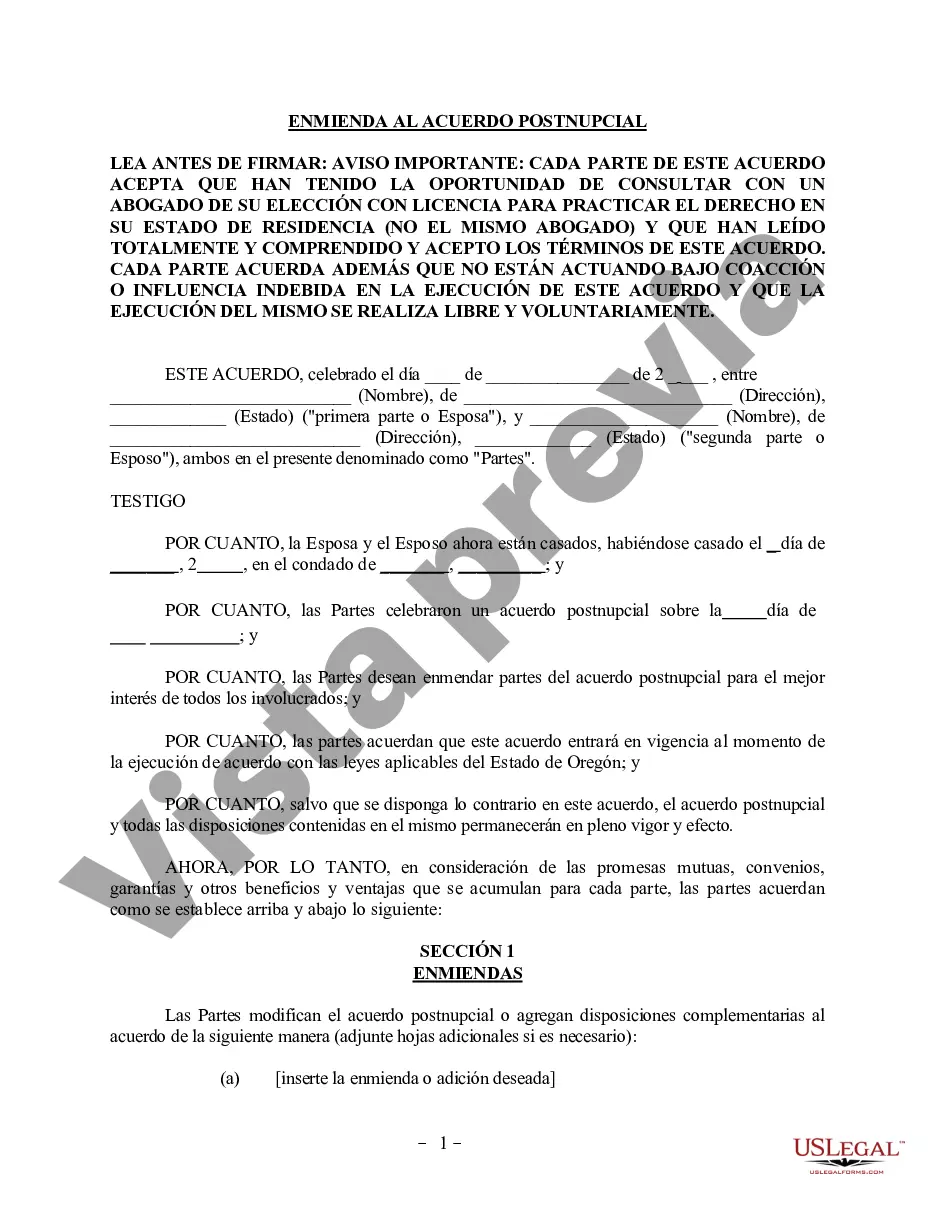

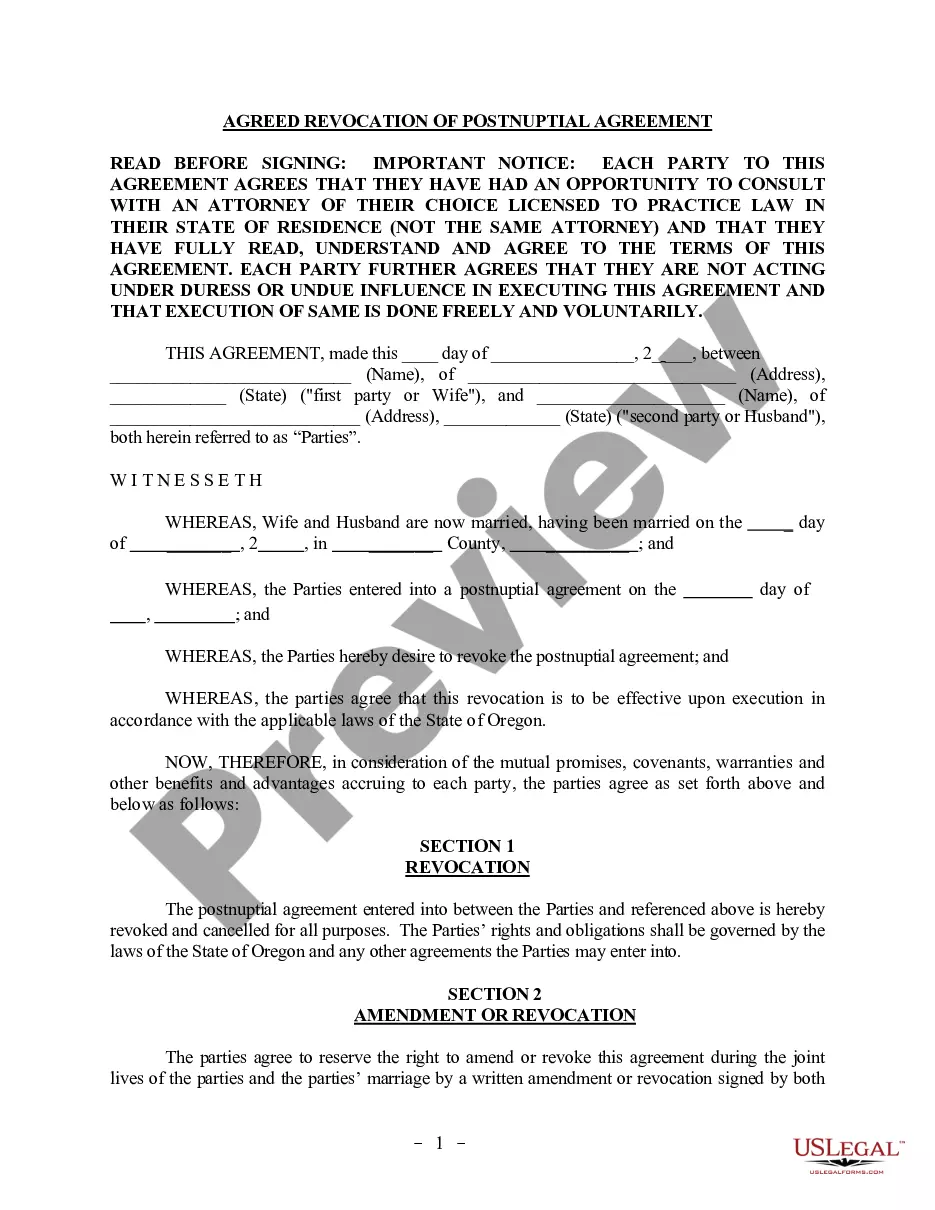

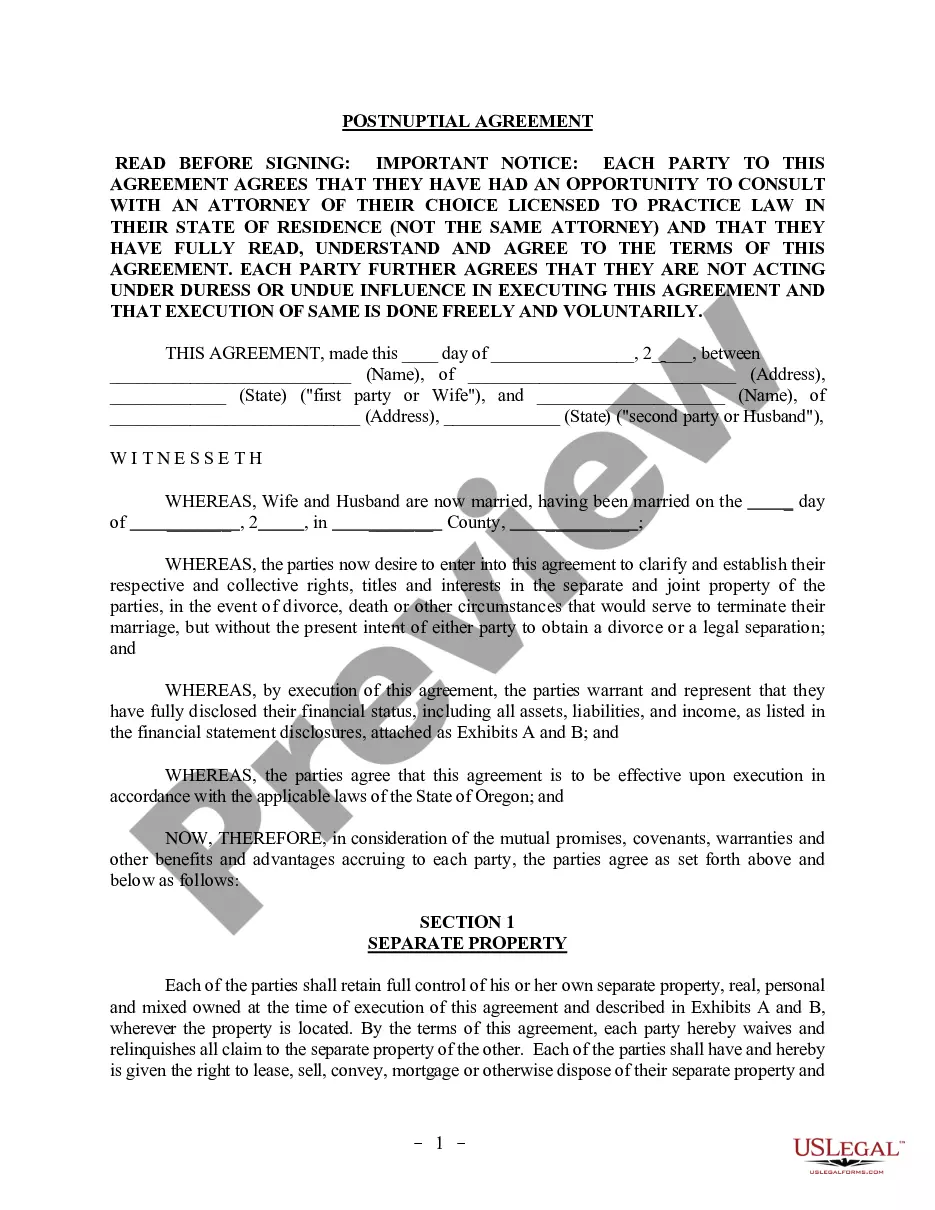

The Gresham Amendment to Postnuptial Property Agreement in Oregon is an important aspect of family law that addresses the division and distribution of assets and debts between spouses. It allows couples to modify a postnuptial agreement to reflect changes in their financial situation or to clarify certain aspects of property ownership. The Gresham Amendment is named after the city of Gresham in Oregon, where it originated. It is a popular option for couples in Oregon to tailor their postnuptial agreements to their specific needs. The amendment provides a detailed framework for couples to adjust the terms of their postnuptial agreement relating to property rights. It allows them to define how assets acquired during the course of the marriage will be divided in case of divorce or separation. This includes real estate, investments, retirement accounts, businesses, and personal belongings. Furthermore, the Gresham Amendment also addresses the division of debts, including mortgages, loans, credit card debts, and other financial obligations that the couple may have incurred together. It ensures that both parties have a clear understanding of their financial responsibilities and can protect themselves in the event of a divorce or separation. There are several types of Gresham Amendment to Postnuptial Property Agreement in Oregon, depending on the specific circumstances and needs of the couple. Some common types include: 1. Inheritance Protection: This type of amendment can be added to protect inheritances received by one spouse during the marriage, ensuring it remains separate property in case of divorce. 2. Business Ownership: Couples who own a business together may use this amendment to specify the division of assets in the event of a separation or divorce, including how the business will be valued and potentially divided. 3. Debt Allocation: This type of amendment allows couples to assign responsibility for certain debts, such as student loans or credit card debts, to one spouse or the other, ensuring that each party is accountable for their own financial obligations. 4. Real Estate Division: Couples who own multiple properties may use this amendment to define how these properties will be divided or distributed in the event of a divorce or separation. 5. Asset Protection: This type of amendment helps protect specific assets, such as investments or retirement accounts, from being considered marital property and subject to division upon divorce. In summary, the Gresham Amendment to Postnuptial Property Agreement in Oregon is a valuable legal tool for couples to modify their postnuptial agreement according to their evolving financial circumstances. It enables them to tailor their property division and debt allocation, providing clarity and protection while promoting fairness and the preservation of individual rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gresham Oregon Enmienda al Acuerdo de propiedad posnupcial - Oregón - Oregon Amendment to Postnuptial Property Agreement

Description

How to fill out Gresham Oregon Enmienda Al Acuerdo De Propiedad Posnupcial - Oregón?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Gresham Amendment to Postnuptial Property Agreement - Oregon gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Gresham Amendment to Postnuptial Property Agreement - Oregon takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Gresham Amendment to Postnuptial Property Agreement - Oregon. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!