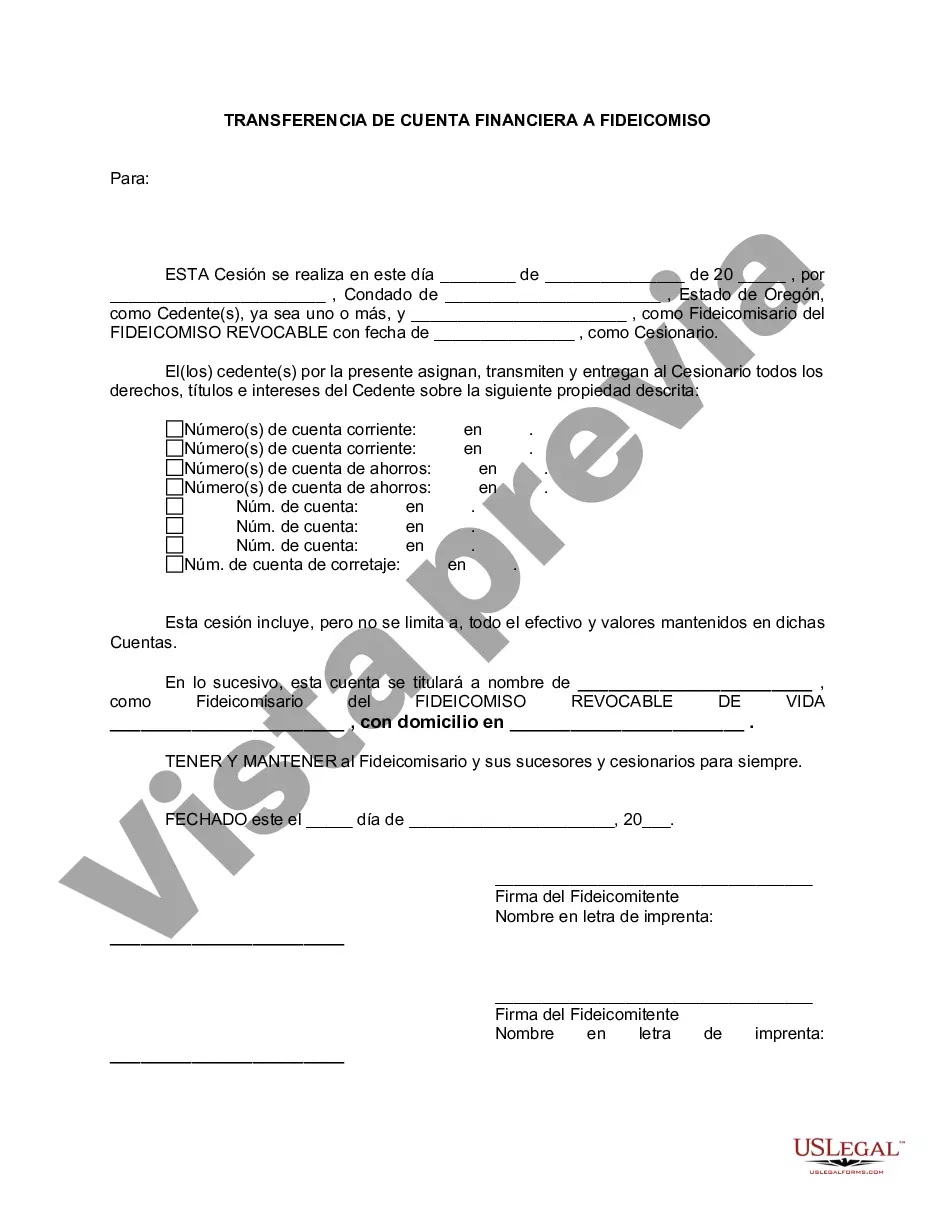

A Portland Oregon Financial Account Transfer to Living Trust refers to the process of transferring financial accounts from an individual's name to a living trust in Portland, Oregon. This legal process involves changing the ownership of accounts such as bank accounts, investment accounts, retirement accounts, and other financial assets, thereby ensuring that these assets are held and managed by the trust while the individual is alive and after their passing. Portland, often known as the "City of Roses," is located in the Pacific Northwest and is known for its thriving economy and diverse population. It is home to numerous financial institutions and provides various options for individuals seeking to transfer their financial accounts to a living trust. There are different types of financial accounts that can be transferred to a living trust in Portland, Oregon: 1. Bank Accounts: This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, individuals can ensure seamless management of their funds, and the trust can continue to operate even in the event of incapacity or death. 2. Investment Accounts: This type of account encompasses brokerage accounts and individual retirement accounts (IRAs). Transferring these accounts to a living trust can help streamline investment management and ensure that the designated trustee can make investment decisions according to the trust's guidelines. 3. Retirement Accounts: Individuals can also transfer their retirement accounts, such as 401(k)s, 403(b)s, and IRAs, into their living trust. This allows for continued tax advantages and ensures that the assets are distributed according to the trust's instructions upon the account holder's passing. 4. Life Insurance Policies: While life insurance policies cannot be directly transferred to a living trust, individuals can designate the trust as a beneficiary. This arrangement enables the proceeds from the policy to be distributed and managed by the trust upon the policyholder's death. 5. Stocks and Bonds: Individuals who hold stocks and bonds can transfer ownership of these securities to their living trust. This ensures continuity in the management and distribution of the assets, as the trust's provisions will dictate how these assets are to be handled after the individual's passing. It is important to consult with an experienced estate planning attorney or financial advisor when considering a Portland Oregon Financial Account Transfer to Living Trust. They can guide individuals through the legal process, ensuring that all necessary documents are prepared, and that the transfer accurately reflects the desires and intentions of the account holder. Additionally, seeking professional advice can help individuals navigate any potential tax implications or other financial considerations associated with these types of transfers. In conclusion, a Portland Oregon Financial Account Transfer to Living Trust involves transferring various financial accounts, including bank accounts, investment accounts, retirement accounts, life insurance policies, and stocks/bonds, to a living trust. This process can provide individuals with peace of mind, knowing that their financial assets will be effectively managed and distributed according to their wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Portland Oregon Transferencia de cuenta financiera a fideicomiso en vida - Oregon Financial Account Transfer to Living Trust

Description

How to fill out Portland Oregon Transferencia De Cuenta Financiera A Fideicomiso En Vida?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no legal background to create such papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you want the Portland Oregon Financial Account Transfer to Living Trust or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Portland Oregon Financial Account Transfer to Living Trust quickly employing our trusted service. If you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are a novice to our platform, make sure to follow these steps before obtaining the Portland Oregon Financial Account Transfer to Living Trust:

- Ensure the template you have chosen is suitable for your location because the regulations of one state or county do not work for another state or county.

- Review the form and go through a short outline (if provided) of cases the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Portland Oregon Financial Account Transfer to Living Trust once the payment is done.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.