The Eugene Oregon Department of Revenue Tax Compliance Certification is a comprehensive program that aims at ensuring businesses and individuals within Eugene comply with the state's tax regulations and requirements. This certification ensures that taxpayers accurately report and pay their taxes, contributing to the overall financial health and stability of the city. The Eugene Oregon Department of Revenue Tax Compliance Certification plays a crucial role in promoting transparency, integrity, and fairness in the tax system. It holds immense significance for businesses, professionals, and taxpayers as it verifies their adherence to tax laws, safeguarding them against potential penalties, audits, or legal consequences. One of the key types of Eugene Oregon Department of Revenue Tax Compliance Certification is the Business Tax Compliance Certification. This certification targets local businesses and measures their compliance with regulations specific to their industry, such as retail, manufacturing, service, or professional services. It ensures that businesses accurately report their income, sales, and payroll taxes. Another significant type is the Individual Tax Compliance Certification. This certification focuses on individual taxpayers in Eugene, validating their compliance with personal income tax regulations, deductions, exemptions, and credits. It assures that individuals correctly report their earnings and pay the required taxes, whether from employment, investments, or self-employment. Moreover, the Eugene Oregon Department of Revenue Tax Compliance Certification may offer additional specialized certifications. These could include Real Estate Tax Compliance Certification, Nonprofit Tax Compliance Certification, or Construction and Development Tax Compliance Certification. Each type ensures that specific sectors or industries comply with relevant tax laws and regulations. The Eugene Oregon Department of Revenue Tax Compliance Certification program involves a meticulous process. It generally requires businesses and individuals to complete appropriate tax forms accurately, submit supporting documents and financial records, and fulfil any licensing or registration requirements. The department then evaluates the submission to verify compliance, conducting audits if necessary. Upon successful completion, the taxpayer receives the Eugene Oregon Department of Revenue Tax Compliance Certification, which can be prominently displayed to signify their commitment to tax compliance. In conclusion, the Eugene Oregon Department of Revenue Tax Compliance Certification is a vital initiative that promotes tax compliance among businesses, professionals, and individuals within the city. By obtaining this certification, taxpayers demonstrate their adherence to tax laws and contribute to the overall financial well-being of Eugene. With various types of certifications available, this program caters to the unique tax requirements of different sectors, providing comprehensive compliance measures for a diverse range of taxpayers.

Eugene Oregon Department of Revenue Tax Compliance Certification

Description

How to fill out Eugene Oregon Department Of Revenue Tax Compliance Certification?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, as a rule, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

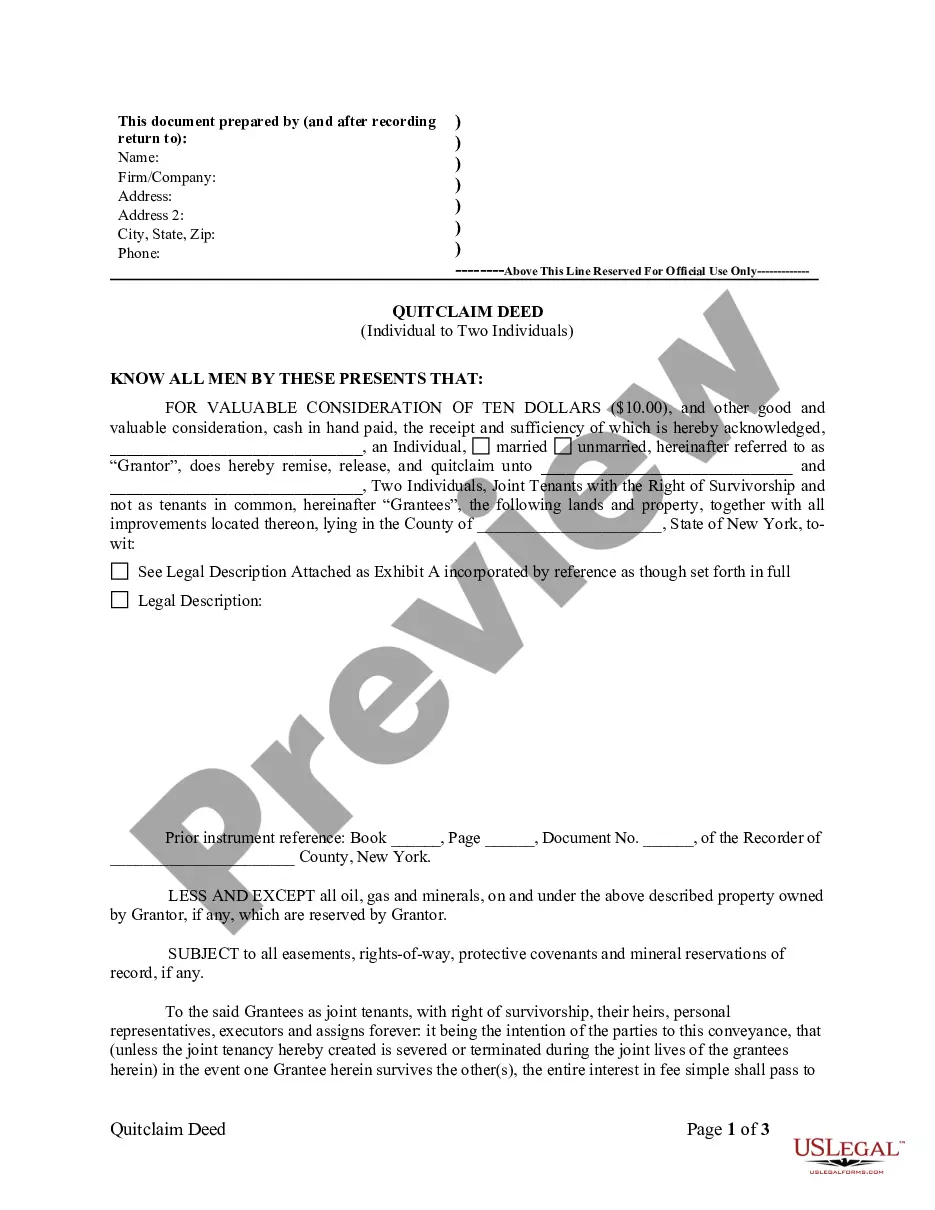

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Eugene Oregon Department of Revenue Tax Compliance Certification or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Eugene Oregon Department of Revenue Tax Compliance Certification adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Eugene Oregon Department of Revenue Tax Compliance Certification is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!