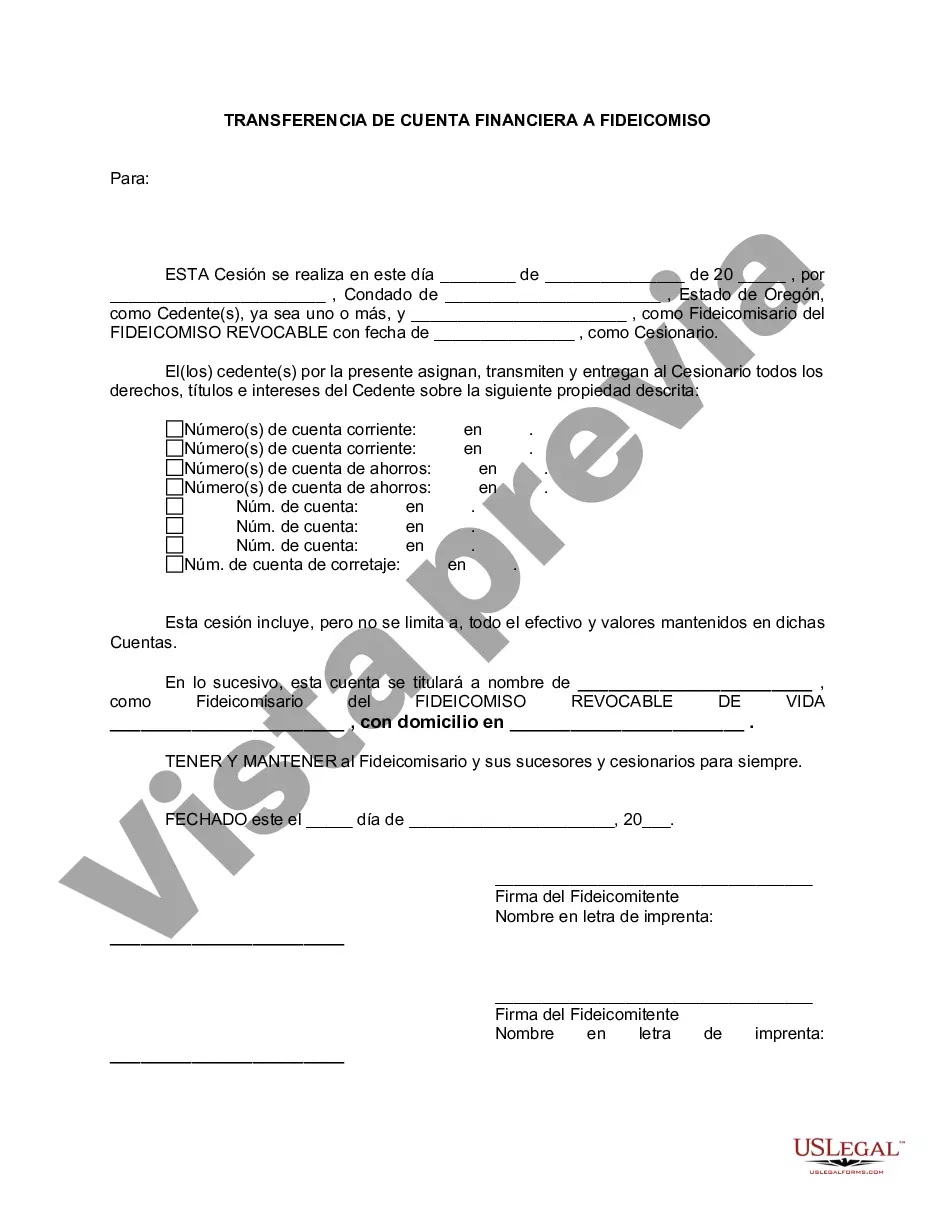

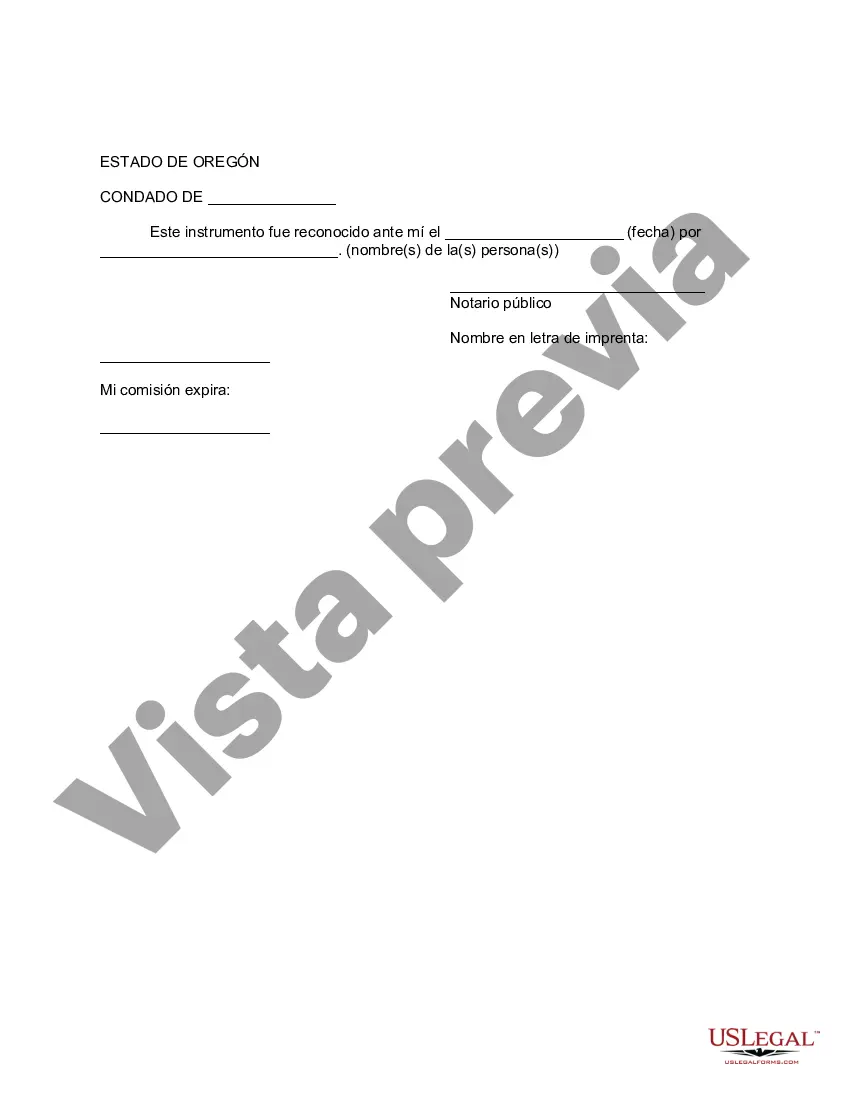

Gresham Oregon Financial Account Transfer to Living Trust: A Comprehensive Guide If you are a resident of Gresham, Oregon, and considering estate planning, one crucial aspect to consider is the transfer of your financial accounts to a living trust. In this detailed description, we will explore the benefits of a living trust, the process involved in a financial account transfer, and various types of Gresham Oregon financial account transfer to living trust. A living trust is a legal arrangement where an individual, known as the granter, transfers their assets, including financial accounts, into a trust during their lifetime. The trust is managed by a trustee designated by the granter, who holds and administers the assets according to the terms defined in the trust document. The primary goal of a living trust is to avoid probate, a time-consuming and costly legal process, and to ensure a smooth transfer of assets to the designated beneficiaries upon the granter's death. The process of transferring financial accounts to a living trust involves several steps. First, the granter must identify the financial accounts they wish to transfer. These accounts can include bank accounts, brokerage accounts, retirement accounts, and investment accounts. It is essential to gather all relevant information about these accounts, such as account numbers, names, and contact details of financial institutions. Once the accounts are identified, the granter must contact each financial institution individually to initiate the transfer process. This requires completing the necessary forms provided by the institutions, which typically include the trust's information, the granter's information, and account details. The granter may also need to submit a copy of the trust document or a certification of trust. It's crucial to note that different types of financial accounts may have specific requirements for transferring to a living trust. For example, retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s, may require additional documentation, such as a trust certification or a beneficiary designation form. In Gresham, Oregon, there are various types of financial account transfers to living trusts available, including: 1. Bank Account Transfer to Living Trust: This type of transfer involves moving funds from personal checking or savings accounts into the living trust. It ensures that the assets held in those accounts will be managed and distributed according to the trust's provisions. 2. Investment Account Transfer to Living Trust: Individuals who have investment accounts, such as brokerage or mutual fund accounts, can transfer ownership of these accounts to a living trust. This ensures that investments held within the trust are protected and distributed as specified in the trust document. 3. Retirement Account Transfer to Living Trust: Gresham residents with retirement accounts, such as IRAs or 401(k)s, can transfer ownership of these accounts to a living trust. This allows for efficient management and distribution of retirement assets upon the granter's passing, providing significant benefits to designated beneficiaries. 4. Real Estate Transfer to Living Trust: Although not a financial account, transferring real estate holdings to a living trust is an essential aspect of comprehensive estate planning. By transferring ownership of properties, such as homes or rental properties, to the trust, the granter ensures seamless management and distribution of real estate assets. In conclusion, Gresham, Oregon residents can benefit greatly from transferring their financial accounts to a living trust. By avoiding probate and ensuring a smooth transition of assets, individuals can maintain control, privacy, and efficiency in their estate plans. Whether it's bank accounts, investment accounts, retirement accounts, or real estate, consult with legal professionals to determine the most suitable types of financial account transfers to meet your estate planning needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gresham Oregon Transferencia de cuenta financiera a fideicomiso en vida - Oregon Financial Account Transfer to Living Trust

Description

How to fill out Gresham Oregon Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Gresham Oregon Financial Account Transfer to Living Trust? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Gresham Oregon Financial Account Transfer to Living Trust conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Gresham Oregon Financial Account Transfer to Living Trust in any provided format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online for good.