Bend Oregon Registro de propiedad de fideicomiso en vida - Oregon Living Trust Property Record

State:

Oregon

City:

Bend

Control #:

OR-E0178B

Format:

Word

Instant download

Description

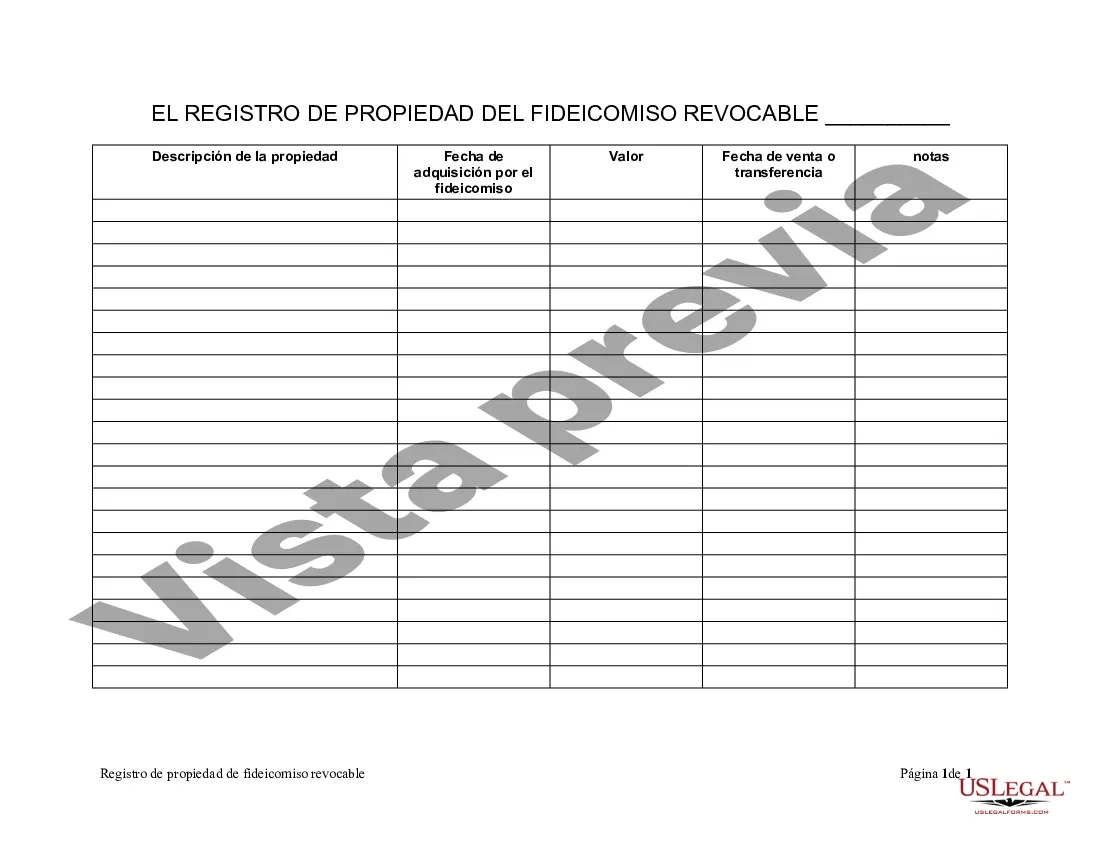

Formulario para realizar un seguimiento de la propiedad transferida a su fideicomiso en vida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Oregon Registro De Propiedad De Fideicomiso En Vida?

If you are looking for a legitimate form, it’s impossible to discover a superior service than the US Legal Forms site – likely the most extensive libraries online.

With this collection, you can find thousands of templates for corporate and personal uses categorized by types and regions, or keywords.

With the enhanced search feature, locating the latest Bend Oregon Living Trust Property Record is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the format and download it to your device. Edit the document. Fill out, modify, print, and sign the acquired Bend Oregon Living Trust Property Record.

- Additionally, the validity of each document is verified by a group of experienced attorneys who routinely evaluate the templates on our website and refresh them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess an active account, all you need to do to obtain the Bend Oregon Living Trust Property Record is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the very first time, just follow the instructions below.

- Ensure you have accessed the sample you wish to use. Review its details and use the Preview feature to check its contents. If it does not meet your requirements, utilize the Search option at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. After that, choose your desired subscription plan and provide your details to create an account.