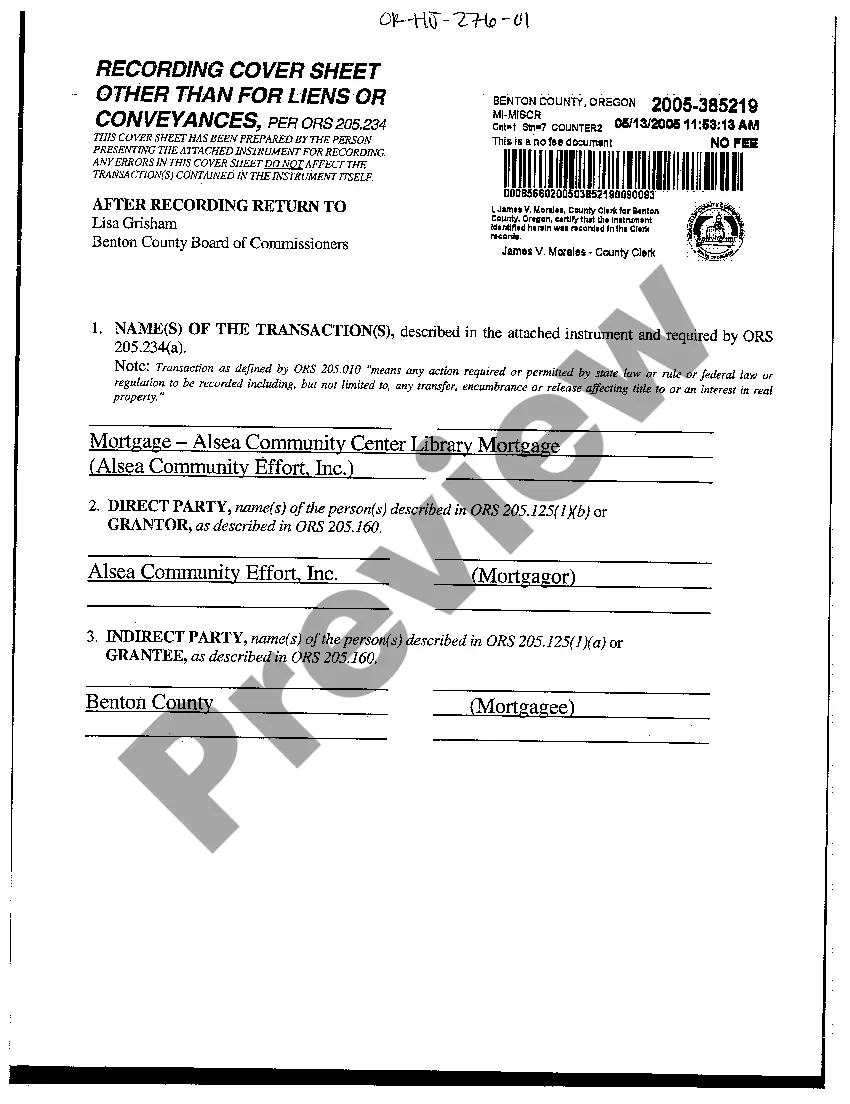

Gresham Oregon Mortgage Recording Cover Sheet is a document used in the process of recording mortgages in the city of Gresham, Oregon. It is an essential requirement for ensuring a smooth and accurate mortgage recording procedure. The Gresham Oregon Mortgage Recording Cover Sheet serves as a cover page for mortgage-related documents, providing pertinent information to the clerk or recorder's office. This cover sheet helps the office classify and index the submitted mortgage documents correctly and efficiently. Key elements included in the Gresham Oregon Mortgage Recording Cover Sheet may consist of the following: 1. Property Information: This section contains relevant details about the property being mortgaged, such as the physical address, legal description, and assessor's tax parcel number. These details help in correctly identifying the property associated with the mortgage. 2. Borrower and Lender Details: The cover sheet captures essential information about both the borrower and the lender. It may include their names, mailing addresses, phone numbers, and email addresses. These details help establish the parties involved in the mortgage transaction. 3. Title Company or Law Firm Information: This section includes the details of the title company or law firm handling the mortgage transaction. This information facilitates communication and coordination between different entities involved in the process. 4. Loan Information: The cover sheet may feature important loan-specific details, including the loan amount, interest rate, loan term, and any additional terms or conditions relevant to the mortgage agreement. These details help clarify the terms associated with the mortgage. 5. Signatures and Notary Acknowledgment: The Gresham Oregon Mortgage Recording Cover Sheet may have spaces for signatures of the borrower, lender, and notary, along with the acknowledgment and seal of the notary public. These signatures and acknowledgments ensure the authenticity and validity of the mortgage document. It is important to note that while the general purpose and content of the Gresham Oregon Mortgage Recording Cover Sheet remain consistent, there may not be different types of cover sheets specific to Gresham, Oregon. Generally, cover sheets used in mortgage recording procedures are standard across various jurisdictions, with slight variations based on local requirements or preferences. Overall, the Gresham Oregon Mortgage Recording Cover Sheet streamlines the mortgage recording process by providing essential details in a structured format. It helps ensure accuracy, prevent errors, and facilitate efficient indexing and retrieval of mortgage-related documents.

Gresham Oregon Mortgage Recording Cover Sheet

Description

How to fill out Gresham Oregon Mortgage Recording Cover Sheet?

If you are looking for a relevant form template, it’s difficult to find a more convenient place than the US Legal Forms site – one of the most considerable libraries on the web. Here you can get a huge number of templates for company and personal purposes by categories and states, or key phrases. With the advanced search option, finding the most recent Gresham Oregon Mortgage Recording Cover Sheet is as elementary as 1-2-3. Additionally, the relevance of each and every file is proved by a group of expert attorneys that regularly review the templates on our platform and update them in accordance with the newest state and county requirements.

If you already know about our system and have a registered account, all you need to get the Gresham Oregon Mortgage Recording Cover Sheet is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the form you need. Check its description and utilize the Preview feature to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the needed file.

- Affirm your selection. Select the Buy now option. After that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Gresham Oregon Mortgage Recording Cover Sheet.

Every single template you add to your account does not have an expiry date and is yours forever. You always have the ability to access them via the My Forms menu, so if you want to have an additional copy for modifying or printing, you can come back and save it again at any time.

Take advantage of the US Legal Forms professional catalogue to get access to the Gresham Oregon Mortgage Recording Cover Sheet you were seeking and a huge number of other professional and state-specific templates in a single place!