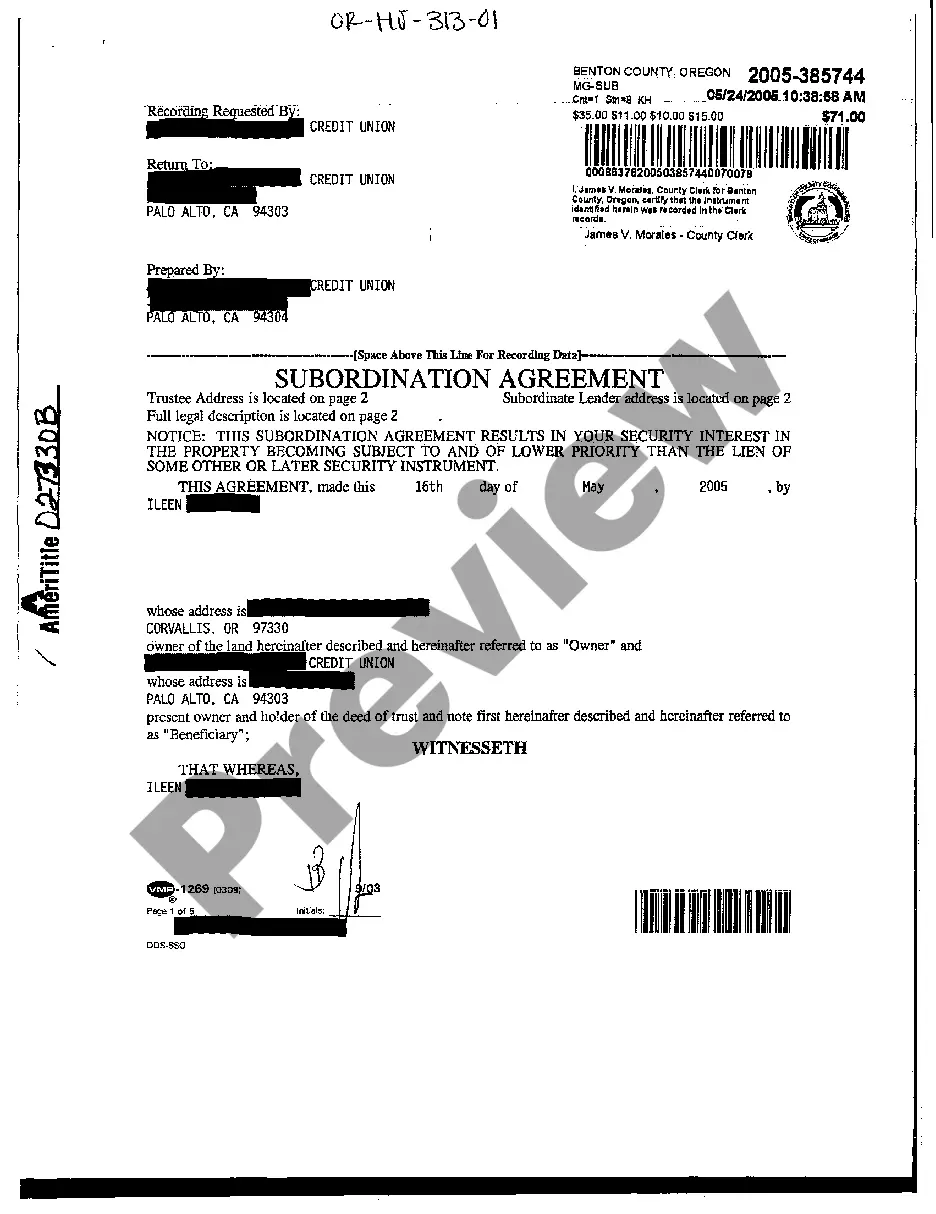

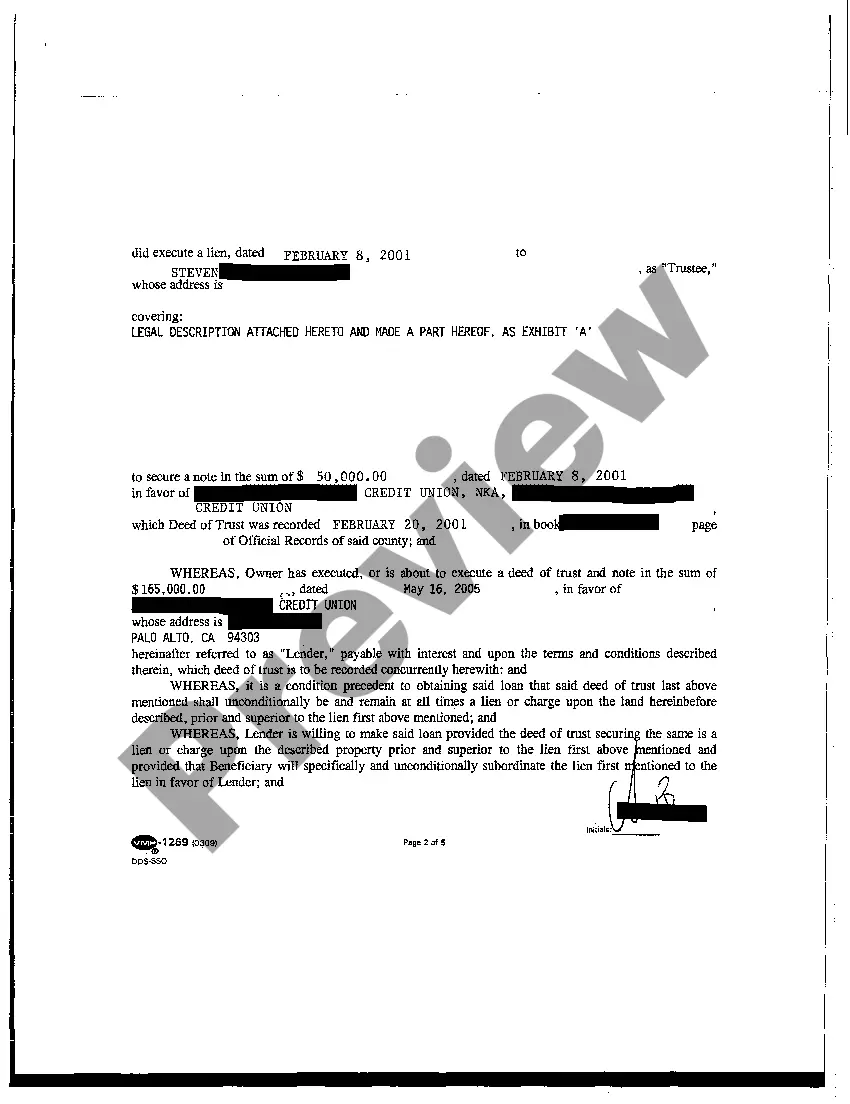

A subordination agreement, specifically in the context of Eugene, Oregon, is a legal document that serves to clarify the priority of liens or claims on a property. This agreement is typically entered into when there are multiple mortgages or other financial interests involved in a real estate transaction. In Eugene, Oregon, a common type of subordination agreement is the mortgage subordination agreement. This type of agreement is often utilized when a homeowner wishes to refinance their primary mortgage, but another lien, such as a second mortgage or a home equity loan, is already in place. By signing a mortgage subordination agreement, the lien holder agrees to subordinate their lien to the new primary mortgage, allowing the homeowner to refinance while maintaining the priority of the new loan. Another type of subordination agreement seen in Eugene, Oregon, is the commercial subordination agreement. This agreement is commonly used in commercial real estate transactions where multiple lenders and creditors are involved. It establishes the priority of claims and liens on the property, ensuring that each party's interests are recognized and protected. It is important to note that subordination agreements in Eugene, Oregon, can also apply to other types of loans or financial interests, such as mechanics liens, tax liens, or judgment liens. These agreements serve to clarify the priority of these claims in relation to other debts, mortgages, or liens. In summary, a subordination agreement in Eugene, Oregon, is a legal document used to clarify the priority of liens and claims on a property. Common types include mortgage subordination agreements, commercial subordination agreements, and agreements related to other types of loans or liens. These agreements play a crucial role in real estate transactions by ensuring clarity and protection for all parties involved.

Eugene Oregon Subordination Agreement

Description

How to fill out Eugene Oregon Subordination Agreement?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Eugene Oregon Subordination Agreement or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Eugene Oregon Subordination Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Eugene Oregon Subordination Agreement is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!