Eugene Oregon Financial Account Transfer to Living Trust Guide: Understanding the Process and Types Are you a resident of Eugene, Oregon, looking to secure your financial assets and plan for future generations? Consider the financial account transfer to a living trust. This comprehensive guide will provide you with a detailed description of the process and shed light on the different types of living trust available to Eugene residents. What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows individuals to transfer ownership of their financial accounts and assets to a trust while maintaining control over them during their lifetime. It is a popular estate planning tool designed to protect one's assets, streamline the transfer of wealth, and minimize estate taxes. Eugene Oregon Financial Account Transfer to Living Trust Process: 1. Understand the benefits: The first step in transferring your financial accounts to a living trust is to comprehend the advantages it offers. This includes avoiding probate, maintaining privacy, ensuring seamless management in case of incapacity, and potentially reducing estate tax liabilities. 2. Seek legal advice: Consult with an experienced estate planning attorney in Eugene, Oregon, who specializes in living trusts. They will guide you through the entire process, ensuring your interests are protected, and help draft the necessary legal documents. 3. Create a living trust: With the help of your attorney, you will establish a living trust document tailored to your specific needs. This document outlines the instructions for the management and distribution of your financial accounts and other assets. 4. Fund the trust: The next step is transferring ownership of your financial accounts to the living trust. This involves updating the account titles to reflect the trust as the new owner. Consult your attorney for guidance on this critical step to ensure the proper transfer of assets. 5. Update beneficiary designations: Review and update the beneficiary designations for retirement accounts, life insurance policies, and any other accounts that pass directly to beneficiaries. Coordinate these designations with the provisions of your living trust to ensure comprehensive estate planning. Types of Eugene Oregon Financial Account Transfer to Living Trust: 1. Individual Living Trust: The most common type of living trust, designed for individuals who want to maintain sole control over their assets during their lifetime. It allows flexibility and easy modification or revocation. 2. Married Couple Living Trust: This type of trust is specifically designed for married couples to transfer their financial accounts jointly. It provides for the seamless transition of assets between spouses and maximizes tax benefits. 3. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable trust is established once created and cannot be altered or revoked without the consent of beneficiaries. It offers additional protection from estate taxes and creditor claims. 4. Testamentary Living Trust: Unlike other types of living trusts, this is created within a will and becomes operational after the individual passes away. It allows individuals to have control over the distribution of assets even after their demise. In conclusion, a Eugene Oregon Financial Account Transfer to Living Trust is an effective way to protect and distribute your financial assets as per your wishes. Consulting with an experienced attorney will ensure a seamless transfer process and appropriate selection of the living trust type that best suits your needs. Secure your financial future and leave a lasting legacy for your loved ones with a living trust.

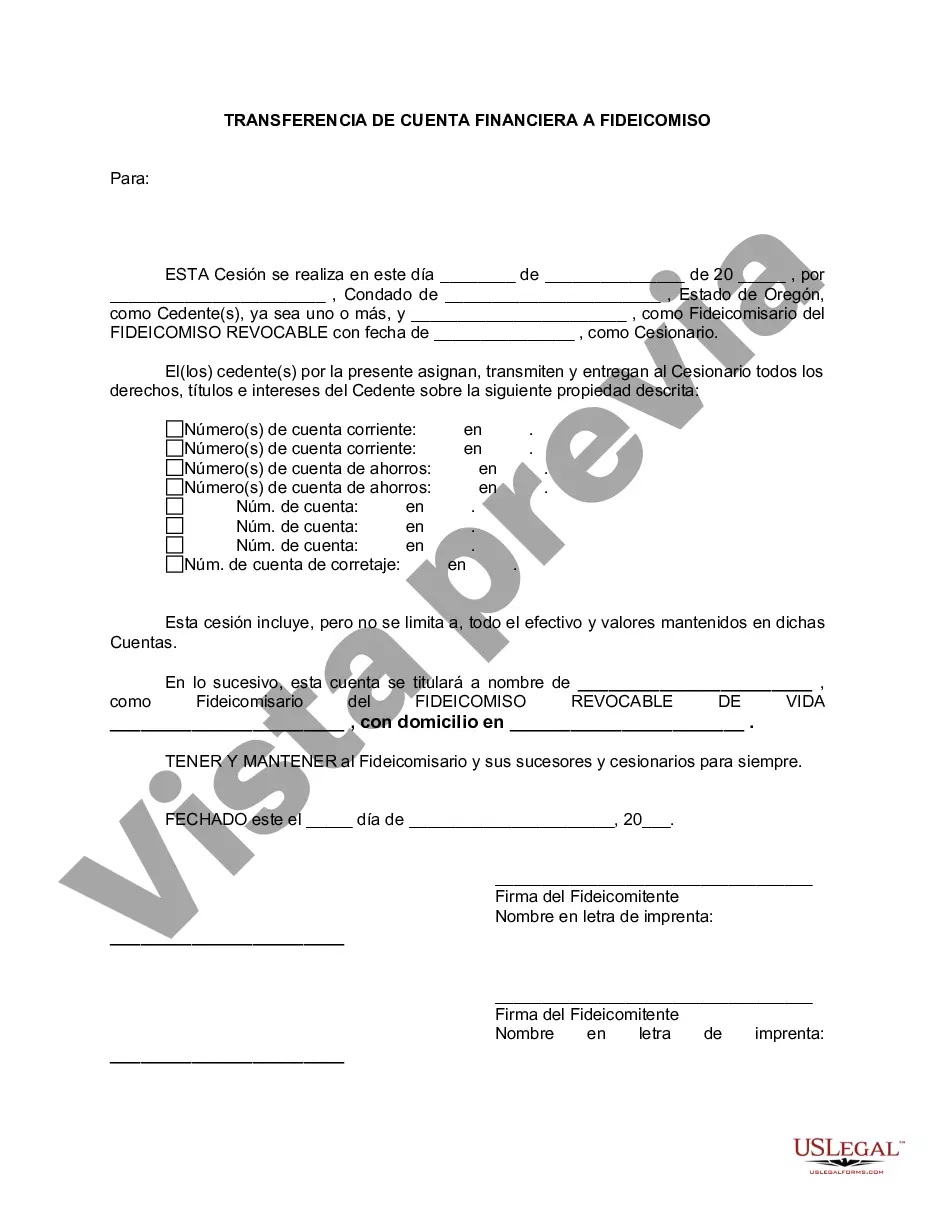

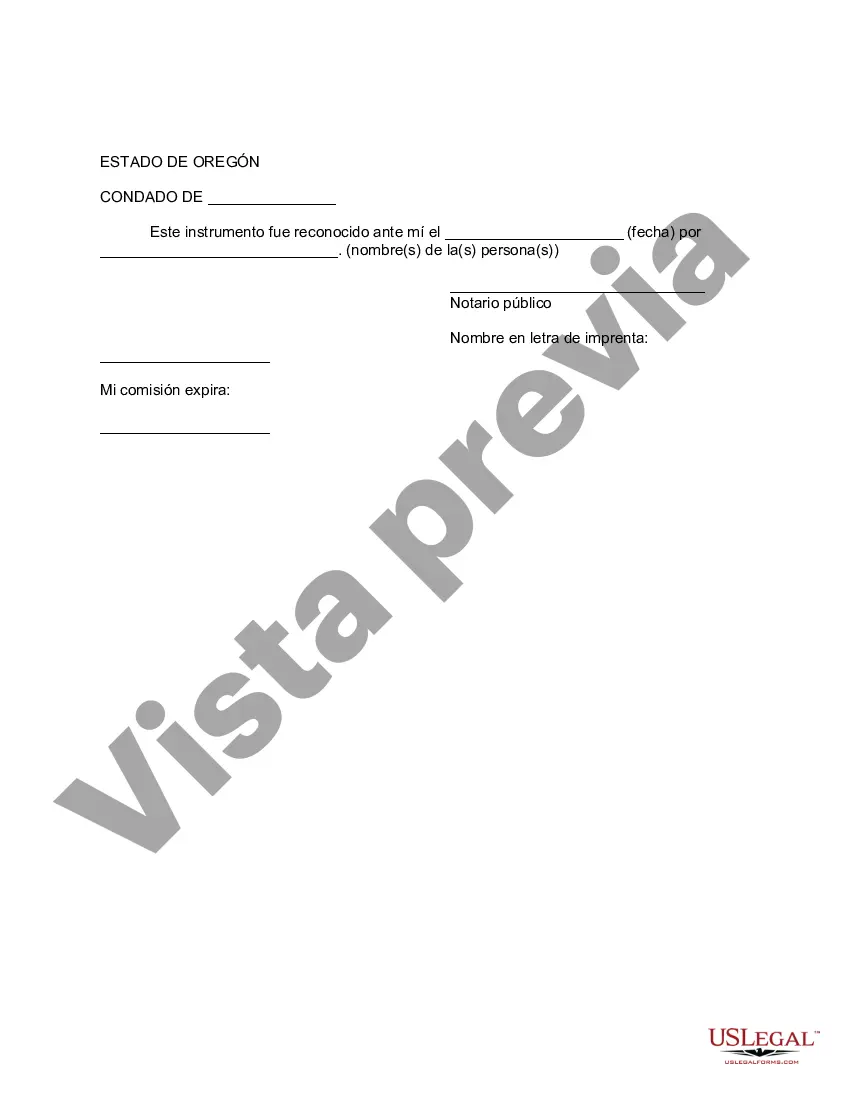

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Eugene Oregon Transferencia de cuenta financiera a fideicomiso en vida - Oregon Financial Account Transfer to Living Trust

Description

How to fill out Eugene Oregon Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Benefit from the US Legal Forms and obtain instant access to any form sample you require. Our beneficial platform with thousands of templates makes it simple to find and obtain virtually any document sample you require. You can download, complete, and certify the Eugene Oregon Financial Account Transfer to Living Trust in a couple of minutes instead of surfing the Net for hours seeking a proper template.

Using our catalog is an excellent way to improve the safety of your form filing. Our professional legal professionals regularly review all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Eugene Oregon Financial Account Transfer to Living Trust? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Find the form you need. Ensure that it is the form you were looking for: examine its headline and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Choose the format to get the Eugene Oregon Financial Account Transfer to Living Trust and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy form libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Eugene Oregon Financial Account Transfer to Living Trust.

Feel free to benefit from our form catalog and make your document experience as efficient as possible!