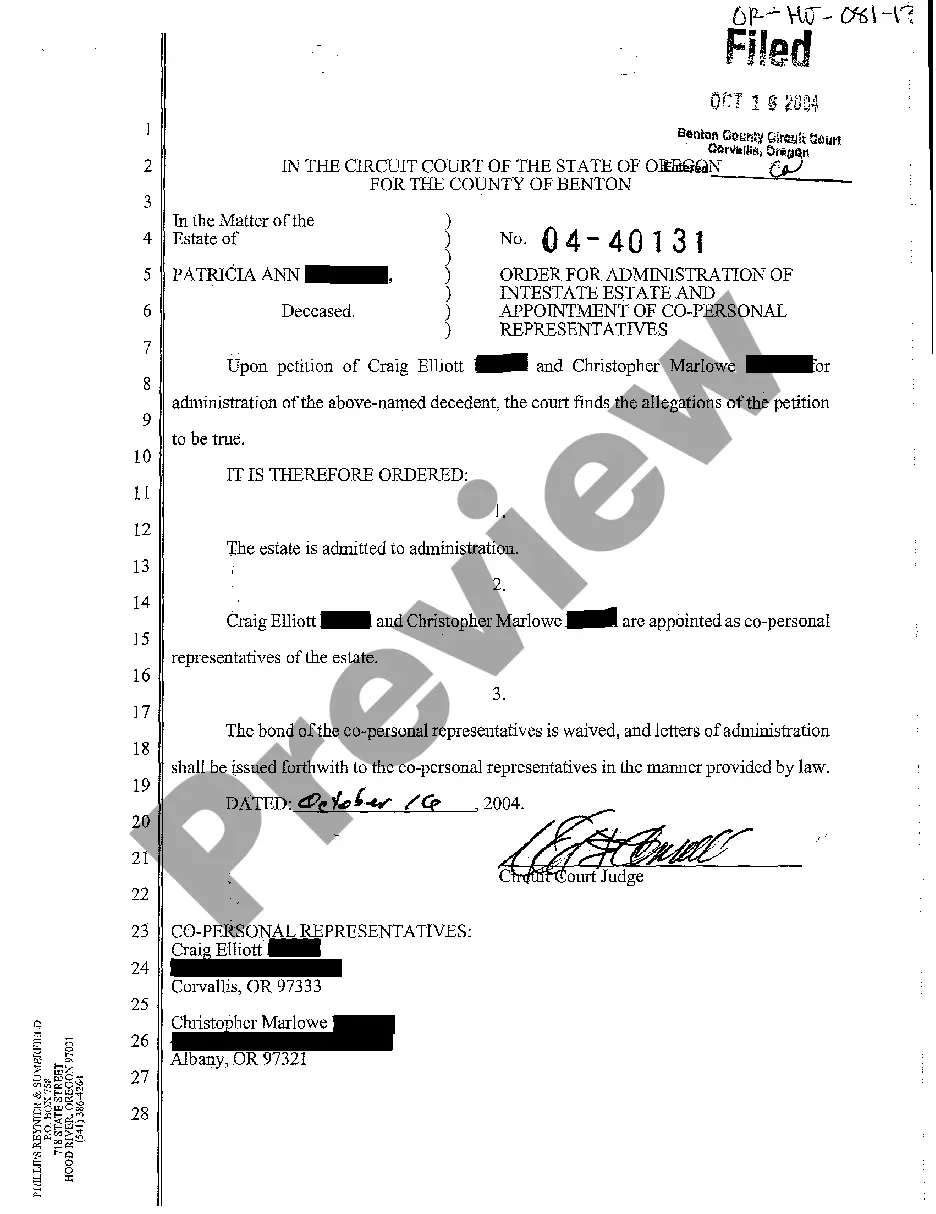

The Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives is a legal process that is utilized when a person dies without leaving a valid will or estate plan. This order is necessary to determine the distribution of the deceased individual's assets and establish co-personal representatives to handle the estate administration. In Hillsboro, Oregon, there are two main types of orders for administration of intestate estate and appointment of co-personal representatives: 1. Hillsboro Oregon Order for Small Intestate Estates: This type of order is applicable when the value of the deceased individual's estate is below a certain threshold, typically a predetermined monetary amount or the value of specific assets. The purpose of this order is to provide a simplified process for administering smaller estates, taking into account their relative simplicity and lower value. 2. Hillsboro Oregon Order for General Intestate Estates: This order applies when the estate's value exceeds the threshold set for small intestate estates. General intestate estates involve more complex administration procedures and often entail a larger number and variety of assets. Co-personal representatives are appointed to oversee the distribution of assets and settle any outstanding debts or claims against the estate. These orders may share certain similarities in their purpose and general process, but the main distinction lies in the size and complexity of the estate being administered. In the Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives, the court typically appoints co-personal representatives who act as fiduciaries responsible for managing and distributing the assets of the deceased individual. These representatives are entrusted with various duties, including: 1. Inventory and Appraisal: Co-personal representatives are required to prepare a comprehensive inventory of the deceased individual's assets, which may include real estate, personal property, investments, and other possessions. Additionally, a detailed appraisal of the estate's value should be conducted to assess its financial worth. 2. Debt Settlement: Co-personal representatives are responsible for identifying and paying off any debts or outstanding bills owed by the deceased individual. This includes liabilities such as mortgages, loans, credit card debts, and unpaid taxes. 3. Asset Distribution: After settling debts, co-personal representatives distribute the remaining assets of the estate according to the laws of intestacy. These laws stipulate the order of priority for distributing assets among surviving relatives, such as spouses, children, parents, and siblings. 4. Accounting and Reporting: Throughout the estate administration process, co-personal representatives must maintain accurate accounting records and provide regular reports to the court and interested parties. This ensures transparency and accountability in handling the estate's affairs. It is important to consult with an experienced probate attorney or legal professional familiar with Hillsboro, Oregon laws to navigate the complexities of the Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives successfully. This will help ensure compliance with legal requirements, efficient estate administration, and fair asset distribution for all parties involved.

Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives

Description

How to fill out Hillsboro Oregon Order For Administration Of Intestate Estate And Appointment Of Co-Personal Representatives?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our beneficial website with a large number of document templates simplifies the way to find and get almost any document sample you need. You can save, fill, and sign the Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives in a matter of minutes instead of browsing the web for several hours searching for an appropriate template.

Using our catalog is a superb way to raise the safety of your document submissions. Our professional legal professionals on a regular basis review all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the form you need. Make certain that it is the template you were seeking: examine its headline and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the document. Choose the format to obtain the Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Hillsboro Oregon Order for Administration of Intestate Estate and Appointment of Co-Personal Representatives.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!