Title: Explore Hillsboro Oregon Sample Mortgages for Individuals: Types and Features Introduction: When it comes to achieving homeownership dreams in Hillsboro, Oregon, understanding the various mortgage options available can be crucial. This article aims to provide a detailed description of Hillsboro Oregon Sample Mortgages for Individuals, highlighting important features and compatibility with different financial situations. 1. Fixed-Rate Mortgage: A fixed-rate mortgage offers stability and predictability, making it an ideal choice for many individuals. With this type of mortgage, the interest rate remains constant throughout the loan term, typically ranging from 15 to 30 years. Borrowers can easily plan their monthly budget as the principal and interest portions of their payments remain unchanged over time. 2. Adjustable-Rate Mortgage (ARM): An Adjustable-Rate Mortgage provides flexibility in interest rates, which can be particularly advantageous for borrowers planning shorter stays in their homes or looking to take advantage of lower initial rates. In this option, the interest rate may be fixed for an initial period (e.g., 3, 5, or 7 years) and then fluctuates based on market rates. ARM mortgages often come with rate caps to protect borrowers from dramatic increases. 3. Jumbo Mortgage: For individuals seeking a mortgage above the conforming loan limits set by Fannie Mae and Freddie Mac, a jumbo mortgage may be the answer. A jumbo mortgage allows borrowers to finance higher-priced properties or borrow larger loan amounts, making it suitable for those eyeing luxury homes or property investments in Hillsboro. 4. FHA Loan: The Federal Housing Administration (FHA) offers government-insured loans with lower down payment requirements and more lenient credit criteria. FHA loans can greatly assist individuals with limited savings or lower credit scores to enter the housing market by reducing the barriers to homeownership. 5. VA Loan: Specifically designed for eligible veterans, active-duty military personnel, and surviving spouses, VA loans are guaranteed by the U.S. Department of Veterans Affairs. These loans feature competitive interest rates, no down payment, and relaxed credit requirements, helping military personnel in Hillsboro become homeowners with ease. 6. USDA Loan: The United States Department of Agriculture (USDA) offers loans to support the purchase of homes in designated rural areas. Individuals exploring homeownership in Hillsboro's outskirts may find USDA loans beneficial due to their zero down payment option and low-interest rates. Conclusion: Understanding the different types of Hillsboro Oregon Sample Mortgages for Individuals is essential for anyone considering homeownership or refinancing. Fixed-rate mortgages provide steady payments, while adjustable-rate mortgages offer flexibility. Jumbo loans cater to those seeking high-value properties, whereas FHA, VA, and USDA loans offer specialized programs to assist individuals with specific eligibility criteria. Consulting with mortgage professionals can further guide individuals in selecting the best mortgage option for their unique financial situation and homeownership goals.

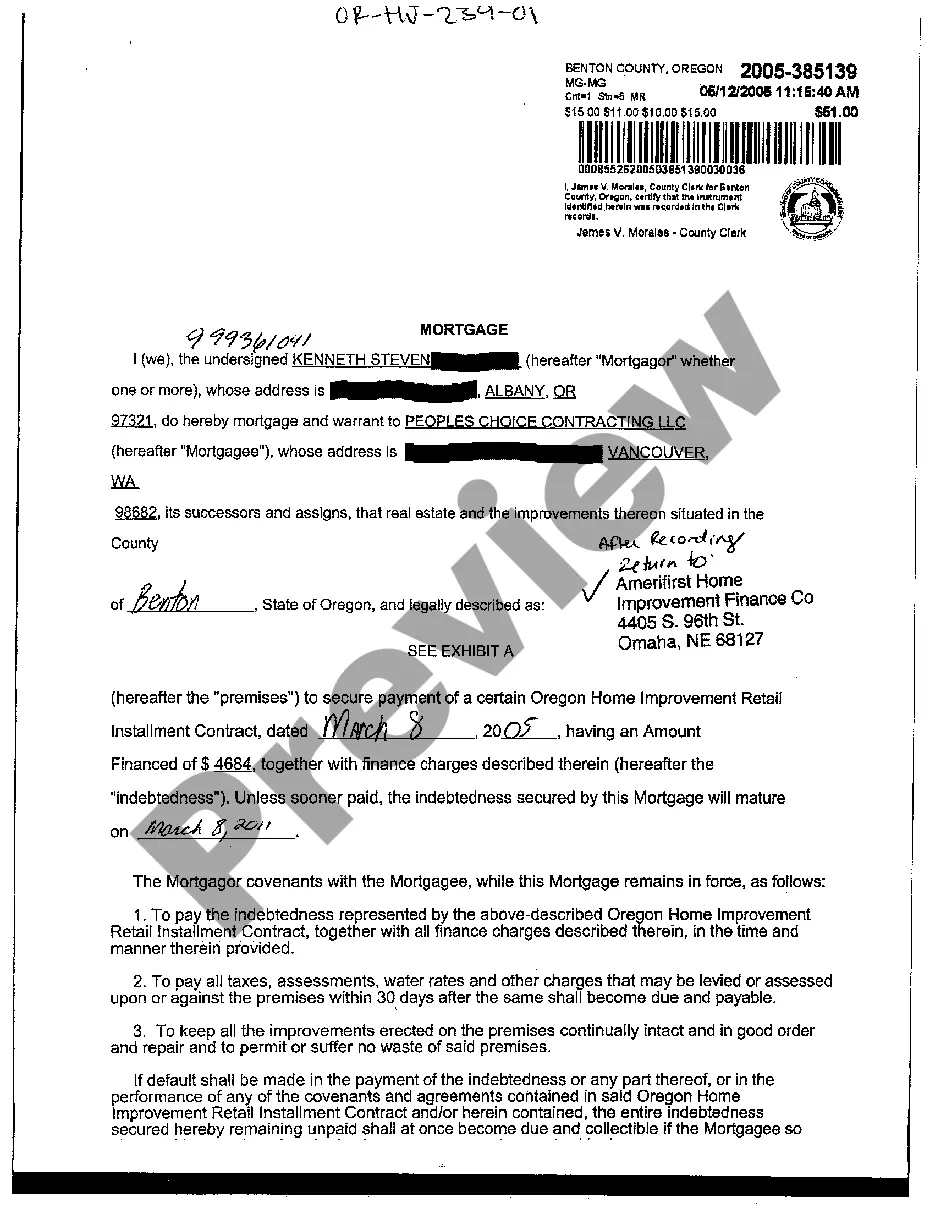

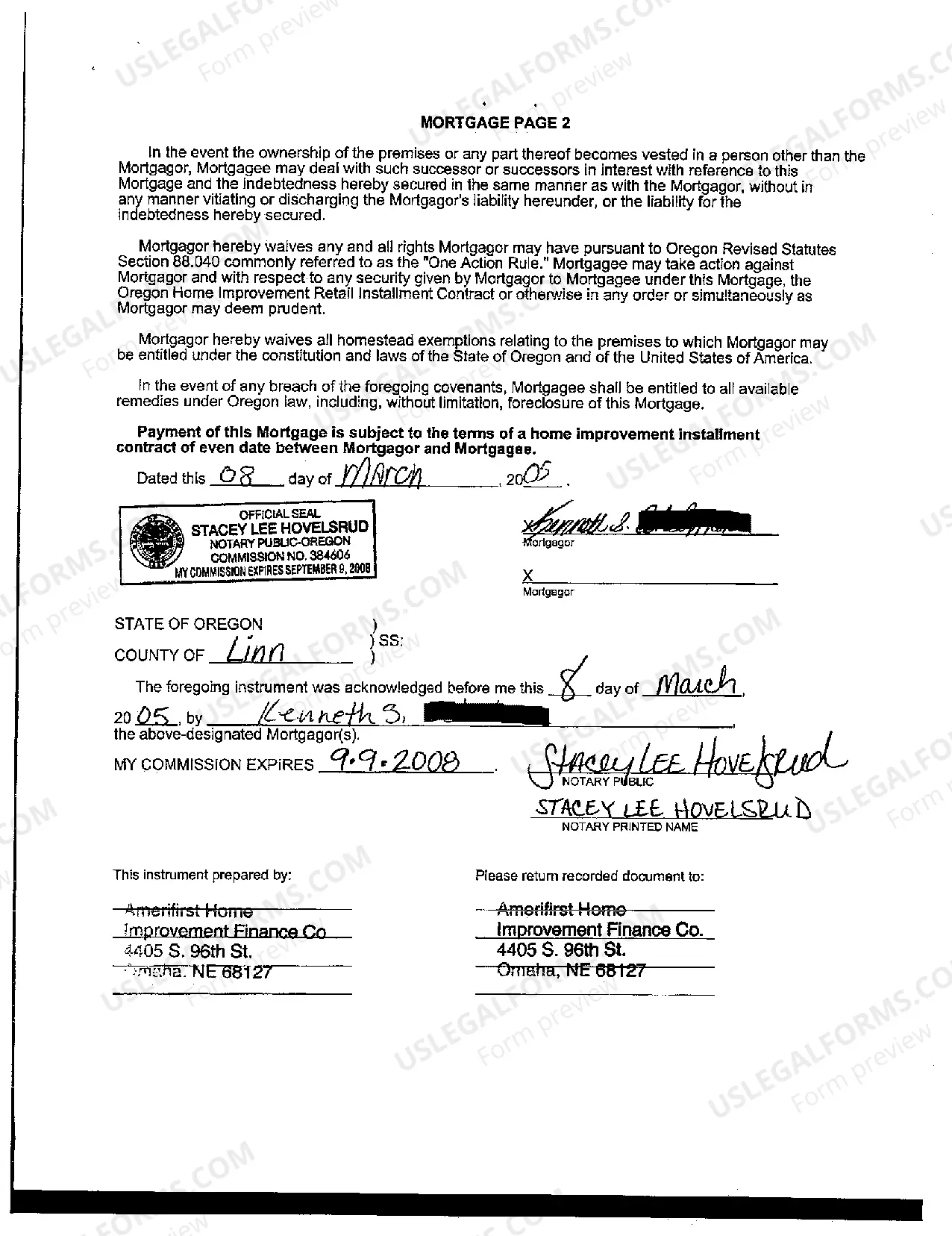

Hillsboro Oregon Sample Mortgage for an Individual

Description

How to fill out Hillsboro Oregon Sample Mortgage For An Individual?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hillsboro Oregon Sample Mortgage for an Individual or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Hillsboro Oregon Sample Mortgage for an Individual complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Hillsboro Oregon Sample Mortgage for an Individual is suitable for you, you can select the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!