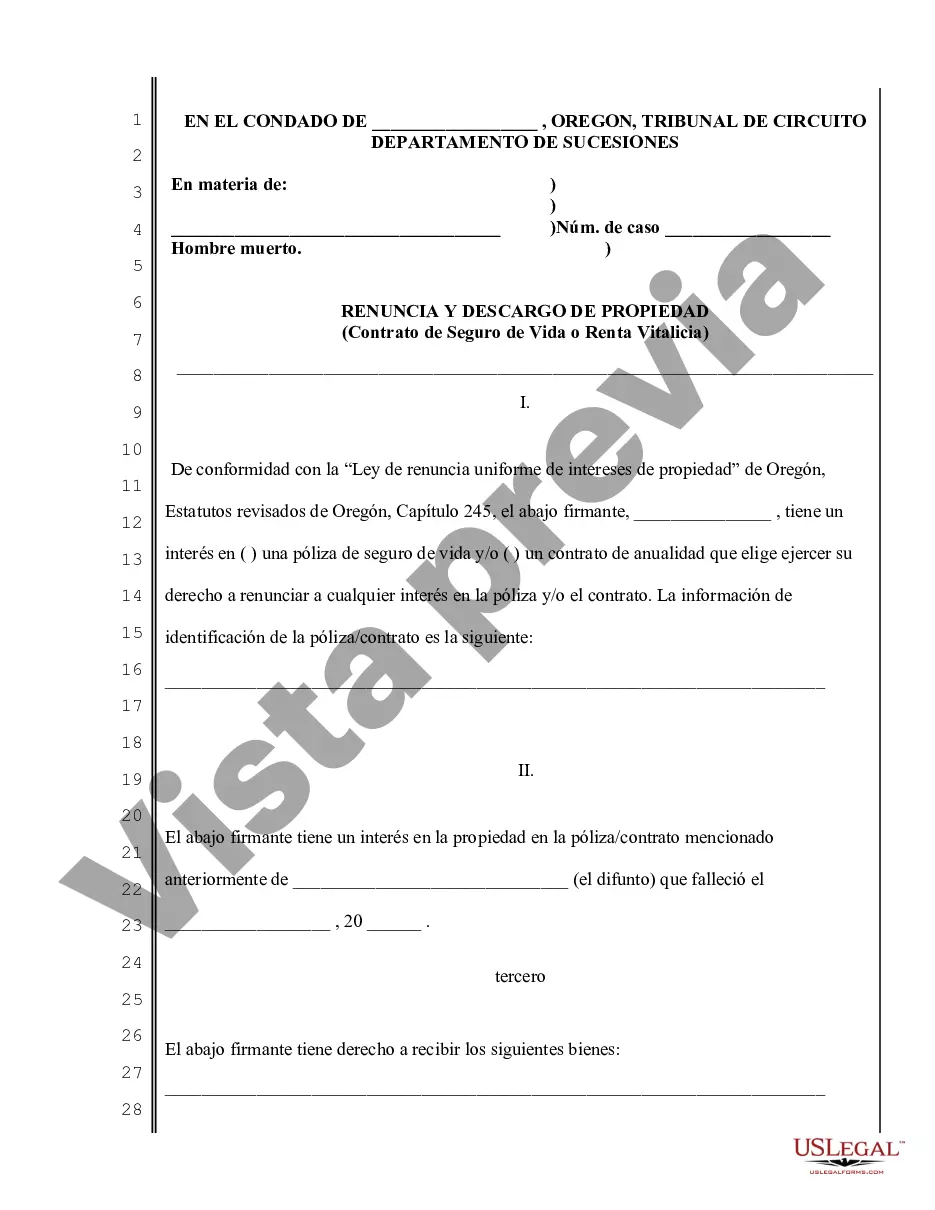

Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia

Disclaimer of Property Interest-Oregon

Oregon Revised Statutes

Chapter 245 Intestate Succession and Wills

Uniform Disclaimer of Property Interests Act

Effective date January 1, 2002

Short Title:

Sections 1 to 18 may be cited as the Uniform Disclaimer of Property

Interests Act. Chapter 245, §1

Definitions:

As used in sections 1 to 18 of this 2001 Act:

(1) "Disclaimant" means the person to whom a disclaimed

interest or power would have passed had the disclaimer not been made.

(2) "Disclaimed interest" means the interest that would have passed

to the disclaimant had the disclaimer not been made.

(3) "Disclaimer" means the refusal to accept an interest in property

or a power over property.

(4) "Fiduciary" means a personal representative, trustee, agent

acting under a power of attorney or other person authorized to act as a

fiduciary with respect to the property of another person.

(5) "Jointly held property" means property held in the name of

two or more persons under an arrangement pursuant to which:

(6) "Person" means an individual, corporation, business trust, estate,

trust, partnership, limited liability company, association, joint venture,

government, governmental subdivision, agency, public corporation or any

other legal or commercial entity.

(7) "State" means a state of the United States, the District of

Columbia, Puerto Rico, the United States Virgin Islands or any territory

or insular possession subject to the jurisdiction of the United States.

The term includes an Indian tribe or band, or Alaskan native village, recognized

by federal law or formally acknowledged by another state.

(8) "Trust" means:

(a) A charitable or noncharitable express trust, including

any additions made to the trust, whenever and however created; and

(b) A trust created pursuant to a statute, judgment or decree that

requires the trust to be administered in the same manner as an express

trust. Chapter 245, §2

Scope:

Sections 1 to 18 of this 2001 Act apply to disclaimers of any interest

in or power over property without regard to when the interest or power

that is disclaimed was created. Chapter 245, §3

Effect on other law:

(1) Unless displaced by a provision of sections 1 to 18

of this 2001 Act, the principles of law and equity supplement sections

1 to 18 of this 2001 Act.

(2) Sections 1 to 18 of this 2001 Act do not limit any right of

a person to waive, release, disclaim or renounce an interest in property,

or power over property, under a law other than sections 1 to 18 of this

2001 Act. Chapter 245, §4

Power to disclaim; general requirements; when irrevocable:

(1) A person may disclaim, in whole or part, any interest

in property or any power over property, including a power of appointment.

A person may disclaim the interest or power even if the person who created

the interest or power imposed a spendthrift provision or similar restriction

on transfer or imposed a restriction or limitation on the right to disclaim.

(2) Except to the extent that a fiduciary's right to disclaim is

expressly restricted or limited by another statute of this state or by

the instrument creating the fiduciary relationship, a fiduciary may disclaim,

in whole or part, any interest in property or power over property, including

a power of appointment, without regard to whether the fiduciary is acting

in a personal or representative capacity. A fiduciary may disclaim the

interest or power even if the creator of the interest or power imposed

a spendthrift provision or similar restriction on transfer or a restriction

or limitation on the right to disclaim, or an instrument other than the

instrument that created the fiduciary relationship imposed a restriction

or limitation on the right to disclaim.

(3) To be effective, a disclaimer must:

(a) Be in writing or otherwise recorded by inscription

on a tangible medium or by storage in an electronic or other medium in

a manner that allows the disclaimer to be retrieved in perceivable form;

(4) A partial disclaimer may be expressed as a fraction, percentage,

monetary amount, term of years, limitation of a power or as any other interest

or estate in the property.

(5) A disclaimer is irrevocable when the disclaimer is delivered

or filed pursuant to section 12 of this 2001 Act or when the disclaimer

becomes effective as provided in sections 6 to 11 of this 2001 Act, whichever

occurs later.

(6) A disclaimer made under sections 1 to 18 of this 2001 Act is

not a transfer, assignment or release. Chapter 245, §5

Disclaimer of interest in property:

(1) For the purposes of this section:

(a) "Time of distribution" means the time when a disclaimed interest

would have taken effect through possession or enjoyment.

(b) "Future interest" means an interest that takes effect through

possession or enjoyment, if at all, at a time later than the time that

the interest is created.

(2) Except for a disclaimer governed by section 7 or 8 of this

2001 Act, the following rules apply to a disclaimer of an interest in property:

(a) The disclaimer takes effect when the instrument creating the

interest becomes irrevocable or, if the interest arises under the law of

intestate succession, when the decedent dies.

(b) The disclaimed interest passes according to any provision in

the instrument creating the interest providing for the disposition of the

specific interest in the event the interest is disclaimed, or according

to any provision in the instrument creating the interest providing for

the disposition of interests in general in the event the interests created

by the instrument are disclaimed.

(c) If the instrument creating the interest does not contain a

provision described in subsection (2) of this section, the following rules

apply:

(A) If the disclaimant is an individual, the disclaimed interest

passes as if the disclaimant had died immediately before the time of distribution.

However, if by law or under the instrument the descendants of the disclaimant

would share in the disclaimed interest by any method of representation

had the disclaimant died before the time of distribution, the disclaimed

interest passes only to the descendants of the disclaimant who survive

the time of distribution.

(d) Upon the disclaimer of a preceding interest, a future interest

held by a person other than the disclaimant takes effect as if the disclaimant

had died or ceased to exist immediately before the time of distribution,

but a future interest held by the disclaimant is not accelerated in possession

or enjoyment. Chapter 245, §6

Disclaimer of rights of survivorship in jointly held property:

(1) Upon the death of a holder of jointly held property,

a surviving holder may disclaim, in whole or part, the greater of:

(a) A fractional share of the property determined by dividing

the number one by the number of joint holders alive immediately before

the death of the holder to whose death the disclaimer relates; or

(b) All of the property except that part of the value of the entire

interest attributable to the contribution furnished by the disclaimant.

(2) A disclaimer under subsection (1) of this section takes effect

upon the death of the holder of jointly held property to whose death the

disclaimer relates.

(3) An interest in jointly held property disclaimed by a surviving

holder of the property passes as if the disclaimant predeceased the holder

to whose death the disclaimer relates. Chapter 245, §7

Disclaimer of interest by trustee:

If a trustee disclaims an interest in property that otherwise would

have become trust property, the interest does not become trust property.

Chapter 245, §8

Disclaimer of power of appointment or other power not held in

fiduciary capacity:

If a holder disclaims a power of appointment or other power

not held in a fiduciary capacity, the following rules apply:

(1) If the holder has not exercised the power, the disclaimer

takes effect as of the time the instrument creating the power becomes irrevocable.

(2) If the holder has exercised the power and the disclaimer is

of a power other than a presently exercisable general power of appointment,

the disclaimer takes effect immediately after the last exercise of the

power.

(3) The instrument creating the power is construed as if the power

expired when the disclaimer became effective. Chapter 245, §9

Disclaimer by appointee, object or taker in default of exercise

of power of appointment:

(1) A disclaimer of an interest in property by an appointee

of a power of appointment takes effect as of the time the instrument by

which the holder exercises the power becomes irrevocable.

(2) A disclaimer of an interest in property by a person who is

an object of an exercise of a power of appointment, or by a person who

is a taker in default of an exercise of a power of appointment, takes effect

as of the time the instrument creating the power becomes irrevocable.

Chapter 245, §10

Disclaimer of power held in fiduciary capacity:

(1) If a fiduciary disclaims a power held in a fiduciary

capacity that has not been exercised, the disclaimer takes effect as of the time the instrument creating the power becomes

irrevocable.

(2) If a fiduciary disclaims a power held in a fiduciary capacity

that has been exercised, the disclaimer takes effect immediately after

the last exercise of the power.

(3) A disclaimer under this section applies to another fiduciary

if the disclaimer so provides and the fiduciary disclaiming has the authority

to bind the estate, trust or other person for whom the fiduciary is acting.

Chapter 245, §11

Delivery or filing:

(1) As used in this section, "beneficiary designation"

means an instrument, other than an instrument creating a trust, naming

the beneficiary of:

(d) A pension, profit-sharing, retirement or other employment-related

benefit plan; or

(2) Subject to subsections (3) to (12) of this section, delivery of

a disclaimer may be made by personal delivery, first class mail or any

other method likely to result in receipt of the disclaimer.

(3) If the interest to be disclaimed is created under the law of

intestate succession or an interest created by will, other than an interest

in a testamentary trust:

(b) If a personal representative is not serving at the time the

disclaimer is made, the disclaimer must be filed with a court having authority

to appoint the personal representative.

(4) In the case of an interest in a testamentary trust:

(b) If a trustee is not serving at the time the disclaimer is made

but a personal representative for the decedent's estate is serving, the

disclaimer must be delivered to the personal representative; or

(c) If neither a trustee nor a personal representative is serving

at the time the disclaimer is made, the disclaimer must be filed with a

court having authority to enforce the trust.

(5) In the case of an interest in an inter vivos trust:

(b) If a trustee is not serving at the time the disclaimer is made,

the disclaimer must be filed with a court having authority to enforce the

trust; or

(c) If the disclaimer is made before the time the instrument creating

the trust becomes irrevocable, the disclaimer must be delivered to the

settlor of a revocable trust or the transferor of the interest.

(6) In the case of an interest created by a beneficiary designation

made before the time the designation becomes irrevocable, a disclaimer

must be delivered to the person making the beneficiary designation.

(7) In the case of an interest created by a beneficiary designation

made after the time the designation becomes irrevocable, a disclaimer must

be delivered to the person obligated to distribute the interest.

(8) In the case of a disclaimer by a surviving holder of jointly

held property, the disclaimer must be delivered to the person to whom the

disclaimed interest passes.

(9) In the case of a disclaimer by a person who is an object of

an exercise of a power of appointment or a taker in default of an exercise

of a power of appointment at any time after the power was created:

(a) The disclaimer must be delivered to the holder of the

power or to the fiduciary acting under the instrument that created the

power; or

(b) If a fiduciary is not serving at the time the disclaimer is

made, the disclaimer must be filed with a court having authority to appoint

the fiduciary.

(10) In the case of a disclaimer by an appointee of a nonfiduciary

power of appointment:

(a) The disclaimer must be delivered to the holder of the

power, the personal representative of the holder's estate or to the fiduciary

under the instrument that created the power; or

(b) If a fiduciary is not serving at the time the disclaimer is

made, the disclaimer must be filed with a court having authority to appoint

the fiduciary.

(11) In the case of a disclaimer by a fiduciary of a power over a trust

or estate, the disclaimer must be delivered as provided in subsection (3),

(4) or (5) of this section as if the power disclaimed were an interest

in property.

(12) In the case of a disclaimer of a power by an agent, the disclaimer

must be delivered to the principal or the principal's representative.

Chapter 245, §12

When disclaimer barred or limited:

(1) A disclaimer is barred by a written waiver of the right

to disclaim.

(2) A disclaimer of an interest in property is barred if any of

the following events occurs before the disclaimer becomes effective:

(b) The disclaimant voluntarily assigns, conveys, encumbers, pledges

or transfers the interest sought to be disclaimed or contracts to do so;

or

(3) A disclaimer, in whole or part, of the future exercise of a power

held in a fiduciary capacity is not barred by the previous exercise of

the power.

(4) A disclaimer, in whole or part, of the future exercise of a

power not held in a fiduciary capacity is not barred by its previous exercise

unless the power is exercisable in favor of the disclaimant.

(5) A disclaimer is barred or limited if so provided by a law other

than sections 1 to 18 of this 2001 Act.

(6) A disclaimer of a power over property that is barred under

this section is ineffective. A disclaimer of an interest in property that

is barred under this section takes effect as a transfer of the interest

disclaimed to the persons who would have taken the interest under sections

1 to 18 of this 2001 Act had the disclaimer not been barred. Chapter

245, §13

Tax qualified disclaimer:

Notwithstanding any other provision of sections 1 to 18 of this

2001 Act, if as a result of a disclaimer or transfer the disclaimed or

transferred interest is treated pursuant to the provisions of the Internal

Revenue Code and the regulations promulgated under that code, as in effect

on the effective date of this 2001 Act, as never having been transferred

to the disclaimant, then the disclaimer or transfer is effective as a disclaimer

under sections 1 to 18 of this 2001 Act. Chapter 245, §14

Recording of disclaimer:

If an instrument transferring an interest in property or a power over property that is subject to a disclaimer

is required or permitted by law to be filed, recorded or registered, the

disclaimer may be so filed, recorded or registered. Failure to file, record

or register the disclaimer does not affect the validity of the disclaimer

as between the disclaimant and persons to whom the property interest or

power passes by reason of the disclaimer. Chapter 245, §15

Application to existing relationships:

Except as otherwise provided in section 13 of this 2001 Act, an interest in property or power

over property existing on the effective date of this 2001 Act may be disclaimed

in the manner provided by sections 1 to 18 of this 2001 Act after the effective

date of this 2001 Act unless the time for delivering or filing a disclaimer

had expired under law in effect immediately before the effective date of

this 2001 Act. Chapter 245, §16

Note:

Sections 1 to 18 of this 2001 Act do not allow

any person to disclaim an interest in property, including any jointly held

property, if the purpose or effect of the disclaimer is to prevent recovery

of money or property under ORS 411.620. Chapter 245, §17

Uniformity of application and construction:

In applying and construing sections 1 to 18 of this 2001 Act, consideration must be given

to the need to promote uniformity of the law with respect to disclaimers

among states that enact versions of the Uniform Disclaimer of Property

Interests Act. Chapter 245, §18

Repeals:

ORS 105.625, 105.627, 105.630, 105.632, 105.635,

105.637, 105.640, 112.650, 112.652, 112.655, 112.657, 112.660, 112.662,

112.665 and 112.667 are repealed. Chapter 245, §19

Applicability:

Sections 1 to 18 of this 2001 Act apply only

to disclaimers made on or after the effective date of this 2001 Act.

Chapter 245, §20