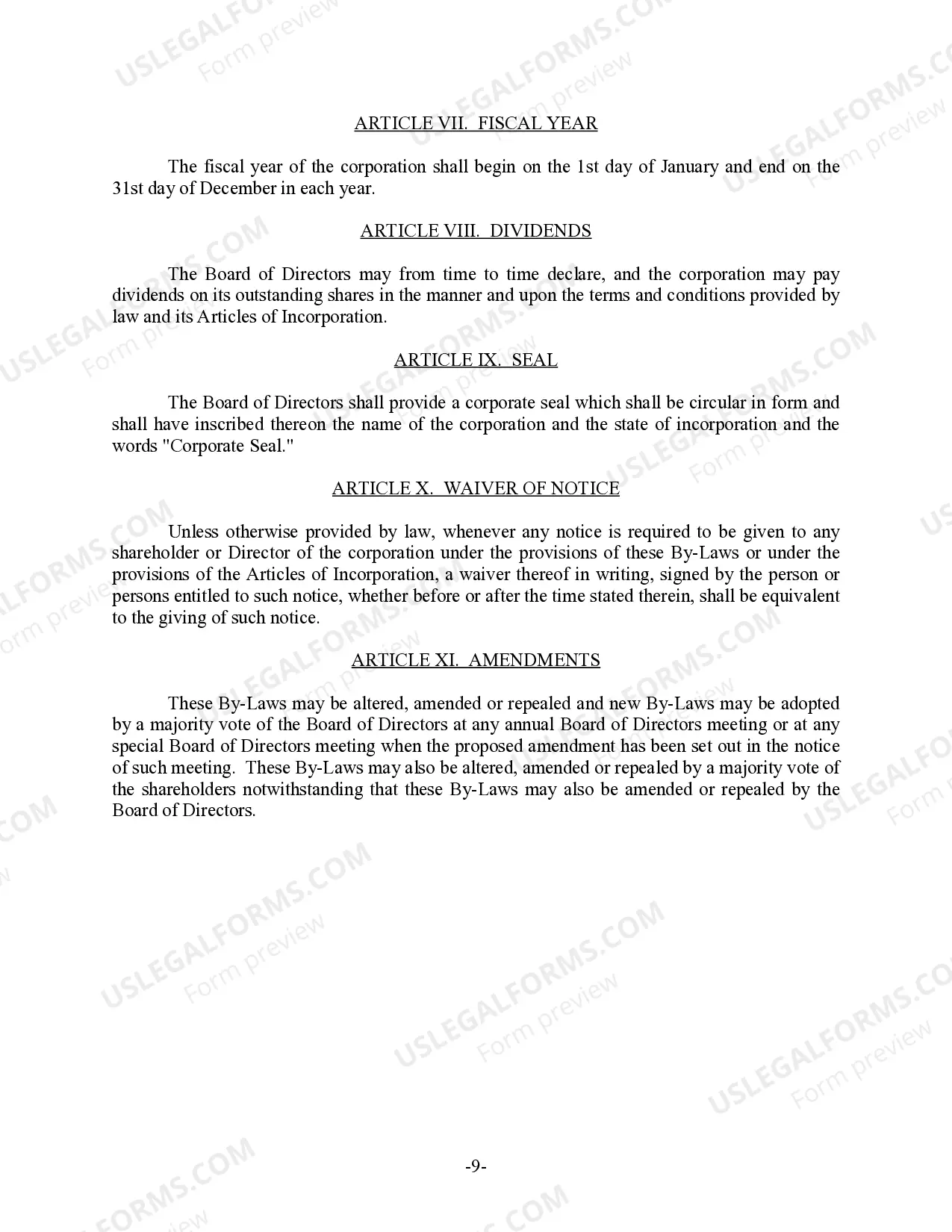

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more.

The Eugene Oregon Bylaws for Corporation outline the legal framework and rules governing the operations of corporations within the city. These bylaws serve as a guide for corporate governance, internal operations, and decision-making processes. Adhering to these bylaws ensures transparency, accountability, and compliance with local laws and regulations. Key components of the Eugene Oregon Bylaws for Corporation include provisions related to the structure and composition of the board of directors, shareholders' rights and responsibilities, financial management, voting procedures, stock issuance, and dispute resolution mechanisms. The bylaws typically cover important aspects such as meetings, quorum requirements, officer roles and responsibilities, asset management, amendments, and more. Eugene Oregon offers various types of bylaws for corporations, allowing businesses to choose a structure that best suits their needs and goals. Some common types of corporation bylaws include: 1. General Corporation Bylaws: These bylaws establish the basic framework for all types of corporations, outlining fundamental operating procedures and rules that apply to most businesses. 2. Nonprofit Corporation Bylaws: Designed for nonprofit organizations, these bylaws provide guidelines specific to nonprofits, including the purpose and mission statement, board composition, membership requirements, fundraising, and compliance with tax-exempt status. 3. Close Corporation Bylaws: These bylaws are geared towards small, closely-held corporations, often family-owned or held by a limited number of stakeholders. Close corporation bylaws offer greater flexibility in decision-making, stock transfers, and corporate governance. 4. Professional Corporation Bylaws: Tailored for licensed professionals such as doctors, lawyers, or accountants, these bylaws address industry-specific regulations and requirements. 5. Benefit Corporation Bylaws: With a focus on social and environmental impact, these bylaws are intended for corporations seeking to pursue both profit and a public benefit. They detail the corporation's commitment to achieving specific beneficial goals and provide guidelines for reporting and maintaining such benefits. It is important for businesses operating in Eugene, Oregon, to carefully consider and draft their corporation bylaws in accordance with local laws and regulations. Seeking legal advice or consulting with a professional familiar with Eugene Oregon's corporate guidelines can assist in ensuring compliance and tailoring the bylaws to the unique needs of the corporation.The Eugene Oregon Bylaws for Corporation outline the legal framework and rules governing the operations of corporations within the city. These bylaws serve as a guide for corporate governance, internal operations, and decision-making processes. Adhering to these bylaws ensures transparency, accountability, and compliance with local laws and regulations. Key components of the Eugene Oregon Bylaws for Corporation include provisions related to the structure and composition of the board of directors, shareholders' rights and responsibilities, financial management, voting procedures, stock issuance, and dispute resolution mechanisms. The bylaws typically cover important aspects such as meetings, quorum requirements, officer roles and responsibilities, asset management, amendments, and more. Eugene Oregon offers various types of bylaws for corporations, allowing businesses to choose a structure that best suits their needs and goals. Some common types of corporation bylaws include: 1. General Corporation Bylaws: These bylaws establish the basic framework for all types of corporations, outlining fundamental operating procedures and rules that apply to most businesses. 2. Nonprofit Corporation Bylaws: Designed for nonprofit organizations, these bylaws provide guidelines specific to nonprofits, including the purpose and mission statement, board composition, membership requirements, fundraising, and compliance with tax-exempt status. 3. Close Corporation Bylaws: These bylaws are geared towards small, closely-held corporations, often family-owned or held by a limited number of stakeholders. Close corporation bylaws offer greater flexibility in decision-making, stock transfers, and corporate governance. 4. Professional Corporation Bylaws: Tailored for licensed professionals such as doctors, lawyers, or accountants, these bylaws address industry-specific regulations and requirements. 5. Benefit Corporation Bylaws: With a focus on social and environmental impact, these bylaws are intended for corporations seeking to pursue both profit and a public benefit. They detail the corporation's commitment to achieving specific beneficial goals and provide guidelines for reporting and maintaining such benefits. It is important for businesses operating in Eugene, Oregon, to carefully consider and draft their corporation bylaws in accordance with local laws and regulations. Seeking legal advice or consulting with a professional familiar with Eugene Oregon's corporate guidelines can assist in ensuring compliance and tailoring the bylaws to the unique needs of the corporation.