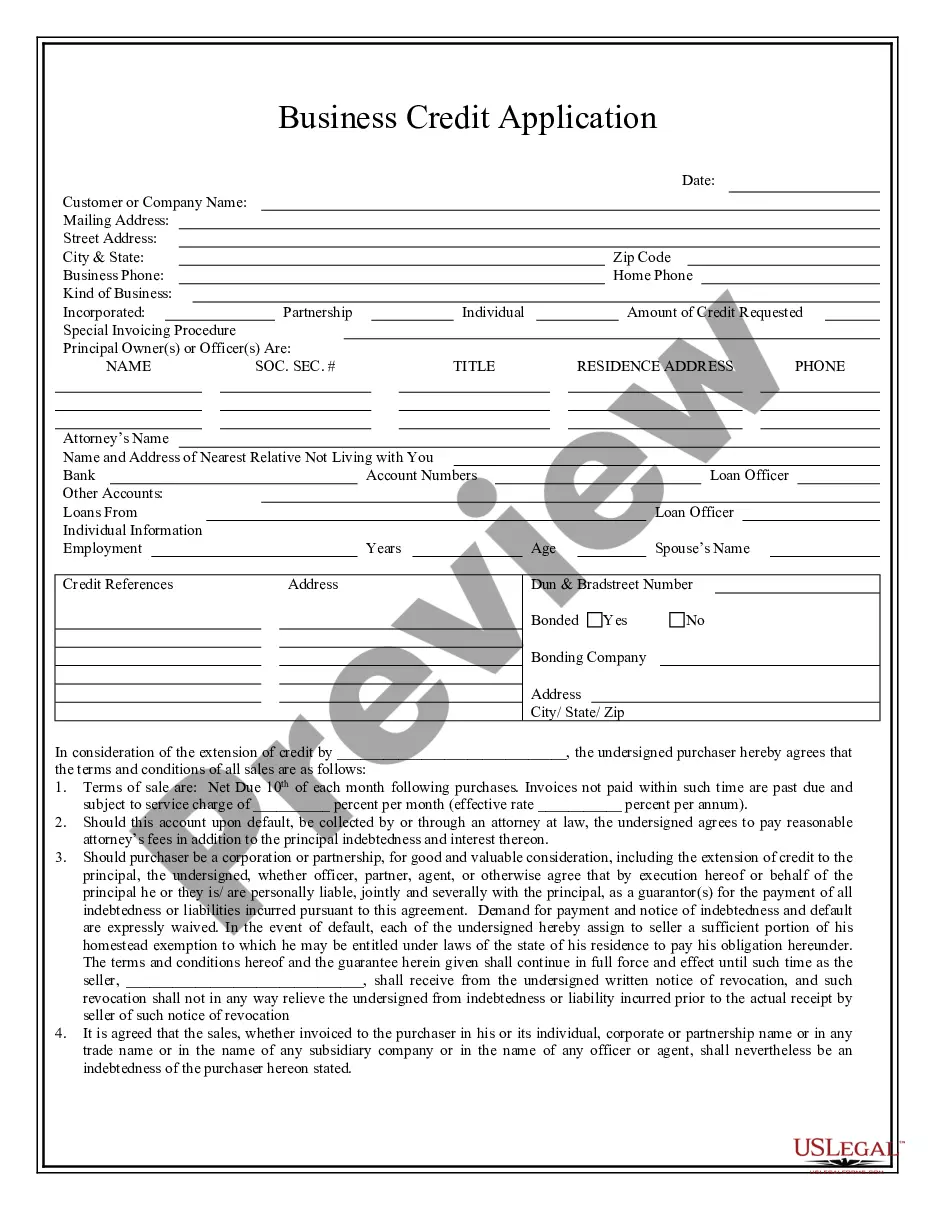

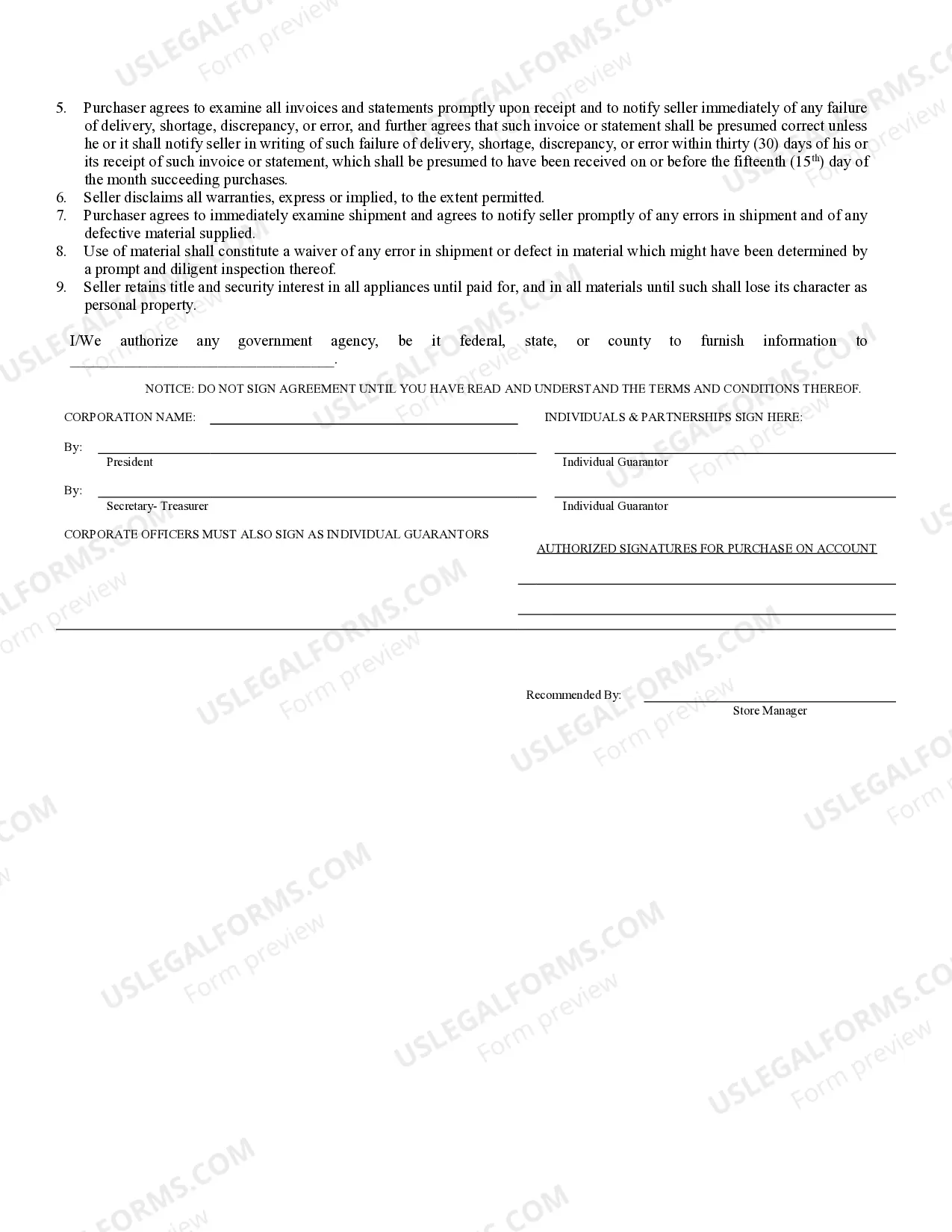

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Bend Oregon Business Credit Application is a comprehensive document that enables businesses operating in Bend, Oregon, to apply for credit from financial institutions or lenders. This application serves as a formal request for credit and provides essential information for assessing the creditworthiness of a company. Keywords: Bend, Oregon, business, credit, application, financial institutions, lenders, creditworthiness. There are several types of Bend Oregon Business Credit Applications, each tailored to specific purposes and industries. Some prominent types include: 1. Standard Business Credit Application: This type of application is suitable for general businesses operating in Bend, Oregon, regardless of their industry or size. It requires businesses to provide details about their nature of business, ownership structure, financial statements, credit history, and other relevant information. 2. Small Business Credit Application: Primarily designed for small businesses in Bend, Oregon, this application is ideal for businesses with less extensive operations or limited financial history. It typically requires less detailed information compared to a standard business credit application. 3. Startup Business Credit Application: Specifically catering to newly formed businesses in Bend, Oregon, this application is designed to assess the creditworthiness of startups that might not have an extensive financial history. It places more emphasis on the business plan, initial capital investment, and projections. 4. Industry-Specific Credit Application: Many industries in Bend, Oregon, have unique credit requirements. Examples include construction, manufacturing, healthcare, hospitality, and retail. Industry-specific credit applications are tailored to gather information specific to those industries. 5. Vendor Credit Application: Bend businesses seeking credit from vendors or suppliers can utilize this application to establish credit terms for purchasing goods or services. Vendors often require this application to evaluate a business's ability to fulfill payment obligations. Regardless of the type of Bend Oregon Business Credit Application, it is essential to provide accurate and detailed information. The application covers vital aspects such as business details, financial statements, tax information, legal structure, ownership, previous credit history, and references from banks or suppliers. By diligently completing a Bend Oregon Business Credit Application, businesses can significantly increase their chances of obtaining credit, expanding their operations, and fostering financial growth in the thriving Bend, Oregon business community.The Bend Oregon Business Credit Application is a comprehensive document that enables businesses operating in Bend, Oregon, to apply for credit from financial institutions or lenders. This application serves as a formal request for credit and provides essential information for assessing the creditworthiness of a company. Keywords: Bend, Oregon, business, credit, application, financial institutions, lenders, creditworthiness. There are several types of Bend Oregon Business Credit Applications, each tailored to specific purposes and industries. Some prominent types include: 1. Standard Business Credit Application: This type of application is suitable for general businesses operating in Bend, Oregon, regardless of their industry or size. It requires businesses to provide details about their nature of business, ownership structure, financial statements, credit history, and other relevant information. 2. Small Business Credit Application: Primarily designed for small businesses in Bend, Oregon, this application is ideal for businesses with less extensive operations or limited financial history. It typically requires less detailed information compared to a standard business credit application. 3. Startup Business Credit Application: Specifically catering to newly formed businesses in Bend, Oregon, this application is designed to assess the creditworthiness of startups that might not have an extensive financial history. It places more emphasis on the business plan, initial capital investment, and projections. 4. Industry-Specific Credit Application: Many industries in Bend, Oregon, have unique credit requirements. Examples include construction, manufacturing, healthcare, hospitality, and retail. Industry-specific credit applications are tailored to gather information specific to those industries. 5. Vendor Credit Application: Bend businesses seeking credit from vendors or suppliers can utilize this application to establish credit terms for purchasing goods or services. Vendors often require this application to evaluate a business's ability to fulfill payment obligations. Regardless of the type of Bend Oregon Business Credit Application, it is essential to provide accurate and detailed information. The application covers vital aspects such as business details, financial statements, tax information, legal structure, ownership, previous credit history, and references from banks or suppliers. By diligently completing a Bend Oregon Business Credit Application, businesses can significantly increase their chances of obtaining credit, expanding their operations, and fostering financial growth in the thriving Bend, Oregon business community.