Hillsboro, Oregon Notice of Tax-Deferred Properties is a significant document that provides crucial information regarding tax deferral programs available to property owners in Hillsboro, Oregon. This notice aims to educate property owners about tax deferral options and their eligibility criteria, helping them make informed decisions regarding their taxes. Here, we will discuss the various types of tax-deferred properties in Hillsboro, Oregon and explain their key features using relevant keywords. 1. Senior Citizen Tax Deferral Program: The senior citizen tax deferral program is designed exclusively for qualified residents aged 62 years or older. Through this program, eligible seniors can defer a portion or the entirety of their property taxes, helping alleviate financial burdens and maintain homeownership. 2. Disabled Citizen Tax Deferral Program: Hillsboro's disabled citizen tax deferral program is intended to assist individuals with disabilities in managing their property taxes. Eligible residents with qualifying disabilities can defer their property taxes or a portion thereof, ensuring that they can afford to continue living independently. 3. Veteran's Tax Deferral Program: The veteran's tax deferral program is dedicated to supporting military veterans who own property in Hillsboro. This program allows eligible veterans to temporarily delay their property tax payments, offering financial relief and recognition for their service to the country. 4. Surviving Spouse or Registered Domestic Partner Tax Deferral Program: This tax deferral program is available for surviving spouses or registered domestic partners of deceased property owners. It enables eligible individuals to postpone their property tax payments, granting them the necessary time to adjust their financial situation following the loss of their loved one. 5. Oregon Medical Expense Deduction: In addition to the above tax deferral programs, Hillsboro, Oregon also offers an Oregon Medical Expense Deduction that allows eligible residents to deduct certain medical expenses from their property taxes, reducing their overall tax liability. It is essential for property owners in Hillsboro, Oregon to carefully review the Hillsboro Oregon Notice of Tax-Deferred Properties to gain a comprehensive understanding of these programs. By leveraging these tax deferral opportunities, residents can actively manage their finances, retain their property, and ensure a better quality of life for themselves and their families.

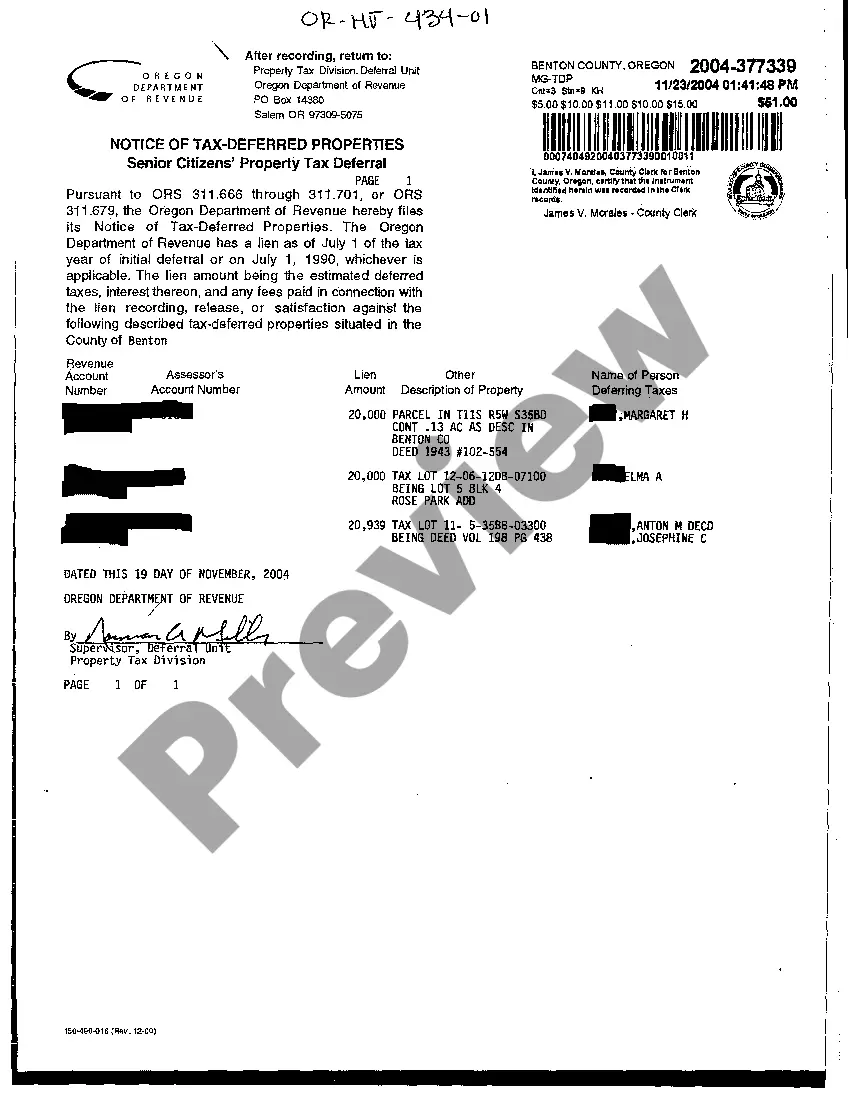

Hillsboro Oregon Notice of Tax-Deferred Properties

Description

How to fill out Hillsboro Oregon Notice Of Tax-Deferred Properties?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Hillsboro Oregon Notice of Tax-Deferred Properties gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Hillsboro Oregon Notice of Tax-Deferred Properties takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Hillsboro Oregon Notice of Tax-Deferred Properties. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!