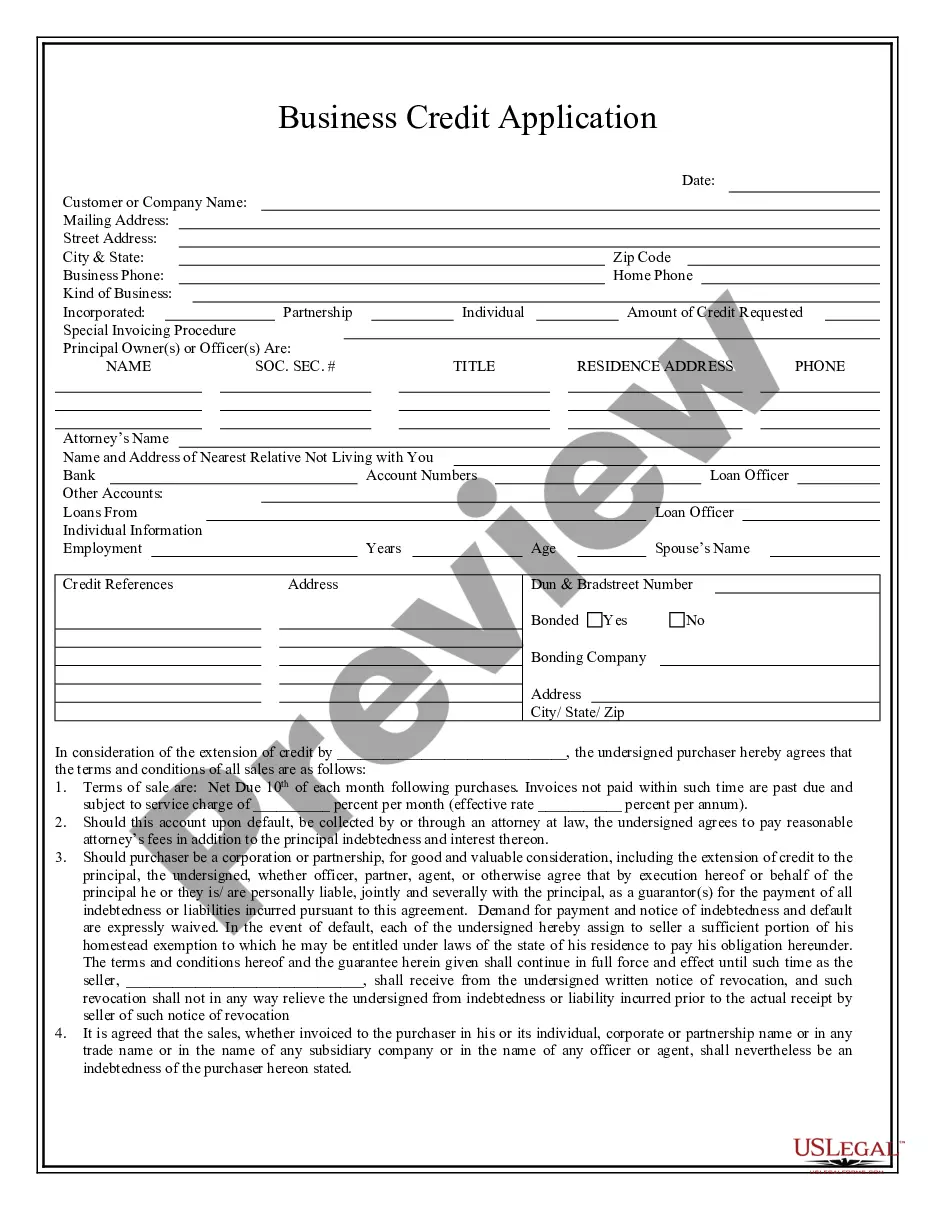

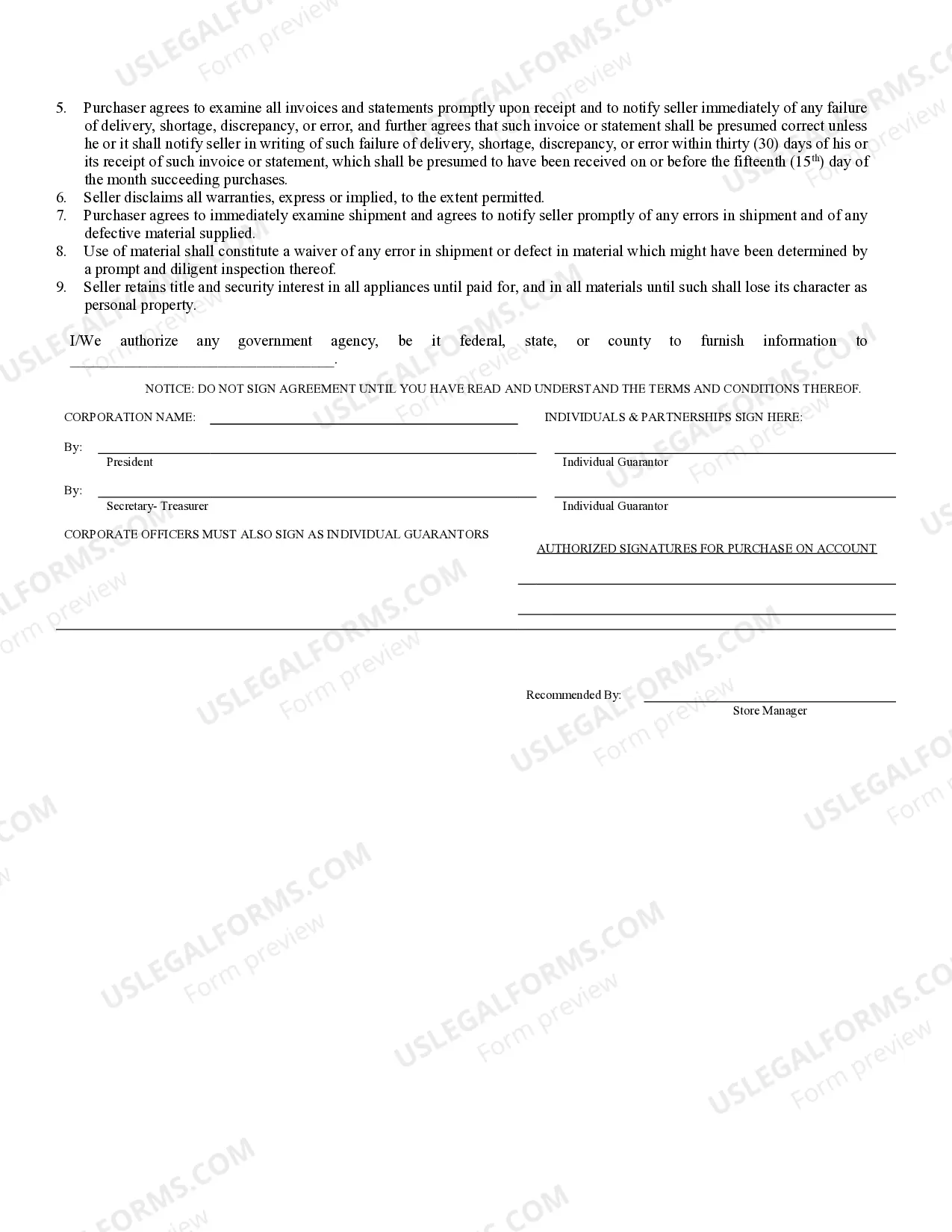

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Keywords: Eugene Oregon, business credit application, types Eugene Oregon Business Credit Application is a comprehensive application form used by businesses in Eugene, Oregon, to apply for credit from various financial institutions and lenders. This application serves as a crucial document for businesses seeking financial assistance and enables lenders to evaluate the creditworthiness of the applicant. The Eugene Oregon Business Credit Application asks for detailed information about the business, its owners, and their financial history. This includes the legal name of the business, contact information, the nature of the business, the number of years in operation, and the ownership structure. Additionally, the application may require information on the business's annual revenue, assets, liabilities, and expenses. Different types of Eugene Oregon Business Credit Applications may exist, depending on the specific needs and requirements of the lender or financial institution. Some common types of business credit applications in Eugene, Oregon, include: 1. Small Business Credit Application: Tailored for small businesses, this application focuses on the financial history of the business, including revenue, expenses, and credit history. 2. Start-up Business Credit Application: Designed for newly established businesses, this application emphasizes the business plan, market analysis, and financial projections rather than a long credit history. 3. Line of Credit Application: This type of application is used by businesses in Eugene, Oregon, that seek a revolving line of credit, allowing them to borrow up to a predetermined limit as needed. It requires information about the business's financial position and may also involve collateral. 4. Equipment Financing Credit Application: Aimed at businesses needing funds to purchase or lease equipment, this application concentrates on the specific details of the equipment being financed and its expected value. 5. Business Credit Card Application: Intended for businesses that prefer a credit card for their financial needs, this application focuses on the business's creditworthiness, annual revenue, and other relevant financial details. Eugene Oregon Business Credit Applications are vital for businesses seeking financial assistance in Eugene, Oregon, and play a significant role in determining their eligibility for credit from various lenders and financial institutions. By providing accurate and detailed information, businesses can increase their chances of obtaining the required funding to support their growth and success.Keywords: Eugene Oregon, business credit application, types Eugene Oregon Business Credit Application is a comprehensive application form used by businesses in Eugene, Oregon, to apply for credit from various financial institutions and lenders. This application serves as a crucial document for businesses seeking financial assistance and enables lenders to evaluate the creditworthiness of the applicant. The Eugene Oregon Business Credit Application asks for detailed information about the business, its owners, and their financial history. This includes the legal name of the business, contact information, the nature of the business, the number of years in operation, and the ownership structure. Additionally, the application may require information on the business's annual revenue, assets, liabilities, and expenses. Different types of Eugene Oregon Business Credit Applications may exist, depending on the specific needs and requirements of the lender or financial institution. Some common types of business credit applications in Eugene, Oregon, include: 1. Small Business Credit Application: Tailored for small businesses, this application focuses on the financial history of the business, including revenue, expenses, and credit history. 2. Start-up Business Credit Application: Designed for newly established businesses, this application emphasizes the business plan, market analysis, and financial projections rather than a long credit history. 3. Line of Credit Application: This type of application is used by businesses in Eugene, Oregon, that seek a revolving line of credit, allowing them to borrow up to a predetermined limit as needed. It requires information about the business's financial position and may also involve collateral. 4. Equipment Financing Credit Application: Aimed at businesses needing funds to purchase or lease equipment, this application concentrates on the specific details of the equipment being financed and its expected value. 5. Business Credit Card Application: Intended for businesses that prefer a credit card for their financial needs, this application focuses on the business's creditworthiness, annual revenue, and other relevant financial details. Eugene Oregon Business Credit Applications are vital for businesses seeking financial assistance in Eugene, Oregon, and play a significant role in determining their eligibility for credit from various lenders and financial institutions. By providing accurate and detailed information, businesses can increase their chances of obtaining the required funding to support their growth and success.